Gold and bonds soar on ‘fight to quality’

2020.02.22

Gold and silver prices went parabolic this week during a raging storm of safe-haven demand, as the coronavirus, re-named Covid-19 by the WHO, spread from China to the Middle East, South Korea and Japan.

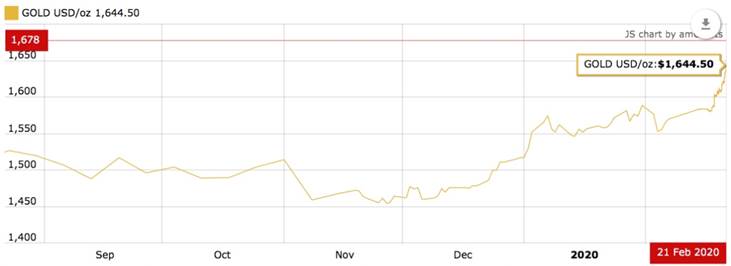

Market participants woke up Friday morning to spot gold hitting a fresh seven-year high of $1,627 an ounce, beating Thursday’s $1,626 record. The precious metal continued climbing and last traded at $1,644.70, as of 3 pm EST.

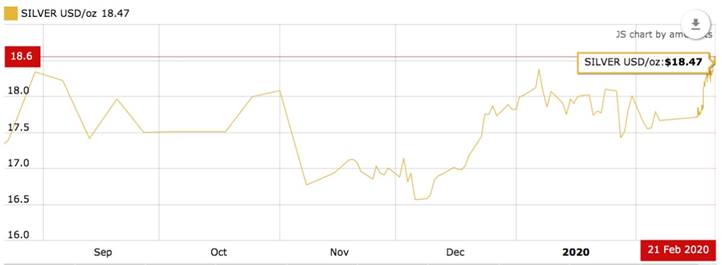

Silver rose to $18.61/oz Friday, a gain of just over 4% gain for the week, while palladium, the darling metal of the last two years, went up another 13%, notching a stunning year-to-date 37% increase.

Investors are in a decidedly risk-off mood, and have reacted to reports of the Covid-19 outbreak impacting economic growth forecasts, earnings and stock prices, by piling into safe-haven assets – namely, precious metals and US Treasuries, despite the latter’s record-low yields.

“Investors have suddenly got cold feet and are running for the exits,” Bloomberg quoted Chris Rupkey, chief financial economist for MUFG Union Bank. “Bond yields and stock prices are back in sync today as the plunging markets mean the economic outlook is not looking as good this year as many thought.”

The yield on 30-year Treasuries tumbled to a record low, Friday, amid data showing US business activity shrank in February for the first time since 2013, due to supply chain interruptions from the Covid-19 virus.

After reaching a record high on Wednesday, the S&P 500 index saw its first weekly decline since January, and the soaring dollar on Friday quit a four-day winning streak. Apple warned that sales will fall short of its forecast for the current quarter, owing to virus-related production problems in China, causing a 2% hit to the iPhone maker’s shares and calving $34 billion off its market value.

Traders are piling into hedges in case the contagion becomes a disaster for the already weak global economy. In its January update, the IMF lowered its 2020 global growth forecast by one-tenth of a percentage point to 3.3% – following last year’s 2.9%, the lowest in a decade.

If the coronavirus continues to be a problem, many are expecting the Fed will step in to lower interest rates, currently at a range of 1.5 to 1.75%.

The Guardian reported the German economy flat-lined to 0% growth in the fourth quarter – side-swiped by lower exports on account of trade tensions, and a slowdown in consumer and government spending.

In Japan, GDP has fallen a precipitous 6.3%, nearly twice as much as the predicted 3.7% – catalyzed by poor weather and a hike in the sales tax.

Friday’s poor economic news was catalyzed by reports that cases of Covid-19 are showing up in Japan, Korea and the Middle East.

Four Iranians died after contracting the virus and health authorities there are warning it may have spread to multiple cities. Lebanon and Israel reported their first cases, South Korean Prime Minister Chung Sye-kyun declared an emergency after 100 new cases and the country’s second death was confirmed, and Japan started suspending major public gatherings to head off the spread of Covid-19 as the number of new cases rises.

Ominously, the head of the World Health Organization said the “window of opportunity is narrowing, so we need to act quickly before it closes completely”.

The latest numbers show Covid-19 has infected more than 76,000 people in 27 countries, including Canada, and has killed over 2,2000 since December – making it the deadliest outbreak since SARS.

Gold

Normally gold prices run counter to the US dollar, given that a strong dollar makes gold, and other commodities priced in USD, more expensive in other currencies, therefore lowering demand for them. However this year, gold’s rise has come about despite the rise in the greenback which is trading at a 4.5-month high against other major currencies.

“Gold and the dollar are going up for the same reason,” Kitco quoted Daniel Pavilonis, senior commodities broker with RJO Futures. “There is a flight to quality in the dollar and a flight to quality in gold because of the coronavirus.”

The precious metal is not only trading at a 7-year high in dollars but is smashing records in euros, yen, Canadian, Australian and New Zealand dollars, and most emerging market currencies.

Gold is also gaining despite robust growth in US stock markets – meaning gold, without offering any dividends or interest, is attracting as much attention as stocks and US government bonds.

In a research note Thursday, the head of commodity strategy at Saxo Bank said January holdings in gold ETFs, already at record highs, increased an average 1.3 tonnes per day, while February holdings have been rising by 1.9 tonnes. “With the metal moving higher, despite the mentioned headwinds from other markets, it is difficult to see what at this stage can halt or pause the rally,” Ole Hansen wrote.

Gold-silver ratio

It’s interesting to not only look at how gold and silver are doing during periods of safe-haven demand, but also the ratio between the two.

We can use the gold-silver ratio to find out how silver prices compare to gold, since the precious metals have roughly the same amount of above-ground supply – 6.1 billion ounces, and around the same level of 0.999 fine bullion used for investments – 2.5Boz.

The gold-silver ratio is the amount of silver one can buy with an ounce of gold. Simply divide the current gold price by the price of silver, to find the ratio.

On June 12, the gold-silver ratio hit a 26-year high by breaking through the 90-ounce mark – meaning it took over 90 ounces of silver to purchase one ounce of gold. The higher the number, the more undervalued is silver or, to put it another way, the farther gold is pulling away from silver, valued in dollars per ounce.

At the current ratio of 88:1, which is far out of whack from the historical ratio of 54:1, silver is on sale. The question precious metals investors need to ask themselves is, with the world having become a much more dangerous place with the coronavirus spreading and all the other hot spots, like Iran, North Korea, the Middle East, etc., still in play, will gold move down to adjust to a more normal ratio, or will silver prices head up?

As we wrote in Hi-yo Silver Away! silver is expected to do well this year through a combination of higher industrial and investment demand, and tightened supply owing to mine production issues and output cuts.

The main factors that will determine silver’s fate, are whether or not there is a full resolution to the US-China trade war (a complete deal, to follow the Phase 1 agreement, would be bullish for the world economy, and boost demand for all metals including silver); global growth prospects, particularly in sickly Europe; the relative strength of the US dollar; bond yields; and whether central banks continue to keep a firm lid on interest rates.

Bonds

As the stock market climbs a wall of worry related to the coronavirus, and nearly $14 trillion worth of negative (ie. below 0%) global debt continues to slosh around, yield-hungry investors are looking state-side – where the yield on the benchmark 30-year Treasury bond has fallen to an all-time low (<1.9%) but is still positive!

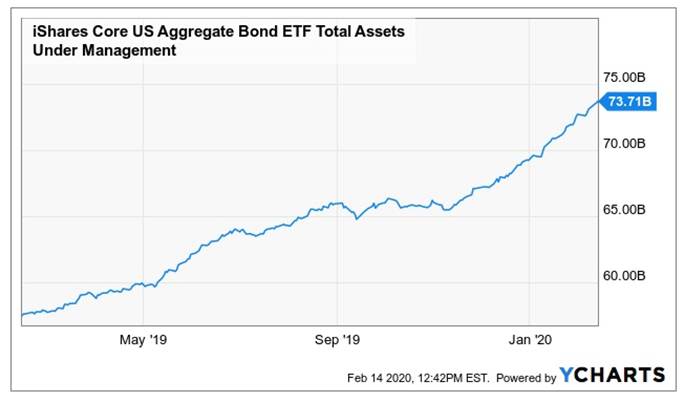

That, and the fear of a US stock market correction, has US bond funds hitting record inflows of capital not seen since 2001.

According to an article in Seeking Alpha, bond funds including those linked to US Treasuries, could attract roughly $1 trillion in assets by the end of 2020.

Contributor Josh Ortner writes, Record inflows continue for treasuries as investors perceive them as one of the safest places to invest.

If you are a global investor looking to de-risk your fund or add a security with somewhat negative correlation to equities, you turn to U.S. Treasuries.

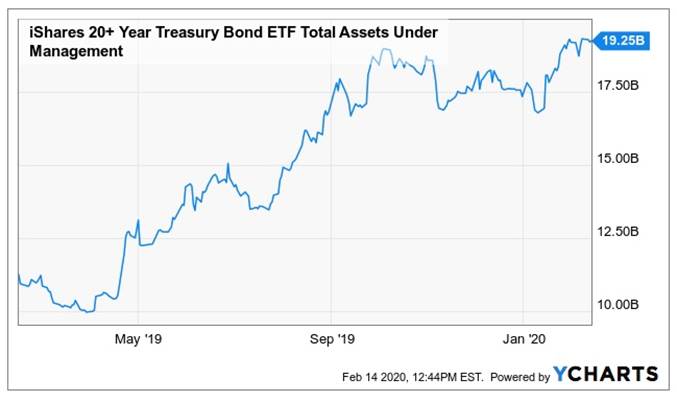

The U.S. Treasury sold $19 billion of long-term bonds with a record low yield of 2.061% [last] Thursday. Global investors and domestic investors are buying bonds, and I don’t see many reasons for these investors to stop… Why would anybody purchase a bond with a negative yield when you can purchase U.S. treasuries still yielding 2%? This simple question is fueling more assets the way of TLT. [the iShares Barclays 20+ Year Treasury Bond ETF]

Conclusion

We are seeing something very interesting happening in the flight to safe havens, owing to fear and panic of the Covid-19 pandemic worsening.

On the one hand we see major demand for the US dollar and Treasuries, which despite being at record low yields of around 2%, are still offering a better return than the majority of sovereign bond yields which are negative.

We know a lot of investors are buying bonds because yields fall as bond prices rise. And we know Treasury demand is rising because to buy Treasuries you need dollars, and the US dollar remains very strong.

On the other hand, precious metals are seeing healthy safe-haven demand, for all the reasons people like holding gold – it’s a hedge against inflation, a long-term store of value, it functions as a currency when fiat currencies fail.

Recent gold buyers may also be motivated to buy bullion instead of T-bills because they refuse to swallow the narrative of the US economy doing well. As we pointed out in a recent article, this is “fake news”

The question is, which will win amongst the safe havens, bonds or precious metals? At AOTH we’re betting on gold and silver. While the coronavirus hasn’t yet impacted the US economy, the way things are going it will only be a matter of time before it does. A worsening US economy will turn investors away from bonds and Treasuries. The dollar will fall and commodities will rise, including gold and silver, pushed higher by investment demand for ETFs and physical metal.

Which is the better buy, gold or silver? The gold-silver ratio is currently at 88 and rising as both silver and gold keep climbing on virus fears. However the ratio is far higher than its historical average of 50-60:1, meaning either gold must fall or silver must rise. If I was a betting man, I’d put my money on a 2020 run on silver.

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.