Copper bulls ride on Chinese demand, South American supply squeeze

2020.10.31

Despite fund managers having trimmed their exposure to copper following a mini-price crash in the first two days of October, according to Reuters mining reporter Andy Home, This looks to be no more than a blow-off of speculative froth accumulated on copper’s long march higher from the covid-19 lows in March.

Overall commitment to copper’s bull narrative seems largely unshaken, with money manager long positioning on the CME High-Grade copper contract still elevated and bears conspicuous by their absence.

Chinese demand

Indeed it’s hard to be bearish on copper from reading the favorable reports coming out of China. The Asian superpower has practically recovered from the coronavirus, with the rest of the world starting to follow.

Six months into covid-19, global manufacturing posted its strongest growth in over two years, with factory bosses around the world reporting that new orders and output grew in September.

This resulted in JP Morgan’s Global Manufacturing Purchasers Managers Index (PMI) increasing from 51.7 in August, to 52.3 in September. Figures above 50 indicate growth, those under 50 a contraction. It should however be noted, that despite factory growth, some companies are still cutting staff. Manufacturing employment in September fell for the 10th month straight; although the US and China are hiring, the eurozone and Japan are reducing payrolls.

In China, however, it’s full steam ahead.

China is the world’s biggest commodities consumer so the health of its economy is watched closely to see whether there is demand and in which sectors. China’s official PMI in September stood at 51.5, half a percentage point higher than August, while the Caixin/Markit manufacturing PMI, which better represents small, private firms, fell slightly to 53.0.

According to the World Bank and the OECD, the Chinese economy in 2020 will grow 2% – the only G20 country to show positive economic output this year.

Recent media reports indicate that China’s next five-year plan, beginning in 2021, calls for huge increases in state reserves of crude, strategic metals and farm goods. Last month Bloomberg reported China had drawn up plans to buy 2,000 tons of cobalt, used in EV batteries. NDRC, the agency that oversees the reserves administration, bought cheap oil after crude prices crashed, and in early September, London Metal Exchange (LME) warehouses reported their lowest copper stock levels since 2005, as Chinese buyers scrambled to purchase material. The result was the copper price riding to a two-year high of US$3.09 per tonne.

Even the suggestion that a powerful agency like China’s NDRC might be buying a specific commodity, can send the price of said commodity soaring. This is especially the case for China, which consumes about half of the world’s red metal.

Every month, higher tonnages are passing over the country’s docks, driven by China’s rapid industrial recovery from widespread lockdowns during the first quarter.

In August, the country imported 489,000 tonnes of refined copper, with cumulative imports this year surging 39% to 3 million tonnes. Amazingly, despite the pandemic, the world’s largest copper buyer, China, has ordered an additional 850,000 tonnes, compared to this point in 2019.

China’s opaque media and economic statistics make any definitive answers as to why the country is stockpiling copper difficult, but among the most likely explanations is the fact that China wants to ensure that its secretive stockpiles are large enough to withstand disruptions to global trade, like we have witnessed with covid-19.

In a previous article we pointed out there are more nefarious explanations, other than just being prepared, that could be driving China to have large enough buffers for its inputs, that it needs to use up its +$3.3 trillion in US dollar reserves in a massive raw materials splurge. China, we argued, is preparing for war.

Infrastructure

China is likely to need even more copper, for example China’s State Grid has announced plans to spend nearly $900 billion over the next five years. There’s also China’s Belt and Road Initiative (BRI), expected to require billions of tonnes of copper, iron ore, zinc and other industrial metals needed to feed the regional infrastructure building program.

A key question is, how far the rest of the world follows China. Citi Bank, quoted in Andy Home’s article, predicts that copper usage outside of China will drop 11% his year. However, Home expects, as do we at AOTH, that the demand destruction caused by covid-19 is temporary, and will reverse itself, especially due to planned infrastructure and green infrastructure plans that have been proposed by Europe and the United States by way of economic recovery.

The European Commission has released a €1.85 trillion recovery plan focusing on “EU Green Deal” initiatives aimed at reaching the eurozone’s net emissions by 2050 target.

The Chinese have been touting their own form of blacktop politics as a way of restoring their economy. Among the projects that could receive a huge boost in investment, courtesy of a $700 billion stimulus program, are a $44.2 billion expansion to Shanghai’s urban rail transit system, an intercity railway along the Yangtze River ($34.3B), and eight new metro lines worth $21.7 billion, to be constructed in the virus epicenter city of Wuhan.

Beijing recently kicked off a widely anticipated program focused on “new infrastructure” and “new urbanization”.

New urbanization refers to refurbishing old urban housing stock, railways, airports, and upgrades to power grids and local utilities, while new infrastructure includes 5G networks, ultra-high voltage power grids, EV charging stations and data centers.

A global infrastructure spending push would mean a lot more energy metals will need to be mined. Copper’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal.

A report by Roskill forecasts total copper consumption will exceed 43 million tonnes by 2035, driven by population and GDP growth, urbanization and electricity demand. Total world mine production in 2019 was only 20Mt.

The global 5G buildout and the continued movement towards electric vehicles – including cars, trucks, vans, construction equipment and trains – are two big copper demand drivers.

Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

Infrastructure spending is an idea that has been kicked around quite a bit by Trump and his Cabinet, along with House Democrats.

In March, Trump talked about reviving a $2 trillion plan for improving the country’s roads, bridges, water systems and broadband Internet. Earlier in his presidency a $1.5 trillion plan for infrastructure spending became dead on arrival when Trump and the Democrats failed to agree on how to pay for it. Politics was also alleged to have played a role. Fortune reported Democrats said Trump walked out of a meeting on a $2 trillion plan and vowed not to work with them unless they stopped investigating him and his administration.

Nonetheless, infrastructure is back on the table, in a big way.

The Trump administration sees an existing infrastructure funding law, up for renewal by Sept. 30, as a vehicle to push the initiative through a broader package, sources told Fortune. The FAST Act authorizes $305 billion over five years. It could also be rolled into the next round of pandemic relief.

Joe Biden’s “green credentials” make him a popular candidate among eco-friendly Democrats and American voters who want to see an acceleration of the shift from fossil-fueled to renewable energies.

Biden’s $2 trillion clean energy plan calls for installation of 500,000 electric vehicle charging stations by 2030, and would provide $400 billion for R&D in clean technology.

A Biden administration would strengthen fuel economy standards – good for platinum group elements used in catalytic converters – and facilitate the electrification of the global transportation system – a shift we at AOTH have been firmly behind since Obama first introduced the idea in 2009.

Key to Biden’s $1.3 trillion infrastructure improvement plan, is a $50 billion investment in repairs to roads and bridges; $10 billion for transit construction in poor areas of the country; a doubling of BUILD and INFRA grants, and more funding for the US Army Corps of Engineers.

According to Wikipedia, the plan also includes investments in high-speed rail, public transit, bicycling, school construction, expansion of rural broadband, and replacement of pipes and other water infrastructure.

It will be interesting to see, if Biden gets elected, whether he revives the Obama administration’s $53 billion proposal to construct an intercity high-speed rail network, which was rejected by Republicans in Congress.

Supply tightness

Goldman Sachs recently raised its forecasts (3, 6 and 12 months) by $1,000 per tonne to $7,000, $7,250 and $7,500 respectively. In per pound terms, that is $3.17, $3.28 and $3.40. At these prices, copper mining is a very profitable business.

The influential bank forecasts the copper market will experience a 421,000-tonne supply shortfall next year, “the largest refined copper deficit in over 15 years, which should drive an acute level of market tightness.”

On the supply side, the market for copper is quite bullish. Chilean state-owned Codelco, the largest copper miner in the world, lost 4.4% of its production in July, as the coronavirus forced the company to scale back staffing, slow projects and turn off a smelter.

Currently, Chile’s BHP-run Escondida, the world’s largest copper mine, is desperate to fend off a strike that could lead to production bottlenecks or slowdowns. Canada-based Lundin Mining is also talking with its union about ending a work stoppage at its Candelaria mine.

In Peru, the mining industry has reduced its workforce to help stop the spread of covid-19, but this has affected output and construction of new mines, including Anglo American’s $5.3 billion Quellaveco project.

Although some restrictions were lifted in May, Peru’s copper production in August fell 2.5% to 193,852 tonnes. Full-year production is expected to drop 7.2%, due to disruptions at a number of large mines including Las Bambas, Constancia, Toromocho and Cerro Verde. The world’s second largest copper producer outputted 2.45Mt in 2019.

Covid-related mine closures, albeit temporary, are upending the copper market and bidding up prices, as investors fret over whether the industry can meet demand, especially now that China appears to be back on its feet.

Last month Bloomberg wrote that The global copper market could be on the cusp of a historic supply squeeze as Chinese demand runs red hot and exchange inventories plunge to their lowest levels in more than a decade.

Copper output from the world’s top 10 producers declined 3.7% during the second quarter, due to lockdowns in Chile, Peru and Mexico.

According to GlobalData, total output during the three-month period decreased from 2.7 million tonnes to 2.6Mt. Total annual mined copper production is around 20 million tonnes.

Another supply squeeze is likely in Zambia, where copper mines have halted $2 billion worth of planned expansions, due to a dispute over a royalty tax introduced last year. Among the companies refusing to cow to the government’s policy of “double taxation” (not allowing mining companies to deduct the royalty from other corporate taxes) are Canada’s First Quantum Minerals (Kansanshi mine), EMR Capital and its Lubambe copper operation, and Glencore’s Mopani Copper Mines. As Africa’s number 2 copper miner, any supply reductions from Zambia’s mines will likely be reflected in increased copper prices.

As we have reported, without new capital investments, Commodities Research Unit (CRU) predicts mine production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

The big question, of course, is whether the copper mining industry will be able to meet demand for all of copper’s industrial uses, plus new clean-tech applications like green energy and electric vehicles. A recent study by Mining Intelligence looked at 65 properties across the globe with exposure to copper, cobalt and nickel – metals that are essential for an EV’s motor and batteries. The properties all had feasibility studies completed within the past five years.

What Mining Intelligence found is shocking: the total proven and probable reserves of copper at the 65 projects totaled just 21.9 million tonnes – roughly equivalent to one year of global production. Actually, less than a year, considering that 100% of the reserves will not be extracted.

Mining is a relatively straightforward business: any producing asset has a limited lifespan and will eventually need to be replaced.

For every ounce or pound taken out of the ground, a mining firm must think about how to replace a mine’s reserves long before it reaches the end of the road. This not only ensures the business keeps pace with the demand-supply market dynamics but also the rest of competition.

However, for metals like gold and copper, the task of replacing reserves has become increasingly difficult as there is a severe shortage of large deposits around the world left to find or buy.

In the gold industry, the substantial decline in new discoveries has led many companies to resort to acquisitions instead of organic exploration to maintain or bolster their production. In 2019, global gold miners completed nearly US$20 billion worth of transactions, the best of any calendar year for nearly a decade.

Hunt for Copper Begins

Copper may dictate mining M&A activity in the foreseeable future. Major copper producers, like BHP, are already on the lookout for new deposits to replace their declining reserves.

For mining majors, most properties under development must have the scale to match the output of their depleting assets. Any new project must also sit on the lower end of the cost curve to make it a worthwhile investment.

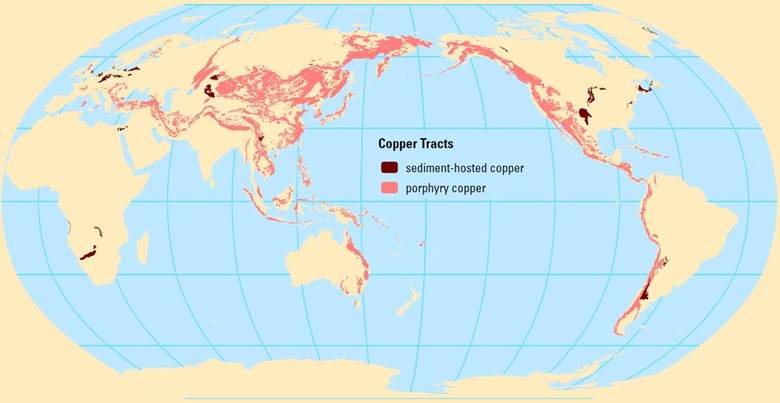

According to the US Geological Survey, three-quarters of the world’s identified copper resources are porphyry deposits (see map below), some of which may contain tens of billions of ore even after operating for several years like Chile’s massive Escondida mine.

USGS map

Copper miners can also lower their costs by taking advantage of these polymetallic deposits with precious metals by-products, which is the secret to success for many operations such as BHP’s Antamina.

Even the gold majors are starting to recognize the value of mining copper porphyry deposits, seeing as the metal has become a cornerstone of the global electric vehicle revolution and large gold deposits are now so hard to find.

This year, the world’s second-biggest gold miner Barrick Gold started eyeing copper deals, specifically Freeport-McMoran and its monstrous Grasberg mine in Indonesia.

This means the copper playing field is about to get even bigger.

Finding the Next Copper Mine

In January, RBC Capital Markets predicted that M&A in the copper space could surge in 2020. “It’s just getting more and more difficult to find copper let alone to mine it and bring it into production,” an RBC analyst quoted.

Now, any M&A deal headline would likely involve a mining junior holding what potentially could become the world’s next copper mine. The question then becomes: what kind of profile are big miners looking for?

As mentioned, any project must have the prospective scale to match a major’s appetite. This project should also have serious backing from investors and related parties to reach that potential. As well, it has to be located in an ideal mining jurisdiction, preferably in an underexplored area.

South American nation has become much more pro-mining since President Iván Duque Márquez took office nearly two years ago.

Secondly, and more importantly, Colombia is finally broadening up its mining industry after years of focusing mainly on digging coal.

In a Reuters interview, newly appointed mining minister Diego Mesa claimed that “the country is practically unexplored, almost in its entirety.”

Currently, mining concessions cover just 3% of Colombia’s territory and mining operations less than 1% of the country’s land. So, there is a great opportunity for metals such as copper, gold and even nickel, Mesa said.

As of now, the nation has pinned its economic hopes on the development of four projects including the newly opened Buritica gold mine in Antioquia province. But that number will undoubtedly grow over the coming years, and the government is looking to auction over 30 potential blocks of mining concessions as soon as 2021.

Some of the big gold players have already entered the fray. Recently, Newmont and Agnico Eagle Mines formed a joint venture near the Mid-Cauca belt, focusing on porphyry, epithermal and VMS mineralization.

In December 2019, we saw one of the year’s biggest gold deals happen with China’s Zijin Mining buying Canada’s Continental Gold and its Buritica mine at a premium price of $1.4 billion.

Conclusion

The supply-demand outlook for copper is not speculation; the expected structural deficit is real and quite frankly, terrifying, considering that countries are literally underpinning their “clean and green” economies on enough of the red metal being available.

How on earth is copper going to satisfy all of the demands on it, looking ahead 5, 10, 20 years? Will the mining industry be able to find new mineral deposits to replace the ones existing mines are depleting? Let alone find enough new copper tonnage required by vehicle electrification, energy storage, infrastructure upgrades, and an expanding developing world population that wants all of the copper products we in the developed West take for granted and plan to keep buying at first-world volumes?

I’ll leave that to greater minds to answer, but for now, and the near future, I expect copper prices will continue to rise on the back of robust industrial demand, both from China and from countries rolling out infrastructure programs seen as essential to economic recovery; and supply shortages owing to mine depletion and lower ore grades.

In this environment, owning a copper junior or two with a large, scalable deposit, and decent enough grades to interest a major, seems like a wise investment.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.