Lower-priced platinum keeping palladium supply in check

2019.11.30

Palladium prices are marching up again despite the platinum-group element (PGE) losing about $20 per ounce earlier in the week.

As of noon PST on Tuesday, spot palladium was trading at $1,791/oz, having briefly poked above $1,800 earlier in the trading session – not far from the all-time high of $1,824.50/oz reached on Oct. 31.

Palladium is the second-best-performing metal this year among the PGEs, which comprise ruthenium, rhodium, palladium, osmium, iridium and platinum. Having similar physical and chemical properties, the platinum group elements tend to cluster together in the same mineral deposits.

The metal used mostly in catalytic converters for gas-powered vehicles is up over 40%, year to date. Rhodium has gained a whopping 144%.

Meanwhile platinum, which traditionally is more expensive than palladium, is languishing at $907 an ounce, nearly half the value of its sister metal.

Demand for palladium has surged since 2016 as auto makers shift from diesel to gas-powered cars or hybrids, that use a higher percentage of palladium than any other metal in their auto-catalysts.

Electrification is also playing a role in the lofty demand figures. Palladium use in hybrids and plug-in hybrids, which like regular cars need catalytic converters, in 2020 is expected to nearly triple that of 2016.

Air pollution savior

The “diesel-gate” scandal at Volkswagen put tailpipe emissions on the radar of policy makers especially given that the rigging of diesel cars to fraudulently meet emissions came amid reports of the dangers of air pollution to human health.

Such concerns led the EU to set a target of cutting emissions by at least 40% by 2030, from 1990 levels. According to Euractiv, the mayors of 10 European capitals are urging a switch to zero-emissions vehicles within the next 20 years.

The Euro 6 standard currently in force sets a limit of 80 mg of nitrogen oxide (NOX) per kilometer.

China, whose major cities are often cloaked in a thick fog of air pollution, has also begun to implement tougher vehicle emissions standards. Xinhua, the state news agency, reported earlier this year that several regions will start rolling out “China VI” standards, after official data showed emissions from 6.2 million vehicles were responsible for 45% of Beijing’s particulate matter in the air.

The country is targeting a reduction of between 26 and 28% of emissions from 2005 levels by 2030.

The new rules demand that vehicles emit fewer pollutants such as nitrogen oxides, particulate matter and ammonia. They were initially supposed to take effect in July 2020 but have been pushed ahead due to heavy pollution in the Pearl River Delta region, Sichuan province and the city of Chongqing, Xinhua stated.

Thus, the greater average loadings of palladium per vehicle (versus other metals), owing to these tighter emissions regulations in the EU and China, are what is keeping a solid floor under palladium prices, despite a slump in car sales in top consumer China. In September the country’s auto sales fell for the 15th month in row. Car sales in the US are also expected to come in under 2018’s total.

8 years in deficit

That alone says something about the resilience of palladium demand. But the more interesting market dynamic is happening on the supply side; 2018 was the seventh year in a row that palladium was in deficit, and 2019 is expected to be number 8.

The deficit is expected to rise to 800,000 ounces this year as palladium consumption reaches 11.2 million ounces while mining production lags and stockpiles dwindle.

According to a report from Sprott Asset Management, “Supply shortages continue to support palladium’s performance, with strong multi-year growth in palladium demand now straining a fixed supply.”

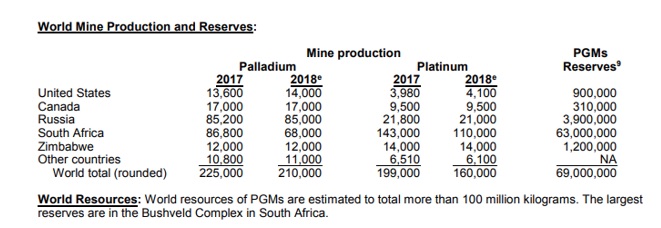

To understand this, we need to appreciate where and how palladium is mined – over 80% is extracted as a by-product of nickel ore in Russia, and platinum in South Africa. These two countries control three-quarters of global production.

Production challenges in South Africa

According to the US Geological Survey, the supply of PGEs from South Africa is anything but guaranteed. Last year production there fell compared to 2017, owing to jobs cuts and mine shaft closures – a trend that is likely to continue.

Platinum mining in South Africa is frequently interrupted by labour unrest. In 2014 workers at the country’s three major producers – Lonmin, Anglo American Platinum and Impala Platinum – downed tools for five months demanding that wages be doubled. The strike was the longest and most expensive in South African history, shutting down about 40% of the world’s platinum production.

The country’s platinum miners are under constant pressure to contain costs, because their mines are some of the deepest and most labor-intensive in the world. High temperatures are also a serious issue. Platinum is being mined in reefs up to two kilometers deep, where virgin rock temperatures have been measured at 70 degrees C; 75 degrees is considered to be the limit for mining.

There are significant infrastructure constraints, too. The country has limited processing capacity and water is a constant concern. In 2018 Cape Town came dangerously close to running out of water and was only saved from “Day Zero” by stringent restrictions on water usage.

Power in South Africa is notoriously unreliable – blackouts are frequent. In 2008 the country’s electricity grid nearly collapsed due to a shortage of coal for power stations and system faults. Eskom, the main utility, ordered all mining operations to evacuate underground staff and to stop mining for five days, then cut electricity supply across South Africa to minimum levels; the mining industry uses about 15% of Eskom’s output. The stoppage, affecting roughly a quarter of generating capacity, cost the industry billions in lost output.

Anglo American’s CEO, Mark Cutifani, recently told delegates at an investment conference in Johannesburg that Eskom’s problems are a key issue the company has to consider in any plans to expand output of platinum, manganese and iron ore.

Platinum getting in the way

With palladium and rhodium prices at record highs, it makes sense for platinum and nickel companies that mine them, to ramp up production to take advantage. Problem is, there is limited scope for producers to increase supply, especially in South Africa. Just as important, a boost in output could add to the glut in platinum, which is these miners’ bread and butter.

To the first point, despite the rally in palladium and rhodium extending the life of mine shafts in the Rustenburg platinum belt, producers are not keen to invest in new mines.

Impala Platinum, a major industry player, expects output from South Africa’s mines to start declining over the next five years. New projects in South Africa would take years to develop, while those in neighboring Zimbabwe may be stymied by political and economic uncertainty, according to a company spokesman, Bloomberg reported this week.

The second point, about flooding the platinum market, thereby depressing prices further, is due to the fact that for every ounce of palladium mined, 2-3 oz of platinum comes with it. The dilemma South African miners face is one of robbing Peter to pay Paul – in this case, extracting cheap platinum ounces in order to be paid more for platinum and rhodium, currently priced at USD$6,000/oz.

“They can’t increase production because the main metal is platinum and they don’t want to make the price come down,” Bloomberg quotes Rene Hochreiter, an analyst at Noah Capital Markets Ltd. in Johannesburg.

Although platinum has rallied 15% this year, given a boost through steady purchases of platinum-based ETFs, demand is expected to drop in 2020 and put the platinum market back in surplus.

The only company planning to expand operations is Norilsk Nickel. The world’s top palladium producer said one year ago it expects to spend up to $11.5 billion to raise output of PGEs from its Arctic mines by 25% by 2025, an increase of about 860,000 ounces, Reuters reported.

The Russian company now gets most of its revenue from palladium, with its ores containing four times as much palladium as platinum, and low extraction costs in Siberia.

Hard to go back

Some market observers believe that platinum is bound to catch up to palladium because automakers will simply switch to platinum, the cheaper ingredient, in their auto-catalysts.

The release of the World Platinum Investment Council’s quarterly report contains a forward by CEO Paul Wilson. In his remarks, Wilson says the WPIC sees, “Increased automotive demand as [a demand driver], as platinum replaces palladium in gasoline and diesel car emissions control.”

He continues, “The palladium price rose above that of platinum in September 2017 and in 2019 to date has traded, on average, $637/oz higher than platinum. This remains well above the level autocatalyst manufacturers suggested as the point of substitution in gasoline engines on cost grounds alone. The high price, sustained demand growth and limited supply growth of palladium now makes material platinum demand growth due to substitution of some palladium in gasoline cars extremely likely.”

At Ahead of the Herd, we are not so sure. For one thing, car makers have for the most part switched over to palladium-heavy auto-catalysts. They did so in the 2000s because palladium was much cheaper than platinum.

Re-tooling them back to platinum would be unproductive and expensive – likely negating the money saved by purchasing cheaper platinum. And why incur the cost, since the auto industry is eventually going to go all-electric? (EVs do not require catalytic converters)

A Reuters article reports that “The auto industry has all but stopped developing next-generation combustion engines as limited resources are directed towards building electric and self-driving cars.”

Geoffrey Caveney, a contributor to Seeking Alpha, explains the hesitancy of automakers to go back to platinum-dominant autocatalysts, despite a significant price discount.

The reason he argues, is due to a greater diversity of countries that mine palladium, versus those that produce platinum. The latter market is almost completely dominated by South Africa, whereas some palladium, albeit in relatively small quantities, is mined in Canada, the US, Zimbabwe and a handful of other countries.

Caveney writes:

Looking at the production gap another way, the U.S. produces more than three times as much palladium as it does platinum, and Canada and other countries produce almost twice as much palladium as they do platinum.

Therefore, in case of a significant temporary or prolonged supply disruption from South Africa in particular, or from Russia and Zimbabwe as well, automakers and other manufacturers in North America and the rest of the world could potentially have much more difficulty dealing with supply shortages in platinum, than they would with palladium.

In other words, the threat of a supply disruption just isn’t worth the risk.

In 2014 the five-month-long platinum mining strike caused Ford and Toyota to temporarily suspend operations at its South African car plants. The industry narrowly averted a strike this year, having recently inked a deal after four months of negotiations.

Palladium One (TSX-V:PDM)

Considering the difficulty the world’s largest palladium miners, especially those in South Africa, are having increasing production, the onus is on smaller companies to find and develop new deposits of the platinum-group element. One company that happens to have one, our favorite pick in the PGE arena, is Palladium One (TSX.V:PDM), developing its LK copper-nickel-PGE project in Finland.

In September the company published the first (maiden) NI 43-101-compliant resource on its Kaukua target, thereby placing Palladium One in the starting blocks of what should prove to be a very interesting run at developing an open-pit Cu-Ni-PGE mine.

Palladium One’s current private placement is expected to raise CAD$3.8 million. The offering, at 6 cents per unit, caught the attention of storied resource investor Eric Sprott, who, the company says, intends to buy just over a third of the 62.9 million units, for $1.09 million – representing a 19.9% ownership stake in the company.

The LK project is mostly a palladium play, offering investors great exposure to the auto-catalyst ingredient, for which demand is only going up, owing to stricter air pollution standards, amid a long-term structural supply deficit.

The new “pit-constrained” resource at Kaukua is estimated at 22 million tonnes and includes:

- 11 million tonnes of indicated resources containing 635,000 tonnes of palladium equivalent (Pd_Eq) ounces graded at 1.8 grams per tonne (g/t) Pd_Eq.

- 11 million tonnes of inferred resources containing 526,000 tonnes of Pd_Eq ounces graded at 1.5 grams per tonne Pd_Eq.

The exciting part about Kaukua, is the envisaged open pit is just one part of a very large 2,500-hectare land position. Nine exploration permit applications feature three mineralized zones: Kaukua, Murtolampi and Haukiaho.

Only about four kilometers of the 25-km basal contact has been drill-tested.

Conclusion

Palladium One is an excellent way for investors to leverage growth in the red-hot palladium market. At around $1,800 per ounce, palladium is twice as valuable as platinum and has so far this year outpaced spot gold, currently priced at $1,459/oz. Assuming the trend continues for another month or so, palladium is going to have quite a year.

Much of the element’s success is due to problems expanding output particularly in South Africa which represents about a third of global production. Along with operational problems that stem from having to go deeper to find PGE ore, labor unrest and infrastructure issues (power and water), there is the added disincentive to mine more and/or expand, due to low platinum prices. Miners can’t get more valuable palladium and rhodium without mining and milling platinum.

While platinum has managed to claw back some of its losses this year, the World Platinum Investment Council is forecasting a 2020 surplus of 670,000 ounces. We therefore expect platinum prices to remain in the doldrums while the bull run for palladium continues, offering great upside for PGE investors.

Palladium One

TSX.V:PDM, Frankfurt:7N11, OTC:NKORF

Cdn$0.08, 2019.11.29

Shares Outstanding: 44,202,350m

Market cap: Cdn $3,536,188.00

PDM website

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions.

Richard owns shares of Palladium One (TSX.V:PDM). PDM is an advertiser on his site

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.