Demand for battery metals strong despite weak EV sales

2019.12.14

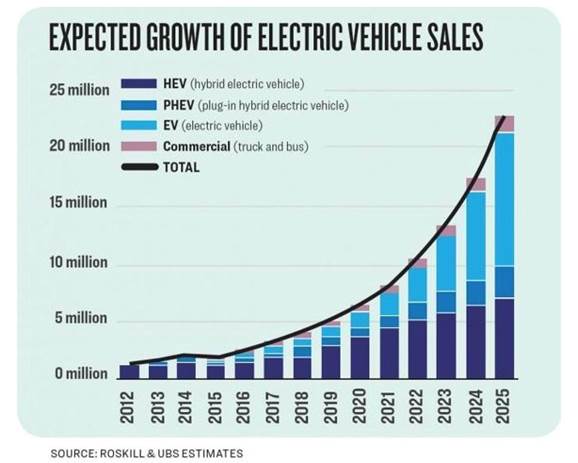

For all the hype over electric vehicles and their relentlessly optimistic growth forecasts (Bloomberg says there will be a 54-fold increase between 2017 and 2040, the IEA predicts 24% annual growth until 2030), in July 2019 we saw something we’ve never seen before: a drop in EV sales.

Citing a report by Sandford C. Bernstein, a New York-based brokerage firm, Business Insider states that monthly EV sales fell 14% in July, to 128,000 plug-in units. The decline was due to China’s June 26 decision to reduce subsidies on purchases of new electric cars, done to cut EV makers’ reliance on government help. The country has been subsidizing EV purchases to promote the industry and ease the transition for consumers to zero-polluting vehicles. But subsidizing hundreds of local startups fueled concerns about an industry bubble, so over the last few years Beijing has reduced the subsidies.

When it did that in June, however, the move backfired; on account of sticker shock resulting from the subsidies reduction, and the weakened Chinese economy, for the first time ever, China’s monthly EV sales dropped.

And since China accounts for half of EVs, the number of global EV sales fell, too.

The subsidy slash also exacerbated the most prolonged downturn in China’s total automobile market (traditional plus electric vehicles), the world’s largest; in September sales sagged for the 15th month straight.

Given that China is by far the largest buyer and seller of EVs, this makes sense. You would also expect that, if EV sales drop, so should the demand for the battery metals that go into them – nickel, manganese, cobalt, aluminum, lithium, graphite, phosphate.

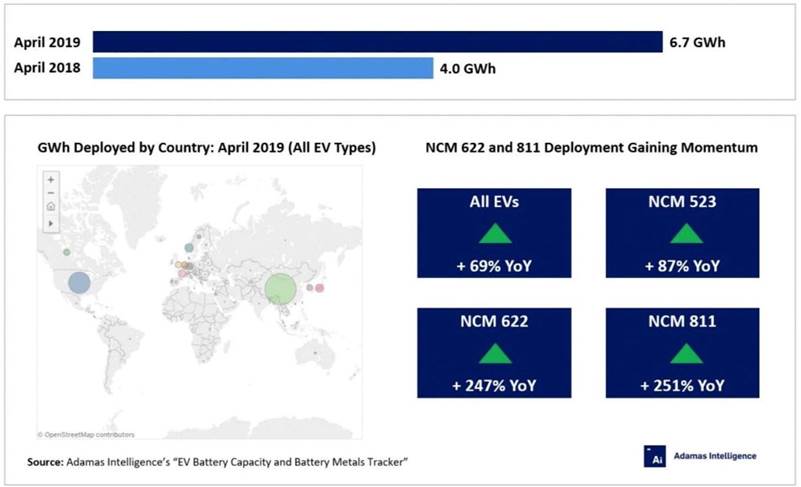

In fact the opposite is occurring. According to Adamas Intelligence, the amount of nickel, manganese and cobalt used per NMC electric vehicle battery continues to rise despite weakened market conditions – IHS Markit says the world’s automakers will make 6% fewer EV cars and light trucks than a year ago.

EV sales are falling as the demand for EV battery metals increases? What gives?

NMC popularity

The answer is due to a shift in the composition of EV batteries. Battery-makers are moving from low- or no-nickel battery cathode chemistries such as lithium ion phosphate (LFP) batteries that use zero nickel, and NMC 111 batteries that use equal parts nickel, cobalt and manganese, to higher-nickel varieties such as NMC 523, 622 and 811 (8 parts nickel to 1 part cobalt and manganese) batteries.

According to Adamas, a minerals research firm, the average new EV now contains 22% more nickel, 19% more cobalt and 15% more manganese than a year ago. This helped to offset the broader slowdown in EV sales and battery capacity growth.

It makes sense to use more nickel in EV batteries, because doing so increases the battery’s energy density, thereby extending the vehicle’s range. “Range anxiety” is a key limitation on the penetration rate of EVs into the total vehicle market. People don’t want to buy an electric vehicle only to discover they can’t use it for anything beyond short trips in the city. So battery makers are turning to nickel.

Battery-cos have been developing nickel-rich NMC 811 batteries (80% nickel, 10% cobalt and 10% manganese) because they have longer lifespans and allow EVs to go further on a single charge. They also use about three times less cobalt, which is over twice as expensive as nickel. ($USD $15.88/lb vs $6.09/lb)

The base metal needed for stainless steel is now used in two of the dominant battery chemistries for EVs, the nickel-manganese-cobalt (NMC) battery used in the Chevy Bolt (also the Nissan Leaf and BMW i3) and the nickel-cobalt-aluminum (NCA) battery manufactured by Panasonic/Tesla.

The CAGR of NMC 811s has been phenomenal. According to Adamas Intelligence’s EV Battery Capacity and Battery Metals Tracker, in April 2019 the NMC 811 cathode chemistry saw a 251% increase in deployment year over year. Despite holding just 1% of the passenger EV market by gigawatt hour deployed (GWh), 811s are expected to rise further in coming months due to the release of the Nio ES6 battery electric vehicle (BEV) and the GAC Aion S BEV, both equipped with NMC 811 battery cells from China’s CATL, the largest EV battery manufacturer in the world.

Inside EVs reports NMC 811’s CAGR (June 2018 to June 2019) was 251%, the NCM 622 battery CAGR was 247% and the NMC 523’s was 87%. A Fitch Solutions forecast has NMC batteries nearly tripling from 28% of global EV sales currently to 63% by 2027.

China is playing a critical role in the growth of NMC 811 battery chemistry.

Most Chinese battery manufacturers use lithium-iron-phosphate (LFP) batteries with no nickel, but they are looking to migrate to nickel-containing batteries with several including Shanshan, Nichia, L&F & Reshine producing them. This past April, CATL said it had begun mass production of the NMC 811.

Fine with phosphate

That doesn’t mean however that LFP batteries are on their way out in China. Among the LFP battery’s advantages over its NMC and NCA cousins, are its relatively low cost, and safety. For while NMC and NCA batteries are currently preferred due to their better ranges, they are also susceptible to “thermal runaways” ie. combustion. The battery could start a fire if it’s been damaged, overcharged, has an internal fault, or is operating in a very warm environment.

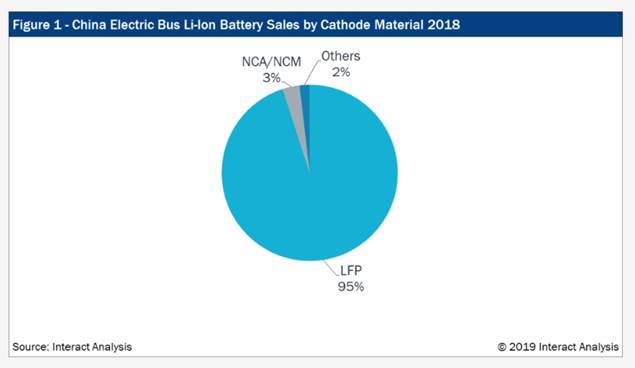

LFP batteries are less apt to overheat but they can’t provide the same range (energy density) as NMC and NCA chemistries. They are fine for applications requiring limited range. This makes LFPs ideal for the electric bus market. Considering that 98% of electric buses operated worldwide are in China, where almost all LFP batteries are made, the importance of LFP chemistry becomes apparent.

Chinese EV bus manufacturers prefer to use LFP batteries because they’re cheaper, but also due to the high density of population centers the buses operate in. Their short duty cycles, being driven in crowded cities like Beijing, Shanghai and Shenzhen, makes range less of an issue for their batteries. The buses are usually driven at slow speeds due to traffic congestion. The stop and go traffic allows the opportunity for drivers to recharge their batteries by breaking.

A transportation industry trade publication notes there are intellectual-property issues associated with Chinese cities switching to NMC batteries in buses – using LFP batteries avoids any risk of litigation and promotes domestic battery suppliers.

China also has a lot of phosphate – in 2018 it produced almost half of the world’s total shipments – so why not mine the mineral domestically and use it in batteries?

Cobalt not going anywhere

EV- and battery-makers want to reduce the amount of cobalt in their batteries because, as mentioned, it is over twice the cost of nickel. Using cobalt is also likely to attract unwanted attention to the awful conditions of cobalt mining in the DRC, including the use of child laborers; the unstable African country has become the battery metals’ “blood diamonds”. A third reason for lessening the percentage of cobalt in EV batteries is cobalt’s dependence on other host minerals. Because it is mostly mined as a by-product of nickel and copper, end users are at the mercy of those markets. If the price of either base metal should fall, the incentive for mining cobalt will decrease, potentially making it hard to source cobalt.

For these reasons, some industry observers think cobalt’s days are numbered, but they’re wrong. That’s because cobalt is actually the “safe” element in the battery cathode. Reducing the amount of cobalt shortens the life of the cell. The battery has to last at least eight years – the industry standard – if not, the owner can replace it under warranty. Those battery replacement costs would likely negate any savings gained from using less cobalt.

Summing up, a lithium battery used for electric vehicles has to be both strong and long-lasting. It’s mostly the nickel that gives the battery its strength, and the cobalt that gives it stability.

“Cobalt is the element that makes up for the lack of stability of nickel, says Marc Grynberg, CEO of Umicore, a nickel and cobalt company. “There isn’t a better element than nickel to increase energy density, and there isn’t a better element than cobalt to make the stuff stable.”

So, while Elon Musk may claim that he plans to bring the amount of cobalt in the Tesla 3 batteries down to zero, the reality is that cobalt is an indispensable battery ingredient. This has, and will continue to change the market for the specialty metal. Formerly used mostly in superalloys for jet engines and hardware, now over 50% of cobalt demand comes from the battery sector.

Range limitations lessened

Ultimately, improvements in EV battery chemistry are aimed at lowering the cost of EVs and allaying any concerns motorists have about the battery’s power and range. While much ground has been gained in this respect, many people still see limited range as an obstacle to purchasing an EV.

The industry got off to a bad start by over-stating the mileage motorists could expect to get out of a fully charged battery. It wasn’t uncommon to achieve less than 70 miles from a single charge. These days the range has been extended across a broad spectrum of EV models. Light-duty EVs with a range of over 200 miles (321 km) either available now, or for release in 2020, include: Tesla’s Model 3 and X, the Jaguar I-Pace, Kia e-Nero, Hyundai Kona Electric, Mercedes-Benz EQC, Chevrolet Bolt, Nissan Leaf and Audi e-tron.

As for what is an acceptable range, the survey data is mixed. A study in the UK found a third of respondents wanted the range to be 300 miles. Another third would settle for 400 miles and the remaining third would only buy an EV is the range was 400-1,000 mi. This is despite research showing that most drivers don’t drive more than 60 miles per day, in fact it’s closer to 30. A separate study in the US found drivers could accept a range of as little as 75 mi.

Charging infrastructure buildout

Notable and likely unknown to most people is the amount being invested in public charging infrastructure, to deal with drivers’ range anxiety.

Wood Mackenzie states that US utilities have invested nearly $2.3 billion in EV charging infrastructure. In the fourth quarter of 2018, the New York Public Authority announced a $500 billion commitment to grow the state’s clean energy economy, with half of that ($250 billion) earmarked for a fund to lessen range anxiety. The fund would pay for interstate direct current fast chargers (DCFC), airport charging hubs and developing EV-modeled communities.

America’s Transportation Infrastructure Act of 2019 sets aside capital for public EV charging infrastructure. The bill would authorize $287 billion to finance the next five years of Highway Trust Fund operations.

Wood Mackenzie predicts that by 2020 9.4 million EVs will be on the road, with 7 million residential charging points in service. By 2030, those numbers climb to 74 million EVs and 30 million charging points.

Conclusion

These figures indicate that the United States, despite White House reluctance to embrace clean energy, is putting up a lot of money to fund what we at Ahead of the Herd believe is an inevitable shift from a fossil-fuel-powered to an all-electric global transportation system. It may not be fully realized in our lifetime, but it will happen eventually.

Mining is inseparable from this transition. The widespread adoption of NMC and NCA batteries by car- and battery-makers guarantees a steady flow of demand for nickel, cobalt, manganese, aluminum and lithium for many years to come. The more pressing question is, is there going to be enough of these materials to go around?

Richard (Rick) Mills

subscribe to my free newsletter

aheadoftheherd.com

Ahead of the Herd Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.