EV and lithium battery markets to experience significant growth

- Home

- Articles

- Metals Battery Metals

- EV and lithium battery markets to experience significant growth

2019.03.30

In North America, electric vehicles are still a niche market, with most EVs priced higher than gasoline cars, and limited charging infrastructure failing to provide an incentive for consumers to switch. Globally it’s a different story.

The International Energy Agency is predicting 24% growth in EVs every year until 2030. The global fleet is expected to triple by 2020, from 3.7 million in 2017 to 13 million in 2020, according to the IEA.

Prognosticating until 2040, Bloomberg states that there will be a 54-fold increase in EVs between 2017 and 2040, when global light-duty EV sales are expected to hit 60 million; there are currently about 4 million EVs in the world.

A Reuters analysis shows that automakers are planning on spending a combined $300 billion on electrification in the next decade.

Volkswagen has said it will invest $800 million to construct a new electric vehicle – likely an SUV – at its plant in Chattanooga, Tennessee, starting in 2022.

GM is planning to sell its first EV this year, a 2020 Cadillac SUV, built in Spring Hill, Tennessee, in a move designed to challenge Tesla.

Meanwhile more battery factories are being built, driven by the demand for lithium-ion batteries which is forecast to grow at a CAGR of over 13% by 2023.

There are 68 lithium-ion battery mega-factories already in the planning or construction stage.

All these EVs will need lithium-ion batteries with their metallic components – lithium, cobalt, nickel – not to mention copper and rare earths for other parts of the vehicles (the rare earths neodymium and praseodymium are used in permanent magnets that go into EV motors).

EVs are the biggest growth driver of lithium-ion batteries, but there are others.

Lithium-ion batteries find their most common applications in small electric devices and power tools. They can also be employed in large-scale energy storage. As renewable energies come down in price and become a larger percentage of countries’ total energy mixes, the need to store energy for later feeding into the grid will become more and more important.

Researchers at Imperial College London developed a model to determine the lifetime costs of nine electricity storage technologies for 12 applications, between 2015 and 2050. The model predicted that the cost of lithium-ion batteries would fall far enough to beat pumped hydro energy storage – currently the cheapest way to keep energy on ice, as it were.

For more on this read our Lithium-ion batteries to become cheapest form of energy storage by 2030

The finding is another arrow in the quill of lithium-ion battery makers and lithium miners, opening up a potentially lucrative market for lithium and other metals that go into lithium-ion batteries, beyond electronics and EVs.

Lithium-ion batteries

The ability of lithium to be used in rechargeable batteries has been known about since the early 1900s, but lithium-ion batteries have only been available in the last 27 years. As the lightest of all metals, it was discovered that having rechargeable batteries with lithium on the anode could provide extremely high energy densities. Attempts to commercialize lithium batteries in the 1980s, for use in mobile phones, failed because small particles called “dendrites” would accumulate on the anode. This caused an electrical short.

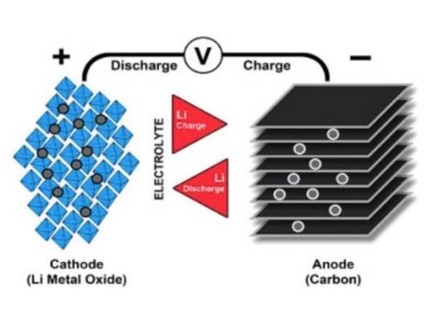

Research then shifted to a metallic solution using lithium ions. While lower in energy than lithium-metal batteries, lithium-ion batteries are safer. The first lithium-ion battery was produced by Sony in 1991. There are three parts to the battery: a cathode (positive electrode), an anode (negative electrode) and a conductive electrolyte. The cathode is composed of metal oxide and the anode is made from graphite. Ions flow from the anode to the cathode through the electrolyte and separator, as illustrated in the graphic below by Battery University. When the battery is charged, the reverse happens, with ions moving from the cathode to the anode.

Today, there are several combinations of lithium-ion batteries that use different metals. These include lithium-cobalt-oxide, lithium-manganese-oxide, lithium-nickel-manganese-cobalt-oxide (NMC), lithium-iron-phosphate, lithium-nickel-cobalt-aluminum-oxide (NCA) and lithium titanate.

Either lithium carbonate or lithium hydroxide can be used as the raw material for the lithium-ion battery cathode. What are these compounds and what do they do?

Carbonate vs hydroxide

Let’s start with the basics. Battery-grade lithium is either mined from brines (underground salt-water lakes) or pegamites, where the mineral spodumene is extracted using traditional open-pit mining methods. In brine mining, the lithium-rich solution is pumped to surface and piped into large evaporation ponds. The wind and sun take care of the rest. There is no substitute for the lithium found in Li-ion batteries.

Lithium carbonate can be made from brines or hard-rock (pegamite) deposits, and clay-based lithium deposits where the lithium is agglomerated in claystones. Lithium carbonate is the first compound in the lithium production chain. The next is lithium hydroxide, a white crystalline compound. Both materials can be used in the lithium-ion battery cathode. Lithium hydroxide is made either from lithium carbonate (brine mines) or from a spodumene concentrate (hard-rock mines).

The industry term “lithium carbonate equivalent” (LCE) is used to encompass both lithium carbonate and hydroxide in a batch of lithium destined for batteries.

There is another type of lithium product, called technical-grade lithium, that is too low-grade for batteries. It is typically used for glass and ceramics.

While carbonate has dominated lithium-ion battery chemistry for a long time, that is changing, because lithium hydroxide offers a longer battery life and larger capacity – two key factors in EV battery quality. However, lithium hydroxide is more expensive.

The cathodes of two types of EV batteries can only be made from lithium hydroxide: the nickel-aluminum-cobalt (NCA) battery and the nickel-manganese-cobalt-oxide (NMC) battery.

As well as making a better battery, lithium hydroxide can also produce cathode material more efficiently than carbonate, because it decomposes at a lower temperature. That means it takes less heat and less energy to get more material, using the same equipment.

For all these reasons lithium hydroxide is expected to be in higher demand than its carbonate cousin, as the need for EVs and EV batteries continues to accelerate.

Hydroxide bulls

The cost of raw materials is obviously a key concern for battery-makers. Materials account for nearly half of the total battery costs, among which cobalt, lithium, nickel and graphite are the most expensive.

The choice of lithium-ion battery chemistry depends on the application, but among the key factors for EVs is energy density. This relates to “range anxiety” ie. the worry that your EV won’t travel far enough before it needs re-charging. To gain more range, a manufacturer could increase the battery’s capacity, but upping the size could create a space problem and the vehicle would be heavier. The better solution is to make the battery more efficient.

But then the problem is the battery becomes more costly. The energy-dense, long-range NCA battery is preferred by Tesla, while other EV makers like NMC batteries. Both contain cobalt, a pricey material to obtain. Cobalt prices quadrupled between 2016 and 2018.

You can’t make NCA or NCM batteries with lithium carbonate; it has to be lithium hydroxide.

China, which dominates the EV market, is a big reason for the popularity of NCA or NCM batteries. Nexant, a software and consulting firm, notes that China uses subsidies to incentivize production of Li-ion batteries with higher densities – to allay the range-anxiety concerns of motorists. Manufacturers have therefore switched to NCA or NCM batteries from lithium-iron-phosphate chemistry. The latter type of battery also uses lithium hydroxide in the cathode.

China more than doubled its imports of NCM batteries (using lithium hydroxide) from South Korea and Japan, between 2017 and 2018, according to data from Global Trade Tracker.

Among the major battery manufacturers that are ramping up to produce more lithium hydroxide, Tianqi Lithium expects to complete the second stage of its 24,000 tonnes-per-annum Kwinana plant in Western Australia this year. Top lithium miners Albemarle, SQM and FMC are following suit with plans for lithium hydroxide facilities in Australia and China.

Nexant expects demand for lithium hydroxide to climb 23% a year until 2023, with capacity reaching 285,000 tonnes in 2021 if all the supply additions go through.

At the Advanced Automotive Batteries Conference (AABC) in Strasbourg, France, one of the presenters said that production of lithium hydroxide is expected to blow past lithium carbonate in the next five years.

Benchmark Mineral Intelligence, a reliable industry analyst, predicts the price of lithium hydroxide to average $18,000 a ton between 2017 and 2020, compared to $14,000/t in 2015-16. The London-based firm also believes that with all the new spodumene production coming out of Australia, long-term prices for lithium hydroxide will converge with lower-priced lithium carbonate.

Conclusion

As I’ve said before, the best leverage against a rising commodity price is a junior resource company. Our pick in the lithium space is Cypress Development Corp (TSX-V:CYP), developing a sizeable claystone lithium deposit in Nevada. The project is close to the only lithium mine in the US, Albemarle’s Silver Peak. Cypress is in Phase ll of a prefeasibility study.

Recent metallurgical test results closely match those outlined in a preliminary economic assessment (PEA) released in October.

The completion of the prefeasibility study (PFS) first phase confirms that lithium can be acid-leached to between 75% and 83% purity, by consuming sulfuric acid levels of between 85 and 132 kilograms per tonne – lower than the 132 kg/t estimated in the PEA. The tests also showed minuscule levels of impurities such as magnesium – which can significantly increase the complexity and costs of processing lithium.

For more detail read our article about Phase 1 prefeasibility completion

Watch our recent interview (regarding prefeasibility study and just completed 6 hole drill program) with the CEO of Cypress Development Corp Bill Willoughby

Cypress is now on to the second stage of the prefeas, the goal of which is to produce saleable lithium products in forms that can be marketed to end-users. We’re expecting the PFS in the second quarter.

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Cypress Development Corp (TSX.V:CYP), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of CYP

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.