Palladium One cashed up to survey/drill PGE-Cu-Ni Project

2019.12.18

Palladium One Mining (TSX-V:PDM, FRA:7N11) will be kicking off the new decade with an exploration program that features a geophysical survey and 5,000 meters of diamond drilling at its flagship LK copper-nickel-PGE project in Finland.

An extensive Induced Polarization (IP) survey is expected to get underway in mid-January, followed by diamond drilling later in the winter.

Maiden resource estimate

Palladium One is exploring for platinum group elements (PGEs) at LK, short for Lantinen Koillismaa, and for nickel, copper and PGEs at its Tyko property near Marathon, Ontario.

Located in north-central Finland, nine exploration permit applications (totaling 2,500 hectares) at LK feature three mineralized zones: Kaukua, Murtolampi and Haukiaho.

Surface sampling and previous drilling have shown evidence of palladium, platinum, gold, copper, cobalt and nickel.

Palladium One’s goals are to upgrade historical estimates at Haukiaho to comply with NI 43-101 standards, and to find another million ounces of palladium-equivalent. Ultimately PDM aims to define >3 million ounces of palladium equivalent in open-pit resources.

Earlier this year the company published the first (maiden) NI 43-101-compliant resource at Kaukua, thereby placing Palladium One in the starting blocks of what is proving to be a very interesting run at developing an open-pit Cu-Ni-PGE mine in Finland.

This week shares in the company rose 22%, after a Dec. 17 news release detailing the 2020 exploration program at LK.

- A new geological model that was developed in 2019

- A pit constrained resource methodology. Here the company used numerous economic assumptions to model a resource, within an economic pit shape that, based on those assumptions, could be economically extracted e.g. the price of palladium used was US$1,100/oz versus the current price >$US$1,900/oz

- The conceptual open-pit mine plan used a cutoff grade of 0.3 grams per tonne (g/t) palladium, versus the earlier 0.1 g/t cutoff grade

The new 22-million-tonne resource therefore contains slightly less tonnage than the 2013 estimate but at a higher grade. This “pit-constrained” resource is estimated to contain 635,000 palladium-equivalent (Pd_Eq) ounces (@ 1.8 g/t) in the indicated category, and 526,000 oz (@ 1.5 g/t) inferred, for a total of 1.16 million oz.

The modelled pit suggests the future mine is expected to have a relatively low ‘waste-to-resource’ ratio of 3:1, resulting in a low-cost, low-capital operation.

Exploration program

For the first half of 2020 Palladium One expects to be occupied with exploring LK in order to shore up existing ounces on the property and to expand known zones of mineralization.

The three-dimensional IP survey, totaling 75 line kilometers, will be used to zero in on shallow zones of conductivity, containing higher sulfide concentrations, with a view to building an open-pittable resource at Haukiaho, the target containing the most available data.

Chip samples recently taken this past summer 2 km east of the historic 2011 resources returned grades of up to 0.51% Cu, 0.33% Ni, t and 0.957 g/t of PGE (palladium + platinum + gold), indicating the PGE mineralization extends well beyond the historical resource.

While historical drilling found multiple anomalous holes along the entire 10-km strike length, higher-grade shoots/ pods were not targeted and no modern IP survey has been done.

The Haukiaho zone is more extensive than Kaukua but not as continuous, with discrete pods of mineralization present. Palladium One plans to start exploring the higher-grade intercepts and step out from there.

“These historic resources indicate that Haukiaho mineralization possesses pods/lenses of higher-grade material and with focused drilling could result in a higher-grade 43-101 compliant resource being defined,” PDM stated in an Aug. 12 news release.

Previous IP surveys at Kaukua worked very well, clearly identifying the core of the deposit. For example, drill hole Kau08-018 in the core of the deposit returned 65m @ 1.57 g/t PGE (1.04g/t Pd, 0.35g/t Pt, 0.18g/t Au, 0.18% Cu, 0.10% Ni)

Along with news flow from LK in the New Year, PDM investors can also expect the results of recent sampling and assay work from the company’s earlier-stage Tyko project – recognized for its high-tenor nickel potential.

Tyko is located in northwestern Ontario around 25 km north of the Hemlo mine, and 55 km from the Marathon deposit which hosts a measured and indicated resource of 3 million ounces palladium and 618 million pounds of copper.

A 2016 winter drill program (14 holes, 1,780m) expanded historical showings and delivered the best nickel, copper and PGE grades to date. The project has been airborne-surveyed but requires further geophysics.

The upside

Much of the ~25 km of Koilissmaa’s basal (base) contact was mapped and reconnaissance-drilled (81 holes/11,514m) by majority-state-owned Outokumpu for copper/ nickel and later by GTK for Cu-Ni-PGE mineralization. GTK, the Geological Survey of Finland, punched in a series of widely spaced, shallow (typically ~ 40 meters depth) drill holes that demonstrated anomalous Cu-Ni-PGE mineralization along the 25 km of basal contact. Therein lies the exploration opportunity, the upside.

Only about four kilometers of the 25-km basal contact has been drill-tested.

The company hopes to at least double the Kaukua zone resource through additional exploration at Kaukua and other nearby target areas, like Murtolampi, where a recent sample showed 3.106 g/t PGE (Pt + Pd + Au).

There is also the possibility of higher base-metal values (copper and possibly nickel) on the southern reaches of the property, where the mafic-ultramafic intrusion caused thrust faulting with different mineralogy.

Grab sample results taken this summer showed 1 g/t PGEs graded at a very decent 0.51% copper and 0.333% nickel – opening up the possibility of an open-pittable PGE-copper mine.

Palladium pushing higher

Palladium One is advancing its Tyko and LK projects at a very interesting time in the palladium market. The most exciting development from an investment point of view is the price. The precious/ industrial metal on earlier this week breeched $2000/oz, nearly $500 per ounce better than gold, which has slipped from a one-year high of $1,550/oz in the first week of September, to around $1,475.

The palladium price tripled from the start of 2016 to spring of 2019, beating gold just under a year ago for the first time in 16 years.

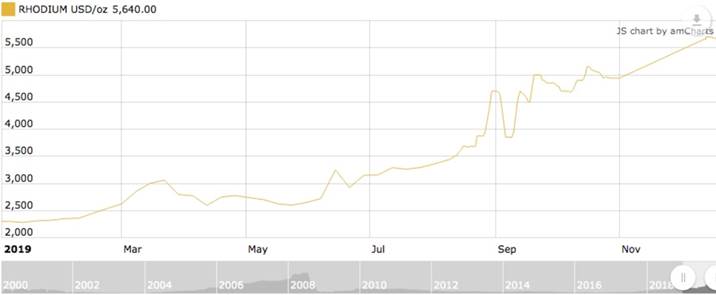

Having gained 47% year to date, palladium is on track to win the best-performing metal for the second year in a row, fueled by tight supply and smoking-hot demand from the auto sector. The only other PGE doing better than palladium is rhodium, also used in autocatalysts – it’s more than doubled, up 145% YTD.

Demand for palladium has surged as auto makers shift from diesel to gas-powered cars or hybrids, that use a higher percentage of palladium than any other metal in their auto-catalysts.

Higher air emissions standards in Europe and China mostly, following the “diesel-gate” scandal at Volkswagen, are what is keeping a solid floor under palladium prices, despite a slump in car sales in top car-consumer, China. In September the country’s auto sales fell for the 15th month in row. Car sales in the US are also expected to come in under 2018’s total.

Electrification is also playing a role in the lofty demand figures. Palladium use in hybrids and plug-in hybrids, which like regular cars need catalytic converters, in 2020 is expected to nearly triple that of 2016.

Before leaving demand, a few words about palladium jewelry. While palladium used to be the younger relative of higher-priced gold and platinum, as we know the palladium price has raced well past both. Gold may be thought of as rare, but it is actually about 30 times more common than palladium.

Jewelry-makers have traditionally preferred platinum because it is heavier and stronger. Also, palladium has a lower boiling point, making it hard to work with, in certain applications. These cons however can be turned into pros especially considering that an ounce of palladium is pushing $2,000. Some people prefer lighter palladium jewelry to platinum. And because it is harder than platinum, palladium lasts longer. Finally, gold alloyed with palladium produces “white gold,” a popular material for rings, necklaces and bracelets.

On the supply side, 2018 was the seventh year in a row that palladium was in deficit, and 2019 is expected to be number 8.

The deficit is set to rise to 800,000 ounces this year as palladium consumption reaches 11.2 million ounces while mining production lags and stockpiles dwindle.

Palladium prices got another boost earlier this year after Russia said it was considering banning ore exports.

Over 80% is extracted as a by-product of nickel ore in Russia, and platinum in South Africa. These two countries control three-quarters of global production. There are very few pure-palladium deposits in the world, aside from major mines in Russia, South Africa, Ontario and Montana.

According to the US Geological Survey, the supply of PGEs from South Africa is anything but guaranteed. Last year production there fell compared to 2017, owing to jobs cuts and mine shaft closures – a trend that is likely to continue.

Platinum mining in South Africa is frequently interrupted by labour unrest. In 2014 workers at the country’s three major producers – Lonmin, Anglo American Platinum and Impala Platinum – downed tools for five months demanding that wages be doubled. The strike was the longest and most expensive in South African history, shutting down about 40% of the world’s palladium production.

With palladium and rhodium prices at record highs, it makes sense for platinum and nickel companies that mine them, to ramp up production to take advantage. Problem is, there is limited scope for producers to increase supply, especially in South Africa. Just as important, a boost in output could add to the glut in platinum, which is these miners’ bread and butter.

A couple of other points about palladium add to the tight supply narrative. The first is regarding the idea that for most raw materials, “the cure for high prices is high prices,” but not for palladium. This refers to the idea that a rally induces higher production, and more supply, pressuring prices down. There just isn’t a lot of new supply that can be easily accessed by profit-seeking PGE miners.

TD Securities head of global strategy Bart Melek agrees, telling Kitco News on Nov. 28, “Ultimately, what the market is trying to price in here is scarcity down the road. There is certainly isn’t a lot of new capacity coming in from the mining side. Recycling is probably steady. We expect a bit of inflection on the demand side and not really seeing significant growth on supply.”

The second point concerns the theory that the auto industry can just substitute cheaper platinum for palladium in their catalytic converters. At Ahead of the Herd, we are not so sure. For one thing, car-makers have for the most part already made the switch to palladium-heavy auto-catalysts. They did so in the 2000s because palladium was much cheaper than platinum.

Re-tooling them back to platinum would be unproductive and expensive – likely negating the money saved by purchasing cheaper platinum. And why incur the cost, since the auto industry is eventually going to go all-electric? (EVs do not require catalytic converters)

Also, the palladium market is larger than the platinum market – averaging about 200 and 175 tonnes per year, respectively, meaning a switch to platinum carries the risk of an auto supplier being unable to fill its orders, especially if the platinum comes from South Africa with all its problems mining PGEs. Palladium is more reliable as a raw material.

As for what is in store for palladium prices next year, AOTH’s research finds that, while the market will probably be more volatile, with natural pullbacks following rallies, palladium is likely to continue breaking records. Melek agrees.

“We think it will hit $2,000 at the latter part of next year when gold does better as well,” he said in the Kitco article. “We formally have $2,000 average in Q4 2020, but given normal volatilities, it could be $2,100-2,150. We wouldn’t be shocked if that happened.”

Conclusion

Palladium’s rise is one of the most compelling metal stories of the mining industry this year. The supply-demand fundamentals are so solid, prices right now seem unassailable.

Considering the difficulty the world’s largest palladium miners, especially those in South Africa, are having increasing production, the onus is on smaller companies to find and develop new deposits of the platinum-group element.

Anyone with a deposit containing palladium, even if mined in combination with other metals, is going to be in high demand.

One company that happens to have one, our favorite pick in the PGE space, is Palladium One (TSX.V:PDM, OTC:NKORF, FRA:7N11), developing its LK copper-nickel-PGE project in Finland.

The LK project is mostly a palladium play, offering investors exposure to the auto-catalyst ingredient, for which demand, and prices, are only going up, owing to stricter air pollution standards, amid a long-term structural supply deficit.

This week’s announced exploration program at LK is great news for PDM investors. We see major potential for both shoring up existing resources, through infill drilling, and locating new ounces, particularly at the Haukiaho target, via the IP survey and drilling. If all goes well, a new resource at Haukiaho will be announced in 2020, adding to the resource at Kaukua published in September.

Palladium One recently raised CAD$3.78 million through a private placement. The offering, at 6 cents per unit, caught the attention of storied resource investor Eric Sprott, who, the company says, acquired 20 million units for $1.2 million – representing a 19.4% ownership stake in the company.

The company is cashed up and ready to explore. I expect solid news in 2020 with ample entry and exit points for savvy investors.

Palladium One

TSX.V:PDM, Frankfurt:7N11, OTC:NKORF

Cdn$0.12, 2019.12.19

Shares Outstanding: 109,792,349m

Market cap: Cdn $13,175,081m

PDM website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard owns shares of Palladium One (TSX.V:PDM). PDM is an advertiser on his site

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.