Re-capitalized, re-named Palladium One focused on mining-friendly Finland

2019.05.24

In 2017 Finland claimed the number one spot on the Fraser Institute’s ranking of investment attractiveness for mining jurisdictions, up from fifth place in 2016.

Among the factors that set Finland apart from its country peers, according to the annual survey, are its mineral endowments, relatively low corporate income tax rate, and clear rules surrounding mining and exploration.

Mining companies in Finland pay 20% corporate tax, compared to 21% in the United States and 28.5% in Australia, in addition to 24% VAT spent on goods and services. Exploration permits and mining permits are granted by the Mining Authority, which supervises and enforces compliance with applicable legislation. Exploration permit holders have four years to conduct geological surveying and other work, with three-year extensions for up to 15 years. Finnish authorities are generally considered to be supportive of mining. Property rights and the rule of law are entrenched.

World-class infrastructure is another selling point to mining companies. Electricity is reliable and inexpensive, and there are paved roads even in remote areas, along with a comprehensive network of railways, canals and sea lanes. Finland boasts one of the highest living standards in the world, which attracts a strong pool of skilled and well-educated workers.

Lastly, compared to its jurisdictional competitors, Finland has one of the better geological databases available to junior explorers. The icing on the cake: nearly everyone speaks English.

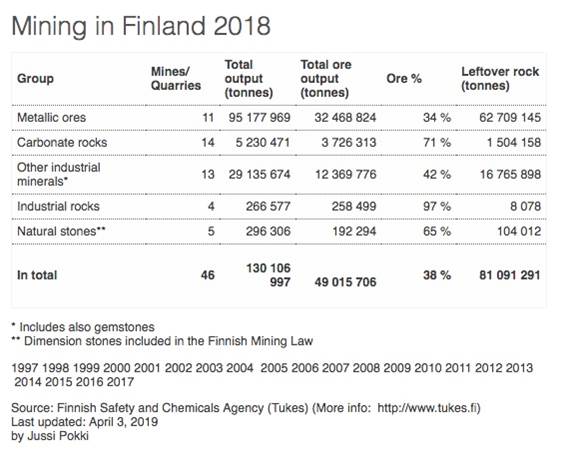

Mining in Finland dates back as early as 1540, with the production of iron ore. Since then, some 270 metals mines have been in operation, outputting 250 million tons of ores – two-thirds sulfide and one third oxide ores.

Geologically, Finland sits on the Fennoscandian Shield, a segment of the earth’s crust that shares similarities with Canada and Australia. Much of the area remains unexplored.

Finland has an established cache of industrial metals, including copper, nickel, cobalt, zinc and lead ores, as well as deposits of chromium, vanadium and iron ore.

Industrial minerals talc, phosphate and limestone are also heavily mined.

Historically, Finnish companies Outokumpu Oy and Rautaruukki Oy were the top miners, producing copper, zinc, nickel, cobalt, lead, gold and iron, but after Outokumpu Oy exited the business in the 1990s, mining in Finland stagnated.

Recent years though have seen a revival. Despite the closure of some base metals mines, Finland’s production has doubled over the past 10 years.

Mineral exploration has also jumped, with a number of important discoveries made, including Anglo American’s Sakatti copper-nickel-platinum group elements project, 150 km north of the Arctic Circle, and the Rajapolot-Rompas gold-cobalt discovery being developed by Mawson Resources.

The Nordic nation sharing a border with Sweden and its eastern boundary with Russia, has quietly advanced, over the past decade, to become Europe’s largest gold producer. There are thought to be about 100 gold-producing sites, between southern Finland and Lapland. Currently, four mines produce gold.

Canadian mining companies Agnico Eagle, Aurion Resources, Mawson Resources and Nordic Gold, have all purchased gold properties. Agnico Eagle’s Kittila mine in northern Finland is the largest gold producer in Europe – with reserves expected to last until 2034.

Finland is well known for its processing capabilities and its mining equipment sector. Large metal mills process nickel concentrates at Harjavalta, zinc at Kokkola, chromium at Kemi and iron ore at Raahe.

Finnish companies Outotec and Metso are two of the largest suppliers of mineral processing equipment and expertise in the world, including crushers, screens, milling equipment, conveyors and plant control systems. For Outotec, manufacturing takes place in the city of Outokumpu; Metso is based in Helsinki.

Palladium One (TSX-V:PDM)

One company in an excellent position to benefit from Finland’s “open for business” mentality, is Palladium One Mining (TSX-V:PDM). The Vancouver-based junior, formerly called Nickel One, is exploring for platinum group elements (PGEs) in north-central Finland, and for nickel, copper and PGEs near Marathon, Ontario, on the shores of Lake Superior.

The two projects have languished in recent years but Palladium One plans to raise enough capital to breathe new life into them. Two ways to do that are through a name change, announced on May 1, and a previously announced share consolidation, whereby the number of outstanding shares were cut in half. A week later PDM completed an oversubscribed private placement, raising $1.352 million, up from the previously planned $640,000.

LK Project

Palladium One is currently focused on its LK (Lantinen Koillissmaa) Project.

The geology dates back to the early Palaeoproterozoic era, ~2.4 billion years ago, during which igneous activity produced mafic-ultramafic rocks containing palladium-rich copper-nickel-platinum group elements (Cu-Ni-PGE) sulfide minerals, chromium, as well as iron-titanium-vanadium.

Geologists think the deposit is a “basal Cu-Ni-PGE bearing sulphide accumulation within the larger Koillismaa Layered Mafic Intrusion” that is part of an intrusion belt that runs east-west across Finland and into neighboring Russia.

Nine exploration permits cover four mineralized zones: Kaukua, Lipeavaara, Murtolampi and Haukiaho.

Surface sampling and previous drilling have shown evidence of palladium, platinum, gold, copper, cobalt and nickel.

A 2013 historical resource estimate (not NI 43-101-compliant) came up with 10.2 million tonnes graded 0.73 grams per tonne (g/t) palladium, 0.26 g/t platinum, 0.15% copper, 0.1% nickel and 0.08% gold (cu-toff grade 0.1 g/t palladium), plus an inferred resource of 13.2 million tonnes.

A 0.1 g/t Pd cut-off grade seems aggressively low. At AOTH we believe the 0.3 g/t cut-off numbers are more credible and still demonstrate the deposit ‘hangs together.’

Palladium market

Palladium is an ingredient in catalytic converters for gasoline-powered cars, vans and trucks; platinum is in the catalytic converters of diesel vehicles. Autocatalyst demand accounts for three-quarters of palladium demand.

Demand for the metallic element has surged since 2016 with the movement away from more polluting diesel-fueled vehicles. The price has more than doubled over the last three years (+124%) and ran up 18% in 2018. That compares to declines in spot gold, platinum and silver last year.

As drivers shift from diesel to gas-powered cars or hybrids, the market for palladium used in gasoline engines has buoyed the price. In 2017 palladium raced past $1,700 an ounce for the first time since 2001.

Despite automobile demand slumping in China last year, palladium finished 2018 at $1,262 an ounce – almost catching gold’s year-end close of $1,282/oz.

The increasing use of palladium in hybrid vehicles deserves more fleshing out. An executive at Russian nickel and palladium miner Norilsk Nickel PJSC said recently that the combined use of palladium in hybrid and plug-in hybrid/rechargeable vehicles is set to triple this year compared to 2016. A 2018 report by JP Morgan Chase & Co. predicts hybrids are expected to grow from 3% of global marketshare to 23% by 2025.

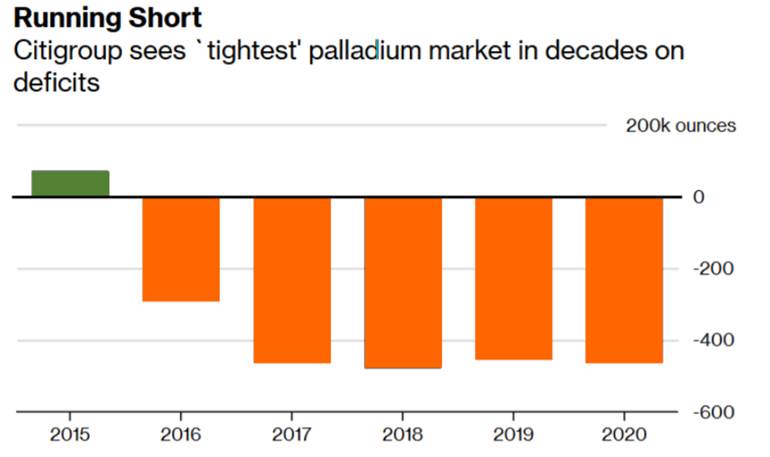

Not only has demand bounced up, palladium is also facing constricted supply.

According to a report from Sprott Asset Management, “Supply shortages continue to support palladium’s performance, with strong multi-year growth in palladium demand now straining a fixed supply.” Indeed there is limited scope for producers to increase supply, in the near term.

The Sprott report also notes that supply for palladium is inelastic because it’s usually a by-product of other ores like platinum and rhodium.

South African palladium is a by-product of platinum mining and palladium from Russia is a by-product of nickel. Between them, the two countries control almost 90% of the palladium market.

On March 19, 2019, palladium prices ran up past $1,600 an ounce, the market’s reaction to news that top producer Russia is considering banning the export of precious metals scrap, refining it domestically instead. That was on top of an announcement that Fiat Chrysler has been ordered to recall almost a million vehicles over failed emissions testing.

The spot price for palladium is currently $1,324 an ounce.

Metals Focus, a London-based consultancy, is forecasting palladium to outperform platinum, palladium’s sister metal, in 2019. For platinum, Metals Focus thinks there will be a surplus of 630,000 ozs this year, whereas palladium will see a 574,000-ozs deficit.

Among the factors in favor of palladium are a 3.6% forecasted rise in autocatalyst demand, driven by tighter emissions standards, and increased marketshare for gasoline vehicles in Europe.

According to Metals Focus, despite short-term headwinds for palladium such as slumping car sales in China and the US, palladium prices are expected to hit 1,490/oz this year, a 45% increase year over year.

For more on palladium read our Palladium, darling of the PGEs, shifting into high gear

Conclusion

Platinum group metals are extremely advantageous for exploration or mining companies to have in their deposits because PGEs provide a “kick” to lower-value base metals.

PGEs also fit in with the electrification trend I continue to follow and invest in. Palladium, platinum and rhodium are not only used in catalytic converters required for diesel/gas-powered vehicles, but cleaner and greener hybrids. Platinum also has an emerging use in fuel-cell vehicles.

We also need to emphasize that PGEs are critical metals. A relatively small amount is mined in the US and Canada – the most friendly country to the United States in the event of a supply disruption. Who are the alternatives? Russia, Zimbabwe and South Africa.

Russia is the target of US sanctions and a constant thorn in its side, Zimbabwe has a basket-case economy, and South Africa can’t be counted on for a reliable supply of PGEs. Last year production there fell compared to 2017, owing to jobs cuts and mine shaft closures – a trend that is likely to continue.

For all these reasons I have PGEs and PGE explorers on my radar screen. At Ahead of the Herd we know investable, palladium pure-play juniors are as scarce as the metal itself.

Palladium One – after a management change, a 50% share consolidation and raising $1.3 million – is ready to get to exploring. Palladium One is now in an excellent position to benefit from Finland’s “open for business” mentality and decades of mining expertise.

I can’t wait to see what PDM has planned for its LK Project in Finland – what looks to be a very prospective piece of ground that already has a resource estimate, in a red-hot palladium market.

Stay tuned.

Palladium One Mining

TSX-V:PDM Cdn$0.105 May 23

Shares Outstanding 43.7m

Market cap Cdn$4.58m

Palladium One website

*****

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Palladium One Mining (TSX.V:PDM), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of PDM

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.