Nevada is the Golden State

2019.10.11

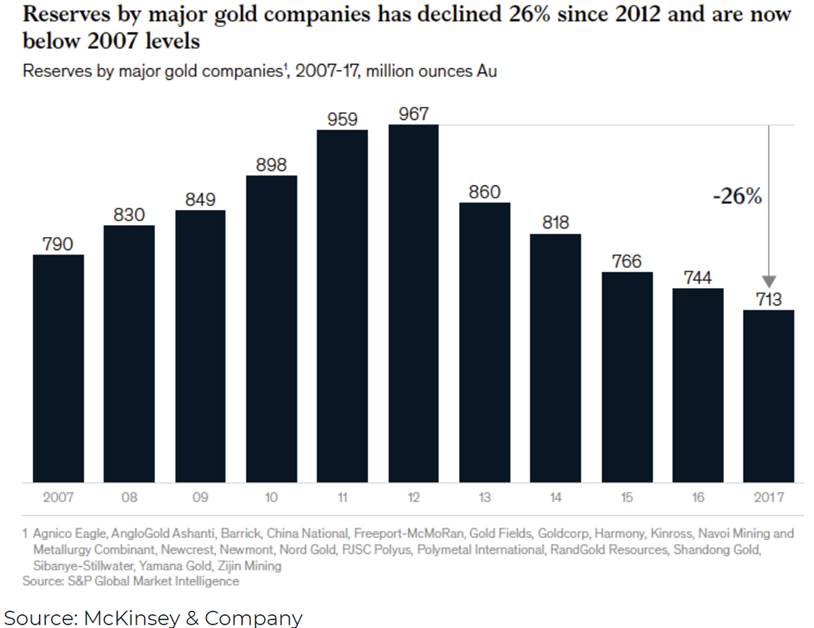

Major gold companies are running out of reserves and every year it costs more to mine. That is causing an “existential crisis” for the gold mining industry, as executives at gold producers like Barrick, Newmont Goldcorp, Randgold, AngloGold Ashanti, Newcrest and Kinross, puzzle over how to replace their depleted reserves, where new gold will come from, and how they will deal with the rising costs of extraction.

At the PDAC conference in Toronto this year, Mark Ferguson, head of mining studies at S&P Global Intelligence, shared data suggesting the industry is indeed running out of gold ore to mine.

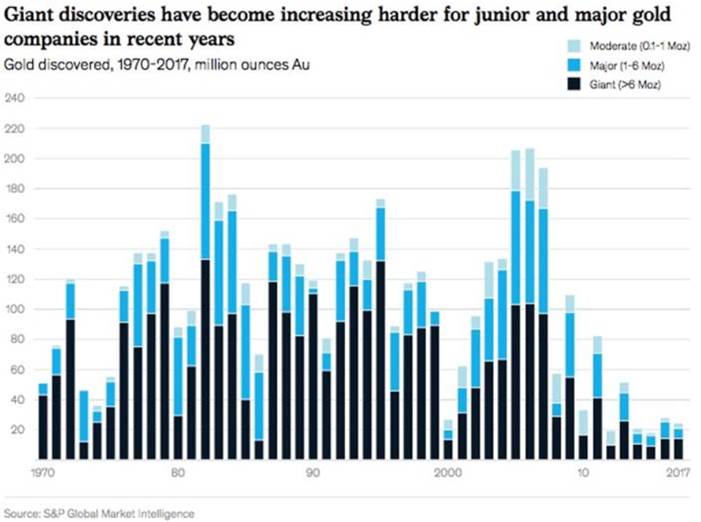

“Clearly the industry did very well in the 1990s and even through 2008. But since then there’s been a dearth of new big deposits (discovered), and … there is going to be a shortfall in new gold discoveries,” Ferguson told conference-goers in March.

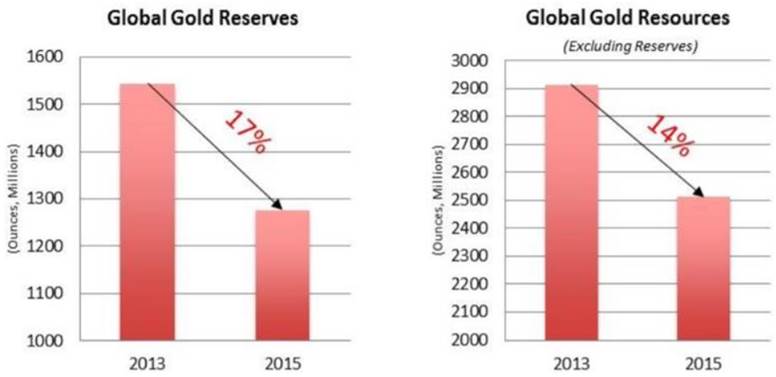

Reserves depletion

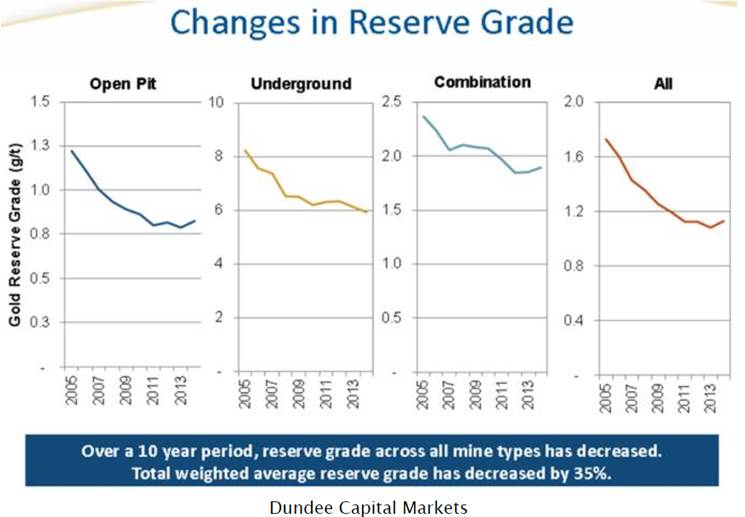

A 2018 report from S&P found that, as a group, 20 major gold producers had to cut their remaining years of production by five years, from 20 to 15, based on falling reserves. Moreover, gold grades have been declining since 2012, meaning more ore has to be blasted, crushed, moved and processed, to get the same amount of gold as when the grades were higher, significantly adding to costs per tonne.

It’s not surprising that gold companies are finding it tougher to add to reserves. The fact is, all of the easy, low-hanging fruit has been picked. Even with a six-fold increase in exploration spending between 2002 and 2012, there has been a significant dearth of new discoveries.

According to McKinsey, in the 1970s, ‘80s and ‘90s, the gold industry found at least one +50 Moz gold deposit and at least ten +30 Moz deposits. However, since 2000, no deposits of this size have been found, and very few 15 Moz deposits.

Any new deposits will cost much more to discover. This is because they are in far-flung or dangerous locations, in orebodies that are technically very challenging, such as deep underground veins or refractory ore, or so far off the beaten path as to require the building of new infrastructure from scratch, at great expense.

The costs of mining this gold may simply be too high.

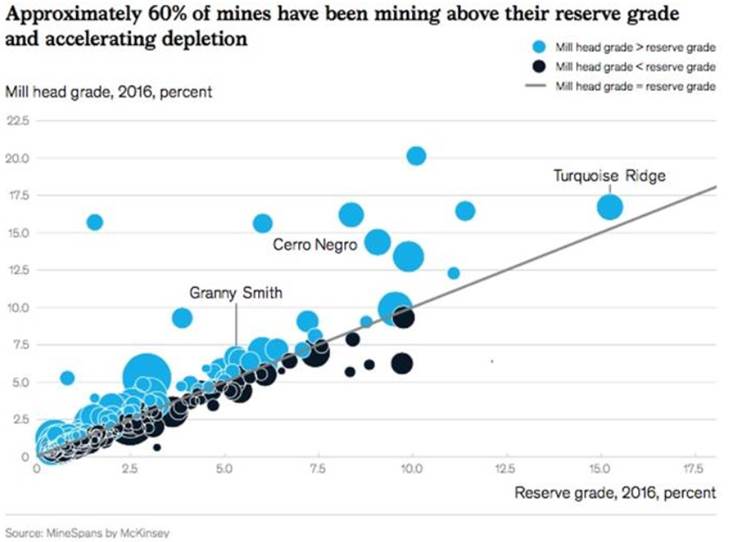

Add to this the practice of high-grading where, instead of mining a deposit as it should be, economically, by extracting, blending both low-grade and high-grade ore at a given strip ratio of waste rock to ore – the company “high-grades” the orebody by taking only the best ore, leaving the rest in the ground.

The implication of high-grading is a dramatic improvement in a company’s margins, but at a huge loss of ounces to its reserve base, as well as lowering the deposit’s average grade, since all the best material has been removed.

According to McKinsey, in 2016, about 60% of gold operations were mining with mill grades above the mine’s reserve grade – in other words, they were high-grading. Large mines where this was occurring included Goldfields’ Granny Smith mine in Australia, Goldcorp’s Cerro Negro, Argentina and Barrick’s Turquoise Ridge operation in Nevada.

In sum, the combination of high-grading, which lowers both reserves and grades, a drastic reduction in new discoveries due to a lack of exploration spending, and decreased mine lives, means the industry will be extremely challenged to maintain current production levels. According to a background report, by 2020 global mine production is expected to drop 3% to 95 million ounces and keep falling after that – in other words – we have hit peak gold. The report estimates that by 2025 production will be one-third lower than 2020’s output.

Peak gold

The concept of “peak gold” should be familiar to most gold investors. Like peak oil, it refers to the point when gold production is no longer growing, as it has been, by 1.8% a year, for over 100 years. It’s stopped growing because existing mines are getting depleted without enough new gold deposits to replace them.

Since reaching “peak gold” in the mid-2000s, six major gold miners experienced declines in production. According to Bloomberg Intelligence data on the big producers, combined gold reserves shrank by almost half in 2018, to 406 million ounces, due to exploration budget cuts.

The 10 largest gold mines operating since 2009 will produce 54% of the gold as a decade ago – 226 tonnes versus 419 tonnes.

No wonder, then, that for gold miners to grow, they need to “eat each other”. They require big gold mines, and the only options out there are existing mines run by their competition. If you can’t beat ‘em, join ‘em.

None of this is news to gold companies. But it is good background to explain recent mega-mergers and joint ventures – the Barrick-Newmont combination in Nevada, and the fusing of Newmont and Goldcorp – along with other examples of gold mining M&A.

Barrick’s problem, and solution

Why did Barrick want to partner with Newmont, its competition in Nevada where the two gold giants have been finding and pumping ounces out of the Carlin Trend for decades?

It all comes down to the need to replace reserves and cut costs. At the end of the first quarter, Barrick’s gold reserves had declined from 64.4 million ounces to 62.3Moz. The company explained its reserves declined mostly due to depletion at its Cortez Hills open-pit mine, and changes at its mine in Tanzania.

Initially Barrick, which in January 2019 acquired South Africa’s Randgold, tried a hostile takeover for Newmont valued at a whopping $18 billion.

Barrick’s CEO, Mark Bristow told shareholders he could get $7 billion in synergies over the next two decades, through cost savings realized by combining operations. Newmont has 19 mines in Nevada, many adjacent to Barrick’s.

However when Newmont, which in April 2019 gobbled up Canada’s Goldcorp, rejected the offer, Barrick focused on the prize: Nevada.

Instead of fighting Newmont for a set pile of gold in Nevada, why not join forces with its rival to ensure that Barrick remains the largest gold company in the world?

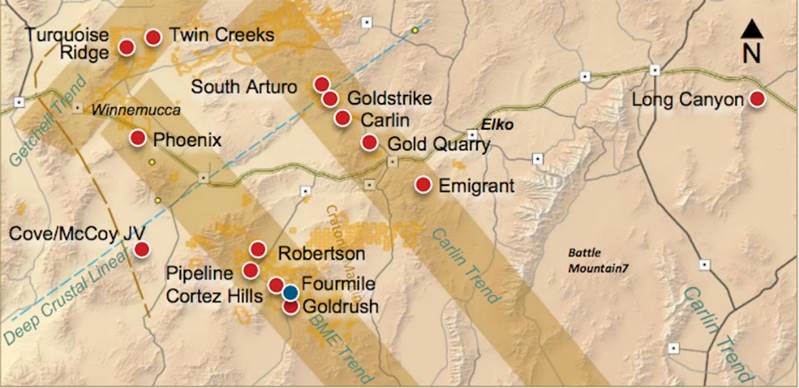

In July Newmont and Barrick established a new joint venture partnership, Nevada Gold Mines LLC, 61.5% owned and operated by Barrick, and 38.5% belonging to Newmont Goldcorp. The JV makes Nevada Gold Mines the largest producing gold complex on Earth. Its northeastern Nevada assets include 10 underground and 12 open-pit mines, plus autoclave, roasting and heap leach facilities that in 2018 produced 4.1 million gold ounces – double that of the next largest gold mine, Muruntau in Uzbekistan.

The joint venture, with proven and probable reserves of 48.3 million ounces, is expected to produce 1.8 to 1.9 million ounces per year. Synergies from combined operations, including the merger of Turquoise Ridge and Twin Creeks into one mine, are targeted at $500 million annually, starting in 2020.

The JV will also help Barrick to shed an estimated $1.5 billion by divesting its less-productive mines, while it looks to acquire new assets.

JV success

It didn’t take long for Nevada Gold Mines to find exploration success on its home turf. Last month Barrick hit a discovery hole just north of its Fourmile project. The new orebody increases the strike length of the Goldrush-Fourmile trend to 6 kilometers, and opens the potential for adding one more Tier 1 asset to the three already wrapped into the Nevada Gold Mines partnership – Goldstrike/Carlin, Cortez and Turquoise Ridge/Twin Creeks – by combining Fourmile with the nearby Goldrush development.

“Discovery is fundamental to value creation and the latest results from Fourmile confirm the potential for further high-value discoveries in the greater Cortez – Carlin region which has been a prolific source of gold discovery and production for 150 years, and still holds an untapped wealth of geological endowment,” Barrick’s Bristow said in a news release.

Nevada

With 160 years of gold mining that dates back to the Comstock Lode discovery in 1859, Nevada has been, and still is, one of the best jurisdictions to find gold.

In 1849, Mormon ‘49ers on their way to California discovered placer gold in a stream that flowed into the Carson River, near the current town of Dayton. As mining lore recounts, the ‘49ers led a mining party upstream into what became known as the Virginia Range. Ten years later, hard-scrabble miners found the first croppings of the Comstock Lode. It’s intriguing to think that, if it wasn’t for the ‘49ers camping and panning in Nevada on their way to the California Gold Rush, the millions of ounces sitting underground could still be undiscovered.

While the Comstock Lode sparked a frenzy of silver mining in Nevada (it was the first major silver find in the United States), it took over 100 years for the state to become gold-famous.

The discovery of microscopic gold on the Carlin Trend prompted Newmont to start operations there, in the early 1960s. At the time, reserves were pegged at a mere million ounces, but by 2016, the Carlin had given up 88.2 Moz in cumulative production, “assuring its place as one of the most productive gold-mining districts in the world,” states a report from the Nevada Division of Minerals.

Between 1835 and 2016, Nevada produced a phenomenal 158 million ounces. This is more than any other gold rush, including California’s, which extracted about $2 billion in precious metals from 1849-62, and the Comstock era, 1860 to 1875, which mined around 34 Moz, according to research by The Nevada Sun. Nevada currently produces around 80% of all the gold in the United States.

Impressive as these numbers are, junior gold investors sometimes overlook Nevada, thinking that all the precious metal has been found – not so. While the western state certainly has been well-explored and mined, there is still huge exploration potential remaining for multi-million-ounce discoveries, especially around the edges and in the depths of existing or past-producing gold mines and trends.

The United States’ primary gold producer has an impressive geological endowment. According to the US Geological Survey, if Nevada were a country, it would be among the world’s top four producers. The Nevada Bureau of Mines and Geology tallied gold reserves in 2015 at about 70 million ounces, enough to sustain gold production near current levels for 12 to 15 years.

Nearly every rock type known to geologists is found within its desert geography, though silver and gold have been the most prevalent. The state owes its unique geology to the northern Great Basin which features a number of mountain ranges and valleys where the rocks below have been smashed together and pulled apart through tectonic activity dating back millions of years.

Most of Nevada’s gold deposits are found within three northwest-trending belts. The most famous is the Carlin Trend, where sedimentary, disseminated gold appears near surface, often surrounded by smaller deposits of similar geology.

Estimated to contain up to 180 million ounces, the Carlin Trend is the second largest gold endowment behind South Africa’s Witwatersrand Basin. The three major players operating mines in the Carlin Trend are Newmont Mining, Barrick Gold and Kinross Gold. Barrick’s Goldstrike mine is one of the world’s most prolific. Between the Betze-Post open-pit mine and the Meikle and Rodeo underground mines, the Goldstrike mines have produced over 1.1 million ounces and have 8.1 million ounces of reserves.

Newmont’s Carlin operations have produced 944,000 ounces out of 15 million ounces in reserves. Kinross’s Bald Mountain mine, purchased from Barrick in 2016, outputted 130,144 gold-equivalent ounces, with 2.1 Moz in reserves.

The other two trends, Battle Mountain-Eureka-Cortez (or just Cortez) and Walker Lane, also host some of the world’s most important gold mines, including SSR Mining’s Marigold mine in Humboldt County and McEwen Mining’s Gold Bar operation – the latter producing 482,815 ounces of gold between 1986 and 1995.

The three major trends feature Carlin-style mineralization, but Nevada also has epithermal, low-sulfidation gold deposits. While generally smaller than the large Carlin-type deposits, epithermal vein-type deposits, which are not unique to Nevada, are often high grade, making them excellent targets for gold exploration companies.

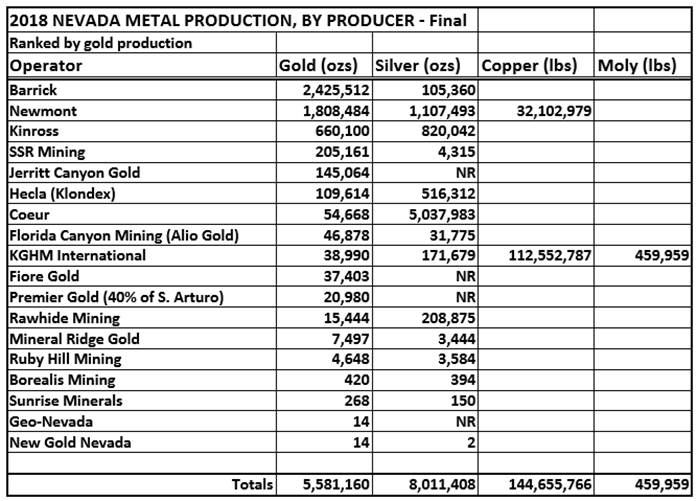

In 2018, from Nevada’s 5.8 million ounces, the top three producing gold mines were Barrick’s Cortez Hills OP/ Pipeline, at 974,391 ounces, Newmont’s Carlin Trend operations, which mined 971,613 oz, and Barrick’s Betze Post mine which outputted 458,287 oz. Barrick’s 2.425 Moz out-paced Newmont’s 1.8 Moz, followed by Kinross at 660,100 oz and SSR Mining at 205,161 oz.

Nevada’s mines also crank out a lot of silver, in 2018 producing 8.011 million ounces of the white metal.

Interest in Nevada has increased significantly since Barrick Gold and Newmont Mining started discussing their expansion strategy in Nevada, and their recent partnership has really heated up the market for all properties in the gold state, specifically interest in drill programs to discover and develop new ounces for the larger market-cap producers.

Recent starts

In the Fraser Institute’s latest (2018) survey, Nevada was ranked number 1, as the most attractive jurisdiction for mining investment, up from third place in 2017.

Among the reasons for retaining its competitive edge, are Nevada’s lack of income tax, the fact that mining is governed under the federal Mining Act of 1872, which would take an act of Congress to change, and that mining taxes are set out in the state’s Constitution. They can’t be suddenly changed willy-nilly.

Taking a run through the latest mine re-openings, readers can see that not only does Nevada produce a lot of gold from existing mines, it is also an excellent place to put a new mine into production or get a mothballed mine restarted. Detailed below are six such mines. Note: this is not an exhaustive list.

Gold Bar – McEwen Mining (TSX:MUX) has two producing mines in North America, Black Fox in Ontario, and Gold Bar in Nevada. Located 41 km northeast of Waterton Global’s Ruby Hill mine, and the same distance southeast of Barrick’s operations, the Gold Bar mine started production in the second quarter of 2019. The open-pit, heap-leach operation in Eureka County is slated to produce 63,000 oz a year.

Florida Canyon – Alio Gold’s (TSX:ALO) (formerly Rye Patch Gold) Florida Canyon mine achieved production in December 2017. Alio envisions the gold-silver mine producing 734,000 oz for the duration of its close to 10-year minelife. Permits were recently granted to construct a second leach pad, expected to be completed in six months.

Isabella Pearl – Just this week, Gold Resource Corp (NYSE American: GORO) announced commercial production at its Isabella Pearl mine, located in Nevada County. The first dore bar was produced in April, and Gold Resource is planning for 2,000 ounces a month, having produced that amount in September.

El Nino – On Sept. 27 Premier Gold Mines (TSX:PG) announced the start of ore processing at its El Nino mine, part of the company’s South Arturo operation, which is 40% owned by Premier and the rest by Nevada Gold Mines, the above-mentioned joint-venture. Previous mining at El Nino, an underground deposit, concluded in 2017. South Arturo is in the Carlin Trend, about 40 km from the town of Carlin.

Relief Canyon. Preparation of the leach pad is 80% and installation of the liner has started at the Relief Canyon mine owned by Americas Gold and Silver (NYSE:USAS). Relief Canyon is at the southern edge of the Pershing gold and silver trend, along the Humboldt Range, about 150 km northeast of Reno. Americas has all the state and federal permits needed to begin mining and heap leach processing.

Pan – Fiore Gold (TSX.V:F) has succeeded in putting the Pan mine in White Pine County, into production – a feat its predecessor, Midway Gold, failed to do and led to Midway declaring bankruptcy in 2016. Fiore completed a number of steps towards a ramp-up this summer, including the commissioning of a primary crushing circuit. Until June Pan was a run-of-mine operation, whereby the blasted ore is placed directly onto the leach pad. Production in the second quarter was 24% higher than the year-ago quarter.

Bald Mountain/ Round Mountain – This last entry is more of an “honorary mention”. Kinross (TSX:K) bought 50% of the Bald and Round Mountain mines it didn’t already own, from Barrick in early 2016. The major gold producer with mines in the United States, Brazil, West Africa and Russia, is eyeing expansions at both mines. The first quarter saw Kinross posting record production at Bald Mountain and its Paracatu mine in Brazil. At Round Mountain, Kinross’ Phase W expansion project aims to extend mining by 5 years (Kinross has operated the mine since 2003) and increase life-of-mine production by 1.5 million ounces. In 2018 Round Mountain poured its 18 millionth ounce.

Up and comers

Viva Gold (TSX.V:VAU) – Viva Gold’s Tonopah project is on the Walker Lane trend in western Nevada. The company has compiled a pit-constrained resource of 253,000 ounces, and identified exploration targets for expansion. Viva Gold recently received approval to drill 20 holes. A reverse-circulation rig was mobilized to begin drilling in early September.

NV Gold (TSX.V:NVX) – Plans to capitalize on under-explored gold properties in Nevada, with control of a large portfolio of gold projects that are all within Nevada’s three major gold trends: Carlin, Cortez and Walker Lane. NVX boasts two extensive geological databases, which serve as an information bank for identifying prospective, drill-worthy projects, and an experienced team. The company successfully executed two summer drill programs at its Frazier Dome and Slumber targets, of which it is waiting for assay results. A third drill program is undergoing permitting – NV’s Root Spring property is 128 km south of Winnemucca, and 41 km east of Coeur Mining’s Rochester silver-gold mine.

Canarc Resource Corp (TSX:CCM) – The company’s Corral Canyon property covers 730 hectares of a low-sulfidation, epithermal gold system over 3 km, evidenced by previous drilling and sampling. At the end of September Canarc identified four new targets at the gold-silver project, located 70 km north of the past-producing Sleeper gold mine in northwestern Nevada.

Ethos Gold (TSX.V:ECC) – Ethos recently completed the first phase of drilling at Iron Point, its project 35 km northeast of Winnemucca. The goal was to test the Lower Plate (“LP”) strata for Carlin-type gold mineralization, to depths up to 700m. Ethos said the drilling confirmed that LP rocks underlie most of the property. The company plans to use data from the drill program to optimize the geological model at depth, and vector towards potential higher-grade gold in Phase 2. Ethos Gold has an earn-in agreement with Victoria Metals.

Allegiant Gold (TSX.V:AUAU) – Summer drilling was completed Oct. 2 at the Bolo gold project, on which Barrian Mining has an earn-in agreement with the owner, Allegiant Gold. Visible alteration was observed in all 10 reverse circulation (RC) drill holes, indicating potential for mineralization down-dip and along strike. Allegiant’s flagship Eastside project has an inferred resource estimate of 654,000 gold ounces and 3.9 Moz of silver.

Conclusion

Nevada has many “wannabes” around the world, all aiming to match or outperform the United States’ leading gold-producing state. Trouble is, many prospects are in politically unstable areas like Africa, are buried under difficult terrain, or are so far off of the beaten path, that building a mine is uneconomic.

At AOTH, we believe that Nevada is tough to beat. Some gold investors steer clear of the state, thinking it has been mined out, but the reality is altogether different. Even this relatively shallow analysis of gold companies operating in Nevada shows there is a lot going on. Sure, a lot of it is around the edges of existing mines, as one would expect, but that doesn’t mean there aren’t any discovery holes left. Just look at Barrick’s recent find, on the Goldrush-Fourmile trend. Moreover, conducting exploration, constructing and building a mine in Nevada is relatively easy. The state isn’t the country’s number one gold producer by far, without good reasons.

When Barrick went looking for areas thought to be prospective for adding ounces to replenish its dwindling reserves, it went straight to Nevada. The answer to why, by now should be obvious: Nevada still has many years of life left in its mines. Scanning the junior mining news, without trying very hard we found six re-starts in the past two years. Not bad for an old gal supposedly on her last legs.

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of NV Gold and NVX is an advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.