Defense Metals has sights set on rare earths, uranium

2019.01.23

Today, the world is a dangerous place. Between Russian aggression in the Ukraine, terrorism, a proxy war in Yemen, North Korea, clashes between the US and Chinese navies, the possibility of another financial crisis (Brexit, unsustainable US debt), ongoing tensions in Europe over migrants, and the fall-out from global warming, the need for the protection of strong militaries is heightened.

In this climate of fear, we need domestic (ie. North American) sources of critical metals that can decrease our dependence on hostile foreign powers like China, and regain control over our high technology and defense.

Enter Defense Metals Corp (TSX-V:DEFN), a British Columbia company aiming to bring a deposit of rare earths into production.

Vancouver-based Defense Metals signed an option agreement with Spectrum Mining in November 2018 for its Wicheeda Lake claims. In the New Year DEFN began trading on the TSX Venture Exchange.

The company is also into uranium, with two well-placed properties in the Athabasca Basin, by far the highest-grade uranium jurisdiction in the world. A number of uranium juniors are exploring there, giving DEFN some serious upside should a discovery be made nearby. We’ll give you our bull case for uranium later on, but for now, let’s focus on rare earths and what Defense Metals has at their optioned WicheedaLake Light Rare Earth Element (LREE) project.

Wicheeda Lake deposit

Defense Metals’ flagship project is the Wicheeda Lake LREE property, located 80 kilometers northwest of Prince George, a major population and logistics hub in north-central British Columbia. Mining and forestry are important local industries employing thousands of skilled tradespeople.

The Wicheeda Lake deposit is situated alongside a major forestry service road that is connected to Highway 97, the main artery running through northern BC. Mining infrastructure is nearby – a CN rail line, a natural gas pipeline and hydroelectric power line runs through the village of Bear Lake, where the forestry access road connects with Highway 97.

The rare earth minerals bastnasite and monazite, containing the REEs, are disseminated fairly uniformly throughout the property.

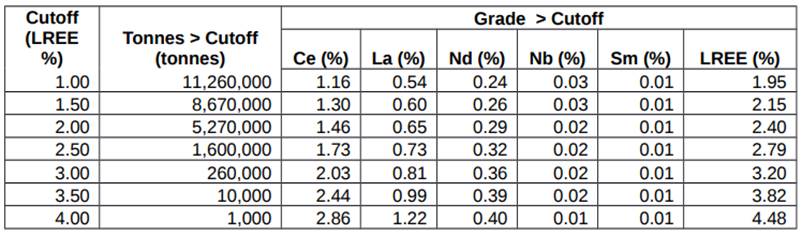

Historical drilling – twelve holes intersected the mineralized carbonatite body over core lengths from 56m to 148m long and found consistent REE mineralization over large widths starting from surface, 721 assays resulted in a non-compliant NI 43-101-inferred resource estimate of 11.2 million tonnes grading 1.95% Light Rare Earth Elements at a 1% cutoff (LREE = Ce + La + Nd).

The deposit, which is open in all directions, outcrops at surface on a hillside, allowing it to be mined as an open pit with a zero strip ratio. This means there should be no need to store or truck out waste rock, saving costs.

Metallurgy

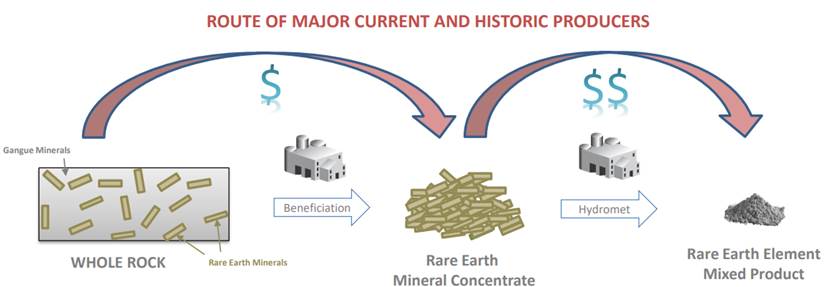

The challenge of putting a rare earth deposit into concentrate production has always been complicated minerology means expensive metallurgy, a lack of infrastructure doubles down on your problems. Even more challenging is developing a hydrometallurgical plant to produce separate rare earth oxides.

Defense Metals Wicheeda Lake LREE deposit has simple straightforward minerology/metallurgy and an easy to follow, for us investors, development path to production of concentrate/ oxide through a series of well-thought-out steps.

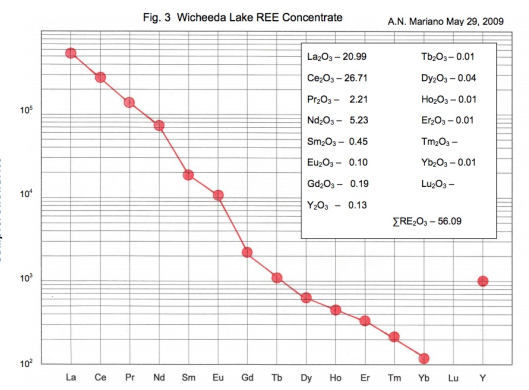

A 2009 study was designed to discover the ease of making a rare earth concentrate from a composite rock sample taken from Wicheeda Lake carbonatite, based on three assay samples.

Bench-scale testing yielded more potentially recoverable rare earth elements than the resource estimates current REEs (lanthanum, cerium, neodymium and samarium) such as dysprosium, europium and praseodymium.

“The result of the mineral concentration made on the Wicheeda sample is very encouraging,” wrote study author Anthony Mariano, PhD, a consulting minerals exploration geologist. Mariano noted he’s only seen a high-grade REE concentrate similar to the Wicheeda composite in China – where around 90% of the world’s rare earths are mined and processed.

“If exploration at Wicheeda Lake can substantiate a sufficient quantity of grade and tonnage of material similar to this it will be a very attractive potential source of LREE to the market place.” wrote Mariano.

Bench-scale flotation and hydrometallurgical testwork was done on Wicheeda Lake drill cores at a SGS Lakefield lab during 2010/2011. SGS successfully developed a flotation flow sheet that recovered 83 per cent of the rare earth oxide (REO) and produced a concentrate grading 42% REO. Subsequent hydrometallurgical testing in 2012 on a two-kilogram sample of the concentrate grading 39.7 per cent TREO (total REO) produced an upgraded and purified precipitate that contained 71 per cent TREO through a process of pre-leaching and roasting.

Scoping study

According to a 2012 scoping study, the Wicheeda deposit is suitable for open-pit mining. An initial 15-year production schedule was been estimated with a mill throughput of 2,000 tonnes per day.

An economic analysis from the scoping study found that a mixed rare earth concentrate could be produced selling for $5 a kilogram, resulting in a highly attractive project with a net present value of $336 million and an after-tax 15% internal rate of return.

However, considering the scoping study is now seven years old, that $5 a kilogram for the NPV is now likely to be higher, potentially much higher. After 2016 surging EV sales and a critical materials crisis for military applications, caused by the realization China controls virtually all REE production and refining, has combined to drive certain REE prices up.

Three-step strategy

As one can see, Defense Metals has a number of moving pieces in this project. These are the plans to move forward:

Step 1: Bulk sample metallurgical testing/ re-assaying the pulps

Defense Metals is sending a 30-tonne bulk sample to SGS Canada Inc.’s Lakefield, Ont., metallurgical facility in anticipation of a multiphase program of bench-scale metallurgical test work preparatory to commissioning larger-scale flotation pilot plant testing.

2019-01-23 – News Release “Wicheeda project’s bulk sample has arrived at SGS Labs in Peterborough, Ont., and has been offloaded and is to be prepped this week prior to initiation of the laboratory work.

SGS Canada Inc. is to immediately begin phase 1a of the planned work program which includes chemical and mineralogical characterization, grindability and laboratory flotation testing on a 200-kilogram subsample. The objectives of this program are to validate the process and confirm that conditions of the previously established 2010/2011 bench-scale drill core flotation testwork can be upscaled and applied to the current bulk sample; in addition to further optimization of the process flowsheet. The ultimate goal of the phase 1a testwork is to finalize the process flowsheet prior to commissioning of larger-scale pilot plant testing. SGS estimates that completion of the phase 1a work will take 2.5 months and it will provide regular updates that the company will provide to the market through each stage of this process.”

Bulk sample concentrate from the bench-scale metallurgical test work will be sent to various rare earth end users to determine its suitability for their purposes.

Defense Metals plans to re-assay the “pulps” used to produce the 2018 43-101 inferred resource in order to produce a new resource estimate. A Preliminary Economic Assessment (PEA) report will follow.

Step 2: Pilot plant

The next step is to build a 200-tonne-per-day pilot plant on a dormant sawmill site at Bear Lake a short 40 minute drive north of Prince George on Hwy 97.

Mining in an open pit scenario is basically just an earth moving operation. The raw ore would be run through a magnetic separator – bastnasite and monazite are magnetic – the resulting early stage concentrate would be trucked to DEFN’s pilot plant in Bear lake for further benefication. Production, under a BC Small Mine Permit, would gradually be scaled up. The idea is to produce rare earth concentrate that would be sold to end users. Defense Metals could also use its scaled-up processing plant to contract process other companies’ rare earths. A CN rail line runs past the old sawmill site and there is a siding running into the site.

The Bear Lake site has adequate power, water, a railway siding and a nearby natural gas pipeline – all the elements need for rare earth processing and shipping.

The environmental impacts are expected to be low – no uranium, low levels of thorium, and radiation well within British Columbia’s strict guidelines. Prince George (PG) has many industries currently using chemicals such as caustic soda and hydrochloric acid, and by-products of operations range from white/black liquor to lime and others. There is a trained workforce already very familiar with the shipping/receiving, use of, and proper disposal of chemicals, being home to a methanex plant and three pulp mills.

Step 3: Hydrometallurgical plant

The last step, and Defense Metals’ ultimate goal, is to build a hydrometallurgical plant at their site in Bear Lake that would convert rare earth concentrate into individual rare earth oxides, for sale to specific end users. Customers could include military defense contractors, considering the high concentration of metals used for defense purposes (see section below), and companies in the magnet manufacturing sector, which require combinations of neodymium, praseodymium and dysprosium or samarium and cobalt.

Like the concentration processing plant plant, the hydro-met plant could also do “contract processing” of other REEs from companies that ship their rare earth concentrates, by rail, directly to DEFN’s Bear Lake facility.

Currently, almost 100% of rare earth processing is done in China, even when the rare earths are mined elsewhere. Imagine being able to cut out the middle man and supply REE’s directly to North American manufacturers? A true ‘in house’ Mine To Magnet story!

Funding is being sought from Canadian and US grant money available for companies that are developing critical minerals’ projects.

Defense applications

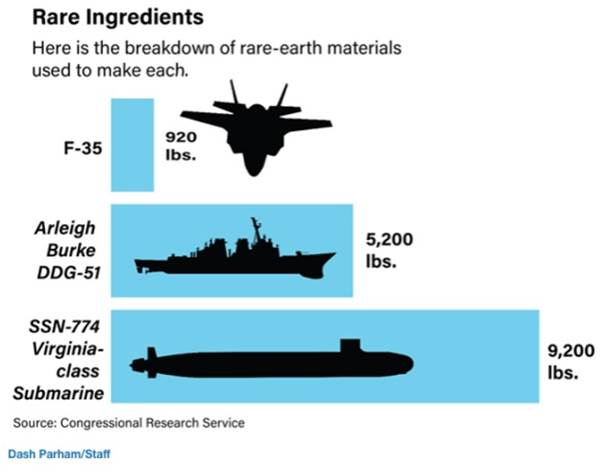

Defense Metals will be mostly targeting the magnetmanufacturing segment and Military defense contractors to buy their rare earth concentrates and oxides.

Certain rare earth elements and the superior magnets made from them are central to the electrification of our transportation system, clean green wind and solar energy and the whole spectrum of defense technologies that are vital to every military. Without them economies suffer and countries would be unable to produce much of the military hardware and equipment required for national defense. In most case there are no substitutes.

“USGS experts prepared an analysis of which critical minerals would be components of a Navy SEAL’s combat equipment. It concluded that the outfit would include five critical mineral elements in night-vision goggles, 13 for communications gear and a Global Positioning System and three for an M4 rifle.

As a former Navy SEAL, I didn’t realize that when I was entering combat, much of it was made in China…”

Interior Secretary Ryan Zinke

For example, smart weapons rely on sophisticated motors and actuators to steer them towards their targets. Missile and bombs therefore incorporate REEs such as terbium, dysprosium, samarium, praseodymium and neodymium.

Neodymium/ praseodymium are also used in permanent magnets, found in electric vehicles and hard disk drives, for example. Samarium-cobalt magnets resist corrosion and can operate at high temperatures. Dysprosium is added to neodymium-iron-boron magnets in high-heat applications.

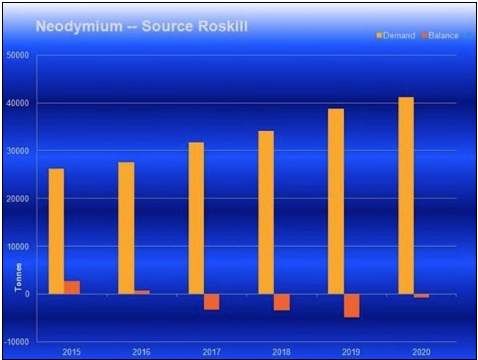

The market for this type of magnet is estimated at $11.3 billion. Demand for neodymium has been growing steadily.

Cerium-based compounds are used as a polishing media for optical lenses encountered in the battlefield, while lanthanum is incorporated into cameras, telescopes and night vision goggles.

For a more complete list of REE military uses, visit our Rare earths in the cross-hairs of new high-tech arms race

REE market

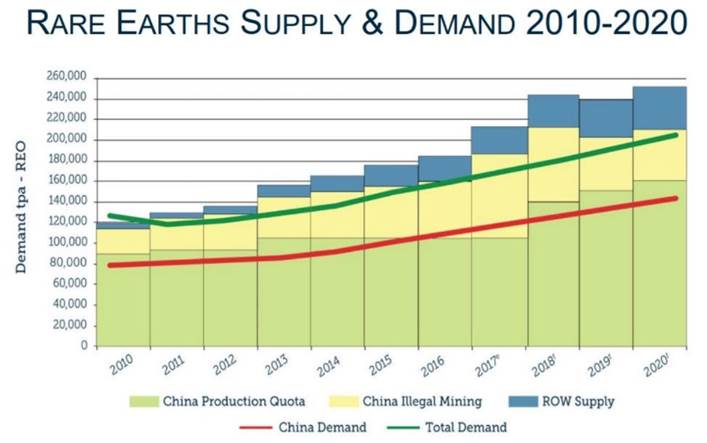

While nearly all rare earth mining and processing currently takes place in China, the United States is making moves to end the monopoly.

The 2019 National Defense Authorization Act prohibits the Department of Defense from acquiring rare earth magnets – along with certain tungsten, tantalum and molybdenum products – from China, Russia, Iran and North Korea.

This is great news for exploration companies like Defense Metals that can step in to replace foreign rare earths with domestic supply.

Moreover, the rare earths market, which was flat for awhile, is poised to take off again. On the demand side, there’s all the military applications, plus the exponentially growing need for permanent magnets in electric vehicles. By 2047, there are expected to be upwards of a billion electric cars on the road, compared to around 4 million currently.

Supply-wise, the Chinese government recently published new guidelines designed to eliminate illegal mining and encourage more high-end processing. These changes are likely to restrict Chinese rare earth exports, which in the past have led to significantly higher prices.

There is another factor that could play into a rare earth revival, and that is a new high-tech arms race that is developing between the US, China and Russia.

Why is this important? Because an arms race requires rare earths – something the US is in very short supply of. Not only that, the United States is about 75% dependent on China for imports of rare earths it needs to expand and modernize its military.

“The United States must not remain reliant on foreign competitors like Russia and China for the critical minerals needed to keep our economy and our country safe.” President Donald Trump

Uranium properties

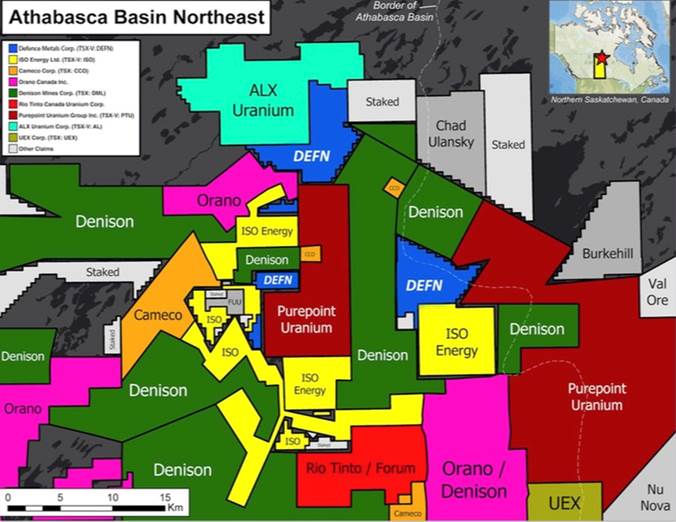

As mentioned Defense Metals is also engaged in uranium exploration. The company has acquired two properties, Geiger and Klaproth, located in the eastern part of the Athabasca Basin in northern Saskatchewan.

Often called “the Persian Gulf of uranium”, the Athabasca Basin is home to high-grade exploration plays, a handful of advanced projects and some prolific uranium mines. These include Cigar Lake, held jointly between Cameco, Areva (now Orano) and Tepco Resources, McArthur River and Rabbit Lake mines, both of which are currently on care and maintenance. The Athabasca Basin produces about 15% of world uranium supply.

The Basin is unique for its grades – at over 20 times global averages. Some deposits are over 100x the world average including Cameco’s Cigar Lake which contains an average 17.8% uranium.

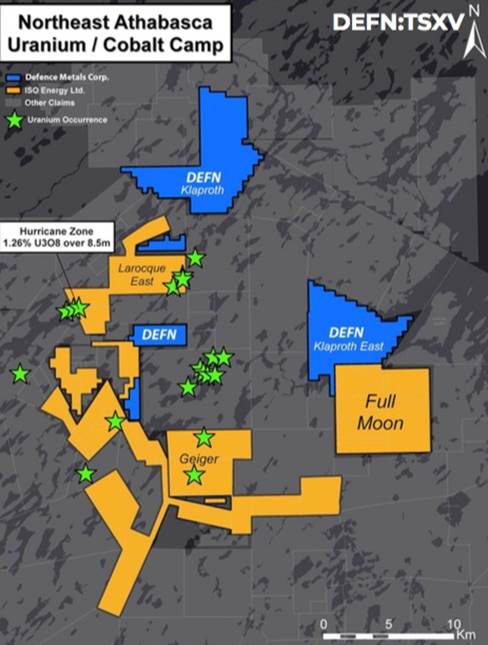

Consisting of two claims totaling 2,310 acres, Geiger North and South is adjacent to the Wollaston-Mudjatik transition zone – a major crustal suture related to most of the major uranium deposits in the eastern Athabasca Basin. Notably, the project is just 35 km northwest of the McLean Lake mine and mill, in a relatively under-explored area of the Basin.

The Klaproth properties consist of two mineral claims totaling approximately 2,089 acres.

Both properties are surrounded by major mining and exploration companies, giving DEFN a strategic foothold in a proven uranium district.

For example ISO Energy’s Laroque East property is only a few miles north of a portion of Defense Metals’ claims. Geochemical results from the Hurricane Zone confirmed the presence of high-grade uranium, with 2.5 meters at 3.58% U3O8, within 8.5 meters at 1.26% U3O8.

Uranium market

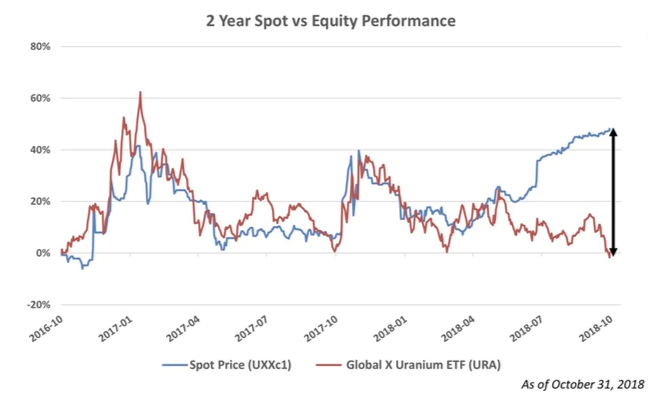

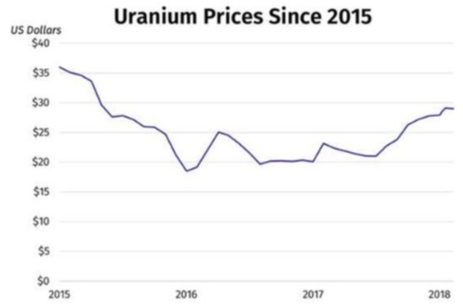

For Defense Metals, it’s a good time to be exploring for uranium. The spot uranium price has risen from an April 2018 low of $20.25 a pound, to the current $28.75/lb. The rising spot rice has strongly correlated with growing strength in uranium equities. Uranium was the best metal performer of 2018.

There are principally four reasons why the uranium price will continue to climb:

- The growing need for nuclear power and reactors.

- The drop in uranium supply due to mine closures and existing mines running out of ore. A supply deficit of at least 57 million pounds is predicted.

- More buying on the spot market from producers needing to fulfill existing contracts, and new uranium funds and holding companies.

- Uncovered uranium demand (utilities’ requirements for U3O8, the nuclear fuel, that is not covered by contracts) is projected to increase by up to 54 million pounds by 2020.

For more on this topic read our Why the uranium price must go up

At Ahead of the Herd we believe a rising price, and exploration discoveries will drive investors back into uranium stocks. Especially those like Defense Metals whose properties are surrounded on all sides by some of the most recognized uranium miners and explorers in the sector.

Defense Metals recently announced that it has appointed Dale Wallster to its technical advisory board. Mr. Wallster is a geologist and prospector with 35 years experience in North American mineral deposit exploration, with a focus on the targeting and discovery of unconformity-related uranium deposits in Saskatchewan’s Athabasca Basin. He was president and founder of Roughrider Uranium Corp., a company acquired by Hathor Exploration Ltd. in 2006 for its strategically located uranium properties in the Athabasca basin. Mr. Wallster, and his team, are widely credited in the mineral exploration sector for the discovery of the Hathor’s Roughrider deposit. In January, 2012, Hathor became a wholly owned subsidiary of Rio Tinto as part of a $650-million acquisition.

DEFn’s next door neighbors, in every direction of the compass, are spending millions of dollars looking for the next uber high grade deposit.

Conclusion

Defense Metals Corp (TSX-V:DEFN) has a compelling story to tell about its Wicheeda Lake rare earths deposit in British Columbia. Having freshly acquired the deposit from Spectrum Mining, along with two uranium properties in the Athabasca Basin of Saskatchewan, DEFN is well placed in two key metals markets: rare earths and uranium.

At Ahead of the Herd we are bullish on both. Rare earths are in high demand for defense applications particularly with the Trump Administration which wants to decrease America’s dependence on China and other foreign powers for its critical metals, including rare earths. Some of the 17 RE elements are also increasing in demand due to the electrification trend we’ve written about extensively – in particular neodymium, praseodymium and dysprosium all used in permanent magnets.

Uranium demand is forecast to outstrip supply and there are millions of dollars being spent in the Athabasca Basin by juniors waiting to supply the market with new U3O8 in lock step with a rising price.

We like Defense Metals for its very attractive light rare earth deposit, which appears to have simple mineralogy and therefore very easy extraction/metallurgy. The deposit is close to a major center, Prince George, facilitating access to a skilled mining workforce including those used to handling chemicals. The proposed pilot plant is on an industrial site that would be perfect for rare earth processing, and a future hydrometallurgical plant that would produce rare earth oxides for the defense industry – a lucrative and stable market. All the necessary infrastructure is there, including roads, water, power, NG and even a railway siding.

We also like that DEFN has a three-step plan for moving the project forward. The first step is bulk sample metallurgical testing, re-assaying the pulps and producing a new resource estimate. Next it’s on to a pilot plant, starting at 200 tonnes per day and gradually ramping up concentrate production, based on customer demand and proof of a quality concentrate product. Then the ultimate goal, rare earth oxide production from a hydrometallurgical plant, that could not only serve Defense Metals’ needs, but those of other rare earth miners.

While it sounds ambitious, the strategy is do-able, with a phased approach. Defense Metals is funded for the initial testing stages, and should have no trouble attracting additional capital if needed when it comes to building a pilot plant, scaling up and building their hydro-met plant.

Investors will also be impressed by the current low public float – just 6 million shares.

For all of these reasons, I have Defense Metals Corp (TSX-V:DEFN) on my radar screen.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Defense Metals (TSXV:DEFN) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of DEFN.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.