Exploits Discovery consolidates land position along Appleton Fault

2020.10.24

Oftentimes in mining — especially for a celebrated commodity like gold — all it takes is a single major discovery for an entire area to garner the attention of those in the industry.

That was what happened in Central Newfoundland, where a private company “struck gold” from drilling within the Exploits Gold Belt area late last year.

In November 2019, New Found Gold Corp. (TSXV: NFG) announced one of the most significant drill results ever reported within the province at its Queensway project: a 19 m intercept at 92.86 g/t Au. Since then, it has successfully gone public and now has over $150 million in market capitalization.

Soon after that breakthrough, word began to spread throughout the mining industry that the region’s untapped gold resources may be bigger than perceived.

Even before New Found Gold put Newfoundland on the gold mining map (see below), Sokoman Minerals Corp. (TSXV: SIC) and Marathon Gold Corp. (TSX: MOZ) have had success with their respective gold exploration quests within the province, with the latter continuing expanded drilling on its Valentine Lake deposit having tabled a new resource estimate earlier this year.

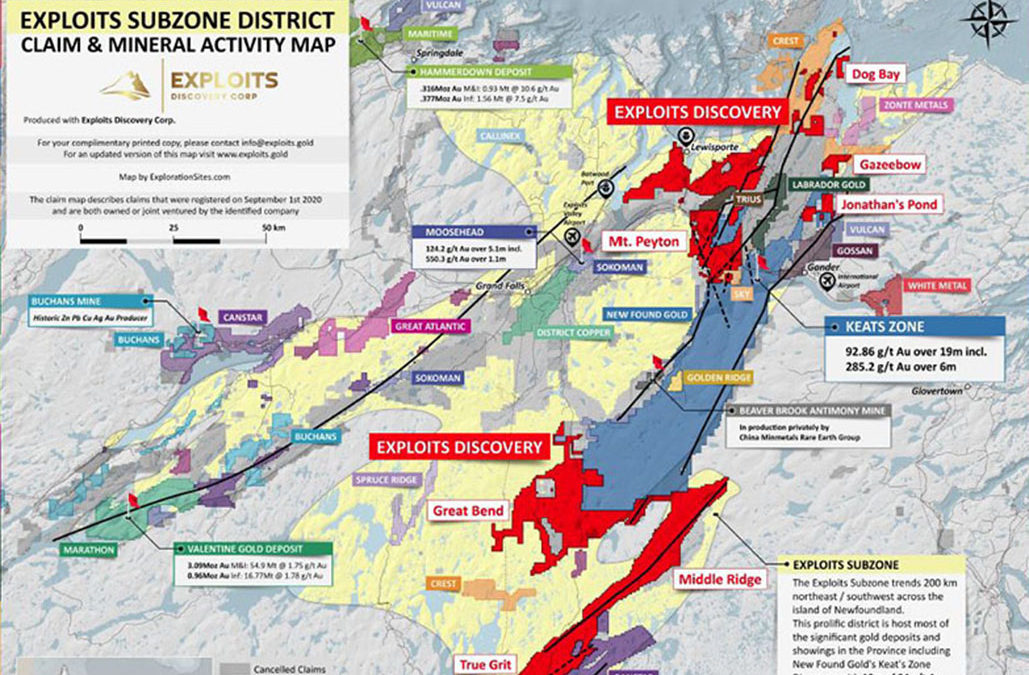

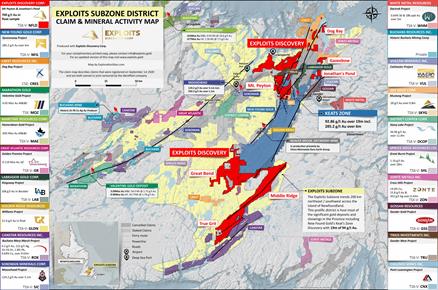

Exploits area play map, click on map for larger image

But the Queensway drill result was simply too good to be ignored, as it hints that the mineralized structures on the Central Newfoundland Gold Belt could be host to numerous multi-million-ounce deposits extending eastward from the Valentine Lake camp and beyond.

That revelation has led to an influx of junior miners looking to join the next potential gold rush and kicking off exploration across the Central Newfoundland corridor in 2020.

One of the companies that have made substantial investments in the area is Exploits Discovery Corp. (CSE: NFLD), which began snapping up a series of highly prospective projects around New Found Gold’s discovery and even changed its name (previously Mariner Resources) to reflect on this exact area play.

Exploits area play

The Exploits Subzone has been considered a prime environment for true discovery, with prominent regional thrust faulting indicative of a long tectonic history and fluid migration.

Trans-compressional strike-slip movement in the regional siliciclastic units underlain by mixed mafic volcanics of the Gander River Ultramafic Belt (GRUB) creates a highly prospective area for exploration, which has become the company’s main focus.

In fact, Exploits owns the largest land package in the province, besting the likes of New Found Gold and Labrador Gold (TSXV: LAB).

And that geographical advantage recently just got even bigger.

Expanded Land Position

This week, Exploits continued its asset buying spree and expanded its already dominant land position with the purchase of four claim blocks, totaling 769 claims and 192.5 km², in an area within the Port Albert Peninsula, where its Dog Bay property is situated.

In exchange, the company issued 6.2 million of its shares (trading at $0.62 per share at the time of transaction) to the claims’ previous owners including Crest Resources (CSE: CRES), which also owns land in the area and was already a stakeholder in Exploits.

Dog Bay

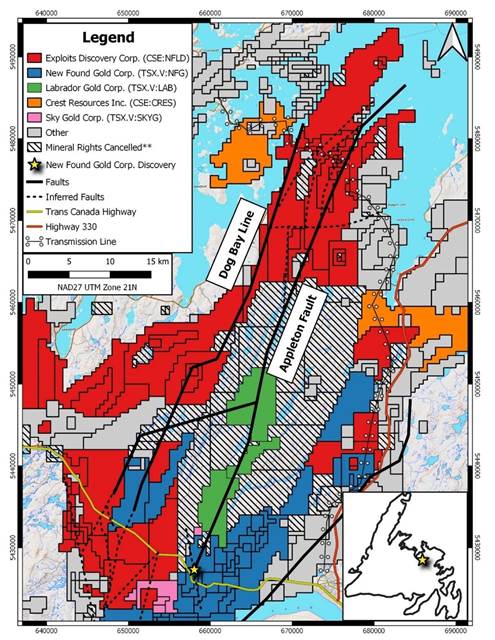

And with that, the Dog Bay project has now more than doubled in size at 1,254 mineral claims and 313.5 km², encompassing 21 km of strike length along the prospective Dog Bay/Appleton Fault.

Appleton Fault

The Appleton Fault has been the focus of a new discovery within the Exploits Gold Belt, with last year’s Keats zone discovery and this month’s discovery of 41.2 g/t Au over 4.75 m and 25.4 g/t Au over 5.15 m at New Found Gold’s Lotto zone, as well as advanced exploration work by Labrador Gold on the Kingsway project.

As for the Dog Bay project, its boundary is located just 40 km northeast of the late 2019 New Found Gold discovery, and is underlain by the same fault zones and similar packages of siliciclastic rocks as the discovery host.

While the Exploits Subzone, which runs 200 km from Dog Bay southwest to Bay d’Espoir, has been neglected since the last major exploration campaigns in the 1980s, incremental advancements in the understanding of gold mineralization in the camp have been made over the last 40 years.

Now, the company strongly believes that the sum of this knowledge is finally coming together in discrete and effective exploration models to drive major discoveries. The newly consolidated land and priority targets along the Appleton Fault could prove to be a good bet.

However, the Dog Bay project is only one of several projects that the company is working feverishly to explore in the Exploits Gold Belt (four already in advanced stage). The remaining projects in Exploits’ portfolio are listed below:

Mt. Peyton

This project contains structurally hosted gold targets around the NW-SE trending Mt. Peyton Linear. Historical fieldwork has defined high-grade mineralization in this area with a strike length of over 7 km.

Mt. Peyton

High-grade gold in outcrop sampled by previous operator Noranda (1991) contained values up to 164 g/t Au. Drilling in the southernmost claims by Noranda also yielded 6 g/t Au over 2 m near surface.

Jonathan’s Pond

Historical trenching done by local prospectors on this property has revealed visible gold in quartz veins but was never assayed (Keats, 2004).

Jonathan’s Pond

Outcrop and float samples with gold values up to 29 g/t Au and 700 g/t Au, respectively, in trenches and till samples up to 27,000 ppb Au were found on west claims. The magnetic geophysical signatures outline multiple highly prospective structures beneath overburden.

Middle Ridge

This property consists of 1,582 mineral claims covering approximately 395.5 km². It encompasses 80 km of the GRUB offset regional structure, which is thought to be very important in the mobilization and concentration of gold mineralization in the area.

Gold deposition in the Exploits Subzone is found in secondary and tertiary structures crosscutting siliciclastic sediments bounded by the GRUB line. Surveys conducted on the property have defined discrete conductive zones within secondary and tertiary structures that warrant further exploration.

True Grit

The property hosts diamond drilling intercepts of up to 117 m of 0.60 g/t Au, including 26 m of 0.83 g/t Au from surface (Moydow Mines, 2002), channel samples of 15.6 g/t Au over 1.0 m (Teck, 1990) and grab samples of 30.2 g/t Au (Teck, 1990).

The property hosts geophysical anomalies coincident with Au-Sb-As soil anomalies measuring over 2.6 by 0.80 km.

New structural model focusing on epizonal orogenic gold within the secondary and tertiary structures stemming along the GRUB line provides a pathway to discovery for new gold deposits.

Great Bend

The largest property of Exploits’ portfolio in terms of size, Great Bend consists of 1,536 mineral claims encompassing a land area of 487.25 km². It is located within the Dunnage zone on the southwest extension of magnetic anomalies that are associated with gold mineralization.

Limited historical drilling on the property consisted of only 2,124 m and included 0.22 m at 0.6% Zn, 1.0% Pb, 0.24% Cu, and 110 g/t Au.

Gazeebow

This property consists of 98 mineral claims encompassing an area of 24.5 km². It contains a significant untested gold occurrence as well as prominent secondary structures trending subparallel to the GRUB.

It is host to the Georges Point gold showing, which is a 3 m wide quartz vein that was traced for 250 m with grab samples of 0.96 g/t Au.

‘Smart Targeting’ Approach

With the vast amount of land yet to be fully explored, it became imperative for Exploits to first discover cost-effective ways of unlocking the Exploits Subzone’s gold potential, or even better: to seek out experts who have successfully done it before.

Hence, it has engaged the services of GoldSpot Discoveries Corp. (TSXV: SPOT), the same company that worked with New Found Gold towards the high-grade discovery at Queensway.

This arrangement will see GoldSpot apply its proprietary machine learning technology — dubbed the ‘Smart Targeting’ approach — and geoscience expertise on the above-mentioned projects held by Exploits.

In turn, GoldSpot will receive a 0.5% net smelter return royalty on Exploits’ land package, with the option to purchase an additional 0.5%on the same claims for $1 million.

“With many areas containing a similar geological model to New Found Gold’s discoveries, we are eager to work with GoldSpot to deploy modern exploration techniques on our property,” Exploits CEO Michael Collins said.

New Found Gold

Denis Laviolette, executive chairman and president of GoldSpot, echoed that optimism about Exploits’ projects:

“We believe in the vast potential of Newfoundland and we are committed to further unlocking its geological value. This deal increases our royalty portfolio, which now includes over 600,000 acres of prospective land in Newfoundland.”

At this rate, it may not be long before the next big Newfoundland discovery is made.

Exploits Discovery Corp.

CSE:NFLD

Cdn$0.57, 2020.10.23

Shares Outstanding 49,339,874m

Market cap Cdn$28.1m

NFLD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Exploits Discovery Corp. (CSE:NFLD). NFLD is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.