Free-spending Biden and/or continued Fed stimulus will hike gold prices

2020-11-14

Gold may have come off the boil a bit after rising beyond $1,900 an ounce in the aftermath of the US election, but the precious metal will do well under a Biden presidency, an Ahead of the Herd analysis has found.

The main factors are drastically increased government spending, leading to even more unsustainable US debt levels than currently; dovish monetary policy as the Fed continues to advocate “lower for longer” interest rates; and a sinking US dollar. Gold prices and the USD generally move in opposition to each other.

Gold and the debt to GDP ratio

The debt-to-GDP ratio is an important metric economists use for comparing a country’s total debt to its gross domestic product (GDP).

The percentage arrived at by dividing the country’s total GDP by its total debt indicates the country’s ability to pay back its loans. The higher the percentage, the higher the risk of a country being unable to pay the interest on its debt, and therefore defaulting on its debt.

According to the World Bank, countries whose debt to GDP ratios are above 77% for long periods experience significant slowdowns in economic growth. Every percentage point above 77% knocks 1.7% off GDP, according to the study, via Investopedia.

During the rounds of quantitative easing (QE) conducted by the US Federal Reserve during the financial crisis, the Fed increased the money supply by $4 trillion. But there was also a massive fiscal stimulus package launched to get the economy moving again. Bailing out the banks cost $250 billion and the American Recovery and Reinvestment Act added $242 billion to budget deficits in 2009 and $400 billion in 2010.

We saw the debt to GDP ratio jump from 62% in 2007 to 83% in 2009, 90% in 2010, and it has kept climbing ever since.

Gold, being a hedge against inflation, which typically rises when the money supply increases, has done well under periods of quantitative easing, when central banks literally “print money” to purchase sovereign debt instruments (like US Treasuries) and mortgage-backed securities (MBS).

Historically, we know that as the percentage of debt to GDP rises, so does gold. The chart below, by the Federal Reserve Bank of St. Louis, shows the debt to GDP ratio from 1970 to 2020. The second chart is the spot gold price since 1974.

The close correlation between gold and the debt to GDP ratio can also help to forecast gold prices, even during our current predicament. As the pandemic worsens in the United States amid a “second wave” of infections there and in several other countries, including Canada, GDP will fall, likely dramatically.

We are already seeing signs of distress in the US economy, as the recovery that started in summer begins to sputter amid a shocking rise in covid cases. (more than 125,000 per day through early November, six times the levels in June. A thousand people a day are dying) Reservations for in-restaurant dining fell for a fourth week in a row, foot traffic to retail sites is dropping weekly, and the Oxford Economics broad index of the recovery declined for its fourth straight week. Reuters quotes the firm’s chief economist saying the index of economic, social and health data “is reeling”, noting it is back to midsummer levels largely due to eroding health conditions, with local indicators falling in 47 states.

That’s the first part of a rising debt to GDP ratio – a hit to GDP. The second part is an increase in debt. Back in March, when the Fed began to “spray billions into the US economy” to deal with covid-19, a Bloomberg article stated that Combined with an unlimited quantitative easing program, the Fed’s souped-up lending facilities are set to push the central bank’s balance sheet up sharply from an already record high $4.7 trillion, with some analysts saying it could peak at $9-to-$10 trillion.

As of Nov. 4, the Fed’s balance sheet stood at $7.2 trillion.

Consider what a $10 trillion balance sheet will do to the debt to GDP ratio.

Already at 98%, a level not seen since World War II, the Congressional Budget Office said it expected federal debt held by the public to exceed the size of the US economy (ie. Debt >100% of GDP) on Oct. 1, 2020.

With overseas investors like China and Japan continuing to gobble up US Treasuries, and zero interest rates likely to remain in place for the foreseeable future, allowing the federal government to keep borrowing to pay for more stimulus, the debt to GDP ratio will almost certainly go higher.

It’s not inconceivable for the ratio to spike to $150%, or 200%, meaning for every dollar the US economy produces, it has to borrow $1.50, or $2.00. That’s insane.

The coming debt crisis

Indeed the flip side of government spending, which everyone agrees is necessary during these unprecedented times, is a new calamity: the crisis of debt.

According to Foreign Policy,The next U.S. administration will likely face a global debt crisis that could dwarf what the world experienced in 2008-2009. To prevent the worst, it will need to address the burdensome debt plaguing both the United States and the global economy.

The current global debt level is a whopping 320% of world GDP.

The article notes that, in addition to the level of US public debt exceeding 100% of GDP for the first time since World War II, the amount of corporate debt in America has skyrocketed:

Almost 20 percent of U.S. corporations have become zombie companies that are unable to generate enough cash flow to service even the interest on their debt, and only survive thanks to continued loans and bailouts.

Biden’s spending spree

The debt is only going to get worse under Biden, although this also means an exceptionally good market for certain metals, including gold.

During the presidential debates, Joe Biden indicated if he becomes president, there will be a major shift away from fossil fuels to clean energy – wind and solar.

Biden has signaled he will embrace central concepts of the “New Green Deal” – a program first espoused by New York Congresswoman, and Democratic wing-nut, imo, Alexandria Ocasio-Cortez – including spending $2 trillion over four years to counter climate change.

(“AOC” will reportedly serve on a panel helping Biden to develop climate policy.)

Dubbed “Clean Energy Revolution”, the plan calls for installation of 500,000 electric vehicle charging stations by 2030, and would provide $400 billion for R&D in clean technology.

If coronavirus continues to grip the US economy during the winter, and we see no reason to believe it won’t, despite talk of a vaccine, slower growth will intensify calls for more stimulus. The $2 trillion aid package that Congress approved back in March is largely exhausted. Biden’s election victory makes the chances of another stimulus bill more likely than if Trump had gotten back in. According to Capital Economics, via Associated Press, a package of $1 trillion to $1.5 trillion would add as much as 4.5% to growth next year – enough to return the economy to its pre-pandemic level by the end of 2021.

The president-elect has promised nearly $5.4 trillion in new spending over the next decade, according to the University of Pennsylvania’s Penn Wharton Budget Model, including $1.9 trillion on education and $1.6 trillion on new infrastructure — roads, bridges, highways and other public structures. Some of it would be paid for by tax increases. Biden has said he would boost the corporate income tax to 28% from 21%, reversing half of Trump’s cut from 35% in 2017.

Two ways the dollar falls

Of course, most observers expect Biden will have difficulty passing his agenda through a GOP Senate, where Republican senators will fight his tax increases and probably try to limit the size of any new stimulus package.

That brings up another factor that bodes well for gold going forward: the US dollar.

A potentially divided US Congress – the Democrats’ smaller majority in the House combined with a Republican-controlled Senate – could mean a smaller coronavirus aid package from lawmakers. This would put pressure on the central bank to ramp up bond-buying and other loose monetary policies that have weighed on the US dollar this year.

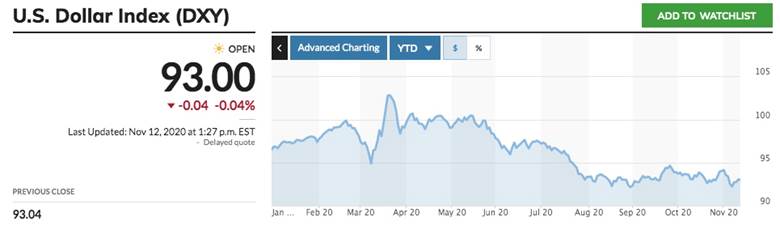

Since reaching a peak of 102 in March, the US Dollar Index (DXY) has lost nearly 10%, and is currently at a two-year low. The weaking of the dollar has been a significant factor in gold prices rising 20.8% year to date.

Last week, Fed Chair Jerome Powell said that the central bank was committed to keeping its bond purchases steady at $120 billion a month.

But whatever happens with the new Congress in January, the dollar takes the brunt. If, however unlikely, the Dems manage to take the two Senate seats still up for grabs in Georgia, that could mean a larger stimulus, and a loosening of the spigot on a torrent of green infrastructure spending by Biden.

A cheaper dollar would be welcomed by many US companies because it makes their goods more competitive abroad, but the problem is in that case, the dollar’s competing currencies are strengthened. So far this year the euro has gained around 6% against the greenback and the Japanese yen has risen about 5%.

These gains go against foreign central banks’ efforts to boost economic growth, by keeping their currencies low in relation to the dollar. Reuters quotes Momtchil Pojarliev, head of currencies at BNP Asset Management, who believes the dollar will sink to fresh lows over the next three months.

“The Fed is very dovish and is going to stay dovish,” he said. “The bigger the stimulus, the worse for the dollar.”

CNBC adds that the dollar is also likely to fall due to the market viewing geopolitical risks to be lower with a Biden win, and the fact that US trade policy will probably become more predictable, without escalating tariff threats. (investors tend to move their funds into US dollars, or USD-denominated assets like Treasuries, in the event of destabilizing events like trade wars, civil unrest or military confrontations)

Conclusion

Biden, despite claiming otherwise, believes strongly in the power of the state to tax and spend, and will face overwhelming pressure from the left wing of the Democratic Party – supporters of hard-left progressives like Elizabeth Warren and Bernie Sanders – to toe the party line. A long wish list waits to be filled, with little to no concern regarding the already out of control $27 billion national debt, courtesy of Modern Monetary Theory, or MMT.

MMT is a new way of approaching the US federal budget that is both unconventional and absurd. It posits that rather than obsessing about how large the debt has grown and the ongoing annual deficits that fuel debt, we should focus on spending, specifically, how the government can target certain spending programs that will cause minimal inflation. Fiscal policy on steroids is, according to its proponents, to be the new engine of US growth and prosperity.

Government is therefore given a free pass on spending, because the only thing that we have to worry about with the national debt is inflation. Curb inflation and the debt can keep growing, with no consequences. This is because the US government can never run out of money. It just keeps printing it, because dollars are always in demand (with the dollar being the reserve currency, and commodities are traded in dollars).

MMT and the ideas of the Democratic Party’s far left fit like hand and glove. Pleas for universal medical coverage, free college tuition and a minimum $15 per hour wage can all be paid for by setting the money presses free.

It doesn’t take a great deal of economics knowledge to see that MMT would decimate the value of the US dollar, which has lost a significant amount of value since hitting multi-year highs in March.

The dollar and commodities move in opposite directions, because when the dollar falls, those using other currencies get a better exchange when they swap their money for US dollars, thereby boosting demand for said commodities.

For example, when the dollar slumped between 1998 and 2008, gold prices nearly tripled, reaching $1,000 an ounce in early 2008. A falling dollar due to MMT will be good for gold, and all metal prices.

Gold prices will also be strengthened by a slew of other factors, including covid-19, inflation expectations on the back of (seemingly) unlimited monetary stimulus, low interest rates worldwide, and geopolitical concerns especially US-China tensions over trade, and the South China Sea. China will be the top foreign policy priority for Biden and his team.

Even if Biden doesn’t fully embrace MMT, we expect stimulus spending on steroids especially if he gets a Democratic mandate from both the Senate and the House. The flood gates of coronavirus relief will be opened, with billions spent on mandatory masks, stricter social distancing protocols, increased and sustained relief for individuals, businesses, food banks, day cares, etc. As long as interest rates remain low, and they are expected to until at least 2023, expect many trillions of dollars to fly out of the Treasury, with little to no consideration of the consequences.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security.

AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.