All eyes on Chile as copper price hits 5-month high

2020.07.05

Hundreds of mine workers in Chile are falling ill from covid-19, prompting Codelco, the world’s largest copper mining company, to shutter its Chuquicamata smelter and refinery to prevent the spread of the virus.

It is the first major copper facility in Chile to close due to a sharp rise in the number of coronavirus cases in the past two weeks.

The country is the world’s largest copper producer, in 2019 outputting 5.6 million tonnes, roughly 25% of the 20Mt produced globally. Along with Codelco, other major mining companies producing copper in Chile include BHP, Anglo American, Glencore, Antofagasta and Freeport McMoRan.

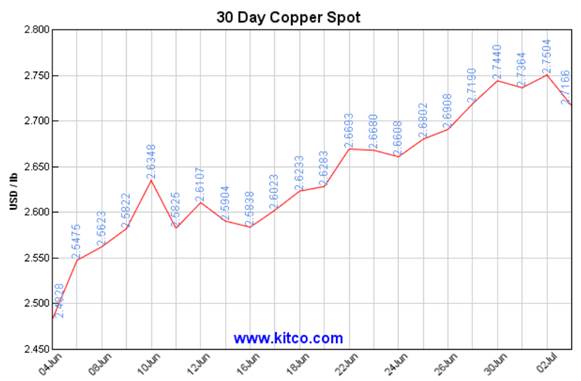

Combined with covid-related mine shutdowns in neighboring Peru, the world’s second biggest red metal producer, and solid demand from China, copper prices were $2.70/lb, Friday, on the London Metal Exchange (LME).

Supply

Closing the Chuquicamata refinery even temporarily, is a big deal for copper supply. The operation is one of the largest of its kind in the world. An anonymous source told Fastmarkets on Friday that the partial closure – one-third of its capacity will stay open to process existing concentrate – is expected to last two weeks. However, The exact duration of the closure will “depend on the number of [Covid-19] cases found,” with tests being carried out on staff, the metal price reporting site said.

The Chuquicamata mine is Codelco’s second-biggest operation after El Teniente, which ranks among the largest copper mines in the world. Last year the 100-year-old operation produced 385,000 tonnes, about a quarter of Codelco’s 1.8 million tonnes of annual production.

Chile’s copper mines have been mostly unscathed by the pandemic, compared to Peru, which imposed a strict quarantine and greater restrictions on movement, resulting in a sharp drop in output. As mega-producers like BHP’s Escondida and Anglo American/Glencore’s Collahuasi continued operating, Peru’s copper production in the first quarter fell 12%, with operations restricted at Las Bambas, Toromocho and Freeport McMoran’s Cerro Verde. Pandemic-related closures in Peru this year are estimated to have affected about 2 million tonnes, representing 10% of global copper production.

In contrast, Chile’s Q1 output actually rose, with copper concentrate production gaining 4.8% and refined copper shipments increasing 12%.

But labor unions in Chile are demanding that companies do more to safeguard the health of their workers, particularly at state-owned Codelco, where three miners died from coronavirus.

The country is experiencing one of the highest infections rates in the world. The +1,000 cases in the mining industry are triggering concerns that further restrictions will cause production to soften.

“Chile has been one of the fortunate producers. It hasn’t suffered too much from the outbreak and government lockdowns didn’t really have much of an impact on production in the first four months of the year,” Kieran Clancy, assistant commodities economist at Capital Economics, was quoted in The Financial Post.

“That being said, there is mounting evidence that they’re starting to struggle with pockets of outbreaks at mines and the pushback from trade unions for safer working practices.”

According to Bloomberg, skeleton crews in Chile are focused on short-term production, which carries risks for future output:

Faced with a reduced workforce, some mines are running down stockpiles and focusing solely on extracting material to produce copper in the short term [ie., high-grading], limiting the stripping work they normally do to prepare areas to mine in the future…

What mines are doing now probably won’t affect the long-term supply trajectory, but it may mean they come in below expectations next year as they play catchup on pre-stripping and maintenance, according to BMO Capital Markets analyst Colin Hamilton…

“Inevitably, companies will reach a point at which these expenditures can no longer be avoided without compromising future copper production,” said Jaime Sepulveda, an analyst at CRU Group. “If it continues, production for 2022 and 2023 could be at risk.”

According to ANZ bank, a large lender to mining companies, Chile’s copper production losses could be greater than the government’s estimate of 200,000 tonnes – equivalent to 3.5% of total output. JP Morgan pegs the fall at around 440,000 tonnes, citing research house CRU.

The actual number, whatever it turns out to be, is sure to have a bearing on copper prices; Chile’s output represents about 25% of global production.

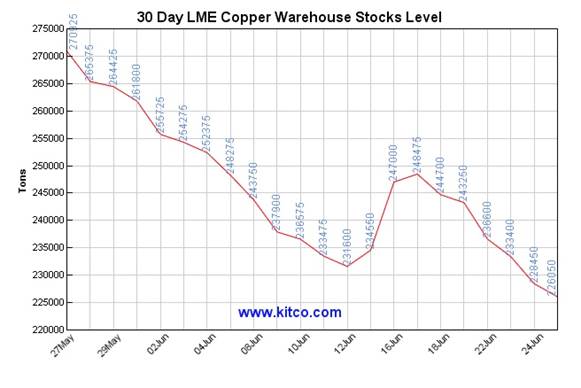

But metal traders don’t have to wait. They already see mine supply disruptions reflected in copper warehouse inventories.

Copper stocks at LME warehouses recently fell below 250,000 tonnes for the first time in seven years. Global inventories between March and June dropped by 412,000 tonnes. Thursday on the LME, on-warrant copper stocks slumped to their lowest since Feb. 24, at 116,800 tonnes. 30-day LME copper warehouse stocks on Friday were down to 226,050t.

Scrap copper supply is also entering the supply picture.

Copper refineries not only buy copper concentrate from mines, but scrap metal for melting down into end-products. The coronavirus has restricted the collection and processing of scrap around the world, including in China.

Lockdowns have idled manufacturing activity and halted the generation of new scrap. Also in the scrap equation are drastically reduced imports, following Beijing’s decision to restrict all “foreign garbage” recyclables that were being shipped to China. Three years ago China was importing over 300,000 tonnes of copper scrap per month. Flows this year have slowed to just 73,000 tonnes a month. The restricted supply has boosted scrap prices.

Copper trading group Trafigura estimates the global drop in scrap supply could be as much as 700,000 tonnes, much higher than the firm’s earlier estimate of 400,000 tonnes.

In fact the supply of scrap copper has dried up so much that buyers in China have been paying higher prices for it, than for brand-new metal.

Demand

The combination of reduced scrap supply and languishing copper warehouse stocks, has meant a big increase in imports from China, by far the world’s largest copper consumer. The country’s imports of refined copper were up 4.8% in the first four months of the year, to 1.18 million tonnes.

The increase in shipments is reflected in much higher utilization rates at wire rod mills, which account for two-third of China’s refined copper consumption. The rates hit 90% in April.

“Although wire rod output eased during the latter part of May, we now anticipate that China’s refined copper consumption will increase by 2 per cent year on year in the second quarter, compared to minus 3.3 per cent previously,” Robert Edwards, principal analyst at consultancy CRU, told the Financial Times in early June.

Where is all that copper going?

According to a June 16 Reuters article, Chinese automotive and construction sectors have rebounded from covid-related contractions and are back to buying metals, with automotive output rising 19% in May, new property sales up 2.5%, and new floor sales increasing 10%. In addition,

Fixed asset investment in infrastructure jumped by 11% with core spending channels such as transport and green energy positive for copper’s prospects.

Indeed, Trafigura’s head of copper trading says demand is being supported by stimulus packages that are focused on copper-intensive “green infrastructure”. This includes renewable energy, electric vehicles, and heating and cooling systems fueled by climate change (copper is the preferred material for heat exchangers, wiring and motors).

According to Eurasia Group, clean energy and 5G programs are expected to push average annual demand for copper up 2.5% this decade, driving consumption toward 30 million tons by 2030 (last year mine production was only 20 million metric tonnes).

Bloomberg also expects demand to rise, by 3.4% a year over the next 10, which will push the market into a deep deficit unless new sources of supply are found.

Given the high costs of development, copper would need to trade above $7,600 a ton [$3.80/lb] to incentivize long-term investments in new mining projects.

We already know that near-term copper supply is expected to be weak, with only a handful of new mines entering production.

Conclusion

At AOTH, our extensive copper coverage predicted a supply shortage by the early 2020s; in fact that supply shock is here already, and will likely get worse, in part due to virus-related mine output cuts in the top two producers, Chile and Peru.

We see tight supply reflected in multi-year lows in copper warehouse stocks, and depleted supplies of scrap copper metal.

Combine the tight supply narrative with surging demand from China, whose recovering economy is clambering for metals, and you have a very bullish set-up for copper going forward.

We already see copper prices reacting to news of infrastructure buildouts that can help put economies hit hard by the coronavirus back on track. On June 4th the red metal hit a 12-week high of $2.50 a pound, on news of China’s $700 billion “new infrastructure” and “new urbanization” rollouts.

BMO Capital Markets said data from China’s Ministry of Finance showed the value of bonds destined for local government spending on infrastructure are already at the mid-point of the year, more than the total allocated for the full year 2019.

BMO cites the latest survey of copper wire and cable fabricators, showing operating rates in May hitting 101.7%, the highest level in the history of the survey – thanks mainly to purchases from China’s state electricity grid.

According to Trafigura Group, one of the world’s largest copper traders, there are signs that copper could emerge from the covid crisis even stronger than before.

Many copper watchers were expecting the industrial metal to take a big hit from the coronavirus, but if market fundamentals continue, we might even see copper posting a 2020 gain on economic recovery momentum.

That would be great for copper explorers and their investors, who know the best leverage against rising metals prices is to own an early-stage junior with a sizeable and scalable deposit in a mining-friendly jurisdiction.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd YouTube

Ahead of the Herd Facebook

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.