Max Resources free gold elephant

- Home

- Articles

- Uncategorized

- Max Resources free gold elephant

2019.02.15

Max Resources (TSX.V:MXR) latest update explains the sampling protocol being used on their Choco Precious Metal Project and tells us to expect initial sampling analysis results some time next week.

The company has determined that the best way to obtain the grade of the gold-bearing conglomerates is to crush the conglomerate and then process the material to recover the free gold from the sample, rather than assaying the samples.

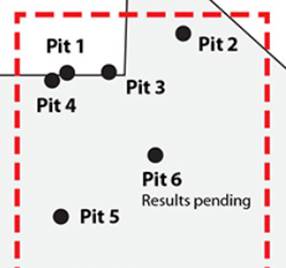

Max conducted a six-pit 2m by 2m by 30cm-deep bulk sampling program, spread over an 8 sq. kilometer area.

About 2,000 kilograms of hard rock conglomerate was randomly collected from each pit, then a 50-kg sample from each pit was sent to a lab in Medellin, where it was crushed to <2mm, then gravity-separated to reveal the gold.

Step-by-step procedure:

- A random 50-kilogram sample is taken from each 2,000-kilogram bulk sample of hard-rock gold-bearing conglomerate and sent to CIMEX.

- The 50-kilogram sample is dried and weighed.

- The entire 50-kilogram sample is crushed to two millimetres and sieved, producing a plus-two-millimetre fraction and a minus-two-millimetre fraction, with each fraction weighed individually.

- The plus-two-millimetre fraction is set aside to later recover any free gold; a sampling protocol is currently being determined.

- The minus-two-millimetre fraction is concentrated down to 75 to 150 grams of material.

- The minus-two-millimetre tailings are set aside to later recover any free gold; a sampling protocol is currently being determined.

- The free gold is separated from the minus-two-millimetre concentrate.

- The minus-two-millimetre concentrate tailings are set aside for later testing; a sampling protocol is currently being determined.

- The free gold is collected, dried and weighed.

The grams per tonne of free gold of the minus-two-millimetre concentrate will be calculated and released as initial sample results next week.

Well, that all seems straight forward enough, the final results of the entire 50-kg sample will be released later.

The plan for the bulk sampling program is to 1) substantiate reports of free gold within the hard rock conglomerate and 2) determine the thickness of the gold conglomerate and how far it extends laterally.

The as yet unanswered question of part 1) is, what are the grades? The answer will be provided in the next news release.

But let’s dig a little deeper before that release – put some ‘what if’ numbers together.

Fun with numbers

It’s wise to play with numbers to keep yourself safe, it’s also a lot of fun. Occasionally the numbers are hard to believe…

Here is a diagram of the 8 sq km area that contains the original test pits. We are suppose to get the grams per tonne of free gold of the minus-two-millimetre concentrate published soon. Let’s say the grams per tonne is 1 g/t – one gram per ton – makes the math easy.

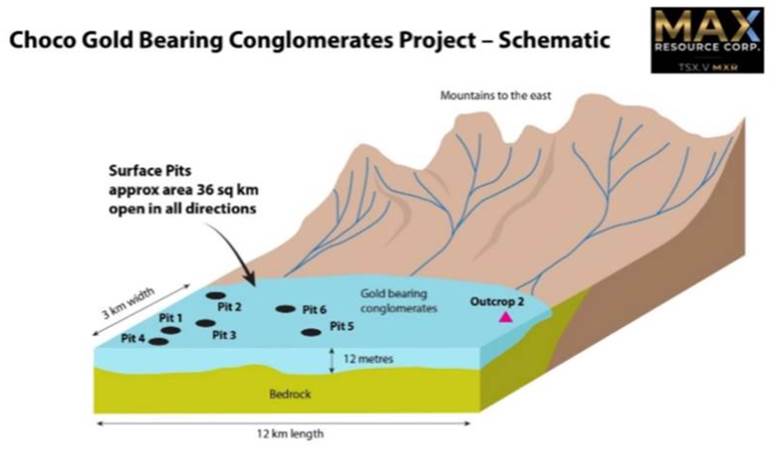

8 sq km is 8 million sq meters, the conglomerate is, on average 12 meters thick and has a specific gravity (SG) of 2.2.

Here’s how to figure the tonnage/gold contained in those 8 sq km.

8,000,000 x 12 x 2.2 = 211,200,000t x 1g/t = 211,200,000 grams gold divided by 31 = 6,812,903 potential ozs of gold.

Each sq meter of conglomerate potentially contains 0.85 g/t gold. Each sq km potentially contains 850,000 ozs gold.

Max Resource Corp (TSX-V: MXR) then identified a second outcrop of gold-bearing conglomerate.

The discovery means that the original 8-square-kilometer exploration zone more than quadruples to 36 square kilometers. The significance can be better understood by taking a look at the schematic below.

Whichever way you figure it, using 0.05g/t, 1 g/t, 1.5 g/t or 2 g/t, using 8 sq km, 12 sq km or 36 sq km the numbers are mind-blowing. Even more so when you consider the mineralization is open in all directions. In other words, the potentially gold bearing conglomerate could extend beyond 36 square kilometers, laterally and at depth.

Max has 100-per-cent ownership of 82 and 50 per cent ownership of seven mineral licence applications totalling over 1,757 square kilometres.

Max also owns the Gachala Copper Project. Located in a sedimentary copper basin comparable to the Zambian Copper Belt, historical sampling has identified a 24-kilometer strike length, with copper grades ranging from 0.5% to 13%. Anything over 1% is considered high-grade copper. A 4-km cobalt anomaly has also been identified.

But Max’s priority is to go after the gold bearing conglomerates in the Chocó project and prove they are of substantial grade and scale.

Max is a first mover progressing its 1,757 sq. km of the Chocó Precious Metals District. Its agreements with the pro-mining indigenous groups in Chocó are the first since 1990. The company has also staked all the mineral claims in the area, thus locking out any competition.

Free gold means the possibility of low-cost processing: no heap-leach pads, no flotation, just crushing followed by good old-fashioned gravity as the means of separating the gold equals low-cost.

Combine these factors with the fact that Colombia is open for business with a pro-mining president, that Max has an excellent team with deep experience including the co-founder geologist of Ivanhoe Mines, the fact that my own potential gold inferred numbers are literally off the charts and this project begins to look very impressive indeed.

We’ll know more next week, but already, it appears that we might be staring eye to eye at one elephant of a gold deposit.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Max Resources (TSX-V:MXR) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of MXR.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.