NFLD Exploits Gold Belt Area Play

2020.09.19

Anyone invested in the junior exploration sector knows that deep and long, active structures are one of the most important commonalities in big mineral deposits.

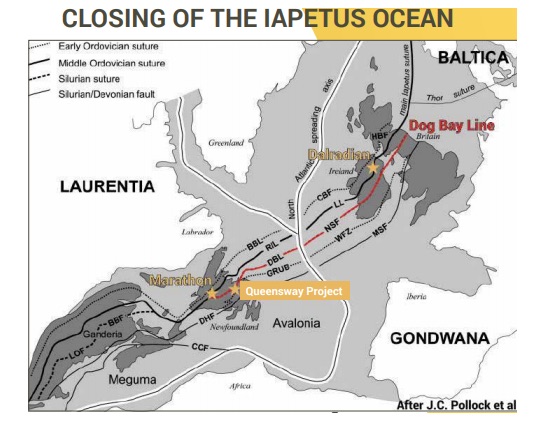

The Central Newfoundland Gold Belt may be one of the most deep-seated structurally prepared environments on the planet. During a period known as the Taconic orogeny that lasted from 480-430 million years ago, the continental plates of Laurentia and Gondwana collided, closing the Iapetus Ocean that lay between them. The islands we now know as Newfoundland, Ireland and Great Britain, were crushed between the continental plates, and deep crustal breaks were created that remained as active fluid conduits for millions of years. The image below shows the five major tectonic breaks that have been traced back to their origins over 400 million years ago and are identifiable across the continents for thousands of kilometers.

These deep crustal breaks are important mineralizing structures for numerous multi-million-ounce gold deposits along these trends. Dalradian’s Curraghinalt gold deposit in Northern Ireland, OceanaGold’s (TSX:OGC) Haile deposit in Southern Carolina, and Marathon Gold’s (TSX:MOZ) Valentine Lake deposit, which lies just southwest of New Found Gold’s (TSX-V:NFG) Queensway discovery, each provide evidence that these structures are an integral conduit for gold deposits.

First movers

In November 2019, privately owned New Found Gold announced one of the highest-grade, most significant gold intercepts ever drilled in the province. Hole 19-01 reported a 19-meter intercept of 92.86 grams per tonne gold. The hole sparked a cacophony of chatter in the geological community but as a private company there was no knock-on effect in the market. That all changed when NFG started trading Aug. 11 on the TSX Venture exchange. An impressive +$31 million raise on their listing set the stage for a 100,000-meter aggressive two-stage drill program, to reveal the true value of the discovery that lies within its Queensway project in the NFLD Exploits Gold Belt Area Play. The stock has been one of the most popular gold juniors on the TSXV this summer, having risen from $1.60/sh upon the start of trading in mid-August, to the current $2.33/sh as of Thursday’s close, a 45% gain. And that is before the publication of any results at Queensway.

The discovery and the wave of news that is sure to follow has sparked a staking rush, a flood of financing to a host of other Newfoundland explorers, and a bonanza of exploration programs kicking off across the province’s mineral belts.

Even before NFG put Newfoundland on the gold exploration map, there was Sokoman Minerals (TSX-V:SIC). In 2017 Sokoman hit 11.9m of 44.9 g/t gold, prompting a number of juniors to stake claims and acquire ground in the Moosehead Gold District.

Earlier in 2020, Marathon Gold released a new resource estimate on their Valentine Lake deposit, which as part of a prefeasibility study identified 4 million ounces at 1.77 g/t gold in four zones of Measured, Indicated and Inferred categories.

MOZ trades at $2.50 per share and has 205 million shares outstanding. They recently announced a 45,000m drill program to expand their resources and closed a $34 million bought deal financing to advance their Valentine Lake property towards feasibility.

With little doubt that Newfoundland can deliver world-class deposits from its remarkable structural setting, junior explorers are having no problem funding property acquisitions and staking binges.

Exploits Discovery Corp (CSE:NFLD)

In August newly listed Mariner Resources, RNR on the Canadian Securities Exchange (CSE), acquired a number of properties in the NFLD Exploits Gold Belt Area Play including Great Bend, True Grit, Shirley Lake, Mt. Peyton, Gazeebow – 35 km north of, and on trend with the North Queensway discovery – and Dog Bay, which has historical drill results including 3.35m at 10.22 g/t gold.

Earlier this month, Mariner Resources acquired Exploits Gold Corp, a private company focused on gold exploration in the prolific Exploits Subzone of Central Newfoundland and Labrador. The addition of Exploits’ key holdings now makes Mariner the largest land tenure holder in Newfoundland, with 1,760 square km of prospective gold exploration ground.

In recognition of the company’s clear focus on the Exploits Subzone, Mariner has applied to change its name to Exploits Discovery Corp and its stock trading symbol on the CSE to “NFLD”.

“We started pushing really to be an early mover in joint ventures beyond the mile and a half around the Queensway deposit and looking at the Exploit Subzone as a district-scale play,” says professional geologist Mike Collins, Exploits’ new CEO, speaking to AOTH earlier this week.

Projects

Exploits has a 100% interest in seven gold projects including four the company says have geological, geochemical and structural settings comparable either to New Found Gold’s Queensway discovery or Marathon Gold’s Valentine Lake deposit. These include Mt. Peyton, Jonathan’s Pond, Middle Ridge and True Grit,

Newly acquired Jonathan’s Pond and Mt. Peyton host anomalies that pre-date Queensway. Both projects contain high-priority exploration targets and are fully permitted for mechanical trenching, geochemical sampling and geophysical surveys.

At Jonathan’s Pond, 17 km NE of Queensway, historical trenching by local prospectors revealed visible gold in quartz veins up to 3m wide, that was never assayed (see pic below). The current strike length, open in in all directions, is greater than 140m, with outcrop grab samples up to 28.82 g/t Au. Magnetic geophysical signatures outline multiple highly prospective structures beneath the overburden. The property is located along the GRUB Line fault, a major crustal structure, and is bounded by the Jonathan’s Pond linear.

The Mt. Peyton project is situated on a 15-km strike length airborne magnetic anomaly, coinciding with anomalous float grab samples of up to 25.8 g/t Au and elevated lake sediment samples of 1,010 ppm arsenic.

High-grade gold in an outcrop sampled by previous operator Noranda contains values up to 164 g/t Au. Historical drilling in the southernmost claims yielded 6 g/t Au over 2m near surface. Arsenic and antimony (gold pathfinder minerals) signatures in tills correspond with Very Low Frequency (VLF) conductors, and are closely associated with the area’s gold mineralization.

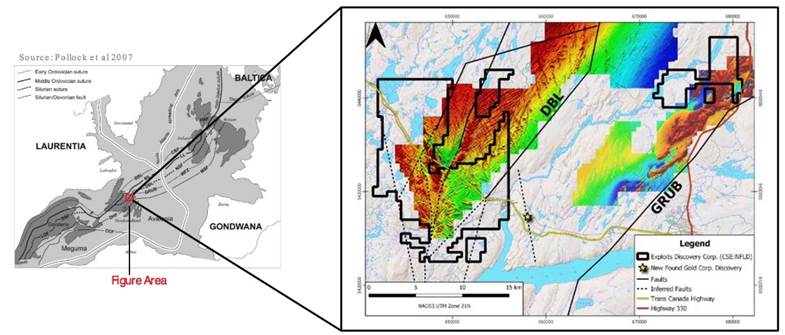

The Middle Ridge property encompasses 80 km of the Gander River Ultra Mafic Belt (GRUB) Line – an offset regional structure which is thought to be important in the mobilization and concentration of gold mineralization in Central Newfoundland. Gold deposition in the Exploits Subzone is found in secondary and tertiary structures crosscutting siliciclastic sediments bounded by the GRUB Line. Magnetic and electromagnetic surveys defined discrete conductive zones within secondary and tertiary structures that warrant further exploration.

The True Grit property hosts diamond drilling intercepts of up to 117m of 0.6 g/t Au, including 26m of 0.83 Au from surface, channel samples of 15.6 g/t Au from 1.0m, and grab samples of 30.2 g/t Au. There are geophysical anomalies coinciding with gold-arsenic-antimony soil anomalies, measuring over 2.6 km by 0.8 km. A new structural model focusing on epizonal orogenic gold within the secondary and tertiary structures stemming along the GRUB Line, provides a pathway to discovery for new gold deposits and reinterpretations of historical work.

Exploits Subzone

According to Exploits Discovery, Modern exploration techniques applied to the property present the opportunity for significant new discoveries. New geological theories suggest that untested historical gold occurrences on the property are controlled by secondary and tertiary structures of the Exploits Subzone, which could lead to discovery. This is the technique that drove the discovery of New Found Gold’s Queensway discovery. The Exploits Subzone is potentially one of the world’s last easily accessible district-scale gold camps.

What makes the Exploits Subzone such a prime target for gold discovery? For starters, prominent regional thrust faulting shows evidence of a long tectonic history including fluid migration. Getting a wee bit technical, Exploits Discovery states,

Trans-compressional strike-slip movement in the regional siliciclastic units underlain by mixed mafic volcanics of the Gander River Ultramafic Belt (GRUB) creates a highly prospective gold environment, exemplified by the Bendigo gold deposit in Victoria (Australia), and Meguma gold deposits (Nova Scotia), which display similar structural and geological controls.

The Exploits Subzone features abundant reactivation features such as sericite seams, iron-rich carbonate hydrothermal alteration and quartz-carbonate veinlets. Historic structurally hosted gold was not adequately tested in the area.

Consider that the majority of Newfoundland’s gold occurrences and exploration, including New Found Gold’s 2019 discovery lie within the Exploits Subzone and are in the vicinity of the above-mentioned GRUB Line fault. All the projects in Exploits’ portfolio are within the Exploits Subzone and the Grub Line.

In fact to be taken seriously in the NFLD Exploits Gold Belt Area Play, as it is shaping up to be, we won’t get any pushback by saying that your property had better overlie one of the deep-seated structures Newfoundland is famous for, and have a secondary structure that provides a trap for the gold mineralization.

The Exploits Subzone and GRUB regions have been the focus of major staking and financing throughout 2020, with increased exploration activities forecasted in the area, moving into 2021.

Collins refers to the map of the Mt. Peyton project, to explain how gold emplacement occurs in this environment:

“These faults are pulling everything apart, the land to the south of the DBL [Dog Bay Line fault] is moving left. As faults move it’s wrenching things along and pulling apart on and between these northeast-trending structures you can see on that map, creating open spaces. You’ve got lower pressure so you’re dropping quartz and potentially gold.”

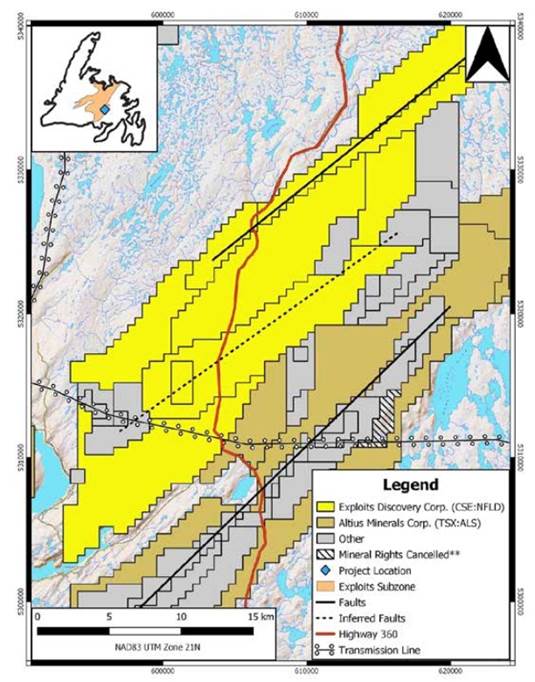

Check out the graphic below, supplied by Exploits to AOTH, to get an appreciation for all the development companies crowding into the NFLD Exploits Gold Belt Area Play. “We are benefiting from an area play to shine a light on our really great projects,” says Collins.

Exploits Subzone District Claim and Mineral Activity Area Play Map

Strategy

Gold juniors that acquire several properties sometimes run into trouble for being unfocused. Investors get confused over what is the priority, lose patience, and eventually, may switch to a company whose activities are easier to follow.

Collins is aware of this risk, and is planning accordingly. He anticipates concentrating the company’s resources on one or two projects, but as the largest land holder on the island, he also expects there to be spin-outs. For now, though, the priority is data compilation and property evaluation.

“We’ve got to get in and value these four properties and see which two are going to be the fastest one’s to progress, in taking these things to deposits and mine development,” he told me.

That approach seems prudent, both in terms of maintaining focus, and protecting shareholders’ capital.

This winter, Exploits Discovery will be compiling data and working with local prospectors in developing and presenting the story for each of its projects. They will also be doing ground-based magnetic surveys, to build their structural models, and line up drilling targets for next spring.

Additionally, the company has been using an innovative soil-gas-hydrocarbon soil sampling – credited Great Bear Resources (TSX-V:GBR) for the discovery of the LP Fault deposit in at their Red Lake gold district Dixie Project in Ontario. The technique allows mineral explorers to “see through” glacial till; validating target models derived from mapping and geophysics thereby facilitating drill targeting.

Collins states: “Our exploration really is focused on understanding the structure of the rocks and that’s through things like MAG and EM geophysics, following up on key targets, by using ground mag [magnetics] to tighten up the lines and get clear focus on the structures. We’re also using soil sampling with the soil gas hydrocarbon technique. We think those will help us get to discovery faster and more efficiently that the competition.”

Conclusion

Exploits Discovery is in a very fortunate position, for a micro-cap company that is so early-stage, its ticker symbol, the appropriately-chosen NFLD, that has just appeared on the exchange.

Its good fortune, and skill, comes via the acquisition of four very promising gold properties, all located within the Exploits Subzone of Central Newfoundland. This is where the majority of the province’s gold occurrences and exploration, including New Found Gold’s Queensway discovery, Sokoman Minerals and Marathon Gold, and all situated. To be a significant player in the NFLD Exploits Gold Belt Area Play your property needs to overlie a deep-seated structure, and have a secondary structure that provides a trap for gold mineralization.

Collins is so keen on the area, he compares it to the Carlin or Battle Mountain trends in Nevada – the former being the second-most mineralized region on Earth, behind only South Africa’s Witwatersrand Basin.

“We don’t have a 40Moz resource yet but if you look at the tenor of mineralization, the variety in discovery types… I don’t think this is going to be a one-hit wonder and it’s a huge package of land that’s never really been effectively explored,” he said. “How many drill holes have actually been put into the 240km long Exploits Subzone? Is it 100? 150 max? You compare that to the exploration that’s happened on the Battle Mountain trend, the volume of work that’s been done to develop those resources. We’re early days but I think there’s the opportunity to be a world-class camp.”

I agree. The NFLD Exploits Gold Belt Area Play, and Exploits Discovery Corp, are just getting started. As an early-stage investor, I want to own a company with lots of prospective land. Exploits is now the largest land tenure holder in Newfoundland, so that box is checked. Then it’s just a matter of sitting back and watching them go to work. Discoveries may not happen immediately, but there is going to be tens of millions of dollars spent in the NFLD Exploits Gold Belt Area Play over the next several years. Patience will be rewarded.

I personally believe, for me, Exploits Discovery Corp (CSE:NFLD) is a “buy and hold” play, giving shareholders the opportunity to benefit from spin-outs and/or discovery holes, while starting out in a company with a tight share structure (43.2 million shares outstanding) and experienced management that knows how to accumulate properties and prioritize them.

Currently there are, imo, extremely affordable entry points into the NFLD Exploits Gold Belt Area Play.

Shortly, with all the money being spent and the likely result being discovery after discovery, that may not be the case.

Exploits Discovery Corp.

CSE:NFLD

Cdn$0.59, 2020.09.18

Shares Outstanding 43,511,302m

Market cap Cdn$25.6m

NFLD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Exploits Discovery Corp. (CSE:NFLD). NFLD is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.