It’s not easy going green

2019.07.06

As Kermit the Frog used to say, “It’s not easy being green.”. Or to paraphrase the affable muppet slightly, it’s not easy going green.

The modernization and electrification of our global transportation system will require a change hitherto unprecedented in the history of civilization. Not even the shift from horse and buggy to the crank-start Ford Model T can compete with what it will take to electrify the billion-plus cars on the planet’s roads.

With a focus on more air-quality legislation in cities, Stuttgart, Paris, Mexico City, Athens and Madrid are all banning diesel fuel by 2030. Norway, the Netherlands, France, Germany, UK, China and India have indicated they will ban cars running on fossil fuels.

Along with the immense political will needed for other countries to legislate electrics-only targets, and the technology required to make EVs that match the range and power of gas or diesel-fueled models, and can achieve price parity with them, consider the amount of raw materials that will be needed to fuel electrics.

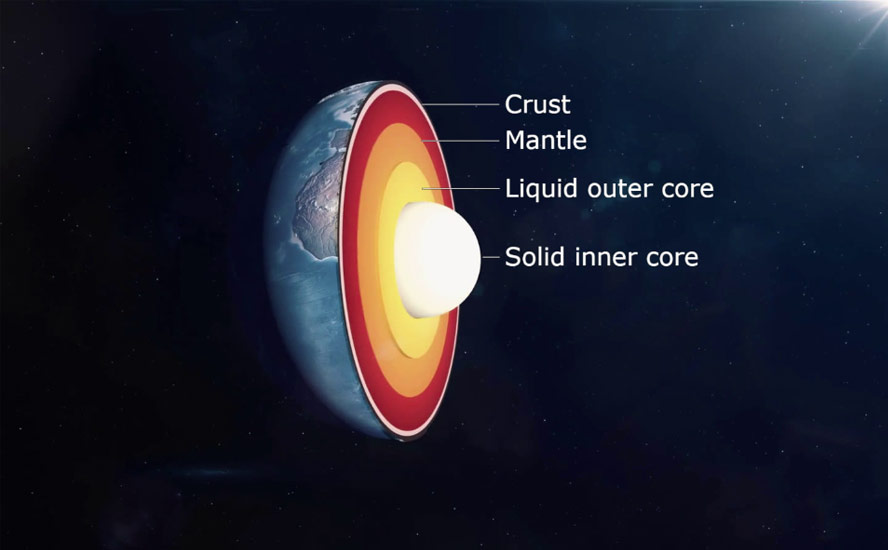

The electric motor in a battery (versus a hybrid) electric vehicle contains copper, steel and permanent magnets, the latter made of the rare earths neodymium, praseodymium and dysprosium. An EV’s lithium-ion battery has three parts – an anode, a cathode and electrolyte. The electrolyte is made of lithium salts, the anode from graphite, and the cathode material varies, between NCA (nickel, cobalt, aluminum), LMO (manganese) and NMC (nickel, manganese, cobalt).

A Tesla Model S contains 54 kilograms of graphite and 63 kilograms of lithium carbonate equivalent (LCE) – more than the lithium in over 10,000 cell phones. An average EV has 83 kilograms of copper and between 4 and 30 kg of cobalt.

Germany is looking at doubling subsidies for EVs costing under 30,000 euros and raising subsidies for more expensive electrics. Mercedes Benz wants to make its entire fleet of vehicles carbon-neutral by 2039.

We often talk of the exponential demand for battery metals, and trot out impressive forecasts on the number of EVs likely to be built in the next 10 to 30 years. Yet rarely do we analyze whether we have enough raw materials, or what it would take to supply them. In this article, we aim to find some answers.

The UK alone

For an idea of how far we have to go in meeting the challenge of an electrified global transportation system, we can start by looking at the United Kingdom.

The UK government has set a target of replacing all of the island nation’s 31.5 million cars by 2050. A team of scientists led by the Natural History Museum’s head of earth sciences, Professor Richard Herrington, took the government to task and calculated how much raw materials that number of EVs would require.

The researchers found that to build 31.5 million EVs would take a jaw-dropping 207,900 tonnes of cobalt, 264,600 tonnes of lithium carbonate, at least 7,200 tonnes of neodymium and dysprosium, and 2,362,500 tonnes of copper.

As reported in AutoExpress, that is almost twice the annual global supply of cobalt, nearly the total amount of neodymium produced each year and three quarters of the world’s lithium plus 2.362Mt of copper.

Of primary importance is the EV’s rechargeable battery, estimated to represent about 60% of the vehicle’s manufacturing costs. According to Business Insider, the lithium-ion battery market is expected to grow at 21.7% annually, meaning that 15.3 gigawatt hours used by Li-ion batteries in 2015, jumps to 93.1 GWh in 2024.

All the extra power needed for “the juice” of the UK’s future electric vehicle fleet is estimated at 63 terawatt-hours a year, 20% more than current levels. Using wind farms would require an extra 6,000 turbines into which a year’s worth of global copper supply would be needed, and 10 years worth of neodymium.

When extrapolating to the rest of the world, the numbers get even more shocking. According to the researchers, just mining the amount of raw materials required to replace 2 billion cars globally would require four times the United Kingdom’s total annual electrical output.

Prof. Herrington told AutoExpress that, while there is urgency in cutting carbon dioxide emissions, “society needs to understand that there is a raw material cost of going green”.

The $4 trillion challenge

Indeed the cost of electrification doesn’t only involve going from A to B. There is also the change in energy production from fossil-fuel-based forms such as coal and natural gas, to renewable wind and solar power.

Wood Mackenzie via Safehaven.com tried to determine what moving away from fossil fuels would cost the United States. The answer, $4.5 trillion over the next 10 to 20 years, would encompass the installation of 1,600 gigawatts of new solar and wind capacity. Right now the US has 1,060 GW installed – of which 130 GW is renewables. Another 900 MW would likely be required to construct utility-scale storage of electricity produced from wind and solar farms, according to Wood Mac. To do that would mean adding more renewable capacity every year for the next 11 years, than has been added over the last 20 years combined.

Pending shortages

Ahead of the Herd found that all of the aforementioned metals are facing a supply squeeze in the near future, which should support prices.

Cobalt

Let’s start with cobalt. The majority of the world’s cobalt comes from the DRC. The exact figure according to the US Geological Survey is 64%; trailing far behind in cobalt production are, in order, Russia, Australia and Cuba.

Cobalt is almost never mined on its own. A full 99% is unearthed as a by-product of copper and nickel mining.

China controls about 85% of global cobalt supply, including an offtake agreement with Glencore, the largest producer of the mineral, to sell cobalt hydroxide to Chinese chemicals firm GEM. China Molybdenum is the largest shareholder in the major DRC copper-cobalt mine Tenke Fungurume, which supplies cobalt to the Kokkola refinery in Finland. China imports 98% of its cobalt from the DRC and produces around half of the world’s refined cobalt.

This makes the possibility of a large cobalt supply surge all but impossible. In fact the cobalt market may head into deficit sometime within the next six years.

“We believe the smarter carmakers have already locked down raw material supply to the early 2020s,” Barclay’s Bank analysts wrote in a May note. “Based on our analysis, there could be a 112,000-tonne cobalt supply shortage by 2025.”

Cobalt prices have seen the largest price increase among all the metals used to make EV batteries. According to Roskill, standard-grade cobalt prices started the year at $26 a pound but have fallen in the first quarter, to $14 per pound in March. That’s a fair distance from the $40/lb prices reached in April of 2018.

Roskill attributed the price slide to oversupply, especially of cobalt hydroxide, clashing with sluggish demand and limited stockpiling. DRC cobalt production expanded by 44% in 2018 to 106,439 tonnes. A lot of cobalt that was not committed to long-term contracts last year added to the glut, Roskill explained.

However, Roskill observes that “some restocking is taking place” which should push cobalt prices back up after reaching a bottom of $14/lb in March. The metals consultancy expects prices to recover this year.

The Canadian Mining Journal states that cobalt consumption for lithium-ion batteries has seen a 6% CAGR for over 20 years – driven by demand for consumer electronics (PCs, laptops, cell phones, power tools, etc.) and more recently, EV batteries. According to CMJ, batteries now account for 60% of the 125,000-tonne cobalt market, compared to 1% of the 35,000-tonne market back in the 1990s.

As to whether cobalt is currently over, or under-supplied, the market is currently in a deficit position “but most analysts believe it will be in balance or in a small surplus after the ramp up of the Katanga and Roan Tailings projects in the Democratic Republic of the Congo (DRC) next year,” Canadian Mining Journal reported.

“There is general consensus, however, that strong demand growth from electric vehicle (EV) mass adoption in the early 2020s will push the market into a sustained period of shortages until new deposits are developed.”

Returning to the UK example above, we know from the USGS that 140,000 tonnes of cobalt was mined in 2018. There are currently 31.5 million cars in the British Isles. At 20kg of cobalt per EV, converting 31.3 million cars to EVs (31.5 million minus 133,670 EVs in Britain = ~31.3 million) by 2050 would require 626,000 tonnes of cobalt – 4.4 times current production.

Now we don’t believe that by 2050, there will be 100% EV penetration, but even if it’s, say, 40%, that is 12,520,000 electric vehicles in the UK. At 20kg of cobalt per EV, we are looking at 250,400t of cobalt, or 1.7X current production.

Remember this is only for one country. A more useful number is to take the global EV penetration to see how much cobalt and other battery metals 40% would require. There are currently ~1.2 billion vehicles in the world. From that, subtract the total number of EVs, currently about 5.6 million, which leaves 1,194,400,000 fossil-fueled vehicles. 40% EV penetration of remaining gas or diesel vehicles gives us 477,760,000 EVs by 2050. (* Important note: This number does not take into account expected EV growth. By 2030 the International Energy Agency projects 125 million EVs will be on the road).

At 20kg of cobalt per EV, we are looking at 9,555,200 tonnes of cobalt, or 68.2X current annual production.

Copper

As we wrote in The coming copper crunch, copper mine production is expected to increase for the next year or so, on the back of copper mines developed during the 2012-16 mining downturn, then drop off significantly. By 2035, without major new mines up and running to replace the ore that is being depleted from existing copper mines, we are looking at a 15-million-tonne supply deficit by 2035. Four to six million tonnes of added capacity are needed by 2025.

That’s the supply side of the equation which, if you’re a copper miner, is pretty flat, at least until around 2021. After that, analysts are predicting that mined supply of the red metal will not be able to keep up with demand. Demand for copper is growing and will continue to keep pushing higher, due to the continuing growth in electrical vehicles (EVs use four times as much copper as gas-powered vehicles), plus all of copper’s uses in infrastructure build-outs that are being planned, such as China’s Belt and Road Initiative and the $2 trillion recently announced to tackle America’s infrastructure deficit.

Copper’s indispensability in construction, telecommunications and transportation means that prices are insulated from a major downturn.

From the previous example, 40% EV penetration gives us 477,760,000 EVs by 2050. At 83kg of copper EV, the electric vehicle market would require 39,654,080 tonnes of copper, or 2.2X 2018 global production.

Lithium

A Tesla executive said earlier this year that the company is worried about a shortage of lithium. And while the number of EVs on the roads are expected to multiply in coming years, they can only progress as fast as the lithium-ion batteries that go into them.

The pendulum is clearly China. Consider that in 2018, China sold 1.182 million NEVs (new energy vehicles including electrics and hybrids), 520,000 or 78% more than in 2017. And that was just 4.1% of China’s total vehicle market.

By 2025, the Chinese government wants EVs to represent 20% of all cars sold.

By comparison, the US sold 361,307 EVs in 2018, just under a third of China’s volume.

As Quartz notes, in order to maintain its dominance in the lithium market, Chinese manufacturers need a lot of cheap lithium. That explains why its largest lithium miner, Tianqi Lithium, owns 51% of Australia’s Greenbushes spodumene mine – the world’s dominant hard-rock lithium mine. And why China bid for, and got, a 23.7% stake in Chilean state lithium miner SQM, the second largest in the world, for $4.1 billion.

As China’s mark on the lithium market becomes more pronounced, growth in the sale of lithium end products is taking off.

According to Adamas Intelligence, in February 2019, 75% more lithium carbonate was deployed for batteries in electric and hybrid passenger vehicles compared to February, 2018.

We know that the lithium market, long term, is likely to be in deficit as troubles ramping up production meet a mounting wall of demand.

Lithium mines throughout the world are expected to produce about 300,000 tonnes of lithium carbonate equivalent (LCE) this year.

40% EV penetration gives us 477,760,000 EVs by 2050. At 63kg of lithium per EV, supplying EVs worldwide in 2050 would require 30,098,880 tonnes of LCE, or 100X current annual production.

Rare earths

For years, China has been the world’s largest rare earths exporter, shipping over 53,000 tonnes in 2018, 4% more than 2017.

It’s all part of China’s plan to produce more rare earths for internal consumption than for export, which is in line with the country’s ambitions in the global clean energy trade. China is already the world’s largest solar power producer and sells the most electric vehicles. By 2020, the Chinese government wants its battery makers to double their capacity (BYD is the largest electric vehicle battery company in the world) and start investing in production facilities overseas.

Without a domestic supply, the US must rely on Chinese rare earths and technology to build “made in America” military and space equipment. (For the fascinating story on how this happened, read Magnequench Has Left the Building and How the US Lost the Plot on Rare Earths)

China has threatened to use rare earths as a weapon in the trade war with the US.

Indeed China’s virtual monopoly on rare earths production throws into question whether rare earths consumers, like defense contractors and renewable energy manufacturers, will have a reliable supply of REE oxides if China remains the dominant producer.

Internal combustion engines (ICE) have a mechanical or hydraulic transmission that is run on gasoline or diesel fuel. Towards the end of the millennium, vehicles with electric transmissions were developed, powered by ICEs, batteries or fuel cells. The advantage of an electric versus a hydraulic or mechanical transmission, is an electric transmission can charge the battery by regenerating energy through braking.

A permanent magnet motor is considered to be more efficient than an induction motor based on copper coils – used for example in Tesla’s Model X and Model 3. Just over a year ago Tesla switched to a magnetic motor using neodymium in its Model 3 Long Range car.

Neodymium is among a mix of rare earth elements (REE) found in the nickel metal hydride (NiMH) batteries of a range of plug-in electric and hybrid vehicles, including GM’s EV1, Honda EV Plus, the Ford Ranger EV and the Toyota Prius.

The anode of a NiMH cell is most commonly a mix of lanthanum, cerium, neodymium and praseodymium.

Permanent magnets are a key technology in the massive transformation that the transportation industry is undergoing, from ICE-powered vehicles to electrics.

Demand for the materials that go into these magnets is only going to grow. The market for neodymium-iron-boron magnets is estimated at $11.3 billion; demand for neodymium has increased every year since 2015. And with electric vehicle sales expected to grow 24% a year until 2030, it’s a valid question whether there’s going to be enough magnet materials, particularly rare earth elements, to go around.

In 2018, 170,000 tonnes of rare earths were mined, of which China produced 120,000t.

The average electric car requires about 2 kg of rare earth permanent magnets for its motor, or around 750g neodymium/praseodymium (Nd/Pr) oxide.

At 2kg of REEs per EV, supplying all the EV permanent magnets in 2050 would require 955,520 tonnes of rare earths, or 5.6X current annual production.

Just as gas-powered cars are being used to phase out high-emissions diesel vehicles, many like to believe that natural gas is a good way of transitioning from a fossil-fuel-heavy power generation industry, en route to an economy dominated by clean-energy renewables, hydro-electric power and nuclear.

The previously-cited article in AutoExpress notes there is a “middle ground”, which pushes renewables into the future and allows natural gas into the energy mix; using 20% natural gas in the US for example, would cut renewable installations costs by 20% and reduce energy storage costs by up to 60%.

At a heavy price

However that kind of thinking can be very costly to a company, as GE learned when it dismissed the expected growth of renewables after the Paris Agreement on climate change, signed in November 2016. GE assumed, wrongly, that coal and natural gas would continue to track global economic growth.

Elektrek cites a recent study from the Institute for Energy Economics and Financial Analysis (IEEFA), which says that “GE made a massive bet on the future of natural gas and and thermal coal, and lost,” resulting in the destruction of US$193 billion or 74% of its market value:

The full report delves into the timeline of how GE’s Power division doubled down on natural gas and coal, and how quickly it fell apart within the past three years, before concluding that global investments must be rapidly and dramatically aligned to match the goals of the Paris Agreement.

The LNG industry is a great example of how policy-makers can embark on a road to ruin without doing a whole lot of market research – a point we’ve made several times in identifying the disproportionate costs versus benefits of British Columbia’s nascent liquefied natural gas industry – in climate feedback loops, methane gas release, and the destruction and poisoning of fresh water supplies through anticipated heavy fracking.

A brand-new report released to the media Monday agrees that “gas in the new coal” in terms of its negative impacts on the environment. CBC writes:

The explosion in spending on planned new liquefied natural gas (LNG) facilities — the vast majority in the U.S. and Canada — combined with new calculations for leakage from the LNG supply chain called fugitive gas — means the world may soon turn against gas in the same way it turned against its solid fuel relative.

“New studies have shown there is significantly more fugitive gas than studies showed five years ago, and the gas is also a bigger contributor to climate change than was understood,” said James Browning, one of the report’s authors.

The report cites at least 202 LNG projects are underway globally, with export terminals concentrated in the US and Canada.

Remember thorium?

Regarding the shift from fossil-fuel powered energy sources like coal and natural gas, to less reliable but eco-friendly solar and wind power, we think we’ve found a middle way by using LNG to get countries like China and India to kick the coal habit, thereby cleaning up choking air pollution. In fact, methane release and fracking will conspire to make LNG one of the worst ideas of the 21st century, except maybe crypto-currencies.

Thankfully, we have another option, that is both clean and reliable. AOTH subscribers will have read about thorium nuclear reactors here

Some scientists believe thorium is key to developing a new version of cleaner, safer nuclear power.

While conventional nuclear plants are only able to extract 3-5% of the energy in uranium fuel rods, in molten salt reactors favored by thorium proponents, nearly all the fuel is consumed.

A key advantage of MSRs is the reactor cannot melt down, as we saw in Japan’s Fukushima when electric pumps were inundated by the tsunami, failing to cool the fuel rods, which overheated and caused radiation emissions. MSRs can also be made cheaper and smaller than conventional reactors, since they do not have large pressurized containment tanks, meaning they could be used in factory settings.

Where radioactive waste from uranium-based reactors lasts up to 10,000 years, residues from the thorium reaction will become inert within 500. Moreover, because plutonium is not created as a waste product in a thorium reactor, it cannot be separated from the waste and used to make nuclear weapons.

The portability of MSRs is another major advantage over the capital-intensive, permanent nuclear power plants we currently have.

Think about British Columbia’s energy needs. Instead of meeting them with the Site C dam, which comes with its own environmental problems – flooding a 100-km stretch of the Peace River Valley – how about deploying thorium reactors?

The Site C dam is slated to provide 1,100 megawatts of capacity – enough to power half a million homes. The same goal could be reached by using a similar thorium reactor to that being developed by Indonesia – a molten salt reactor capable of delivering 1,000MW.

Another plus of thorium reactors is that nuclear waste (ie. plutonium) from uranium fueled reactors can be recycled to recover the fissile materials needed to create the nuclear reaction. In this way, thorium reactors not only generate less waste than conventional reactors, but also help to rectify the nuclear waste disposal problem.

To learn about the fascinating history of thorium and its potential for nuclear power generation, read our Uranium’s ugly stepsister

Conclusion

The most prevalent trend related to mined commodities is the shift, driven by climate change, away from the use of fossil fuels, towards the electrification of the global transportation system.

We have shown it will be a major challenge to slow global warming through electrifying the transportation grid with EVs – not because emissions-free electric vehicles are a bad idea. They are a great idea, and pretty cool, the problem that nobody is talking about, is how to source the raw materials we are going to run out of.

Electric vehicle batteries have three parts and each part requires metals that are either rare and expensive, or not rare (copper) but heading for a supply shortage. An EV also has an electric motor that contains copper and the rare earths neodymium/ praseodymium/ dysprosium. The rare earths market is controlled by China, which has a monopoly on producing the 17 elements found in the periodic table. They could be restricted at any time, thus sending prices soaring.

We have calculated that even at a fairly conservative 40% penetration of EVs into the total vehicle market, the mining industry at current production levels will fall many multiples short of the targets.

It’s true that, as supplies get low, prices will rise, inciting producers to mine more metal. That may keep the wolves away for awhile, but eventually, this race of supply trying to catch demand is going to stop. Maybe there will have to be a halt on EV production until raw material suppliers can catch up. Tough to imagine that happening as it would be unprecedented in the auto industry.

An obvious solution is to mine more of these materials at home. Especially critical metals like lithium, cobalt and rare earths, wherein there are no domestic mines and processing facilities. The US imports about 70% of its lithium, 100% of its rare earths and 100% of its cobalt. We may not reach our goal of supplying 40% of the total vehicle market with EVs, but at least we would have the option of deciding when to release the materials or horde them in times of shortage – instead of allowing foreign countries to control these crucial metal markets.

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.