More smelters, scrap metal ban driving Chinese copper imports

2019.09.25

Despite evidence of a slowing economy, shipments of raw materials are gliding across Chinese docks at a torrid pace, especially metals, which form the backbone of China’s industrial supply chain.

In fact a recent report shows that, while Chinese imports are down 5% compared to last year, and the trade war is hitting China’s manufacturing sector, imports of raw materials and ores “continue their seemingly perpetual upward trend.”

A blistering trade

MINING.com quotes BMO Global Commodities Research, the report’s author, saying that “In our opinion, while the trade war has caused many problems for China, it has not shaken the overall commodity business model of importing raw materials, having enough process capacity and ideally exporting a small amount of finished product as an inflation hedge.”

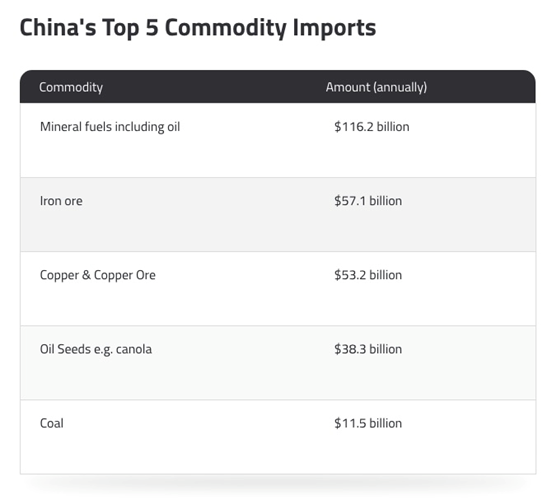

Of course, a blistering trade in commodities is expected for China, which has ranked as the world’s biggest goods exporter since 2009; in 2013 the Asian country sped past the US as the largest trading nation on earth. It imports the most crude oil, and is the biggest buyer of iron ore by far, representing two-thirds of global iron ore imports. Its closes rival, Japan, only accounts for 8.5%.

Copper is among metals that are seeing strong demand from China. Copper concentrate imports gained 10.8% from January to August, compared to the first eight months of 2018, with 2019’s unrefined copper imports already higher than 2018’s record 19.7 million tonnes. Shipments of nickel ore to China have expanded by 15%, year to date.

The country bought nearly 95 million tonnes of iron ore in August, 4.2% more than July and 6.2% more than August 2018, smashing a record set in January, 2018.

Shipments of bauxite, the aluminum mineral, are up 30%, more crude oil is being consumed, and even the coal trade is buoyant despite all the restrictions Beijing has placed on the out-of-fashion fossil fuel.

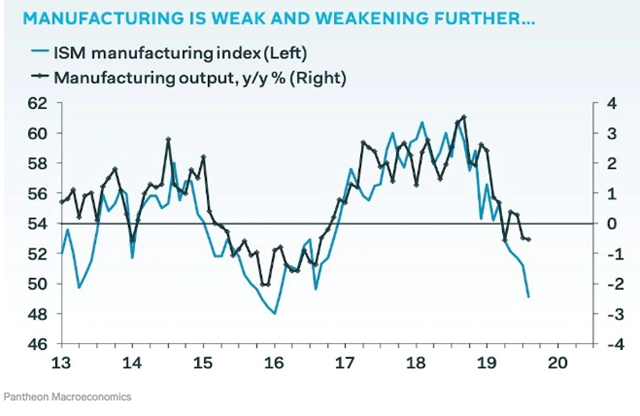

The booming import trade in August was a continuation of commodities growth in June. Bloomberg reported in July that Production of a swathe of materials — from crude steel to coal and aluminum — reached record levels in June, contributing to stronger-than-expected industrial output even as the wider economy expanded at its slowest pace since the early 1990’s.

Despite sagging growth

All of this despite much slower economic growth compared to the decade of double-digit figures posted from 2008-18, as China moves from an export-based to a consumer-oriented economy, and a trade war that has slapped hundreds of billions worth of tariffs on Chinese imports to the US. The latest round kicked in September 2 – $112 billion directed at imports such as diapers, shoes and food.

South China Morning Post quotes Capital Economics predicting that these new import duties will chop about 0.2 percentage points off China’s economic growth in 2019, and another 0.3% in 2020. Importantly, the research firm cut its 2020 growth estimate to 5.7%, below the 6% minimum growth target set by the government for this year.

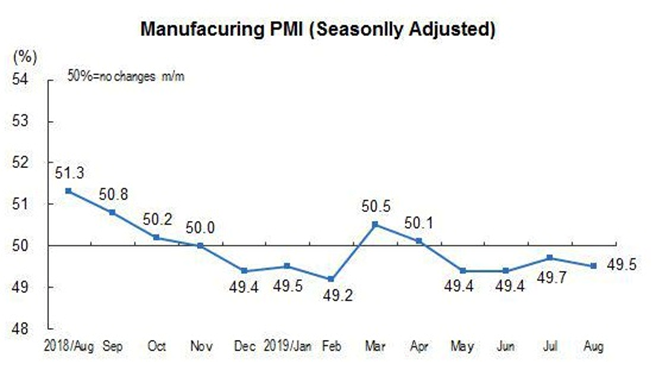

Capital Economics reports that growth in China’s industrial production kept falling to just 4.4% in August, a 17-and-a-half-year low. The country’s manufacturing Purchasing Managers’ Index (PMI) also worsened, slumping to 49.5%. Any number under 50 represents an economic contraction.

Like central banks in the United States and elsewhere that are lowering interest rates to fight stalled growth, the People’s Bank of China did the same – earlier this month lowering its borrowing costs for a second month in a row – to 4.2%.

So how come China’s industrial output is falling but imports of metals like iron ore, copper, nickel and bauxite are rising? The answer becomes clear when we get a bit more granular with the data.

For copper, there are two factors in play: more copper smelters being built and demanding more of the red metal; and China’s scrap metal import restrictions which have resulted in buyers scrambling for other forms of copper.

Scrap metal re-set

Three months ago China implemented new restrictions on scrap metal imports, part of a widespread campaign against accepting “foreign garbage”.

Because scrap copper can be recycled or melted into new products, restrictions on it are significant, in terms of copper supply. Among the new rules set by China’s environment ministry, are import quotas on copper scrap; companies that import scrap must show they have facilities that will process the metal up to environmental standards; and a tightening of the impurity threshold of non-ferrous scrap imports, to 1%. Low-grade copper scrap such as coiled copper cable and scrap motors, has been banned.

China has also imposed a 25% tariff on imports of US copper scrap, one of its biggest sources of the material.

In June, China announced set the first batch of import quotas at 240,000 tonnes, which is around one-tenth of its copper scrap imports in 2018. Scrap metal imports to China sunk by 38% to 343,000 tonnes in the first quarter of this year.

Between the scrap metal ban and expanded smelting capacity, copper buyers are scrambling for alternative forms of copper. As copper scrap imports decline, shipments of copper concentrate produced by mines are on the rise.

Unwrought copper shipments to China have also increased as a result of the scrap metal restrictions. They rose 12.9% to a record annual high of 5.3Mt in 2018. Chinese copper smelters are also also seeking blister, a partially purified form of copper, and off-grade copper cathodes, to compensate for a lack of scrap. Chinese buyers are reportedly very interested in off-grade cathodes which sell at a discount to copper cathode brands that conform to standards set by metal exchanges like the LME.

Copper cathodes are used to make copper products like rods and tubes.

New smelter capacity

A new wave of copper smelting and refining capacity started to come online last year, prompting demand from new smelters that want to stockpile the material. In the first quarter of 2018, China’s copper concentrate imports were up 8.3%, to 4.67 million tonnes, the highest first-quarter figure ever reported, Metal Bulletin said. A monthly high of 2.07Mt was hit this past July.

“There has been a general, ongoing shift in the type of copper China has been importing,” because of expanding smelting capacity that can process concentrate,” Reuters quotes Daniel Hynes, commodities strategist at ANZ.

One research firm forecasts nearly 1 million (950,000) tonnes of new processing capacity will become operational this year.

In fact all the new smelters may even bring about a shortage of concentrate, if too much capacity becomes available without an equivalent amount of concentrate.

Another concern is the cost of copper refining. Smelters lower or raise the amounts they charge for smelting the metal brought to them by mines. These are called treatment and refining charges (TC/RC). Two months ago the top Chinese smelters dropped their charges for the third quarter by 25%. That’s good for mining companies who pay less for smelting but rock-bottom rates can really cut into the profitability of smelters, who may slash output if the TC/RC is too low.

“Processing rates have dropped dramatically and the economic benefits of smelting companies have been downward and even disappeared,” warns the vice president of China Nonferrous Metals Industry Association (CNIA).

However, so far there has been no collective effort to cut production according to an analyst quoted by Reuters.

Supply woes

As copper shipments continue to flow through Chinese ports at good pace, supply is getting tighter owing to events in South America, where most of the world’s copper is mined, and Indonesia. In the first half of the year, global copper output fell 1.4% to almost 10 million tonnes, MINING.com reported. A report from the International Copper Study Group shows Chile’s production dropping 2.5% due to heavy rains in the north.

Poor grades also hampered output. Copper grades have declined about 25% in Chile in the last decade – highlighting the urgent need for grassroots exploration to arrest the trend.

In a final indignity, Chilean state-owned Codelco had to go to the market to get funding for a number of multi-billion-dollar upgrade projects, even though five months ago it said it wouldn’t have to. The world’s largest copper producer has ambitious plans, include converting its Chuquicamata open-pit mine to an underground operation, for $5.6 billion, and a $5.6 billion project to put in a new level at El Teniente, Codelco’s largest mine.

Meanwhile Indonesia’s copper concentrate production crashed 55% in the first half, as the Grasberg mine transitions to underground block caving and the Batu Hijau mine moves to Phase 7, MINING.com said, leaving an HI global refined copper deficit of around 220,000 tonnes.

Conclusion

China is and has been a critical market for copper exports, along with other metals such as nickel, iron ore and bauxite. For copper, top-down changes by China are boding well for the red metal. The decline in scrap copper shipments is being replaced by higher exports of concentrate and other unfinished copper products. More copper smelters in China are bolstering demand.

The bullish case for copper is improving due to other recent developments. In fact the much-anticipated supply deficit has emerged sooner than later. The first half saw global copper production fall by 1.4%, owing to heavy rains in Chile and interruptions in operations, as two of the largest copper mines in Indonesia move underground. Refined copper output was in deficit in H1, to the tune of 220,000 tonnes.

KPMG is predicting that by 2020, copper consumption will reach 24.5 million tonnes “driven by growth in global industrial production and higher investment in energy infrastructure.”

An acceleration in demand for EVs and renewable energy over the next two years are expected to be the main copper demand drivers.

A little further out, over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place. A shortfall of 15 million tonnes is expected by 2034.

Bottom line? We gotta find more copper. I’ve got my eye on junior copper developers that can help to fill the massive deficit that is coming the market’s way.

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.