Mercado Minerals: Boots on the ground at Copalito, drilling in Q1- Richard Mills

2026.01.16

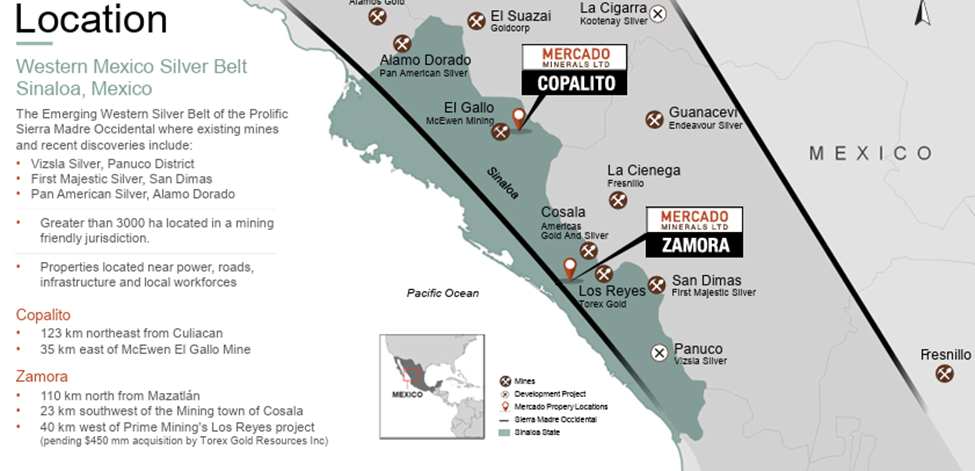

Mercado Minera’s’ (CSE:MERC) properties, Copalito and Zamora, are located within the Western Mexico Silver Belt in Sinaloa state, Mexico. The properties are near power, roads, infrastructure and local workforces in a mining-friendly jurisdiction. This emerging belt of the prolific Sierra Madre Occidental mountain range, which hosts existing mines and recent discoveries, includes:

- Vizsla Silver’s (TSX:VZLA) Panuco District

- First Majestic Silver’s (TSX:AG) San Dimas

- Pan American Silver’s (TSX:PAAS) Alamo Dorado

Copalito Project

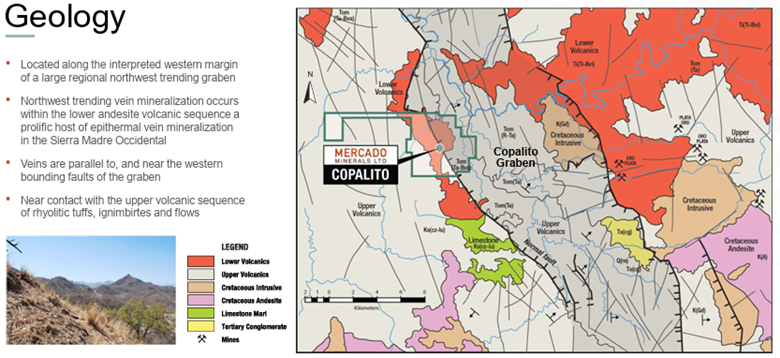

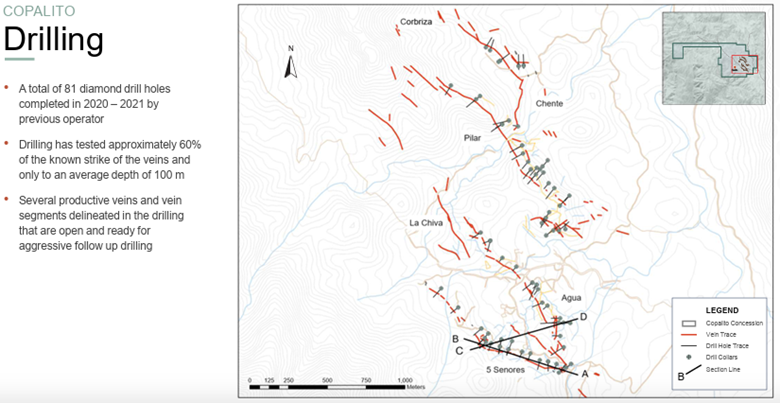

According to Mercado, their flagship Copalito Project presents a district-scale opportunity with known and drilled silver — gold-low-sulfidation vein mineralization that is open for expansion. Historical third-party high-grade silver and significant gold and base metal drill intercepts include 347 g/t silver, 0.22 g/t gold, 0.18% lead and 0.38% zinc over 13.10 meters at the 5 Senores Vein; and 125 g/t silver, 2 g/t gold, 0.34% lead and 0.58% zinc over 23m at the El Agua Vein.

Mercado has acquired an option to purchase seven concessions covering 2,820 hectares. The option is to earn 100% over five years, with staged cash payments totaling $3.5 million. Six known veins on the project have a cumulative strike length of 8 km.

The Copalito Project is located approximately 123 km northeast of Culiacan, Sinaloa. The property has good access, moderate topography and infrastructure nearby. The neighboring property to Copalito is McEwen Inc’s (NYSE:MUX) El Gallo mine complex, located 35 km to the west. Kootenay Silver (TSXV:KTN) was the most recent operator of the project.

Kootenay drilled 81 holes over six veins. This historical drilling has only tested approximately 60% of the veins’ strike and only to an average depth of 100m. Several productive veins and vein segments delineated in the drilling are ready for follow-up deeper drilling.

Mercado has also acquired the existing drill data, which provides an excellent base for future exploration drill targeting of higher and thicker-grade portions of veins along strike and to depth.

In talking with CEO Daniel Rodriguez, he said the technical team, including Senior Technical Advisor Robert Duncan, believes they are at, or near, the top of the mineralizing system as evidenced by vein textures including chalcedonic quartz, geochemical signatures and precious-to-base-metal ratios.

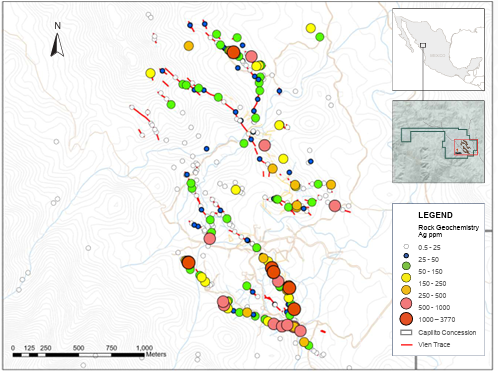

Rodriguez noted the veins pictured in the above image present ample opportunities for expansion. After Kootenay Silver had finished drilling, they uncovered new veins to the northwest of Cinco Senores, north of La Chiva, and also found 300 meters strike length of vein to the southeast.

These areas remain untouched by exploration.

Copalito has four high-priority targets at 5 Señores, El Agua, Pilar and La Chivas.

“Not only do we have targets to fill in the gaps on 5 Señores, but we actually also have veins to go prospect and then extensions to go drill,” he said, adding, “We have multiple angles on this property to grow the discovery and make new ones.”

Inaugural field program

This week Mercado Minerals announced the start of its inaugural field program at Copalito. As I write this, four trucks laden with personnel and their equipment are rumbling towards Copalito, where they will execute the first phase of exploration activities to advance the flagship asset.

Program highlights include commencement of a detailed mapping and prospecting program focused across 40% of the project area, which remains unexplored.

The field crew will re-sample silver, gold, lead and zinc vein mineralization in select historical drill core from the six known veins.

The company also plans to re-log targeted historical core to refine geological understanding; advance logistics for the upcoming first-phase drill program, including securing drill pad access, water, power, drill and equipment contractors, and other necessary operational infrastructure for the planned drill campaign; and further refine drill targets.

“Today marks the start of the exploration work that will lead us to drilling at Copalito,” said Rodriguez in the Jan. 13 news release. “We remain on track to begin our first-phase, 3,000-meter drill program in Q1, focused on our highest-priority targets. I look forward to providing regular updates to the market and our shareholders as we advance. Our goal is to demonstrate the potential of the known veins at depth and along strike, while also testing new areas that have yet to be explored at Copalito. I will be joining the technical team for the initial stage in the field to be part of the process firsthand.”

Vizsla Silver

Mercado announced on Dec. 1 that it had closed a non-brokered private placement, issuing 27,990,000 units at CAD$0.20 per unit, for gross proceeds of $5,598,000.

The offering included participation and a strategic investment from Vizsla Silver in Mercado.

Having Vizsla Silver participate in the financing and come on as a strategic shareholder is a major coup for Mercado Minerals. Being a strategic shareholder means they are not just there for financial help but also technical assistance; they want to see Mercado succeed and are there to support the company.

Viszla’s story is one of consolidating Panuco, a large, historically productive district and aggressively exploring it to unlock a world-class resource through a dual strategy of advancing the Copala mine and continuing to discover new high-grade deposits elsewhere in the district. Vizsla is positioned as a leading silver company with strong project economics, aiming for production through a combination of aggressive drilling, a test mine for de-risking, and a completed preliminary economic assessment.

“This is one of the most exciting silver districts globally. With high-grade resources, existing infrastructure, and strong exploration potential, Panuco has the scale and quality to become a billion-ounce district,” said Vizsla Silver’s CEO Michael Konnert.

Rodriguez has a very good working relationship with Konnert.

He grew up speaking Spanish, and he is fully bilingual. Knowing what the locals are saying not only allows the transfer of valuable information regarding the projects but helps to build relationships with in-country team members, nearby communities and local indigenous.

Everybody on Mercado’s side of the project speaks Spanish and has Mexican ancestry.

Silver market

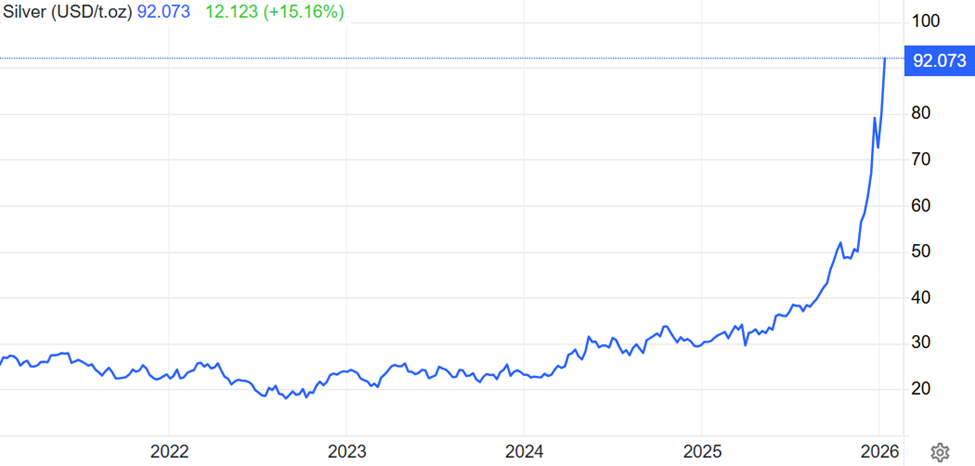

Silver rocketed 137% higher last year compared to gold’s also impressive 57% run.

Gold and silver in ’26 — Richard Mills

The silver market continues its longest streak of supply deficits in recent years, with the 2025 World Silver survey noting 2025 was the fifth straight year of supply not meeting demand. Mine production has fallen to 813 million ounces, unable to keep pace with surging demand mostly from industrial (but also monetary) applications.

Reliable sources report there are roughly twice the investable grade ounces of gold available than investable silver. The total amount of above-ground fine silver bullion for investment is estimated to be around 3 to 3.5 billion ounces, much lower than gold’s supply of approximately 7.6 billion ounces.

It’s estimated that 60% of silver is utilized in industrial applications, leaving only 40% for investing. Of the 60% used for industrial applications almost 80% ends up in landfills.

In November 2025 silver was among 10 minerals the US Department of Defense added to the US Geological Survey’s 2025 List of Critical Minerals.

For the first time, silver was recognized as having growing importance to US economic and national security. This inclusion signals enhanced government focus on securing domestic supply chains through enhanced permitting, subsidies and strategic stockpiling initiatives.

In India, the largest consumer of silver, the price rocketed 180% year on year during Diwali, India’s harvest festival, as consumers pivoted from too-expensive gold to cheaper silver.

Due to its high conductivity, silver has a multitude of industrial applications. This includes solar power, the automotive industry, brazing and soldering, 5G, and printed and flexible electronics.

Three new uses are solid-state batteries, robotics and artificial intelligence (AI).

One thing we haven’t talked about much is where the supply of silver is coming from. Most silver is produced as a byproduct from the mining of other metals, primarily lead/ zinc, copper and gold ores.

Only 30% of the world’s silver supply comes from mines where silver is the primary product.

Lead-zinc mines are the dominant source of silver globally. Significant amounts of silver are also found in copper ores, particularly chalcopyrite.

Silver is commonly alloyed with gold in nature, an alloy known as electrum.

This production structure creates a unique situation where silver supply cannot quickly respond to price signals. Naturally, this is a long-term bullish factor for silver.

When you consider the state of the world’s copper supply, and the fact that 20-25% of silver comes from copper mining operations, there is a very real risk of losing a large percentage of that 25% of silver supply due to a shortage of copper because of the inability of copper mines to meet demand. Global demand for copper is only being met by recycling, mined supply has been falling short for a while.

(The copper market is expected to face its most severe deficit in 22 years in 2026 —590,000 tons — according to Morgan Stanley. The deficit could widen by 2029 to a whopping 1.1 million tons.)

Mine disruptions like the recent Grasberg mine mud intrusion in Indonesia, and the flooding at Ivanhoe Mines’ (TSX:IVN) Kakula mine in the Congo not only strip copper supply from the global market but massive amounts of silver as well.

Silver supply is already in a deficit and has been for a 5th straight year.

Demand, driven heavily by record industrial needs (especially solar/PV & electronics with significant demand also coming from jewelry, silverware, and investment), exceeds supply.

And silver’s supply is “structurally inelastic,” meaning that silver’s production structure cannot easily increase in response to higher silver prices alone.

Conclusion

Silver production from major copper mines, along with overall silver supply, has faced reductions or stagnation due to mine issues, lower grades, and market factors like tariffs, even as prices rise, creating supply deficits.

Mercado Minerals has close to $6 million in its treasury due to a recent private placement that included Vizsla silver, a strategic shareholder that is not only providing financial backing but technical expertise.

Mercado has raised their money, they have their storytelling team in place, and they are ready to go to work at Copalito. A field team is currently on site to re-log core, set up drill targets and more precisely define already identified drill targets.

Prospecting the rest of the property is also part of the 2026 program. They are on the hunt for acquisitions. The news is about to start flowing as promised.

All in all, I feel confident in saying that Mercado is living up to what it has set out to do at Copalito. Junior resource companies often represent the distance between promise and fact. Many juniors are all promise but when it comes to cutting the mustard, facts, say starting a drill program, they find they don’t have the mustard.

Mercado Minerals imo doesn’t fit this description. There is no distance between the promises they were making and the fact that there are now boots on the ground in Mexico.

CEO Daniel Rodriguez has delivered a great deal in a very short period of time. He has put together Mercado Minerals, assembled a great team including two experienced technical advisors, raised funds, and secured a strategic investor for financial and technical backing.

MERC has acquired properties and is on the lookout for more. 2026 should be a seminal year for the company as they execute the first field program at Copalito including a 3,000-meter drill program.

Silver juniors are crucial to the silver market, for their upstream role in finding and developing new deposits. They find and own the world’s silver resources the miners need to replace their mined reserves.

Mercado has turned the lights on, and I for one, am looking forward to seeing what Rodriguez and his team can deliver.

Mercado Minerals Ltd.

CSE:MERC

2026.01.14 Share Price: Cdn$0.36

Shares Outstanding: 41.9m

Market Cap: Cdn$15.1m

MERC website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Mercado Minerals Ltd. (CSE:MERC) MERC is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of MERC.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.