Major expansion in the works at Palladium One’s LK Project

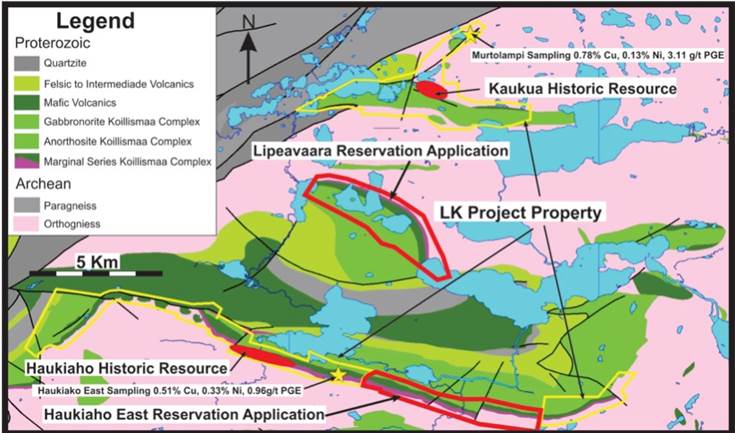

Palladium One (TSX-V:PDM) is in the process of adding fresh ground to its LK Project in Finland, where surface chip samples tested recently from Haukiaho and Murtolampi, two of LK’s target areas, show promising PGE (platinum group elements) mineralization.

This week the company announced it has applied to the Mining Authority of Finland for an additional 13 kilometers of “mafic-ultramafic basal (base) contact” of the Koillismaa Complex in north-central Finland.

LK Project

About 2.4 billion years ago, continental rifting events created mafic-ultramafic intrusions containing palladium-rich Cu-Ni-PGE sulfide minerals, chromium, as well as iron-titanium-vanadium. Continental rifting has produced some of the largest Cu-Ni-PGE (copper, nickel, platinum group elements) deposits in the world including the Duluth Complex in Minnesota, Pechanga and Norilsk in Russia, and China’s Jinchuan deposit.

Several of these mafic-ultramafic intrusions occur in Scandinavia, in an area known as the Fennoscandia shield. This is “elephant-deposit country.”

The Fennoscandia shield includes a number of large Cu-Ni-PGE deposits including Pechanga on Russia’s Kola peninsula, Kevitsa, Sakatti, and the Portimo Complex located 90 km to the northwest of LK.

25–>38 km basal contact

If the application is approved, PDM’s LK Project will be enlarged by 50%, or 1,174 hectares, boosting the highly prospective basal contact from 25 kilometers to 38 km, and upsizing the LK land package from 2,500 hectares to 3,700 ha. The “Lipeavarra Reservation Application” representing the additional 13 km of basal contact can be seen in the map below, roughly equidistant between the Kaukua and Haukiaho targets.

Unexplored ground

The LK Project, which is predominantly a palladium play, has tremendous upside potential. Nine exploration permit applications (totaling 2,500 hectares) at LK feature three mineralized zones: Kaukua, Murtolampi and Haukiaho. Historical exploration goes back to the 1960s.

About 25 km of Koilissmaa’s basal (base) contact was mapped and reconnaissance-drilled (81 holes/11,514m) by majority-state-owned Outokumpu for copper/ nickel and later by GTK for Cu-Ni-PGE mineralization. GTK, the Geological Survey of Finland, punched in a series of widely spaced, shallow (typically ~ 30 meters depth) drill holes that demonstrated anomalous Cu-Ni-PGE mineralization along the entire 35 km of basal contact. Therein lies the exploration opportunity, the upside.

Only about four kilometers of the 25-km basal contact has been drill-tested.

Both Kaukua and Haukiaho have historical resource estimates (RE) (ie. not NI 43-101-compliant)

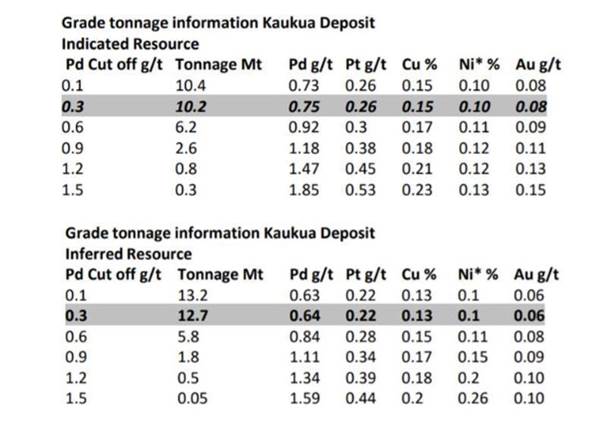

A 2013 historical RE at Kaukua amassed 10.4 million tonnes indicated, using a 0.1 grams per tonne (g/t) cutoff grade, comprising 0.73 g/t palladium, 0.26 g/t platinum, 0.15% copper, 0.10% nickel and 0.08% gold, plus an inferred resource of 13.2 million tonnes using a 0.1 grams per tonne (g/t) cutoff grade comprising 0.63 g/t palladium, 0.22 g/t platinum, 0.13% copper, 0.10% nickel and 0.06% gold.

At Haukiaho, an inferred RE, also completed in 2013, showed 23.2 million tonnes of 0.53 g/t combined PGEs and gold, with tracings of copper, nickel and cobalt.

Palladium One’s goal is to upgrade these historical estimates to comply with NI 43-101 standards and to find a million ounces of palladium-equivalent.

Notice the cutoff grades in the cutoff grade historic sensitivity table below, reproduced from PDM’s latest corporate presentation. The cutoff for the historic non NI 43-101 compliant indicated and inferred resource at Kaukua highlights, 0.3 grams per tonne versus the 0.1 grams per tonne reported previously.

That means slightly less tonnage at Kaukua (22.9Mt, indicated + inferred @ 0.3 g/t, versus the earlier 23.6Mt, indicated + inferred @ 0.1 g/t), but a slightly higher grade.

A 0.1 g/t Pd cut-off grade seems aggressively low. At AOTH we have always felt the 0.3 g/t cutoff numbers are more credible, and still demonstrate the deposit “hangs together”.

Palladium One hopes to produce a new NI 43-101-compliant resource estimate from historical exploration data. To do that, over 100 historical core samples have been sent off for re-assaying. The results of a new resource estimate at Kaukua are due out this month.

Another objective is to at least double the Kaukua resource through additional exploration at Kaukua and other nearby target areas, like Murtolampi, where a recent sample showed 3.106 g/t PGE (Pt + Pd + Au), opening up the possibility of the Kaukua mineralization extending north, let alone east along strike where no drilling has been conducted.

Comparing the structure of the two deposits, Haukiaho is currently more extensive than Kaukua but based on the limited, widely spaced drilling, not as continuous, with discrete pods of mineralization present. Palladium One plans to start exploring the higher-grade intercepts a Haukiaho and step out from there.

Only about one kilometer of an 8-km strike length has been drilled at Kaukua, and some holes host impressively thick “fault-stacked basal units” of greater than 100m. There is also the potential for a parallel zone to the south of Kaukua.

The new ground currently under application holds the potential for additional tonnage. One of the two areas, Haukiaho East, includes 7 km of basal contact on strike to the east of the historic Haukiaho resource, and covers several anomalous mineralized intercepts from historic drilling, including 12.3m of 0.23% Cu and 0.14% Ni in hole R666.

The Lipeavaara area includes 6 km of basal contact, and hosts a historic Cu-Ni-PGE showing. Shallow reconnaissance diamond drilling by GTK in the late 1990’s returned anomalous mineralization up to 14.52m of 0.27 g/t Pd, 0.12 g/t Pd, 0.25 % Cu, and 0.17 % Ni in hole R379.

Management changes

Meanwhile PDM has been staking out new talent for its management team, and cementing existing relationships. Acting chief executive Derrick Weyrauch this week was named permanent President and CEO. Director Neil Pettigrew was promoted to VP – Exploration.

Pettigrew is a geologist with 20 years of industry experience, including expertise in mafic-ultramafic intrusions. He has worked with several junior and major companies in gold and Cu-Ni-PGE exploration, most notably Avalon Ventures, Temex Resources, Rainy River PC Gold, Placer Dome and Goldcorp.

Weyrauch, a chartered accountant for +28 years, was a co-founder and director of Magna Mining, a private, development stage-nickel company in Ontario, and a director of Cabral Gold. He was the CFO of Andina Minerals prior to its sale.

Palladium One also recently welcomed Lawrence Roulston to the board of directors. A mining industry veteran of +35 years, Roulston is well known for running the ‘Resource Opportunities’ newsletter. He currently heads WestBay Capital Advisors, consulting to junior and mid-tier companies, and holds a number of directorships including at Metalla Royalty and Streaming, Auramex Resource, Mountain Boy Minerals, Romios Gold Resources and Thunderstruck Resources.

Roulston is a good fit. He knows the deposit well from when he covered it in Resource Opportunities. I have personally benefited from Roulston’s stock picks. I recall back in 2003, I held Northern Dynasty Minerals, which was/ is developing the huge Pebble project in Alaska. Unknown to me, Roulston was covering Northern Dynasty in his newsletter. Within a year my $0.69 NDM stock raced up to $8 per share!

In other words, Roulston, and I, know how to pick winners.

Conclusion

We see miles of blue-sky potential at the LK Project in Finland. Previous operators have only scratched the surface of what could be an immense PGE-rich deposit on the scale of a Suhanko or Duluth Complex.

The two deposits, Kaukua and Haukiaho, are both open in all directions. Previous drill results look good, and our musings of large-scale tonnage worthy of an open-pit, are backed by recent chip samples collected about 2 km from the Haukiaho resource.

If approved, and we see no reason why it wouldn’t be, PDM’s application for more ground – another 13 km of basal contact smack dab between LK’s two deposits – is more confirmation of a project, and stock, with lots of room for growth.

Palladium One Mining Inc

TSX-V:PDM Cdn$0.07 2019.09.06

Shares Outstanding 43,702,350m

Market cap Cdn$3.05m

PDM website

*****

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Palladium One Mining Inc and PDM is an advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.