Max’s CESAR copper silver project in Colombia shown to be analogous to Poland’s immense “Kupferschiefer”

2020.09.24

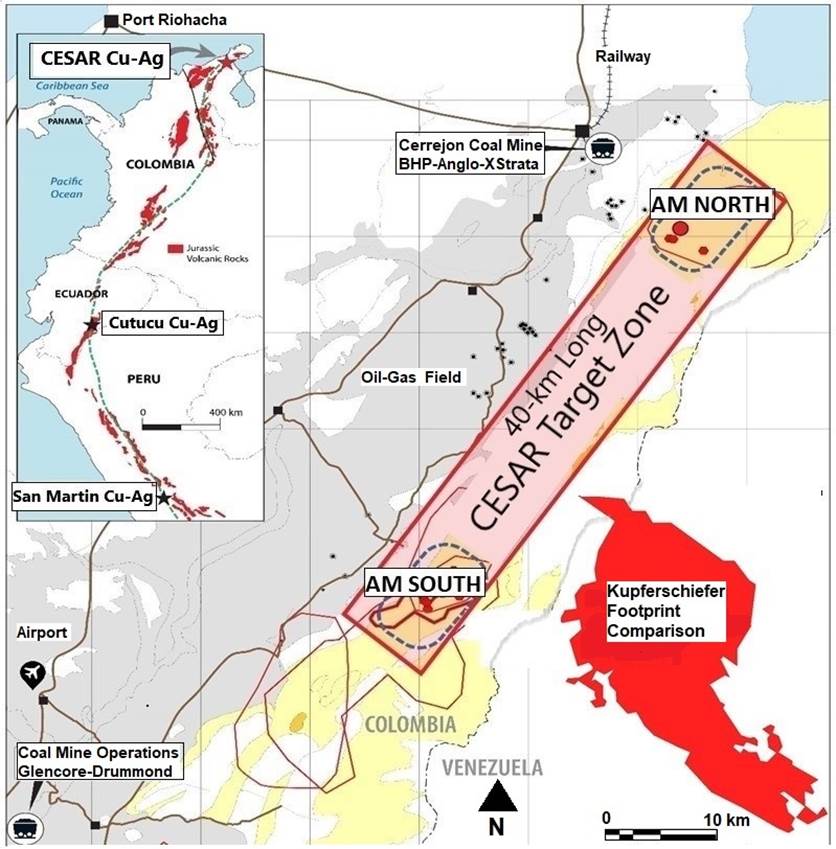

Since November 2019, Max Resource Corp. (TSX-V: MXR) has been identifying stratabound copper and silver zones within a 100 by 20-kilometer area, at their CESAR copper silver project in northeastern Colombia.

Max continues to expand the surface “Kupferschiefer style” mineralization at CESAR, using continuous rock chip panel samples and composite grab samples to identify structures, continuity of thickness, strike length and potential size, prior to drilling.

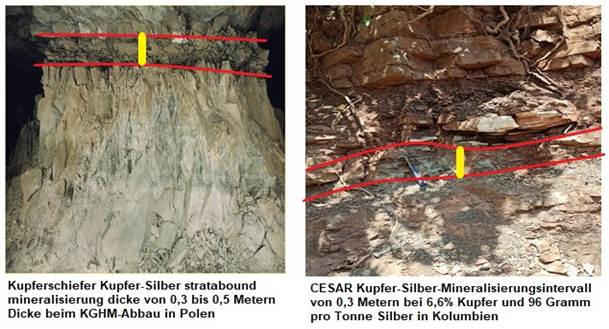

Its recent AM North and AM South discoveries at CESAR are hosted in well-bedded sandstone-siltstone similar to KGHM’s monster “Kupferschiefer” mines in Poland.

Kupferschiefer is Europe’s largest copper mine, with production in 2018 of 30 million tonnes grading 1.49% copper and 48.6 grams per ton silver from a mineralized zone of 0.5 to 5.5 metre thickness.

The Kupferschiefer deposit is also the world’s leading silver producer, yielding 40 million ounces in 2019, almost twice the production of the world’s second largest silver mine (World Silver Survey 2020).

The Vancouver-based company is following the theory that continuous panel samples are pointing to a giant, sediment-hosted copper silver mineralized system.

To understand the significance of the Kupferschiefer analogy, we need to take a brief detour into the geology.

Sedimentary copper deposits

The world’s biggest sedimentary copper deposits are only found in three basins: the Paleoproterozoic Kodaro-Udokan Basin of Siberia, the Neoproterozoic Katangan Basin of south-central Africa, and the Permian Zechstein Basin of northern Europe.

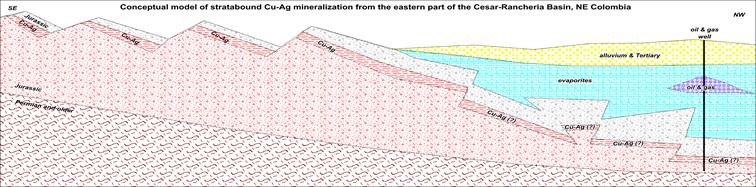

However, this may be changing. Over the past year or so, an intriguing theory has come to light: that within the Andean Copper Belt of northwestern South America, are a series of large-scale sedimentary copper deposits, formed in areas known to contain other minerals, including oil, gas, coal and salt.

The belt runs from Colombia in the north, through Ecuador and Peru, to northern Chile in the south.

Initial exploration of sedimentary basins in Colombia, Ecuador and Peru has revealed a startling realization – that surface outcroppings might be just the tip of giant icebergs of sediment-hosted copper-silver deposits lurking underneath. Samples derived from boots-on-the ground prospecting suggest these areas are analogous to “Kupferschiefer”-type copper-silver mineralization found in Germany and Poland.

Proving this theory could mean billions of pounds of copper and hundreds of millions of ounces of silver lay hidden beneath the diverse geography of northwestern South America.

Sedimentary copper deposits are formed in ocean basins, where the seabed is composed of porous materials such as sandstone, limestone and black shale, through which copper and other minerals travel up and become trapped in the rock layers.

For a sedimentary copper deposit to form, all four of the following conditions must be met: an oxidized source rock, a source of brine to mobilize the copper, a source of reduced fluid to precipitate copper and form a deposit, and finally, there has to be the right environment for fluid mixing.

When the metals precipitate from fluids circulating in the host rock, they may be deposited in sandstones or shales. The Ivanhoe Mines (TSX: IVN) massive Kamoa sedimentary-hosted stratiform deposit in Africa’s DRC is the best example of copper-bearing sandstones.

Sedimentary exhalative deposits formed when hydrothermal fluids contacted a body of water, and precipitated ore. The large deposits in the Zambian copper belt are an example of SedEx-style mineralization.

Red-bed deposits, so named due to oxidation resulting from exposure to the atmosphere, are divided into volcanic and sedimentary.

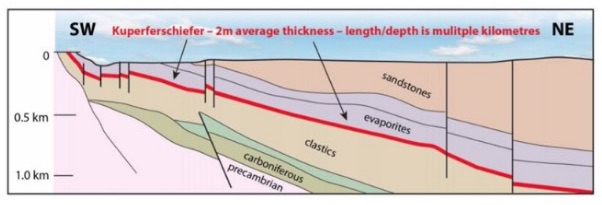

Kupferschiefer deposits are similar to red-beds but larger, even regionally extensive. They typically form in a marine setting, after land is gradually submerged into a shallow sea, then overlain by sedimentary rocks – which formed from the gradual deposition of the carcasses of dead sea creatures, onto the ocean floor.

Kupferschiefer’s consist of three layers – sandstone, limestone and bituminous shale. Copper-containing fluids migrate up through the sandstone and get trapped by the carbon-rich “Kupferschiefer” layer. This is where most of the mineralization is concentrated, although it can also be found in the sandstone, limestone, or a combination of all three layers.

Europe’s Kupferschiefer and Colombia’s CESAR

State-owned KGHM Polska Miedź (KGHM) is the world’s eighth largest copper producer and the second biggest silver producer. Its Kupferschiefer (“copper shale” in German) copper-silver deposits are regionally extensive.

They comprise Europe’s largest copper-mining area, with 2018 production of 30 million tonnes grading 1.49% copper and 48.6 g/t silver from a mineralized zone of 0.5 to 5.5-meter thickness.

The Kupferschiefer deposits are also the world’s leading silver producer, yielding 40 million ounces in 2019, almost twice the production of the world’s second largest silver mine, states the 2020 World Silver Survey.

According to the US Geological Survey, the massive volume of metal at Kupferschiefer is due to continuous mineralization that extends down dip and laterally for kilometers.

Kupferschiefer copper silver mine in Poland:

- Bulk underground mining starts from 500 metres below surface

- Average mining thickness of 2 metres

- Annual production of 30 million tons of copper at average grade of 1.49%

- and 40 million ounces of silver at average grade of 48.6 grams per ton

CESAR stratabound copper silver project in Colombia:

- Mineralization starts at surface and extends down dip and laterally

- Mining can potentially start from surface followed by underground

- Bulk tonnage target grades of 1.0% copper and 20 grams per ton silver

CESAR Copper Silver Project

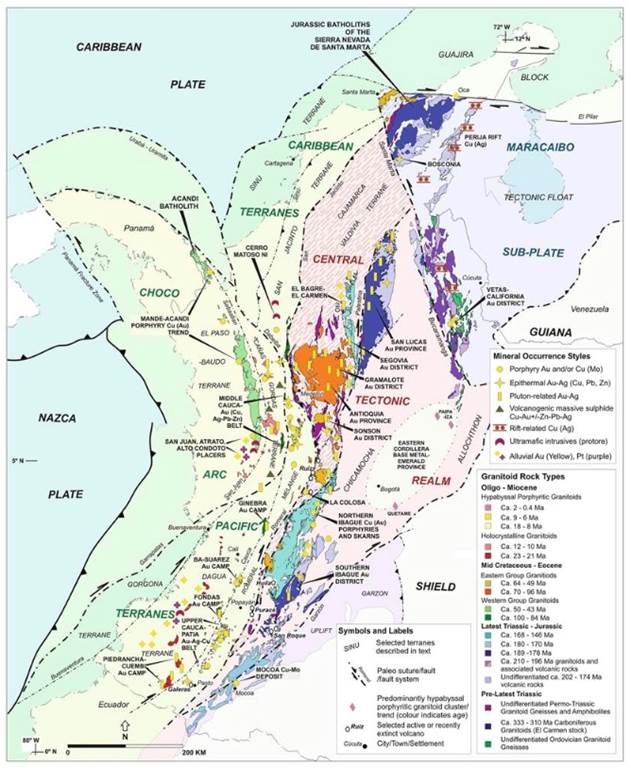

Max’s CESAR project in north east Colombia lies along the northern end of the Andean Belt, the world’s largest producing copper belt. The Cesar region enjoys major infrastructure. Mining operations include Cerrejon, the largest coal mine in Latin America, jointly owned by global miners BHP Billiton, XStrata and Anglo American.

Max’s exploration of CESAR goes back almost one year. After acquiring the initial property, located 420 kilometers north of the capital Bogota, the company embarked on a first-pass exploration program to identify surface outcrops, and to evaluate the potential for expanding its copper holdings.

CESAR region enjoys major mining activities and infrastructure

Initially in late 2019, first pass exploration identified a total of 12 outcrops spread over a 9-square-kilometer area, from which copper assays up to 4.2% were reported, along with silver assays up to 116 grams per tonne. Sixteen of the 24 samples exceeded 1% copper with three surpassing 3% copper, with the mineralization appearing to be open in all directions. Silver was an important constituent, with values ranging from 4 to 116 grams per ton.

Location Map of CESAR 40-kilometre long target zone, AM South and AM North

In January, 2020 Max made a major discovery within its CESAR block of claims in northeast Colombia.

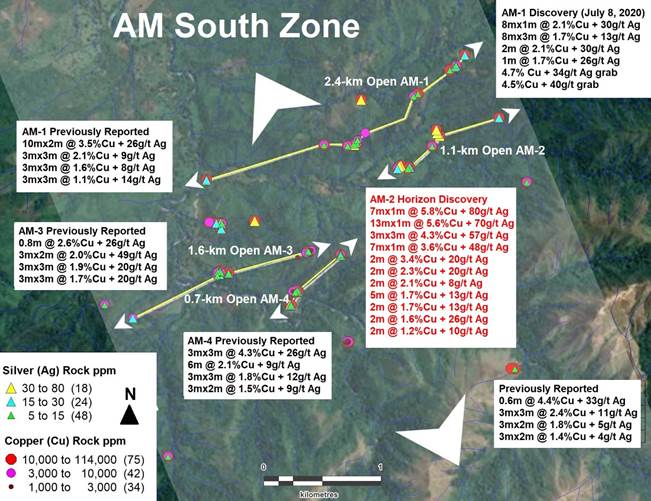

Dubbed the AM South Horizon, the discovery features a stratabound copper silver horizon that trends northeast-southwest in excess of 1.4 kilometers. The mineralized system appears to be open in both directions and dips down about 40 degrees to the northwest.

According to the news release, grades of the main mineralized zone at the AM South Horizon range from 0.05% to 2.7% copper, 3 to 39 grams per ton silver, and mineralized rock chip or panel samples with widths varying from 0.5 to 3.0 metres.

In mid-February, Max followed up with a second high-grade discovery, just south of the AM South Horizon. The aptly named Outcrop Zone is defined by 13 outcrops, from which rock chip and panel samples have been taken.

Chip and panel rock sample highlights included 4.4% copper + 33 grams per ton over 0.6 metre, and 4.3% copper + 26 grams per ton silver over a 3 by 3 metre panel (February 11, 2020).

Two days later, Max announced new assay results, the AM South accumulated zones had been extended by 1.5 kilometers, increasing from 2 to a total of 3.5 kilometers. Chip and panel rock highlights included 2.4% copper + 11 grams per ton silver over a 3 by 3 metre panel, and 4.3% copper + 26 grams per ton silver over a 3 by 3 metre panel (February 13, 2020).

Composite grab sampling returned a preliminary 25-metre interval grading 0.7% copper and 4 grams per ton silver, and a 25-metre interval grading 0.6% copper and 7 grams per ton silver. These thicker intervals include a significant portion of the hanging wall and footwall of the copper-silver horizon, according to the news release.

“We were very encouraged to see such intervals of copper silver values,” said Max’s CEO, Brett Matich.

Note these are very high copper and silver grades up to 4.4% copper and 49 grams per tonne silver. Note also: these grades are averages from panels, not pieces of high-grade ore chipped from the outcrop to fool investors into thinking the whole outcrop is high-grade when only a small chunk of it is. It’s important for investors to differentiate between a select rock chip sample, and average grade across a 3 by 3 metre = 9 square metre panel.

“The CESAR style of mineralization appears to be similar to a large sub-horizontal sheet, with the edges partly exposed at surface,” Matich explained in the Feb. 11 news release.

An example of CESAR mineralization exposed as a large sub horizontal sheet

To date AM South, 5.8-kilometres of accumulated strike open in all directions

In February 2020, Max reported two significant stratabound discoveries at a new zone called “AM North” located on trend 40 kilometres north of AM South.

The AM North discovery outcrop named AMN-1 returned 10.4% copper + 88 grams per ton silver over a 1-meter continuous rock chip sample.

A week later, field crews found another high-grade outcrop named AMN-2, returning 24.8% copper + 230 grams per tonne silver over a 4-metre by 1-metre rock chip panel sample.

AMN-2 is located 1.8 kilometers west of AMN-1. This horizon dips 20 degrees northwest and AMN-1 and AMN-2 appear to be part of the same mineralized horizon.

Two 50-kilogram bulk samples extracted from each end of the 1.8-kilometer discovery horizon, returned 10.5% copper + 79 grams per ton silver and 3.5 % copper + 29 grams per ton silver (May 21, 2020).

To date, AM North consists of a broad 11-kilometre north to south continuous zone of stratabound copper silver mineralization and is open in all directions. The copper silver zone also contains a high-grade area with varying intervals from 0.2 to 3.0-metre grading 4.0 to 34.4% copper + 28 to 305 grams per ton silver (July 29, 2020).

AM North 11-kilometre zone

Kupferschiefer comparison

According to the company, the stratabound copper silver mineralization at AM North and AM South share the same mineralized trend, and are hosted in a well-bedded sandstone-siltstone similar to the Kupferschiefer in Poland.

“The high-grade AM North discovery supports our model of a significant, large-scale stratabound copper silver system, stretching over 40-kilometers from AM North to AM South,” Matich said in the Feb. 27, 2020 news release.

The most significant opportunity for expansion occurs between the AM North and AM South discoveries, a 40-kilometer-long target zone, the footprint size comparison of Kupferschiefer is shown in the Location Map above.

Also, the AM South zone extends over an area of 4-kilometres by 3-kilometres and remains opens laterally. The cumulative strike length of the open-ended AM South horizons exceeds 5.8-kilometers, returning highlight values of 5.8% copper and 80 g/t silver from 0.1 to 25-metre intervals, suggesting these horizons could be of significant size (July 14, 2020).

In an interview with AOTH, Max Resource’s head geologist, Piotr Lutynski, said Colombia’s stratigraphy is similar to his homeland, Poland, and its cluster of Kupferschiefer sediment-hosted copper-silver deposits.

“The copper and silver are very classical elements likely to be in sedimentary deposits like Colombia,” said Lutynski, noting he has worked in similar mineralization in the northern part of South America. “It’s the same stratigraphy with the sandstone below the limestone on top and the Kupferschiefer-equivalent in the middle.”

Similar mineralogy

Mineralogy is the branch of geology that studies the chemistry, crystal structure and physical properties of minerals. When it comes to the potential for mineral deposits to become mines, it is important to know the processes in which the minerals formed, their physical properties, and how they are distributed in the deposit.

Minerals are classified according to their density – often given as specific gravity – hardness, tenacity (how the mineral behaves when it is broken or crushed), and if they are crystalized, how the atoms are structured.

In an April 21 news release, Max said it sent surface rock samples from CESAR’s stratabound copper silver mineralization horizons to Poland’s AGH University of Science and Technology. Researchers at AGH, which has worked extensively with KGHM, the state-owned copper-silver miner, are conducting mineralogical and geochemical studies on the samples; also, a Masters-level student is planning on writing a thesis paper on the results.

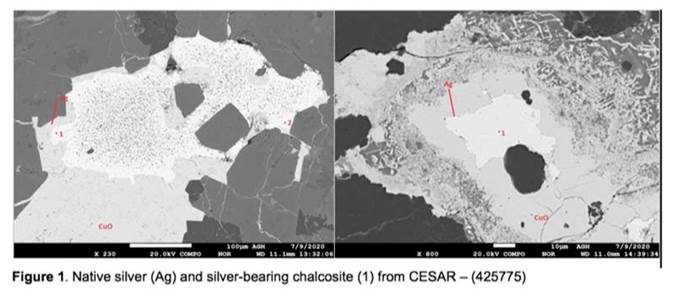

Initial results from petrographic analysis of two samples from AM South were released by Max on May 26.

They confirm the presence of native copper, chalcocite, and malachite hosted in siltstone and sandstone. Covellite, a rare copper sulfide mineral, was also detected, having not been found previously. That could be significant, because copper sulfides are more profitable to mine as a result of their higher copper content. The copper is also more easily separated from other minerals, compared to copper oxides.

This is also meaningful, because it is yet another marker of Kupferschiefer-type mineralization. At the huge cluster of silver-copper deposits in Poland, being mined by KGHM, silver most commonly occurs in copper sulfides – chalcocite and bornite. At AM South, the sample Max sent to AGH for analysis also contained chalcocite.

“The initial AGH results are significant, as they identified silver-bearing chalcocite and covellite as well as native silver at AM South. Silver is a key component of stratabound copper deposits. The presence of silver further substantiates a Kupferschiefer-type system at CESAR,” Matich stated in the Aug. 25 news release.

Bull market for copper, silver

Certain industrial metals, despite lower demand, have done quite well in the new covid-19 normal. Tight supply and strong demand from China have elevated copper prices above $3.00 a pound for the first time since 2018. The country’s total unwrought copper imports this year climbed 38%, to 4.27 million tonnes.

On the supply side, Chilean state-owned Codelco, the largest copper miner in the world, lost 4.4% of its production in July, as the coronavirus forced the company to scale back staffing, slow projects and turn off a smelter.

As we have reported, without new capital investments, Commodities Research Unit (CRU) predicts mine production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

COVID-19 -related mine closures, albeit temporary, are ringing alarm bells throughout the copper market and bidding up prices, as investors fret over whether the industry can meet demand, especially now that China, which consumes 51% of the world’s copper, appears to be back on its feet.

Earlier this month Bloomberg wrote that The global copper market could be on the cusp of a historic supply squeeze as Chinese demand runs red hot and exchange inventories plunge to their lowest levels in more than a decade.

Silver and copper are on an upward trajectory and will continue to do well under a Biden or Trump infrastructure push. Clearly, copper with all its green energy applications will be more in demand under Biden’s plan. Same with silver due to its application in solar panels (millions of them under Biden).

Conclusion

Max’s technical team continues to build a geological model based on KGHM’s Kupferschiefer, Europe’s largest copper deposit, and the world’s leading silver producer. Please note, the average overall CESAR target grade is 1% copper + 20 g/t silver, the high-grade zones at CESAR lowers the cut off grades, which significantly increases the tonnage, its all about scale.

The fact that the AM North and AM South targets appear to be large sub-horizontal sheets, that partly outcrop at surface, adds credibility to the Kupferschiefer analogy – as do the results from a study by AGH university, indicating the silver mineralogy at CESAR is similar to Kupferschiefer.

In Poland’s Kupferschiefer deposits, continuous mineralization extends down dip and laterally for many kilometers. Could the mineralization at CESAR do the same? If so, Max could be looking at a district-scale, even a regionally extensive copper silver mineralized system.

Max has entered into non-exclusive confidentiality agreements with a leading copper producer and a global miner.

The first phase of the partnership with one of the yet-to-be-named companies, involves a technical study by Fathom Geophysics.

The aim of the study is to map stratigraphic (rock layers) features that can help to pinpoint additional stratabound copper silver mineral horizons at CESAR.

Having two majors come in so early – just 10 months into an exploration program – validates Max’s Kuperferschiefer exploration model, and the results.

Though still early-stage, Max’s CESAR has in short order, less than a year, already attracted the interest of not one, but two major mining Company’s.

If Max can demonstrate the potential “district scale” of CESAR, a major may jump early and buyout CESAR, as the prize could be far “too big” to ignore.

Max Resource Corp.

TSX.V:MXR

Cdn$0.35, 2020.09.20

Shares Outstanding 54,570,906

Market cap Cdn$19m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Millswebsite/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources (TSX.V: MXR). Max is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.