Great Thunder Gold completes geophysics at Fenelon Gold Camp, Quebec

2020.07.25

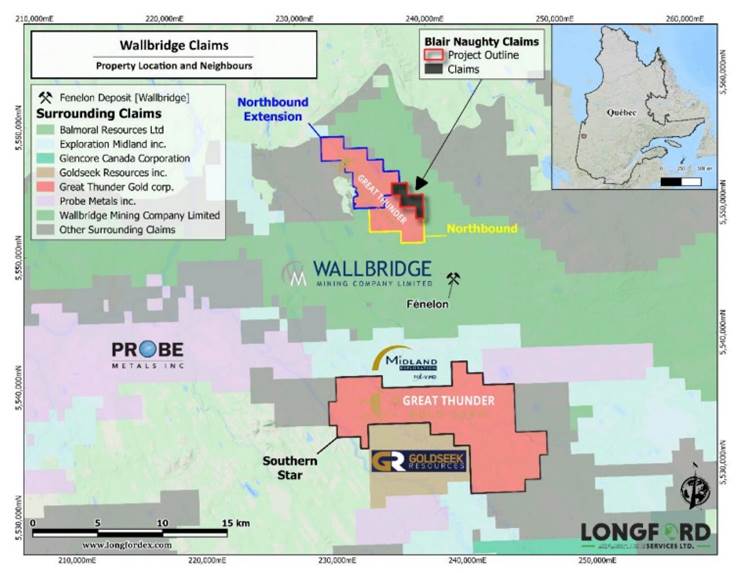

Great Thunder Gold (CSE:GTG) has the first part of its 2020 exploration program in the bag, with the completion of an airborne survey at its Northbound, Northbound Extension, Southern Star and Southern Star Extension projects in the Fenelon Gold Camp of Quebec.

In total, 2,349 line-km was flown over the four properties. The survey was strategically targeted to detect anomalies and to better define structures.

An 853 line-km airborne survey at the company’s Northbound and Northbound Extension – both are adjacent and on-trend with Wallbridge’s Fenelon deposit and Balmoral’s new Reaper discovery – pinpointed magnetic response structures representing shear zones with quartz.

At Southern Star and Southern Star Extension, 1,496 line-km of airborne magnetic and electromagnetics was flown on 100m line spacings, in volcanic-rock areas covered with heavy overburden.

The data from the survey is currently being analyzed and is expected to be released soon. The next step is defining potential geophysical anomalies on the ground, to be followed up by a ground geophysical survey and drilling.

Fenelon Gold Camp

A number of gold exploration companies have established positions in the area east of the Detour Lake gold mine, acquired last November by Kirkland Lake Gold, looking to hit pay dirt in an emerging area play known as the Fenelon Gold Camp.

Fenelon is in the highly prospective Detour Gold Trend, situated within the Abitibi Greenstone Belt that runs through northern Quebec.

One of those companies, Great Thunder Gold (CSE:GTG), has been quietly buying up properties next to the first mover in the region, Wallbridge Mining (TSX:WM), which earlier this year merged with Balmoral Resources.

The acquisition has given the company significant upside to its flagship Fenelon Gold Project, which Wallbridge has been aggressively exploring since 2016, by adding Balmoral’s Detour-Fenelon Gold Trend Project. The 739 sq km trend, running east along a major structural break from the open-pit Detour Lake gold mine, hosts the company’s Fenelon deposit (Main Gabbro, Area 51 and Lower Tabasco-Cayenne) and six other assets – Detour East, Doigt, Martinière, Harri, Jérémie and Grasset.

Last year WM completed just over 100,000 meters of drilling and took a 33,000-tonne bulk sample; another 80,000-100,000m are planned for 2020. The goal is to complete a maiden resource estimate, targeting +1Moz, by mid-2021.

Great Thunder Gold started building its position in the Fenelon Gold Camp in February of this year. The first move was to option the Northbound gold property, which is contiguous to Wallbridge’s Fenelon Gold Project.

The jewel in Northbound’s crown is the Jeremie Pluton, an underlying intrusive becoming increasingly important at Wallbridge’s contiguous Fenelon property. Wallbridge exploration in 2019 tested strike extensions of known mineralization from the metasediments and metavolcanics and gabbro into the Jeremie Pluton. Drilling to date has confirmed the extensions of gold-bearing mineralized zones well into the pluton, and the zones appear to be open.

The Jeremie Pluton intrusive also lies under the 1,582-ha Northbound Extension property, purchased by Great Thunder in March, and the eastern margin of it is beneath Wallbridge’s Fenelon deposit.

In April Great Thunder moved on the South Star property, located 6.5 km south of Wallbridge’s Fenelon/Tabasco deposit. Signing a letter of intent (LOI) to acquire South Star meant a near quadrupling of GTG’s land position to 148 sq km or 11,000 hectares.

Naughty claims

Earlier this month, Great Thunder announced the acquisition of six additional claims, covering 331.79 hectares, thereby expanding Northbound and Northbound Extension to the southeast. According to the company, the claims, formerly belonging to CEO Blair Naughty, cover the folded granodiorite immediately adjacent to greenstone, ie., the Jeremie Pluton.

“I acquired these claims many months ago bordering what ended up being properties purchased by Great Thunder Gold. Now, as CEO and the largest shareholder, I felt compelled to contribute the claims to the company’s ever-growing land position in the Fenelon camp for a nominal $1,” Naughty explained in the July 7 news release.

Including the Naughty claims, Great Thunder Gold now has a commanding land position in the Fenelon Gold Camp of 15,231.47 hectares.

Eric Sprott

Great Thunder’s activity in the area has not gone un-noticed. Eric Sprott is a large shareholder in four of the companies that have been making news in the Fenelon Gold Camp: Kirkland Lake Gold, Wallbridge Mining, Balmoral Resources and Great Thunder Gold.

This week, the acclaimed resource investor increased his investment in Great Thunder, purchasing 600,000 of 4 million units, of a $2.6 million private placement. Each unit, priced at 65 cents, consists of one common share and half a warrant.

It doesn’t take a mining guru to see why Sprott would see the potential of this emerging area play. Now that Kirkland Lake Gold has the Detour Lake mine, why not own the Detour-Fenelon Gold Trend?

Conclusion

For Kirkland Lake to acquire Wallbridge, and potentially Great Thunder, makes sense in the bigger picture. Great Thunder is a good investment with a tight share structure of only 25.66 million shares outstanding. There is no warrant overhang and the company is fully funded. A substantial opportunity exists for share price appreciation, considering Great Thunder has a market cap of just over $11 million compared to Wallbridge’s $678 million, and has more than 15,000 hectares of prospective land holdings in the prolific Fenelon Gold Camp.

Looking at the above map, consider how strategically placed Great Thunder’s properties – Northbound, the Northbound Extension and Southern Star – are in relation to Wallbridge’s Fenelon Gold Project.

Wallbridge recently announced the first assay results from its 2020 program at Fenelon. Shut down for two months due to covid-19, the company now has six drill rigs back on the property, focused on three mineralized areas – Main Gabbro, Tabasco-Cayenne, and Area 51.

At Main Gabbro, in-filling drilling continues to define high-grade shoots near existing mine workings. Highlights were 4.88 g/t Au over 18.95 meters, including 96.90 g/t Au over 0.70m in the Serrano Zone.

Step-out drilling at Tabasco-Cayenne extended the mineralization over 100m down-plunge, including 4.06 g/t Au over 51.70m.

In Area 51, in-fill drilling continues to demonstrate potentially open-pittable zones near surface. The highlight hole hit 15.73 g/t Au over 3.00m in the Andromeda Zone.

Wallbridge’s success at the drill bit is rubbing off on Great Thunder Gold, whose share price has been marching upward. The news on Sprott’s 600,000-unit private placement purchase had GTG up 5.49%, in afternoon trading in Toronto, Thursday.

Completing the geophysics at its four Fenelon Gold Camp properties is a big step forward. Targets are being lined up for a fall drill program and I’m excited to see what they find.

Great Thunder Gold

CSE:GTG

Cdn$0.86 2020.07.24

Shares Outstanding 26,406,660

Market Cap $22,709,727m

GTG website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Great Thunder Gold (CSE:GTG). GTG is a paid advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.