As palladium market sizzles, PDM ready to drill LK project

2020.07.17

Palladium prices have slipped back a bit since the pre-pandemic record high of $2,880 an ounce, but the platinum group element (PGE) appears to have the wind at its back as the auto industry begins to recover from a severe slowdown, owing to coronavirus-related plant closures and slack consumer demand for new vehicle purchases.

Recently Commerzbank compared palladium with its sister PGE platinum, and came to the conclusion that platinum prices will follow gold prices higher, while palladium will benefit from a recovery in auto demand.

Both are used in catalytic converters needed to meet increasingly stringent government standards to reduce tailpipe emissions. Vehicles that run on gasoline use more palladium than platinum in their autocatalysts. The reverse is true for diesel models.

Autocatalysts represent about 80% of the demand for palladium.

In recent years, palladium has become the more popular PGE among automakers, due to an industry shift from diesel-powered models to cars run on gasoline, which pollute less. This is especially true in the two biggest car markets, China and the United States.

Diesel sales have fallen due to their propensity to pollute more, especially following the “diesel-gate” scandal in 2017. A US federal judge ordered Volkswagen to pay a $2.8 billion fine for rigging its diesel-powered vehicles to cheat on government emissions tests – as of June 1, 2020, the fraud had cost the German automaker $33 billion in fines, penalties, financial settlements and buyback costs.

According to Commerzbank, palladium will continue to be priced higher than platinum; although demand has been dented by covid-19, with car factories experiencing temporary work stoppages and consumers stuck at home during lockdowns, it is still around 2.3X more expensive.

“In the case of palladium, the correction we had expected has occurred,” Commerzbank said. “The recovery of the global economy and thus also of automobile production suggests that palladium demand will rise again. As a result, the palladium market could again show a larger supply deficit next year.

“Therefore, the palladium price should rise to $2,000 per troy ounce by the end of the year. The price recovery should continue next year. However, the record high should remain out of reach.”

Market update

Currently and for the foreseeable future, palladium is facing constricted supply. The palladium market has been in deficit for eight straight years, mostly to do with structural problems in South Africa. About 90% of palladium is mined as a byproduct of nickel and copper in Russia, and platinum in South Africa. These two countries dominate the market.

South Africa’s platinum mining companies are under constant pressure to contain costs, because their mines are very deep, hot and labor-intensive. They also face frequent strikes.

In 2014 workers at the country’s three major producers – Lonmin (now Sibanye-Stillwater), Anglo American Platinum and Implats – downed tools for five months demanding that wages be doubled. Additionally, there are significant infrastructure constraints; the country has limited processing capacity and water is a constant concern.

In April, South African mining output fell the most since 1981, as restrictions to curb the spread of covid-19 ground most of industry to a halt.

According to Statistics South Africa, production of platinum group elements (including palladium) dropped 62%, from a year earlier, more than gold (-59%) and iron ore (-68%).

In May, the country’s biggest platinum miner, Sibanye-Stillwater, suspended production guidance, while Anglo American Platinum (Amplats) and Impala Platinum Holdings (Implats) both cut their output forecasts.

The country produces three-quarters of the world’s platinum and about 40% of its palladium.

Norilsk Nickel, one of the world’s largest palladium producers with mines on the Taimyr and Kola Peninsulas in Siberia, has said it is planning to ease market tightness by shifting more production to investment-grade palladium ingots, from the powdered form required by industrial end users.

Earlier this month, BNN Bloomberg reported South Africa is losing palladium market share to Russia, where Norilsk’s operations have “barely missed a beat” compared to producers in South Africa, who are struggling to ramp up production following the national virus lockdown:

Nornickel, whose shallower operations make it the industry’s lowest-cost producer, has so far maintained its 2020 palladium output guidance, a spokeswoman said. The miner on April 30 reiterated its 2.6 million to 2.8 million ounces guidance, which was originally issued in January, before the pandemic was declared.

In 2016 South Africa commanded 38% of global palladium output, to Russia’s 41%. In 2020 Russia pulled ahead to 43%, versus South Africa’s 33%. An analyst at Noah Capital Markets Ltd. quoted by BNN Bloomberg said with South African miners scaling back on new projects, it may take six to seven years for the nation’s palladium output to recover.

Globally, Norilsk expects palladium output to drop by 1.3 million ounces this year to 6.3Moz, swinging the market into balance as auto demand slumps. The Russian miner agrees with Commerzbank that shortfalls will re-emerge in early 2021.

On the demand side, diesel engines are being phased out in favor of gas-powered cars and trucks that meet stricter emission regulations, particularly in Europe and China where air quality is poor. As drivers shift from diesel to gas-powered cars or hybrids, demand for palladium has buoyed the price. Despite a global downturn in auto sales in 2018 and 2019, palladium prices have stayed strong, on concerns that the mining industry will be unable to meet the demand for cleaner-burning vehicles.

Last year, despite sputtering auto sales, there was an increase in the use of palladium in autocatalysts, to 8.9 million ounces, with China and India being the driving forces behind increased demand.

These countries are also leading the auto industry out of its virus-induced funk. In June China’s auto sales rose for the second straight month, following a slump of nearly two years, while in India, May auto sales showed signs of a demand revival.

Electrification is also playing a role in the lofty demand figures. Research shows that hybrid-electric vehicles require more palladium and lithium than gas cars and trucks.

Palladium use in hybrids and plug-in hybrids, which like regular cars need catalytic converters, is nearly triple that of 2016.

A growing number of consumers are choosing hybrids, which are seen as bridging the gap between traditional vehicles and all-electrics. A 2018 report by JP Morgan Chase & Co. predicts hybrids are expected to grow from 3% of global marketshare to 23% by 2025.

Finally, there are hydrogen fuel cell vehicles to consider. Rather than converting pollutants to benign gases, catalysts in fuel cells are needed to start the hydrogen reaction that produces energy. While there are currently very few hydrogen vehicles on the road, due to limited models and a lack of charging infrastructure, a future challenge for car-makers will be obtaining enough PGEs, since fuel cells require significantly more PGEs than gasoline or diesel vehicles. For example, a hydrogen-powered Toyota MMirai requires 14 grams of PGEs compared to 6 grams for the average gas-powered car.

Biden’s Clean Energy Plan

On Tuesday Joe Biden, the Democrats’ presumptive nominee to take on Donald Trump in the November election, laid out his plan for jump-starting the stalled-out US economy, through what he called “historic investments” in clean energy.

If elected president, Biden would end to power plant carbon emissions by 2035, and spend $2 trillion over four years on clean energy projects. His proposed 100% clean electricity standard by 2035 is reportedly modeled after a proposal offered by Washington Gov. Jay Inslee and later embraced by Massachusetts Sen. Elizabeth Warren.

The former Vice President would also hand out cash vouchers allowing citizens to trade in their gas-powered cars for electric vehicles, and steer tens of billions of dollars toward building charging infrastructure in rural communities.

While obviously aspirational, Biden’s plan is highly unrealistic.

Granted, eight states, including California and New York, have committed to eliminating carbon from their electrical systems, but the timeline stretches out to 2045 or 2050. The Biden-Sanders “unity task force” pushes it up by 10 years.

According to Sonia Aggarwal, who researched the policies for a University of California, Berkeley study into the feasibility of the timeline, reaching 90% clean energy would mean doubling the highest historical annual wind and solar deployment through the 2020s, and tripling it in the 2030s.

Green Tech Media says the Berkeley report calls for installing 8 million solar roofs and community solar energy systems within five years. The United States hit 2 million solar installations in May 2019. Wood Mackenzie (Woodmac) estimates about 4.6 million residential solar systems could be installed by 2025, based on a projection that factors in covid-19.

“The U.S. would need substantial policy supports to achieve this goal, because under current conditions we are over 3 million shy of reaching that goal — if the goal is to mean cumulative installations and not additional,” GTM quotes senior analyst Austin Perea.

Biden’s plan for electric vehicles tackles public-sector fleets with specific targets. It would require the nation’s 500,000 fleet of school buses to transition to zero-emission vehicles within five years. A Woodmac report predicts 40,000 heavy-duty electric vehicles will be on roads in Europe and the US by 2025 – falling far short of the half-a-million US school buses target.

The watered-down “New Green Deal” also calls for 500,000 EV charging stations to be installed in the next five years – a nearly 20-fold increase from the current 25,804.

For an idea of how far we have to go in meeting the challenge of an electrified global transportation system, we looked at the United Kingdom.

The UK government has set a target of replacing all of the island nation’s 31.5 million cars by 2050. A team of scientists at the Natural History Museum took the government to task and calculated how much raw materials that number of EVs would require.

The researchers found that to build 31.5 million EVs would take 207,900 tonnes of cobalt, 264,600 tonnes of lithium carbonate, at least 7,200 tonnes of rare earths neodymium and dysprosium, and 2,362,500 tonnes of copper.

As reported in AutoExpress, that is almost twice the annual global supply of cobalt, nearly the total amount of neodymium produced each year, three quarters of the world’s lithium, plus about 10% of the world’s copper supply.

Remember, that’s just for one country.

All the extra power needed for “the juice” of the UK’s future electric vehicle fleet is estimated at 63 terawatt-hours a year, 20% more than current levels. Using wind farms would require an extra 6,000 turbines into which a year’s worth of global copper supply would be needed, and 10 years worth of neodymium.

When extrapolating to the rest of the world, the numbers get even more crazy. According to the researchers, just mining the amount of raw materials required to replace 2 billion cars globally would require four times the United Kingdom’s total annual electrical output.

The cost of electrification doesn’t only involve going from A to B. There is also the change in energy production from fossil-fuel-based forms such as coal and natural gas, to renewable wind and solar power.

Wood Mackenzie via Safehaven.com tried to determine what moving away from fossil fuels would cost the United States. The answer, $4.5 trillion over the next 10 to 20 years, would encompass the installation of 1,600 gigawatts of new solar and wind capacity. Right now the US has 1,060 GW installed – of which 130 GW is renewables. Another 900 MW would likely be required to construct utility-scale storage of electricity produced from wind and solar farms, according to Woodmac. To do that would mean adding more renewable capacity every year for the next 11 years, than has been added over the last 20 years combined.

Palladium One (TSX-V:PDM, OTC:NKORF, Frankfurt:7N11)

As palladium continues its multi-year run, amid supply constraints, new sources of palladium are needed to meet demand for gas-powered autocatalysts, along with hybrids and emerging hydrogen fuel cells.

This bodes well for explorers like Palladium One, whose LK deposit in Finland contains significant amounts of palladium, as well as nickel and copper, which are also required by electric vehicles and their lithium-ion batteries.

PDM has significantly increased the exploration potential at its LK platinum-group element (PGE) and base-metals project.

The Vancouver-based company earlier this year acquired the 20,000-hectare Kostonjarvi (KS) property, which is adjacent to the company’s flagship Läntinen Koillismaa (LK) project in north-central Finland.

Last year Palladium One published the first (maiden) NI 43-101-compliant resource at the Kaukua target, putting the company on track for developing an open-pit PGE-nickel-copper mine in Finland.

Palladium One wishes to add at least a million more ounces of palladium-equivalent resources (Pd_eq) to the Kaukua optimized pit resource.

In January PDM commenced an induced polarization (IP) survey, designed to zero in on shallow zones of conductivity, containing higher sulfide concentrations. These zones will then be drill-tested with up to 5,000 meters of diamond drilling.

A plan to begin drilling in March was suspended due to covid-19, but Palladium One is now looking at firing up the drill rigs in August.

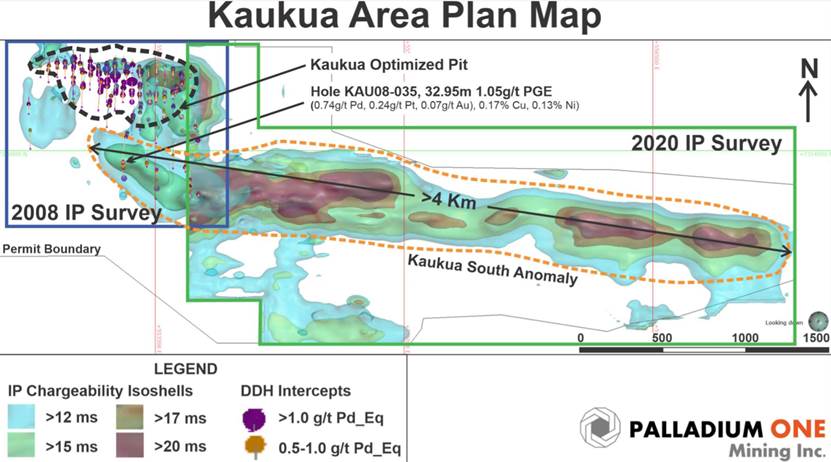

According to a July 14 news release, Initial drilling will be focused on expanding known mineralization to the east of existing drill intercepts in the Kaukua South zone, which hosts a greater than four (4) kilometer long Induced Polarization chargeability anomaly. (Figure 1).

Plan view of the 2008 and 2020 (current) IP survey in the Kaukua Area. The 2008 IP survey area is outlined in blue, while the 2020 survey is outlined in green. The Kaukua deposit’s optimised open pit is outlined by a dashed black line.

The drill targets are based on a highly successful winter IP survey, which identified multiple new IP chargeability anomalies at Kaukua South, where 3.5 km of the 4 km-long strike has never been drilled.

“Considering that Kaukua South has known PGE-rich mineralization similar to the Kaukua deposit, it will be a primary focus of our resumed drill program,” Derrick Weyrauch, Palladium One’s President and CEO, commented.

Before covid-19 the cashed-up company drilled nearly 2,000 meters of the 5,000-meter program, and completed five grids of an IP survey that included the following target areas: Kaukua South, Murtolampi, Haukiaho, Haukiaho East, and Tilsa.

Palladium One

TSX.V:PDM, OTC:NKORF, Frankfurt:7N11

Cdn$0.09, 2020.07.17

Shares Outstanding 124,548,599m

Market cap Cdn$11.2m

PDM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard does not own shares of Palladium One (TSX.V:PDM), OTC:NKORF, Frankfurt:7N11), PDM is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.