MPD Project: Kodiak Copper focusing on resource expansion in ‘26 – Richard Mills

2026.01.14

Kodiak Copper (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1) had a phenomenal 2025, releasing a maiden mineral resource estimate on its MPD property in south-central British Columbia, and the share price up 205% over the last year.

Kodiak Copper doesn’t feel the need to drill in the dead of winter. But that doesn’t mean it’s sitting idle, far from it. In it’s ‘off-season’, the company has been assembling its drill data and other information from last summer and planning its 2026 program.

While the nitty gritty details are still being worked out the overarching broad-brush strategy is to expand the existing resource.

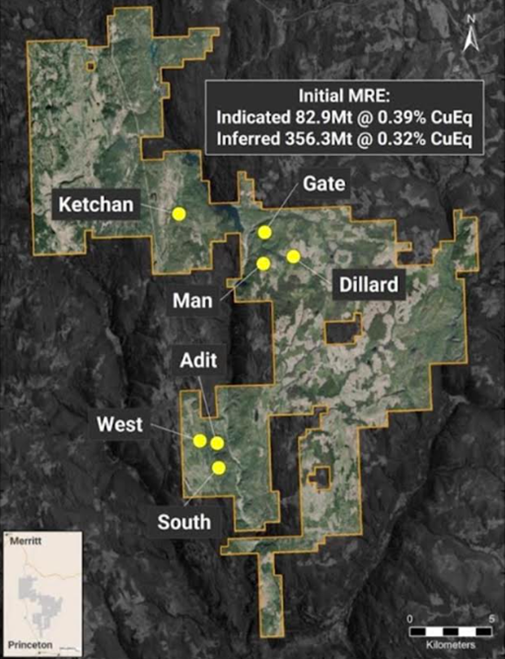

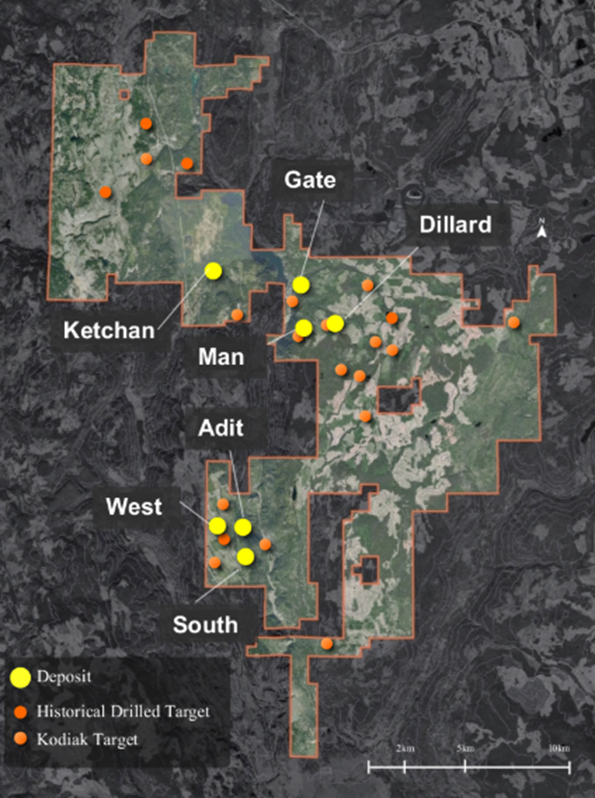

The Vancouver-based junior reported on Dec. 9 that the resource estimate for MPD includes seven deposits in total, with four deposits reported in June and three reported in December.

Kodiak Copper has successfully highlighted a large, open-pit initial mineral resource estimate (MRE), which shows the scale and potential of MPD and lays the foundation for future resource growth and development.

The West, Adit and South deposits all feature shallow mineralization and favorable geometry, characteristics that are expected to support low strip ratios in future economic evaluations. West and Adit host high-grade mineralization from surface, while South is a large bulk tonnage deposit over 1 km in length that is still underexplored.

The new resource on the MPD Project is based on decades of historical exploration and Kodiak’s drilling from 2019 to 2025, totaling approximately 90,000 meters.

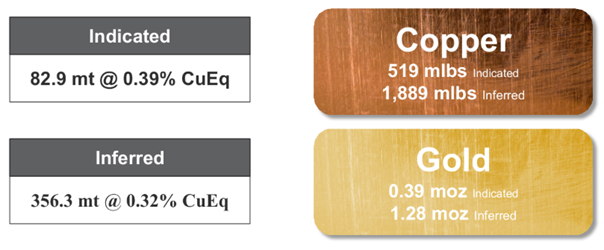

An MRE is a major milestone for any company, Kodiak’s MRE is broken into two parts: the total Indicated mineral resource and the total Inferred mineral resource.

The Indicated is 82.9 million tonnes grading 0.39% Cu Eq for 519 million pounds of copper and 390,000 ounces of gold.

The Inferred is 356.3 million tonnes grading 0.32% Cu Eq for 1.889 billion pounds of copper and 1.28 million ounces of gold.

Between the Indicated and Inferred categories, the resource amounts to 2.408 billion pounds of copper and 1.67 million ounces of gold.

Kodiak Copper publishes sizeable maiden resource with lots of room to grow — Richard Mills

For an initial maiden resource those are great numbers and the team is to be congratulated for running an extremely successful project so far. But now, as the team moves the company forward, the most important aspect of the MPD story is the potential copper and gold upside on the known resource plus the very real potential upside from further exploration, not only on existing known mineralization but new discoveries as well.

While the company has identified multiple mineralization zones, it remains committing to continued exploration to further grow the project, both through zone expansion and the testing of new targets.

All deposits at MPD remain open for expansion within and beyond the MRE pit shells, most in multiple directions and at depth.

“This year’s exploration program will prioritize resource expansion and test multiple target areas with the potential to add meaningful tonnage to our existing deposits,” said Kodiak’s Chairman Chris Taylor.

“We also plan to drill several promising copper and gold targets on the property, some supported by encouraging historic drill results, others defined using VRIFY AI-supported targeting. The large number of targets on the property, approximately 20 at current count, underscores MPD’s remarkable prospectivity and the exciting opportunity for yet another major discovery.”

Kodiak’s VP, Corporate Development Nancy Curry tells me, “the key thing about what we did last year, in putting out that maiden resource, is that it’s a baseline, a floor to the value while we’re de-risking the project.”

“The seven deposits are open to expansion,” she added. “We have lots of exploration targets and that will be the focus this year. The company is very confident that the size of the resource is going to increase materially, plus having 20-plus targets, with a brand-new discovery I think you would get the discovery kick, right? So, you have multiple ways this year of adding more value. On top of that, you have got a market.”

Importantly, Curry noted an updated resource will likely get a boost from higher commodity prices because Kodiak was so conservative in their MRE commodity price estimates, using just $2,600 per ounce gold, $30 silver, and $4.20 per pound copper. The gold price as of this writing is $4,586/oz, silver is $86.93 and copper is trading at $5.95/lb, those won’t be the prices used but mentioning them does show an increase is needed to reflect market reality. So, just by bumping the numbers used you have a built-in value rise on that.

The increase in copper and gold prices does three things. First, as mentioned, the in-situ value of the metal goes up, second it also affects the cut-off grade, which will be lowered, allowing more potentially economic copper pounds and gold ounces to be added to an updated MRE.

Third, a longer mine life (LOM) because higher metal prices add newly added economic ounces and pounds and lower the economic cut-off for the future preliminary economic assessment (PEA).

Minimized dilution

KDK has only issued 95.1 million shares, with a market capitalization of just $91.9 million.

Remember, Chris Taylor, Kodiak’s founder and chairman, never built a mine out of his last project, he developed the project, and sold it. This monster sized success story was the 2022 sale of Great Bear Resources and its Dixie Project in Ontario to Kinross Gold (TSX:K) for CAD$1.8 billion.

Do Chairman Taylor and CEO Tornquist want to sell Kodiak Copper? I don’t know, but if that is an option, the share count is critical if it comes to a buyout.

Just for an example, if a company has 100 million shares out-standing fully diluted (osfd) and is bought for $500 million, that implies $5 a share, but a company whose osfd share count is 200 million gives shareholders $2.50/sh. It’s that simple.

Copper market

Curry says, “we’ve got a market”. Well, do we ever.

2025 was historic in that copper and gold rose significantly at the same time.

Copper, the electrification metal, jumped 42%, gold jumped 64%.

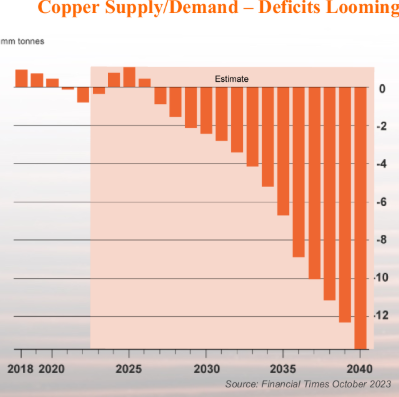

Along with all the usual applications for copper — in construction, transportation and telecommunications — demand is being driven by on-going electrification and decarbonization of the transportation system, AI/data centers, and the exponential growth in battery storage.

This all boils down to everything driving the world’s economies needs more copper, in the face of persistent constraints on mine supply.

Mine disruptions like the recent Grasberg mine mud intrusion in Indonesia, and the flooding at Ivanhoe Mines’ (TSX:IVN) Kakula mine in the Congo not only strip copper supply from the global market and drive up the price but they also highlight just how volatile the copper market is when one mine closure and then another leaves it vulnerable to price spikes from any supply disruption or demand surge.

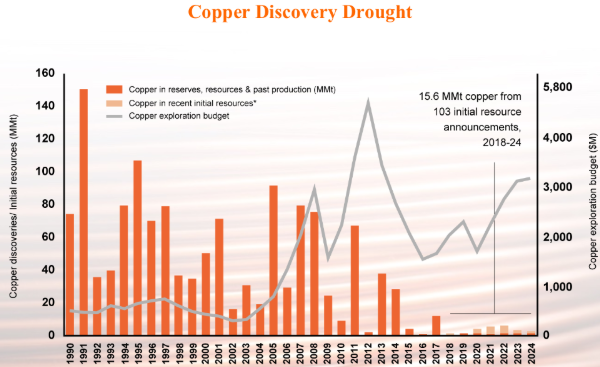

There has been a dearth of new copper discoveries in recent years, and the grades of existing copper mines are dropping, which, when added to operational misses, are making the current, and future, supply problem worse.

The copper market is expected to face its most severe deficit in 22 years in 2026 —590,000 tons — according to Morgan Stanley.

This is what makes the need for new copper projects so important.

“Copper is either the enabler of the modern world and this age of electrification, or it’s an obstacle to it.” Daniel Yergin

Conclusion

Kodiak Copper’s share price has surged 205%, year on year, confirming its position as a top AOTH junior copper company pick.

Kodiak has come a long way since making the Gate Zone discovery at its MPD Project in 2019.

2025 was an important year for KDK as it put out its maiden resource based on 90,000 meters of its own drilling, plus historical drilling.

The company has respected retail by keeping its share count low, compared to other companies at this stage, Kodiak Copper has kept share dilution to an absolute minimum.

2026 drilling will focus on resource expansion, with details forthcoming.

Metallurgical test results should be coming out in the next few weeks along with much more detailed plans for 2026.

Kodiak Copper

TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1

Cdn$1.05 2026.01.13

Shares Outstanding 95.1m

Market Cap Cdn$91.8m

KDK website

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard does not own shares of Kodiak Copper (TSXV:KDK). KDK is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of KDK

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.