Getchell Gold completes IP survey on Star Point

2020.10.16

Ever since Newmont’s discovery of the large Carlin deposit in the 1960s, gold mining has become a focal point of Nevada’s economy.

Each year, more than 5 million ounces of the yellow metal are produced within the state, which based on today’s gold prices amount to about US$9.5 billion in value. Nevada is now home to nearly 30 gold mines, with more to come.

Moving forward, gold may not be the only metal that the state of will be known for. Many parts of the state are also rich in copper, a metal that has seen a big turnaround this year thanks to its usage in electric vehicles.

In December 2019, the Pumpkin Hollow mine in Yerington became the first US copper operation to reach production in a decade. This is a sign of things to come for Nevada’s rising prominence in the copper supply chain as well.

As proven by many others before, the key towards building up a project is identifying and exploring areas on which mining activities have been documented in the past, which is exactly what Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) has done so far.

Less than a month into its fall exploration on the Star Point copper-gold project in Pershing County, the company showed its technical prowess by completing the Induced Polarization (IP) geophysical survey ahead of schedule.

A total of 22.5 km along five lines were completed over two high-grade occurrences identified on the property: the historical Star Point copper mine and the copper-gold-silver Star South artisanal mining site. Results are expected back within 2-3 weeks, which will reveal more about this early-stage Nevada project.

Star Point Copper Mine

The Star Point mine is the site of a near-surface, high-grade copper oxide (tenorite) mine that operated from the late 1940s through the mid-1950s. Ore produced from the mine was shipped to a smelter in Utah for processing, though there is no record of shipped tonnage or grade.

Previous development was focused on a 300 x 300 m area at the southern edge of a north-south trending promontory. The surface area is covered with various pits, portals, shafts, open cuts, and associated dumps, while the underground development consists of several short shafts, winzes and tunnels of varying length leading to a series of stopes and drifts.

Surface sampling first began in 2011, with the samples primarily sourced from the dumps and to a lesser extent from outcrop. Of the 79 grab samples collected, 13 of them returned a grade >0.5% Cu, with the highest grades reported at 4.25, 3.00 and 2.35% Cu (see figure below).

Fast forward to 2018, a magnetic geophysical survey and a limited (one line) IP survey was conducted over the Star Point area. This revealed that the surface mineralized expression at Star Point is underlain by coincident magnetic high, chargeability high and resistivity low anomalies that are interpreted as potential copper sulfide mineralization, possibly intrusion related, and presented a compelling drill target for the company.

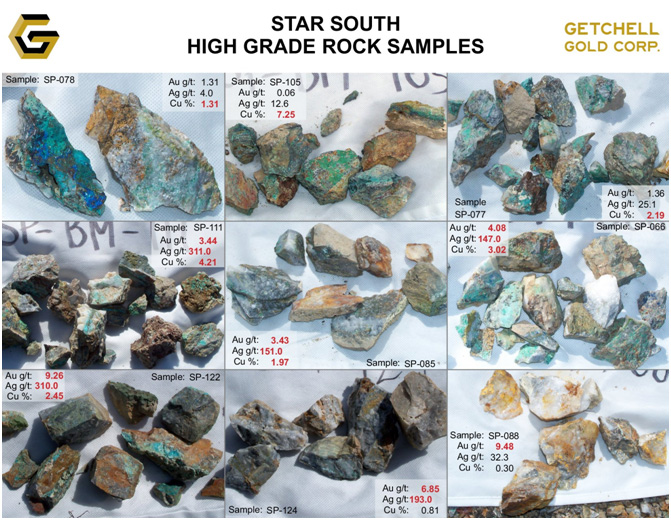

Star South Prospect

The second area of focus within the Star Point property is the Star South Cu-Au-Ag prospect, situated just 2 km south of the historical mine.

This target area consists of a series of pits, artisanal adits and associated dumps within a 300 x 150 m east-west trending area. These adits appear to follow high-grade Cu-Au-Ag mineralization hosted within quartz veins that are associated with shears trending in several different orientations.

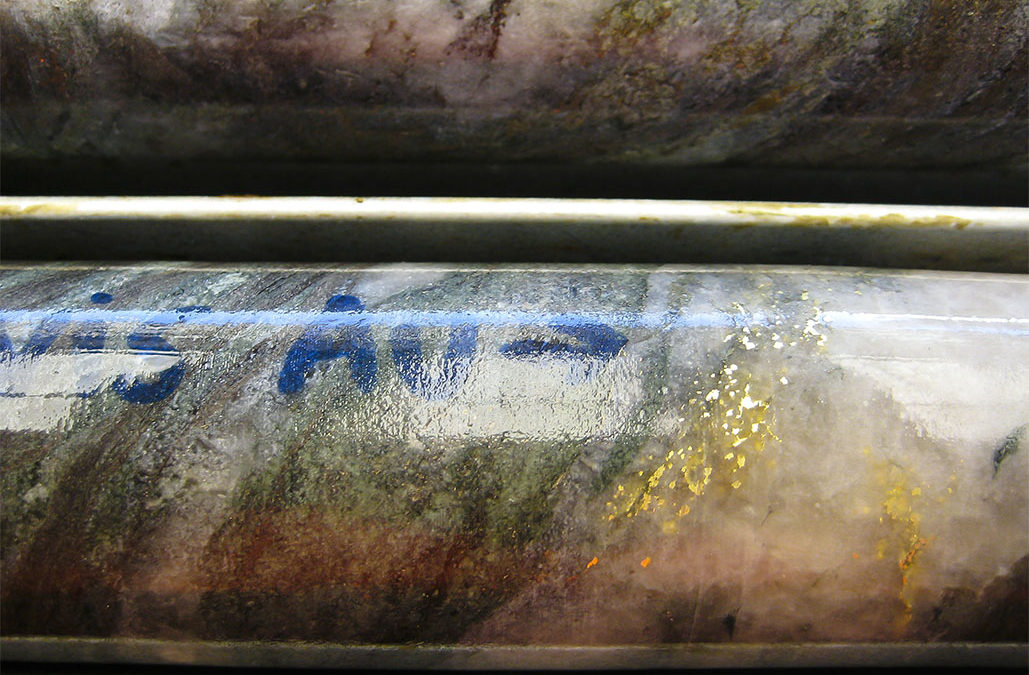

As part of the 2011 sampling campaign, a total of 89 samples were collected with the vast majority sourced from the dumps in the area. As with the Star Point mine, there was an abundance of malachite and azurite mineralization (see images below), which is indicative of a high copper content, as well as gold and silver.

What’s more impressive is that of the samples collected, many of them reported high grades of copper, gold and silver in combination, with 40 samples grading >1% Cu, 21 samples grading >1 g/t Au and 20 samples grading >30 g/t Ag. One sample returned an impressive 2.45% Cu, 9.26 g/t Au and 310.0 g/t Ag.

This sampling work was later validated in the 2018 surveys, which reported the presence of a strong conductor coincident with a NE-SW trending magnetic low. The geophysical signature is interpreted as a potentially mineralized structure along the thrust fault boundary with the high-grade historic artisanal workings representing the mineralized expression at surface.

Fondaway Canyon Drill Program

Star Point is not the only project Getchell is looking to advance. In fact, the real gem of its portfolio is the advanced-stage Fondaway Canyon gold project located about 65 km south of Star Point in Churchill County, Nevada (see map below).

Thus far, four of the six drill holes planned as part of a 2,000 m drill program have been completed, with samples from the first two holes already sent for cutting and assaying.

First set of results from these drill cores are anticipated in 4-5 weeks. Additional core shipments will be scheduled weekly through the conclusion of the drill program, set for completion by the end of the month.

Fondaway Canyon consists of a land package comprising 170 unpatented lode claims. The property has a history of previous surface exploration and mining in the late 1980s and early 1990s.

Getchell acquired the project along with the Dixie Comstock properties as part of a definitive option agreement with Canarc Resource Corp. for a potential outlay of US$2 million cash and another US$2 million in stocks.

Upon signing the deal, Getchell chair and CEO William Wagener said these properties would “dramatically transform and elevate” the company in prominence given that they boast significant gold in the ground and location in a top gold mining jurisdiction.

Given Fondaway Canyon’s project profile, that could be a matter of time.

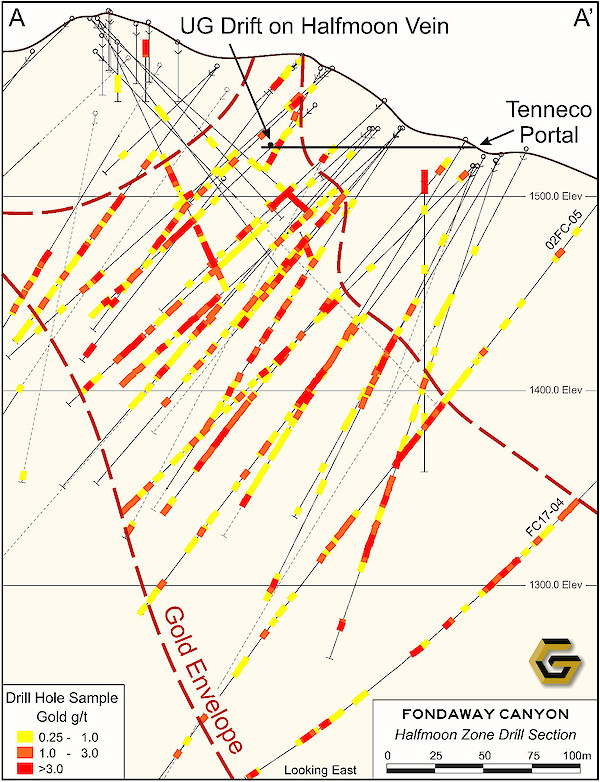

The Fondaway Canyon mineralization is contained in a series of 12 steeply dipping en-echelon quartz-sulphide shears outcropping at surface and extending laterally over 1,200 m, with drill proven depth extensions to > 400 m. The deposit is hosted by Mesozoic age sediments and minor volcanics.

According to a 2017 technical report, the project contains an estimated 409,000 oz of indicated resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au for a combined 1.1 million ounces.

Significant intervals within a large resource have been detailed from prior work, including 2.83 g/t Au over 65.4 m and 1.77 g/t Au over 62.9 m at the Colorado zone; and 1.01 g/t Au over 66.1 m at the Halfmoon zone (see figure below)

When talking about the deposit earlier this year, Getchell confirmed the presence of two mineralized domains on this property: a higher-grade one based on drill intercepts grading >1 g/t Au; and an enveloping lower-grade one based on drill intercepts grading >0.25 g/t Au.

The aim for the company now is to investigate its potential similarities with the world-famous Carlin-style gold system, which is noted for its “invisible” nature. As such, additional work on the veins at Fondaway is warranted.

The fact that Fondaway Canyon has stibnite boulders on the property is very encouraging, the miner previously noted, as a combination of arsenic and antimony (stibnite) is “a strong indicator of a big system.”

Conclusion

With exploration work activated on a second Nevada project, Getchell is now well-positioned to expand its footprint further in the “real golden state” of America and unlock its potential in copper as well.

A recent injection of funds through a $1.1 million private placement also puts the company in a stronger stead to pursue its goals.

Getchell Gold

CSE:GTCH, OTC:GGLDF

Cdn$0.38, 2020.10.16

Shares Outstanding 69,722,750m

Market cap Cdn$26.49m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.