Champion Bear to drill Plomp Farm, Ontario gold play

2020.05.09

When looking for an investment the approach I take involves looking at the global – big picture – conditions. I study trends, read the news, basically watch and listen to what’s going on in the world. Then I study the different sectors in order to select the one that I think is going to match up well with, what I think is, the soon to be overriding theme. This is top down investing.

The second part of my search for the dominant investment is a bottom up approach. This is where I find individual companies in the specific sector I have chosen to invest in.

Company stage – risk v. reward

Only you can decide the level of risk you can tolerate and how much patience you have to sit while developments, the story, plays out.

The most upside (and by far the greatest risk) comes from buying a junior when they are exploring and make an initial discovery. Great drill assay results can send a junior’s share price skyrocketing. The reverse can also be true. Junior explorers, the green field plays, are the riskiest plays by far. Strike out on assay results and it could be goodbye to a share price rise for a very long time – till the company finds another project they can work on. If you’re buying into this kind of play make sure the company has another fallback project in its portfolio.

I always own one or two greenfield, early stage explorers, but my favorite stage junior is a junior in the post discovery resource definition stage (also known as brown field stage companies). These companies have all ready found something, the share price has settled back after the initial discovery (never chase a company whose share price has already exploded, the share price has had its run, for now the moneys been made. I try and enter after the excitement has died down and the share price has settled back) and the company is going in to see what they have and hopefully produce a 43-101 compliant resource estimate and build upon it. The risk has been greatly reduced, the waiting time for a discovery non-existent and the reward very nice considering the much lower amount of risk.

Despite market turbulence from the coronavirus, gold and gold stocks are among the highest-performing assets of 2020, with physical gold up about 14% through April 10, and senior gold miners advancing 2.8%.

There is no denying stock markets are volatile. But picking the right explorers/developers who own the most in-demand minerals, that can be bought at historically low valuations, seems to me a very prudent investing strategy right now.

Juniors, not majors, are the most adept at finding high-value mineral deposits. They already own, and endeavor to find more of, what the world’s larger mining companies need to replace their dwindling reserves.

I believe A massive bull market is building for gold. As an astute investor my job is to find the cheapest metal, still in the ground, to earn maximum returns on investment.

We also want experienced management teams with track records, tight share structures, and companies with money in the bank, to spend judiciously on exploration programs that will move projects forward in a timely fashion.

Champion Bear Resources

Champion Bear Resources (TSX-V:CBA) isn’t letting covid-19 get in the way of summer exploration at its Plomp Farm gold project in northwestern Ontario – one of four properties the Calgary-based company has in its portfolio.

Fortunately for mineral explorers, while the Ontario government’s Mining Lands Administration has put a temporary freeze on staking/ filing new claims, existing drilling, sampling and survey programs shouldn’t be affected by the outbreak.

That’s great news for Champion Bear Resources, which is planning a small drill program at Plomp Farm, scheduled to begin mid-July. The 9-hole program is essentially an information-gathering exercise that will add to an already extensive database of drill core at the property, which Champion Bear acquired back in the mid-1990s after discovering a second gold occurrence (the first discovery was made by Fred Plomp, now a CBA director and large shareholder).

Plomp Farm

Located 20 kilometers west of Dryden, ON, the shear-hosted gold system occurs in two main blocks – Plomp Farm East and Plomp Farm West – that overlie 13 km of favorable stratigraphy within the Thunder Lake assemblage. The West block hosts the Plomp Farm Main Zone where mineralization occurs within a broad corridor of gold enrichment associated with pyrite and elevated silver and base metals (copper, zinc, molybdenum and barium) concentrations. Previous diamond drilling intersected a 36-meter-wide zone containing 1 to 3% pyrite, chalcopyrite, sphalerite, and gold mineralization.

Exploration has been sporadic through the years, with Champion Bear conducting most of the efforts between 1994 and 2007. The project was inactive until 2017, when Champion Bear re-evaluated it. To date, the company has delineated two mineralized domains on the property through the compilation of mapping and diamond drill data.

The initial exploration focus was on quartz veining within the quartz-sericite schists. A schist is a type of metamorphic rock with a plated structure that is readily split into flexible layers. With further investigation, highly anomalous gold values were identified on the property hosted within sericitized felsic tuffaceous units, which indicated a second style of mineralization.

It’s interesting to note that the Plomp Farm mineralization style does not conform to the classic orogenic model characteristic of prolific greenstone belts, such as the world-famous Abitibi Greenstone Belt to the east. Instead, the mineralization ranges from disseminated stockwork zones, to veining with associated sulfide wallrock replacements, to less common sulfide-rich vein systems. This hybrid-mineralization model is also found in the nearby Goliath gold deposit being developed by Treasury Metals, and the Rainy River producing mine near Fort Frances, ON, operated by New Gold.

According to a May, 2019 technical report, a sheared schist hosts the majority of the mineralization and is subdivided into a high-grade and a low-grade domain.

Five phases of drilling were completed on the property between 1994 and 2007. A total of 115 holes were drilled totaling 45,317m.

On a project page, Champion Bear states that Main Zone drilling outlines a strong gold-bearing system over a 2-km strike. The results include 31.7 grams per tonne gold, 33 g/t silver, and 1.36% copper over 0.4m, and 7.84 g/t gold over 2.0m. Drilling continues to define the extent of the system, in particular the orientation of the higher-grade ore shoots, found to contain gold grades over 3 g/t plus zinc and copper values.

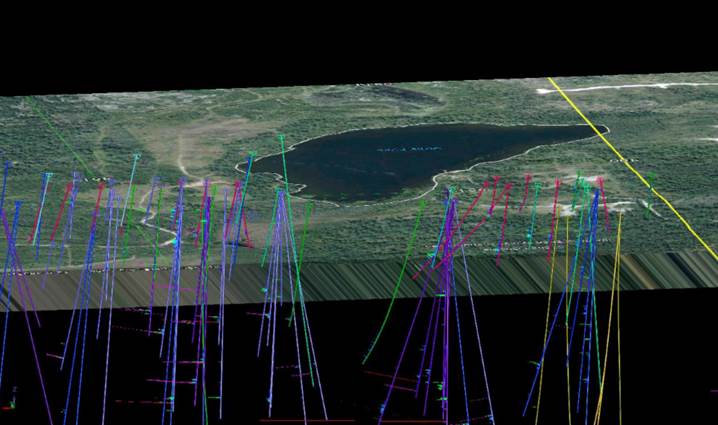

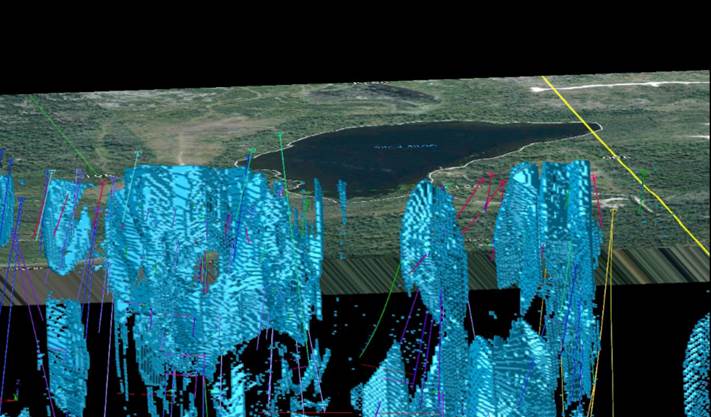

The map below shows drill collar locations and the property’s geology. Notice the white cross-hatched area shown as “Ardis Lake”. Previous drilling has identified mineralization on the east and west shores of the small lake – more accurately described as a pond, at under 2.5m depth – and south of it.

A 250m-long strike has been identified at surface and is thought to run underneath the lake. However, because the lake doesn’t freeze during winter and its shoreline is too soft to plant a drill rig, no drilling has been done yet to confirm that theory. CBA plans to drill 6 holes underneath the lake as part of the upcoming summer work program.

Champion Bear plans to wait until spring water levels drop to normal summer volumes, then use the existing drill pads to vector under the lake.

The lack of drilling from the lake results in data gap on the property

The data gap results in the resource model not having sufficient sample support to estimate grades under the lake.

6 under lake 2020 collar locations and direction

If all goes well, assays results should be available by September, allowing the company to compile a maiden resource estimate at Plomp Farm by October. If that seems fast, consider that the geological modeling for a pit-constrained resource has already been done; plugging in the results of the new holes is relatively easy.

Earlier geological models, done when gold was at $300 to $400 an ounce, skipped over the lower-grade material in the 0.5 to 1 gram per tonne range. But with gold prices now topping $1,700/oz, the cut-off grade will be considerably lower, meaning a whole lot more gold is economical to mine.

The idea is to delineate a pit-constrained resource and to build a mine that can be put into production relatively quickly, then access the deeper material later. There are indications of better grades at depth.

CBA currently trades at CAD$0.13 cents a share with a market value of just $7.3 million.

Following are some other points that impress me about this property:

- Custom-milling option. Champion Bear is exploring the possibility of a temporary custom-milling arrangement whereby its ore could be fed through Treasury Metals’ mill once it’s up and running. Foregoing its own mill, at least in the initial stages of production, would minimize capex, saving the company in the order of $30 million, along with $15-20 million for a tailings impoundment and all the environmental issues that accompany such a facility.

- Patented claims. The fact that a large portion of the claims at Plomp Farm are patented, versus unpatented, facilitates permitting.

- Initial metallurgical test work has not raised any red flags.

- Historical drill results. Champion Bear has accumulated a large bank of historical drilling data from which to compile a resource estimate. However the data needs to be catalogued and updated to current gold market conditions. This is a great opportunity to re-assay some of the broader zones of lower-grade mineralization (earlier programs sampled narrow intervals) which will help to drive the project forward.

- Infrastructure. CBA is in an enviable position as far as the property’s mining infrastructure. A provincial highway running east-west provides direct access and there is a major power to the property and a water well. A modern steel building has room separations to prevent sample contamination, and a cutting-edge, pun intended, computerized saw that cuts drill core at a meter a minute. A long history of mineral exploration in the region contributes to a well-skilled workforce. Although a 20-person camp was built in the ‘90s, it may not be required if labor can be drawn from nearby Dryden – which has an airport with daily connections to Thunder Bay and Winnipeg.

- Geological expertise. Champion Bear is working with WSP Canada’s Todd McCracken, P.Geo, who along with overseeing the drill program, will be surveying previous drill holes to determine their directions and azimuths. McCracken has over 25 years of experience in mineral exploration, mine operations and resource estimation. He was the independent “qualified person” within the meaning of NI 43-101, who signed off on First Mining’s Goldlund Gold Project, 20 km northeast of Plomp Farm.

Parkin JV

About half of the Sudbury Basin’s metal production comes from zones in the footwall of the Sudbury Igneous Complex.

Wallbridge Mining and its partner Impala Platinum (Implats) have an earn-in agreement whereby spending $5 million on exploring a property overlying 7 km of the Parkin Offset Dyke, earns the joint venture a 50% interest. Champion Bear owns 50% of the project and is carried to production.

The Parkin Offset Dyke hosts several known shallow, high-grade sulfide zones including the past-producing Milnet Mine, the Parkin Indicated Resource of 291,000 tonnes @ 1.35% Ni+Cu and 1.65 g/t PGE, and the Brady Showing (2.7m @ 11.8% Ni+Cu and 15.1 g/t PGE). On a project page, Champion Bear states that 2009 drilling at Brady intersected over 850m of locally mineralized Parkin Offset Dyke. Follow-up borehole geophysical surveys further enhanced the quality and location of the targeted anomaly. Nearby on strike, Wallbridge Mining’s new high-grade discovery (14.2m @ 3.35% Ni+Cu and 8 g/t PGE) was intersected in two drill holes and drilling is ongoing.

Eagle Rock

Champion Bear’s 100% owned Eagle Rock Cu-PGE-PM project hosts a number of sulfide showings including the Campbell Zone, which Champion Bear describes as “a continuous, predictable, PGE reef-type horizon exposed at surface over more than one kilometer.”

The 60 x 20 km property sits on top of a large intrusion called Entwine Lake, host to several sulfide showings including the Campbell Cu-PGE-PM Zone, first explored by now defunct Noranda in 1969.

Recently Champion Bear acquired an option on mining claims located on the south side of the intrusion, near Kenora, ON. The new exploration area contains a number of historic mine pits and channel sampling digs that have never been drilled off. The presence of surface mineralization and a significant geophysical signature indicates this southern portion of the project bears a strong resemblance to the Campbell Zone.

Seventy holes punched into Campbell defined the zone up to a depth of 200 meters, at an average width of 8m. Drilling expanded the sulfide mineralization along strike to the northwest and down-dip. The zone is open in all directions.

With mineralization starting at surface, the company considers Campbell open-pittable, and will continue drilling it to define the nature and extent of the zone. Champion Bear is currently compiling geophysical survey data, historical drill logs and other geological information, as it moves towards a maiden resource estimate at Eagle Rock.

A 1,600m drill program, completed in early 2019, encountered platinum group elements in every one of the nine holes.

CEO Richard Kantor said there is reason to believe the Campbell Zone is open at depth, meaning the orebody could extend for 10s or even hundreds more meters – perhaps even as deep as the Flatreef deposit in South Africa that extends over a kilometer underground.

Kantor says previous exploration including the 2019 drill program shows that an already large orebody, open in all directions, is clearly on the property, meaning Champion Bear is able to skip the discovery phase and jump right into resource expansion and delineation.

“We got real lucky but we always knew we’re not looking for the metal, we know it’s there. The vent comes in like a horseshoe, where all the solutions come up and spread on the ground, a layered-type intrusion. The sulfides are like a sponge and it sucks in the PGMs, Pd, Pt and Au,” Kantor explained.

A metallurgical study done back in 2001, using a moderate grinding of 80% passing 74 microns, followed by froth flotation appears straight forward for producing a copper concentrate that contains most of the by-products metals of value. Recoveries were between 90 and 95% copper, platinum and palladium. Gold and silver were recoverable at 85-90%. The resulting sulfide concentrate produces grades between 25 and 29% Cu, 5 to 14 g/t Pt, 8 to 15 g/t Pd, 6 to 9 g/t Au and 200 to 280 g/t Ag.

It may even be possible to produce rhodium (the most valuable PGE) although tests have not yet been carried out.

Conclusion

Champion Bear is fortunate in that the two properties it is working right now – Plomp Farm and Eagle Rock – are advanced-stage exploration projects. Historical drilling and survey data have identified mineralization at a number of targets. From an investment point of view, this takes quite a bit of risk out of both properties, and the company.

At Plomp Farm, a majority of the work has already been done, it’s just a matter of tying it all together. We are optimistic that this summer’s drill program will show mineralization under Ardis Lake and close the data gap, allowing CBA to tally up a mineral resource by October.

We are also aware that re-sampling a lot of the old drill core, assayed when gold was between $300 and $400 an ounce, could substantially increase the resource and build a strong case for a shallow open pit.

Like Plomp Farm, Eagle Rock has the geological footprint to host a major resource. Last year’s drill program hit mineralization in every hole, and delivered some nice widths. A large orebody, open in all directions, is clearly on the property, meaning Champion Bear is able to skip the discovery phase and jump right into resource delineation. Right now it’s all about data compilation – taking all the known surface expressions, studying the geophysics, and seeing whether there are areas on the property comparable to the Campbell Zone, that might warrant a hole or two.

Champion Bear recently completed a shares for debt transaction, whereby 3.5 million CBA shares were issued to eight creditors, thereby extinguishing $528,445.97 of outstanding debt. Watch for more news from Champion Bear in the coming weeks as it ramps up this summer’s drill program at Plomp Farm.

Champion Bear

TSX.V:CBA

Cdn$0.13, 2020.05.09

Shares Outstanding 56,319,996m

Market cap Cdn$7.32m

CBA website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Champion Bear (TSX.V:CBA), CBA is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.