Physical gold frenzy

2019.07.06

The allure of gold goes back thousands of years.

Due to its unique properties, gold was one of the first metals discovered by mankind. Gold is found at surface in flakes and nuggets, making it easily mineable. Historians agree the Egyptians were the first to smelt it and make gold jewelry using the lost-wax method. The funeral mask of King Tutankhamun is one of the most stunningly beautiful examples of Egyptian goldsmithing. The Egyptians also learned how to alloy gold with other metals, to vary hardness and color.

While gold was rare and valuable, it was also ideal for pressing into coins. Because gold coins were portable, private and permanent, they fit the early definition of a currency. Gold could be used as a medium of exchange, a unit of account, and a store of value.

In this article we take a deep dive into the physical gold market. Why buy bullion, where is it refined and stored, who is buying, who is selling, the latest on gold bars, coins, ETFs, etc.

Gold as money

The ancient Chinese, Lydians (in Turkey), Greeks and the Romans all used gold as money, with the Romans acknowledged as the first civilization to employ gold as a currency across their vast empire. Historical records show Emperor Julius Caesar brought back so much gold from a victorious campaign in Gaul to give 200 coins to each of his soldiers and pay all of Rome’s debts. Check out the infographic by Visual Capitalist for more on gold used throughout history.

Over time, as countries moved to paper money, they realized they could fix one unit of currency to a weight in gold, a system that became known as the gold standard. Britain was the first to adopt the gold standard and other countries soon followed suit. In the 19th century, all countries except China used it. Domestic currencies were freely convertible into gold at the fixed price and there was no restriction on the import or export of gold.

The gold standard

In July 1944, delegates from 44 nations met at Bretton Woods, New Hampshire – and agreed to “peg” their currencies to the US dollar, the only currency strong enough to meet the rising demands for international currency transactions.

What made the dollar so attractive to use as an international currency, the world’s reserve currency, was each U.S. dollar was based on 1/35th of an ounce of gold (35.20 US dollars an ounce), and the gold was to be held in the US Treasury.

The United States operated under the gold standard until the Vietnam War, which brought renewed pressure on the dollar.

Since President Johnson refused to raise taxes to pay for social welfare reforms undertaken earlier, and the war in Vietnam, the US was running massive balance of payment deficits with the rest of the world. Speculation against the dollar intensified, and when other central banks became reluctant to accept dollars in settlement, the system began to break down.

In 1971 US President Nixon ended the convertibility of the dollar into gold for central banks, effectively demolishing the gold standard. The Bretton Woods system collapsed and gold was allowed to trade freely without a US dollar peg.

Bullion better than paper

Historically the only way for investors to buy gold was to purchase gold coins or bars, but since 2004 gold, silver, platinum and palladium ETFs have offered a more convenient way to invest in precious metals. According to a 2016 article by Kitco, GLD, the world’s largest gold ETF, and other precious metals ETFs, transparent bullion depositories, and futures exchanges, combine for a total market capitalization of about USD$150 billion – which is almost the value of the entire world’s annual gold mining supply.

The convenience of buying “paper gold” through ETFs however has some serious drawbacks especially in the event of a financial meltdown like 2008 or a cataclysmic event like nuclear war, an EMP attack or solar storm. The biggest downside is that unless you have 100,000 GLD shares, you cannot take physical delivery of your gold; rather, the shares will be settled in cash.

The other problem is potential breaks in the chain of custody. When you buy shares in a gold ETF, the purchase is through an Authorized Participant, usually a large financial institution. If a primary reason in buying gold is as insurance against a financial calamity ie. banking system collapse, an ETF really fails to offer any guarantee that your GLD shares would be safe if the bank were to fold.

“Physical bullion could go supernova in both price and value, yet ETF proxies could deflate or possibly go bankrupt. All long term investors with exposure to exchange traded funds should reexamine the inherent risks associated with these investment vehicles,” writes Kitco.

Buying physical gold

If a gold investor decides, correctly in our view, to buy bullion rather than a gold ETF, there are several options. Over the past decade or so, small bars and coins accounted for about two-thirds of annual “investment gold” demand. According to the World Gold Council, demand for bars and coins have quadrupled since the early 2000s.

For the retail investor, coins are available in denominations of 1/20, 1/10, ¼, ½ and one troy ounce. Bars can be purchased in 1, 10, 20, 50, 100, and 1,000-gram denominations as well as 1, 10, and 100 troy ounces.

Examples of popular investment gold coins are the South African Krugerrand, the American Eagle and the Royal Canadian Mint’s Pure Gold Coin.

The purity of each coin, or fineness, is measured either in carats (24 carats being the highest) or in parts per thousand, usually 995, 999 or 999.5. Investors are usually most interested in products that are 0.999 fine. Another option is to purchase gold rounds which are similar to coins but are not legal tender. In the United Kingdom, gold coins are popular because they are not subject to tax.

The choice of coins versus bars depends mostly on how divisible the investors wants the gold to be. Coins can be collected and sold in very small denominations, versus bars, which are less divisible.

Whether buying a coin or a bar, investors pay a premium over the spot gold price. Generally the smaller the coin or bar, the larger the premium per ounce. Investors would be wise to buy their bullion products from a bank or reputable dealer.

Buyers are provided with a certificate of authenticity, via an assay mark, and have the option of either storing their gold at a secure facility, for an annual fee, or arranging for it to be sent home for safekeeping.

An important distinction exists between large gold buyers, like central banks and gold-backed ETFs, and individual consumers. Large institutions use the London Good Delivery bar – the standard gold bar used for clearing in London (more precisely the London Bullion Market Association – LBMA), each weighing approximately 400 ounces.

The LBMA’s Good Delivery standard is a way of ensuring that gold buyers are purchasing legitimate gold products of stated purity. The requirements include fine ounce weight, purity and physical appearance. Refiners wanting admission to the Good Delivery List must undergo stringent testing to verify their market history, financial standing and ability to produce gold bars that meet the high standards of London Good Delivery bars. They commit to sourcing the metal, refining it and shipping it to approved vaults in London. The bars and then traded between institutions who are part of the LBMA, including refiners, dealers, banks, mining companies and private investors. Current LBMA Good Delivery refiners include the Royal Canadian Mint, Johnson Matthey Ltd, Heraeus Precious Metals, Rand Refinery, PAMP SA, Valcambi SA and Metalor USA.

Central bank gold buying

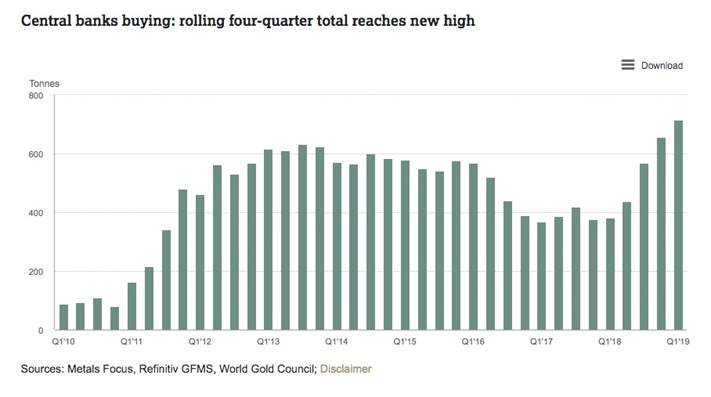

According to the World Council, central banks are continuing a buying spree that stretches back to 2018. A total of 651 tons of gold was accumulated last year, 74% more than 2017 and the highest amount since the end of the gold standard in 1971.

So far in 2019, central banks have squirreled away 207 tons in bank vaults, the highest year-to-date purchases since central banks became net gold buyers in 2010. (before that they were net sellers, selling more gold than purchased).

On a quarterly basis, central banks bought way more gold in the first quarter of 2019 than Q1 2018. The WGC reports first-quarter purchases were the highest in six years, rising 68% above the year-ago quarter. It was the strongest start to a year for gold buying since 2013.

Russia and China were the top two purchasers, particularly Russia which has been trying every means available to diversify away from the US dollar – such as selling US Treasuries and signing energy deals with China whereby the transactions are in yuan or rubles, not USD. The Central Bank of Russia loaded up on 274 tonnes.

China has increased its monthly gold purchases by nearly 50%, to 15 tonnes a month, according to Kitco, with the Philippines’ central bank announcing plans to buy up to 30 tonnes of bullion a year. Other leading purchasers were Turkey, Kazakhstan, India, Iraq, Poland and Hungary, the World Gold Council report states.

The annual survey also said none of the central banks plan on reducing their exposure to gold over the next year from May, with 18% saying they plan to increase their bullion holdings.

De-dollarization

The 2018-19 gold-buying spree is being driven by the de-dollarization of countries like Russia, China and Turkey which have an axe to grind with the US. They want to get out from under the thumb of Uncle Sam. Other factors noted by the World Gold Council, were trade tensions, sluggish growth and expected lower interest rates, as central banks begin to use, or strongly hint of fiscal stimulus to grow their economies.

Forbes notes central banks’ motivations for buying gold are different than they were in previous decades when the financial system was back-stopped by gold:

In the distant past, central banks had to buy gold because of its vital role in the global financial system. Now they are choosing to do so because they are worried about the dollar. In other words, they’ve been scared into this bullion buying binge.

For more on this subject read How central bank gold buying is undermining the dollar

Jeff Christian, managing partner at CPM Group, a New York-based commodities consultancy, agrees. “Today central banks are buying gold to diversify their monetary reserves,” says CPM’s Christian. “Most central banks want to diversify away from the dollar.”

He gives the example of Russia where, as Forbes reports, the change may be partly driven by the need to ditch dollars and disentangle their countries from the US banking system.

Peter Schiff went further than that, telling an interviewer at RT News that he thinks the world is going to go back on the gold standard.

“The days where the dollar is the reserve currency are numbered, and we’re going back to basics. You know, everything old is new again. Gold was money in the past, and it will be money again in the future, and central banks that are smart enough to read that writing on the wall are increasing their gold reserves now.”

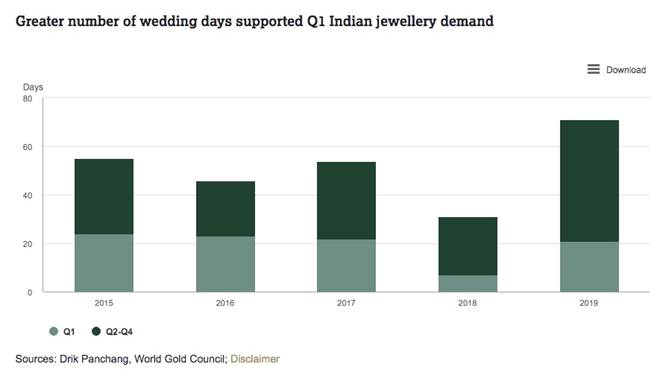

Demand for gold jewelry sales increased 1% in Q1, led by India, where a higher number of wedding-related days boosted purchases by 5%, year on year.

Mints busy

Central bank gold buying is being replicated to some extent by individuals, who are taking a serious look at gold now, amid economic uncertainty not only in the United States – which appears headed towards a recession – but around the world.

According to the World Gold Council, the first quarter of 2019 saw relatively flat purchases of gold coins and bars, but spikes in the United States and the United Kingdom. US purchases were up 38% year on year, while in the UK, demand rose 58%, as Britons looked to protect themselves from a Brexit hard landing. Bar and coin demand in Europe rose 10% as people became aware of the economic slowdown and possibility of a recession.

Amid this context, sales of American Eagle gold and silver coins rose sharply in the first quarter compared to January-April 2018, with Gold Eagles up 33% and Silver Eagles increasing 37.9%. March was a particularly strong month for Gold Eagles, which sold at triple the volumes of March 2018.

In February, the US Mint actually ran out of 2018 and 2019 American Eagles, having sold over 6 million coins year to date, the best start to the year since 2017. Part of the Treasury Department, the US Mint was first set up in 1792. It does not print paper money, and has four coin-producing mints – Philadelphia, Denver, San Francisco and West Point.

The Royal Canadian Mint is a Crown corporation that produces all of Canada’s coins in circulation, plus a number of other countries’ coinage. It also designs and manufactures precious and base metals collector coins, such as the one-ounce Pure Gold and Pure Silver Coins, a Pure Gold Coin with 0.10-carat Canadian Diamond “Magnificent Maple” and a Pure Platinum 4-Coin Fractional Set, commemorating the 30th anniversary of the platinum maple leaf.

The Krugerrand is a prestigious collector’s coin produced jointly by the South African Mint Company and the Rand Refinery. First struck in 1967 to market South African gold, the two-ounce proof Krugerrand features an effigy of former President of South Africa, Paul Kruger on one side, and South Africa’s national animal, the Springbok, on the other.

Swiss gold

Most of us know about the coins, and the mints, but few are aware of where gold is refined. The answer is (mostly) Switzerland. Remember the Good Delivery List? Of the 71 refiners on the list, six companies produce 90% of the volume, and four of those companies are on Swiss soil. Three operate within a few kilometers of each other, just across from the Italian border – Valcambi SA, Pamp SA and Argor-Heraeus SA. The fourth, Metalor Technologies SA, is in the northern canton of Neuchatel.

Despite much of the gold trade being centred in Britain, the country only has one refinery, Baird & Co. The East London operation goes through just 10 tons of gold a year and turns it into coins and bars. Compare that to the seven major refiners on the Good Delivery List, which crank out an astonishing 5,000 tonnes per annum.

Around two-thirds of all the gold produced in the world each year transits through Switzerland – chosen for the country’s exceptionally high security and efficient logistics and financial systems. Roughly half of the gold Switzerland imports for refining comes from Britain, the United Arab Emirates or Hong Kong. Last year the largest amount of bullion by far came from the UK, 491.9 tonnes, versus 177.2 tonnes from the United States and 60 tonnes from UAE.

The buyers were concentrated in Asia. China took the lion’s share, 453.2 tonnes out of a total 1,473.4t, followed by Hong Kong and India, neck and neck at 275.8t and 278.1t, respectively.

Switzerland may be known for clocks and chocolates, but gold beats both of these sectors in terms of economic heft. The industry worth $70-90 billion a year (CHF70-90 billion) is eclipsed only by pharmaceuticals which in 2017 exported CHF 98 billion. That year Swiss clocks accounted for CHF20 billion and Swiss chocolate exports were just under CHF1 billion, or 128,000 tons of chocolate.

Switzerland is to gold like Bordeaux is to wine, notes Gilles Labarthe, journalist and author of a book on African gold. “Apart from its long historical tradition, all the infrastructures and required services are in place.”

Net longs winning

In case anyone hadn’t noticed, gold is on a tear right now. As the gold rally that started in the third week of June continued into July, investors piled into gold ETFs. While we wouldn’t advise buying one, the current froth in the paper market is worth mentioning.

Last Friday gold investors bought a record $1.6 billion worth of SPDR Gold Shares (GLD), the world’s largest physical gold-backed exchange traded fund. The inflow was the largest since the fund was launched in 2004 – pushing total holdings stored as Good Delivery Bars in London warehouses, to 25.7 million ounces.

Bullish bets on gold wagered by hedge funds are now at a 16-month high, MINING.com reported, after a record increase in net long positions over the past three weeks. A year ago, those same speculators were shorting gold futures.

Conclusion

The World Gold Council estimates there are about 190,000 tonnes of gold in circulation, and roughly 54,000 tonnes that could be mined economically. Gold that comes out of the ground is used in a number of ways, with most of it made into jewelry – representing about 50% of gold demand. Around 40% of gold is used for investment purposes; this includes gold purchased by central banks, gold ETFs and retail investors.

The value of gold is not so much in its price, but its rock-solid value.

Investors love gold because it tends to hold its value through time. They see gold as a way to preserve their wealth, unlike fiat currencies which are subject to inflationary pressures and over time, lose their value.

The precious metal is also bought as a hedge against what investors see as government policies that drag down the dollar and create inflation – such as the quantitative easing programs imposed by the United States, the European Central Bank and Japan. In other words, gold is an economic safe haven.

We have written recently about this being The season for gold. From a six-month low of $1,269 an ounce on May 2, gold finished trading at $1,417/oz on Thursday. That’s a gain of 11.6%. Not a bad pop to the portfolio of a physical gold holder.

With all that is going on in the world, we believe the gold price, and physical gold investments, will continue to do well over the next few months.

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.