3 silver plays that leverage rising prices

2020.07.27

Gold prices leapt to fresh highs on Monday, leaving the previous $1,920.70 an ounce record, hit in September, 2011, in the dust.

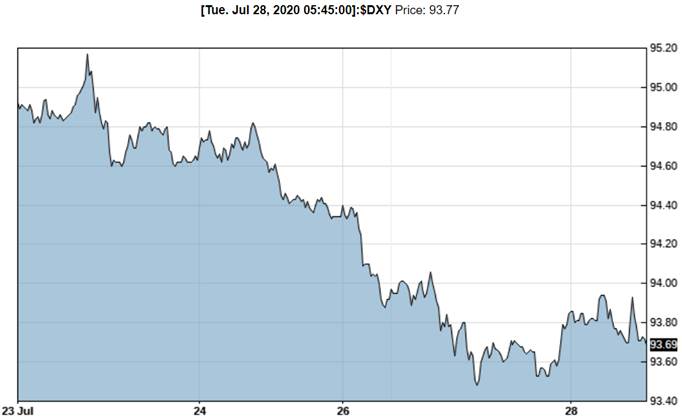

A slew of technical and fundamental factors are pushing precious metals higher, including a weak US dollar index, which sunk to a near two-year low Monday; continued rises in covid-19 infections in major industrialized countries; a new $1 trillion US government stimulus package; rising US-China trade tensions; and a surge in the buying of precious metals ETFs.

Macro themes

As smart resource investors, we want to be invested in metals, and companies, that are at the leading edge of a trend. According to legendary mining investor Eric Sprott, gold and silver are two of the best metals to own right now. Last Friday, during ‘Eric’s Weekly Wrap Up’ Sprott told interviewer Craig Hemke,

“A lot of the reasons that [gold] is going up are the reasons that we talk incessantly about. And the most poignant reasons, I guess right now, are that from an economic perspective we have this potentially weak economy. We have the Covid-19 problems. We’ve got a U.S. dollar that’s weakening. We have bonds with no yields. And we have equities that are stretching the valuation parameters that would be considered normal.”

“Between the forex, the bonds with no yields, the printing of the money, the equity valuations becoming questionable, you can’t ask for that much more momentum,” Sprott enthused.

Two other themes he touched upon, were silver ETFs and the gold-silver ratio.

Silver ETF holdings in June sat at 746 million ounces, the highest on record according to Bloomberg data.

By far the largest is iShares Silver Trust (SLV). SLV owns nearly half of all the silver controlled by the world’s silver funds.

“SLV is getting 10 times more demand for silver than is available, in a normal year.”

What Sprott is driving at, is the amount of silver being demanded by silver ETFs (a silver ETF is backed by physical silver), is far larger than the physical silver market, which is actually quite small. The disconnect is driving silver prices higher.

While most of the mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated around 60% of silver is utilized in industrial applications leaving only 40% for investing. Of the 60% used for industrial applications, almost 80% ends up in landfills.

Since very little gold is used by industry, it trades as an investment commodity – prices moving up and down in relation to factors like the US dollar, inflation, interest rates and sovereign bond yields.

In comparison, silver commands a relatively small amount for investment, just 40% of supply. Because 60% of supply is needed for industrial applications, silver usually trades more like an industrial metal than an investment commodity.

This explains silver’s volatility. Because the investment market for silver is so small prices swing up and down wildly, at relatively low volumes. For this reason, investors nicknamed silver “the devil’s metal”.

Sprott noticed that last week on the Comex futures trading platform in New York, open interest failed to go up – meaning traders stopped shorting silver, ie., placing bets that silver will go down in the near future.

“They realized their goose is cooked, there’s just no way they can stand in front of this thing, the paper cannot cover the physical.”

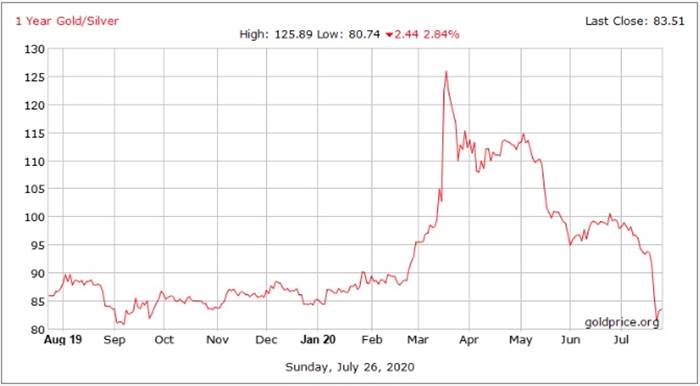

The gold-silver ratio is the amount of silver one can buy with an ounce of gold. Simply divide the current gold price by the price of silver.

The higher the number, the more undervalued is silver or, to put it another way, the farther gold is pulling away from silver, valued in dollars per ounce.

The current gold-silver ratio, 81:1, is higher than the historical ratio of 55 ounces of silver to one ounce of gold, meaning that silver is undervalued compared to gold. It means an investor with an ounce of gold could sell his gold for 81 ounces of silver.

However, over the past few months, the gold-silver ratio has taken a steep dive, from a record 125:1 in mid-March, to the current 81:1. We were telling readers that silver was a buy long before the record of 125:1, positioned ourselves accordingly, and are now reaping the rewards.

Sprott believes the gold-silver ratio is going to head much lower, and I agree with him.

“I think silver is the greatest setup trade here for a large return,” he told Sprott Money host Craid Hemke. “I’d recommend people either should own physical silver, or try to find a way into some silver stocks.”

Which stocks?

In a silver bull market, where a rising price floats all boats, and even turkeys can fly when the wind blows hard enough, practically any stock whose company has silver, will probably do okay. It may even be possible to make a blind investment in a silver play and earn a double, triple or more. That also explains why many silver (and gold) stocks have come off the boil a bit right now. Some junior resource investors have seen their precious metals stocks run during the pandemic, and they are taking profits. Nothing wrong with that. Companies are also cashed up from private placements, and are in the middle of their summer exploration programs.

For the most part, there’s very little news. Not yet. But once assay results start coming in expect these companies to start rising again. Investors who “sold in July and went away” will be back for more gains.

3 AOTH silver plays

Mountain Boy Minerals (TSX.V:MTB) is active in northwestern British Columbia’s Golden Triangle, in my opinion, if close to power, highway and port facilities as MTB is, one of the best jurisdictions for base and precious metals exploration.

MTB has assembled a large land position centered around its flagship American Creek project and zeroed in on three targets for its summer drill program. Work this year on the other projects – BA, Surprise Creek and Southmore – is intended to set them up for larger programs next year, perhaps funded by joint venture partners.

In 2006, Mountain Boy conducted a 19-hole drill campaign around the old Mountain Boy silver mine that lies at the center of American Creek. A small underground drill was used. The average hole length was 47 meters – barely scratching the surface. The focal point was the aptly named High Grade Vein, which was the heart of the historic mining. Six holes in that vein intercepted more than a kilogram of silver over at least a meter, with the highlight being hole 2006-10 which hit 5,258 g/t over 5.18 meters. (5 kg is 160 troy ounces)

CEO Lawrence Roulston and his team are going for high-grade in the Golden Triangle. Although it’s still early for Mountain Boy, a discovery hole on any of these targets could light American Creek up like a Christmas tree. We expect a slow ramp-up in the first phase and growing interest once the drills start turning in late summer to fall.

Mountain Boy Minerals

TSX.V:MTB, Frankfurt:M9UA

Cdn$0.40, 2020.07.27

Shares Outstanding 36,710,382m

Market cap Cdn$14.68m

MTB website

Silver Dollar Resources (CSE:SLV) has a boatload of talent and experience at the management and board levels. Having recently IPO’d on the Canadian Stock Exchange @ $0.15 a share, SLV has already started field work at one of two prospects in the famous Red Lake District of northwestern Ontario, where a number of gold juniors including 2019 belle of the ball Great Bear Resources (TSX-V:GBR), are proving up gold ounces in a new “Red Lake 2.0” area play.

Silver Dollar is also poised to activate a letter of intent (LOI) with First Majestic Silver Corp. (TSX:FR) for the La Joya silver-copper-gold property in Mexico.

Under the LOI, Silver Dollar would acquire up to a 100% interest in First Majestic’s La Joya Silver Project, located in the State of Durango in the Mexican Silver Belt.

A 2013 resource estimate outlined 159.7 million inferred silver-equivalent ounces at a 30 grams per tonne cut-off. Doubling the cut-off grade to 60 g/t yields a more conservative 92.9 million AgEQ ozs.

To acquire an 80% interest in La Joya, Silver Dollar will pay First Majestic $1.3 million in cash over four years, issue 19.9% of its shares, incur $1 million in exploration expenditures within five years, and grant FR a 2% NSR royalty. If Silver Dollar spends the million dollars within three years, First Majestic will waive nearly half, or $600,000, of the cash option payments.

SLV can earn the remaining 20% by issuing First Majestic additional shares equal to Silver Dollar’s then-outstanding common shares, within five years.

According to Silver Dollar, the exploration potential at La Joya is considered excellent, given that it hosts the La Joya Mineralized Trend as well as the Santo Nino and Coloradito deposits. The Ag-Cu-Au property consists of 15 mineral concessions totaling 4,646 hectares.

Silver Dollar Resources Inc.

CSE:SLV

Cdn$0.85, 2020.07.27

Shares Outstanding 19,600,001m

Market cap Cdn$16.6m

SLV website

Max Resource Corp (TSX.V:MXR) continues to expand the surface mineralization at its CESAR copper + silver project in Colombia. Since November, Max’s geological teams and prospectors have been identifying copper and silver targets within a 120 km x 20 km area, at their Cesar copper+silver project in northeastern Colombia.

Max is using rock panel and composite grab samples sampling to identify structures, continuity of thickness, and strike length, to determine potential size prior to drilling.

The Vancouver-based company is following the theory that continuous panel samples are pointing to a giant copper + silver mineralized system.

In a Feb. 27 news release, Max notes that its recent AM North and AM South discoveries are hosted in well-bedded sandstone-siltstone similar to KGHM’s monster “Kupferschiefer” mines in Poland.

In an earlier interview with AOTH, Max’s head geologist, Piotr Lutynski, said Colombia’s stratigraphy is similar to his homeland, Poland, and its cluster of Kupferschiefer sediment-hosted copper-silver deposits.

State-owned KGHM Polska Miedz is the world’s eighth largest copper producer and the second biggest silver producer. Its Kupferschiefer (“copper shale” in German) copper-silver deposits are regionally extensive.

The giant Lubin-Sieroszowice deposit contains 52 million tonnes of copper and 2.275 billion ounces of silver. The Kupferschiefer is the world’s leading silver producer, yielding 40 million ounces in 2019, almost twice the production of the world’s second largest silver mine, states the 2020 World Silver Survey.

Consider:

Max has signed two non-exclusive confidentiality agreements with global miners.

What junior resource company out there has more potential silver in the ground than Max?

Max Resource Corp.

TSX.V:MXR

Cdn$0.24, 2020.07.27

Shares Outstanding 35,719,906m

Market cap Cdn$8.57m

MXR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Max Resources, Mountain Boy Minerals. Richard does not own shares of Silver Dollar Resources.

MXR, MTB & SLV are paid advertisers on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.