Commodities are the right story for 2019

2019.01.12

The markets are up and down like a bride’s nightgown, as my dad used to say, bitcoin is in the toilet, and tech stocks, once as steady as the banks, are as unreliable as an old Apple computer. If you’re reluctant to dip your toe back into the stock market, you’re not alone.

‘The Hunt for Red October’ was a great movie but nobody thought ‘Red October’ would actually happen. In October it did. Anyone that was invested saw their equities turn as red as a Russian submarine commander. The S&P 500 churned. When the calendar mercifully turned to November, the benchmark US stock index had fallen 8.5%, the worst month since February 2009 and the ugliest October since the collapse of Lehman Brothers in 2008. The Dow and the Nasdaq were equally pummeled.

And then it kept going. December was the worst month since the Great Depression. The financial talking heads couldn’t decide what was going on. The trade war with China, speculation that the Federal Reserve would raise interest rates in December (it did) and slowing global growth, were all trotted out as culprits. Algorithmic trading and end-of-the-year tax selling also played a role, as did good old profit-taking by retail investors, who figured it was as good a time as any to exit a nine-year bull market.

A recent post-mortem pointed the finger at retail bearish sentiment, the partial US government shutdown, and a weakening Chinese economy. Despite improvement so far in 2019, some equity strategists are tempering expectations, thinking that companies’ soon-to-be-reported fourth-quarter-earnings and 2019 outlooks will be anemic.

So where is a smart investor, cash account flush after having sold all their 2018 underperformers, to park their capital in 2019? In a word: commodities. Forget about trendy cryptocurrencies, blockchain and marijuana. We like investing in tangible things that create real jobs, real money and real wealth.

The question is: which commodities?

Well an irrefutable truth right now is the global shift towards the electrification of the transportation system (cars, trucks, buses, trains) as governments and businesses realize that saving the planet from certain environmental destruction involves moving from an oil-based economy to one grounded on electric vehicles and sources of energy that emit fewer to no greenhouse gas emissions.

At Ahead of the Herd we’re invested in commodities that ride this electrification trend. Among the metals we’re most bullish on, are copper, lithium, rare earths and gold. The first three are crucial to this global transportation shift. We continue to believe in gold because a/ it’s smart to have gold as a portion of your portfolio (most managers say 10% at minimum) and b/ now is an excellent time to own physical gold or gold stocks. All of this will be explained. But first, why commodities, and why now? We offer three reasons: timing, a lower US dollar, and a global infrastructure build-out.

1. Timing. Commodity prices rise and fall with economic conditions. Conventional wisdom has it that commodities tend to do well during late expansions and early recessions. As the economy slows, interest rates are cut to stimulate the economy (remember QE?), the US dollar falls and demand for commodities, which are priced in USD, goes up, along with commodity prices. Stocks and bonds on the other hand don’t perform well during recessions.

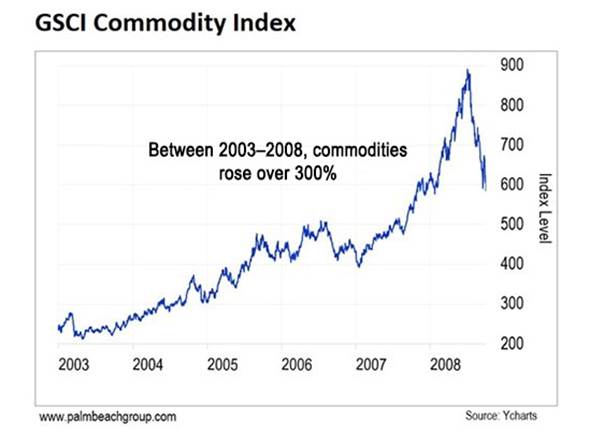

A commodities “supercycle” can happen in the late stages of an economic expansion, where growth is running so hot that companies can’t produce enough commodities to keep up with demand. The last commodities supercycle was between 2004 and 2008. From the bottom in 2003 to the peak in 2008, commodities rose over 300%.

So where are we now? The popular narrative is that the great “commodity supercycle” of the 2000s collapsed in the Great Recession of 2008, then resumed from 2009 to 2011. The supercycle ended in the bear market of 2011-15, and we have only seen commodities recover since 2016, or so it goes.

The problem with this argument is it assumes a complete reset of commodity prices. In fact this hasn’t happened. The prices of copper and other base metals, gold and some agricultural commodities have indeed fallen from 2011 heights, but not to below 2002-03 levels.

Some, like Seeking Alpha contributor Geoffrey Caveney, believe that the commodity supercycle is far from over; rather, it’s been “put on pause” and is about to take off again. In a June 2018 commentary he writes:

I argue that the “Commodity Supercycle” has a lot more to do with industrial and base metals in particular, since the trend was driven predominantly by China’s massive consumption of industrial raw materials in its construction and infrastructure building boom of the 2000s.

The bottom line is this:

Copper, other base metals, and iron ore are the true heart at the core of the Commodity Supercycle boom.

The boom was driven predominantly by China’s voracious consumption of industrial raw materials in its construction and infrastructure building boom of the 2000s. Above all, this required massive amounts of copper, steel, iron ore, zinc, lead, and nickel.

Most people in the market think the Commodity Supercycle ended with the bear market of 2011-2015. I disagree. I think the supercycle merely got put on pause for a few years. And I think it “unpaused” in 2016: the copper and base metal rally we have seen in the past couple years, is the first step in the resumption of the Commodity Supercycle.

Where’s the evidence? Caveney points to the record amount of copper that China imported in spring of 2018 – more than at the height of the supercycle – driven by the country’s ‘Belt and Road Initiative’ aimed at creating a huge infrastructure supply chain from over a hundred countries, all feeding into new Chinese bridges, roads, ports, dams, etc. And we haven’t even begun to supply the amount of copper needed for electric vehicles which promise to demand as much or more of the red metal currently used in construction, transportation and communications.

Casey Research has a bit different take on the timing of commodities. Looking back at what happened in 2004-08, author Nick Rokke believes that the three tailwinds necessary for a commodities bull market – strong global growth, rising inflation and the expansion of credit in the United States – are back again.

First, while in 2004 all but one of the 35 countries in the OECD showed accelerating GDP growth, currently all 35 countries do. Bloomberg graphed what global growth will look like in 2018-19, and 2022-23. Of interest is what happens to China, India and the US. While China contributes the most to global growth in both charts, it begins to pull even farther away from the US in the 2022-23 chart. In 2018-19 the US and India are pretty close, but in the early 2020s, India contributes nearly twice to global growth as the States.

Second, inflation is on the rise again. While the current US inflation rate of around 2% is within the range of the Federal Reserve, there was no inflation in 2015. Inflation is bad for bonds, but good for commodities, since price rises tend to float all boats, including commodities.

Third, an expanding economy requires credit. When the US economy is expanding, as it is now, people and businesses borrow more money, which is used to buy products. Those products are made from commodities, meaning demand for them increases, as do their prices. Critics might argue that in 2004 total US credit grew by 10% versus the current measly 3.5%, with the difference accounted for by the early 2000’s housing boom, but as Rokke maintains, “any time credit expands, it’s good for the overall economy.

“These three conditions generally line up near the end of an economic cycle. And we’re in the “melt-up” phase—or late stages—of the current bull market. The conditions are now ripe for another supercycle in commodities.”

Dave Forest, also of Casey Research, writes that a coming “Business Inversion” will be great for commodities. What does this mean? It means that when the business cycle expands, making companies profitable and growing their dividends, commodities tend to suffer. The chart below compares historical dividends paid by the stocks making up the S&P 500 index, to the value of commodities measured by the CRB index. During periods of business expansion, the ratio declined.

Forest writes:

During each of the last four business expansion cycles, the ratio of commodities to dividends dropped – showing that as dividends were rising, commodities were also falling.

But… once the business cycle ends and stocks start to suffer, commodities take off – you can see how rising commodities lifted my ratio during each of the commodities booms (blue bars) that followed periods of business expansion.

I call this point the “business inversion.” And it may be the most profitable pivot you can make in your portfolio this decade.

If you’re not yet invested in commodities, now’s the time. A resurgence is underway… and it’s shaping up to be the biggest bull market I’ve seen in my career.

It appears that Forest is onto something here, when we look at the two main commodity indices, the S&P GSCI (GSG) and the Thompson Reuters/Core Commodity Index (CRB). While it’s early days, both show an uptick starting in the New Year.

2 Lower dollar/ Fed loosening. A weak dollar usually means stronger commodities prices. Because the USD is the reserve currency and commodities are traded in dollars, the value of the dollar is of crucial importance in determining the value of the commodity in question. Take the case of a low dollar. When the dollar drops it takes less of another currency to buy dollars needed to purchase the commodity, so the demand for that commodity will increase. The inverse happens when the dollar strengthens.

As the dollar barreled along during the mining bear market of 2012 to 2016, commodity prices slumped. For most of the past year, however, the greenback gained strength against a basket of other currencies, with the US dollar index (DXY) rising from April until mid-December, as the chart below shows.

This is the opposite of US President Trump’s plan to keep the dollar low, in order to make exports cheaper. Trump wants to bring jobs back to the US after many were exported abroad to take advantage of lower labor costs, and therefore rebuild the US manufacturing sector.

What happened to keep the dollar high? It was mostly the purchase of US Treasuries, a safe haven. Foreign investors purchased some $26 billion of T-bills in May, for example, driven by fear of a trade war. Institutional and retail investors were also drawn to T-bills due to their higher yields which competed with the average S&P dividend yield.

The situation with the USD now however has changed. Since mid-December the greenback has fallen, due to doubts about the Federal Reserve’s ability to raise interest rates any further. While the Fed originally planned to raise rates four more times in 2019, after last year’s stock market rout, it is being pressured to hold the rate hikes to two, or possibly even none, as the economy recovers.

If the dollar continues to fall, and the Federal Reserve follows a looser monetary policy (ie. keeping rates low), it will be good for commodities.

There are other factors that could affect commodities to the upside. A resolution to the US-China trade war would accelerate the ongoing USD downleg, notes FXStreet, adding:

In addition, the rising dichotomy between the US solid fundamentals (favouring further tightening) and markets’ belief that some slowdown would be in the offing, in turn prompting the Fed to refrain from acting on rates this year, keeps fresh USD-buyers at bay and undermines any serious attempt of recovery in the Dollar.

3 Global infrastructure spend. Commodities are the building blocks of the infrastructure we all rely on for daily life. This includes roads, bridges, ports, railways, commercial buildings, fibre-optic installations, sewers, water lines, etc. Iron ore and coking coal are the chief ingredients in steel, copper is used in construction, telecommunications and transportation, and nickel is used to make stainless steel. Agricultural commodities feed the world and satisfy our modern-day tastes. Without staples like wheat, rice and corn, billions of people would die. Coffee, sugar and tobacco aren’t life or death, but doing without them would be a hardship for many. These are just a few examples.

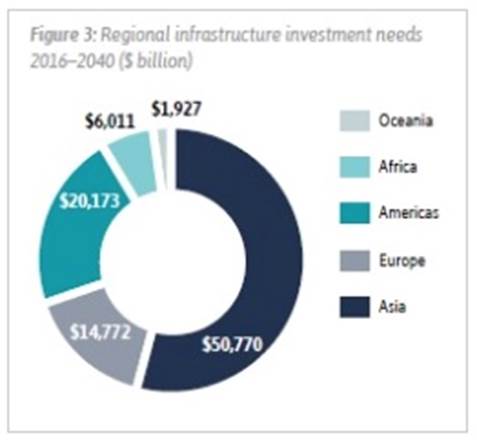

According to a 2017 report, an expected 2 billion rise in population (46% in cities) will necessitate $94 trillion in global infrastructure spending by 2040. That works out to $3.7 trillion a year – an amount equal to the annual economic output of Germany.

Three of the top five countries most in need of new infrastructure are in Asia: China, India and Japan. China, being the world’s largest commodities consumer, will need about a third of the total, $28 trillion. The United States will have the largest gap in infrastructure spending – $3.8 trillion – despite Trump’s campaign pledge to fix America’s crumbling cities.

Much of the Chinese demand will come from its ‘Belt and Road Initiative’ (BRI). The ‘Belt’ refers to a network of overland road and rail routes and oil and natural gas pipelines planned to run along the major Eurasian land bridges. The ‘Road’ is a network of ports and other coastal infrastructure projects, from Southeast Asia to East Africa and the Mediterranean Sea.

Taking copper as an example, BRI is expected to generate an extra 2.2 million tonnes of copper demand, between now and 2030. That’s about 10% of the total amount of copper mined throughout the world in 2017, 20 million tonnes (International Copper Study Group).

More spending on infrastructure means more mined commodities. More copper, iron ore, nickel, zinc, manganese, vanadium, lithium, graphite, rare earths, etc.

So, if we accept the reasoning that now is a good time to be getting into commodities, the next question is, which commodities?

Electrification

The most prevalent trend related to mined commodities is the shift, driven by climate change, away from the use of fossil fuels, towards the electrification of the global transportation system. Future Agenda, a non-profit think tank, identifies three reasons for the inevitable move away from the internal combustion engine (ICE) vehicle, to the electric vehicle (EV): total cost of ownership, brand commitment and political will.

Battery-powered electric vehicles versus hybrids or ICEs are already the cheapest option in the UK, with a subsidy, according to Future Agenda. This is because, while the up-front cost of buying an EV is more than a gas vehicle, owning an EV costs considerably less, over time, in terms of electricity use versus gasoline, plus the relative lack of maintenance in an EV engine.

Electric vehicles have far fewer moving parts than gasoline-powered cars – they don’t have mufflers, gas tanks, catalytic converters or ignition systems. There’s also never an oil change or tune-up to worry about. But the clean and green doesn’t end there. Electric drives are more efficient then the drives on ICE-powered cars. They are able to convert more of the available energy to propel the car therefore using less energy to go the same distance.

Auto manufacturers are increasingly investing in EV models. Just about all car makers are incorporating EVs into their production mix, and they are calling for public charging infrastructure to accommodate them. Volvo has banned the ICE, stating that this year, all models will be electrics or hybrids. Nissan, JLR, Daimler, BMW, Geely and BYD have made public commitments to EVs.

The last piece is the hardest to accomplish: political will. In North America a very small percentage of the auto market is electric, but elsewhere governments have made deeper commitments. Future Agenda states:

With a focus on more CO2 and NOx legislation in cities, Stuttgart, Paris, Mexico City, Athens, Madrid, Paris all banning diesel by 2030. Moreover, countries such as Norway, The Netherlands, France, Germany, UK, China and India have indicated they will ban cars running on fossil fuels.

At Ahead of the Herd we are invested in commodities that support the electrification of the transportation system. These include copper, lithium and rare earths, all of which are critical components of electric vehicles. By 2047, there are expected to be upwards of 1 billion electric cars on the road. All these EVs will need lithium-ion batteries containing lithium, graphite, nickel and cobalt, plus other mined metals that go into EVs, like copper.

Clean power

We are also bullish on uranium, since it will take a great deal more electricity to power all those EVs, which are estimated to be 35% of new vehicle sales in the US and around 75% of UK new vehicle sales by 2030. Natural gas and coal power plants spew greenhouse gas emissions and contribute to climate change. Renewables are great, but they are currently a niche form of power and still require fossil fuel-powered “peaker plants” (coal or gas-powered) to supply an adequate amount of power to electricity grids.

If we want to save the Earth – and the signs are everywhere that the planet is in trouble from warming surface and ocean temperatures – there is only one form of clean, stable, emissions-free power that we can do it with: nuclear.

Uranium

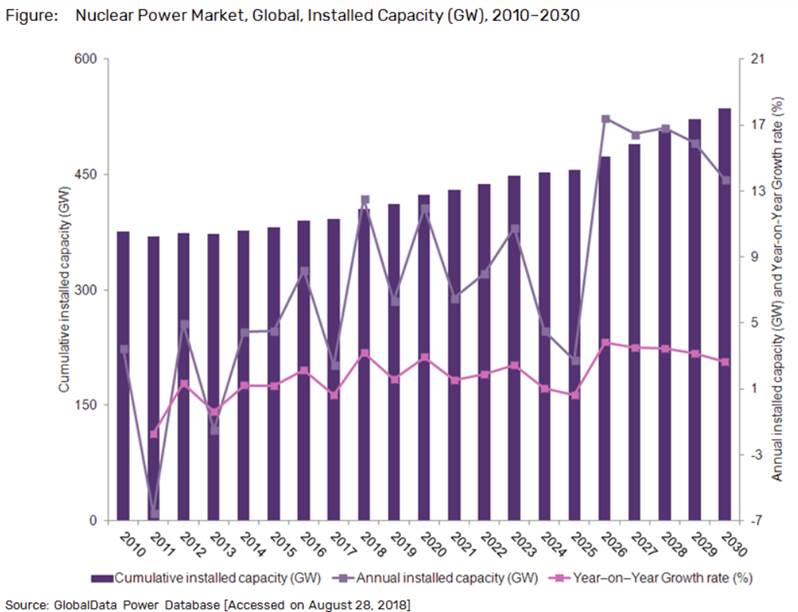

Demand for uranium is directly tied to the need for nuclear power, which is growing exponentially especially in Asia due to the problems with air pollution from coal-fired power plants. The global demand for electricity is expected to increase by 76% by 2030, and while everyone knows about the electric vehicle revolution, what is not often talked about is how will all that extra power be generated. Much of it will have to come from nuclear.

According to nuclear consultant UxC, the global capacity for nuclear power is expected to grow by 27% between 2015 and 2030. That means a whole lot more uranium. UxC estimates annual uranium demand will spike by nearly 60%, from the current 190 million pounds of U3O8, the nuclear fuel, to 300 million pounds by 2030.

While the uranium price has been suppressed since 2011 when it took a major hit due to the nuclear accident cause by the tsunami in Japan, things are looking up. Uranium supply has been steadily dropping since 2016. That year total mined supply was around 163 million pounds, in 2017 it was 154 million, and in 2018 it was under 135 million. With current U3O8 demand at 192 million pounds, that leaves a shortfall of at least 57 million pounds.

Where will this extra uranium come from? While production at big Canadian uranium mines McArthur River and Rabbit Lake have been suspended due to low prices (at current prices, about three-quarters of uranium mines are uneconomic) exploration is going full tilt in the Athabasca Basin of Saskatchewan, the world’s richest source of uranium ore – with junior miners anticipating the return of higher prices. The long wait might finally be over: uranium was the best-performing metal of 2018.

One of the most promising uranium explorers is Skyharbour Resources (TSXV:SYH). In 2016 Vancouver-based Skyharbour optioned the highly prospective Moore Project from Denison Mines.

The company also has a 50% interest in the Preston Project – one of the largest land packages (75,965 hectares) in the Basin – strategically located near Fission Uranium’s Patterson Lake South Triple R uranium deposit and NexGen Energy’s Arrow deposit, both of which contain high-grade uranium.

While Skyharbour is a top-tier uranium explorer, with the expertise to back that up, the company is also a prospect generator, meaning its strategy is to ink option agreements on its secondary properties thus allowing other companies to come in and incur exploration expenditures in return for earning stakes on those properties.

Skyharbour’s fall drill program at Moore discovered a new high-grade uranium zone, with most of the zone below the unconformity – the point where the sandstone meets the underlying basement rocks. That’s important because most of the highest-grade deposits discovered in the Athabasca Basin in recent years have been found in “the basement”.

A new 3,000m program will include more exploratory drilling into the basement rocks with the goal of adding high-grade uranium mineralization that can be plugged into a maiden resource expected to be published sometime this year.

Copper

While the copper price has lagged in recent months over fears of slowing Chinese growth and the US-China trade war, the market fundamentals are solid. Over 200 copper mines currently in operation will reach the end of their productive life before 2035. Most of the low-hanging copper “fruit” has been picked. New copper mines will be lower-grade and farther afield, meaning higher capex and production costs.

Demand for the “red metal” needed for construction (copper wiring), communications and transportation, is now being wired in, pun intended, to the electrification trend. Copper is an essential component of EVs. An average electric vehicle contains 85 kilograms of copper compared to 25 kg for regular vehicles.

That means copper demand is going to soar even higher than it already is.

Second, we are on the cusp of a major change in the copper market, where supply is not going to be able to keep up with demand. A supply deficit is expected as soon as 2020. There are already signs. Copper stockpiles at London Metal Exchange warehouses are at a decade low.

Without new mines to fill the gap, a 15-million-tonne deficit is expected by 2035.

If supply can’t meet demand that means one thing: higher prices. It also means that governments (and companies) will be scrambling to get their hands on new copper properties to meet the demand. Nothing less than their economic growth is at stake. Without copper, the construction, communications and transportation industries would grind to a halt. Maintaining a smooth supply chain is critical to growth.

Copper miners are on the hunt for new deposits that can help slow the inevitable decline of their aging mines. Consider this: we have seen a recent flurry of mergers and acquisitions (M&A) in the copper space. Barrick Gold, which took over Randgold Resources recently in a $6.1 billion deal, wants to get back into copper. And multi-mineral behemoth Rio Tinto is rumored to be setting up an offer for a minority stake in Teck Resources’ Quebrana Blanca copper mine in northern Chile. For more on M&A and the copper market read our Copper fundamentals still solid

According to Bloomberg, a survey of eight diversified major miners showed that copper is eating up an outsized share of their capital spending right now, just shy of $8 billion between June 2017 and June 2018.

A great place for major and mid-tier copper producers to look for new acquisitions is Canada. The country has a storied copper mining history, particularly in BC (copper-gold) and Saskatchewan (VMS deposits), ample power and water, and an experienced mining workforce.

We’ve identified a copper junior in Saskatchewan with a property well worth looking into. Rockridge Resources (TSX-V:ROCK) has an option on the Knife Lake Copper VMS project currently owned by Eagle Plains Resources (TSX-V:EPL).

The project is an advanced-stage copper, zinc and cobalt exploration property. Over 400 diamond drill holes have been completed. Characterized as a “remobilized VMS deposit,” Knife Lake has about a 15m-thick mineralized zone containing copper, silver, zinc and cobalt. It dips 30 to 45 degrees eastward over a 4,500m-long strike.

Rockridge’s option agreement with Eagle Plains was recently approved by the TSX Venture Exchange.

Flush with over $2 million in its treasury, Rockridge is planning a $700,000 drill program to begin in February or March. The program will focus on confirmation drilling as well as expansion drilling and some exploratory holes. This will provide ample news flow for the first half of the year.

Lithium

Arguably, lithium is the most important metal for electrification. As the main ingredient in lithium-ion batteries necessary for EVs, a steady supply of lithium for battery-makers and auto manufacturers is going to be crucial. This is why we’ve been following the lithium market for going on a decade, ever since former President Obama announced, in 2009, $2.4 billion to support “next generation” electric vehicles.

Like copper, lithium is setting up to be in a deficit – despite the lithium bears thinking that new supply will overwhelm demand as EV manufacturing goes bonkers. We know this to be false. To learn why read our Why the lithium bears are wrong

Approximately 215,000 tonnes of lithium carbonate equivalent (LCE) was produced in 2016. Chile was the world’s largest producer with 37%, followed by Australia with 34%. By 2025, if a very reasonable 30% of mining projects come to term, 700 kt LCE will be produced. Australia will supply 45% of world production at this time; Chile and Argentina will each supply 15%, China 10%, and the rest of the world 15%.

According to Roskill’s 15th edition market outlook report, demand from companies that produce batteries to power electric cars, laptops, cell phones, etc. is expected to increase 650% by 2027, with overall lithium demand forecast to more than triple over that period. Electric vehicle lithium-ion battery pack manufacturers’ share of the market for lithium-ion batteries will grow from 46% in 2017 to 83% by 2027.

Use of lithium hydroxide will increase from 25% of lithium compounds used in rechargeable batteries in 2021 to 55% by 2027.

The Chinese vehicle market is on its way to 38.2 million units sold in 2025 (equal to 52% of global volume growth over that period). By 2030, 40% of vehicle sales in the region will be EVs. The European car market is likely to expand by 2.5m units by 2030 to reach 23.1m units annually with a roughly 30% penetration of EVs by that time. The US will lag and only 16-21% or 2.6m–3.5m of sales in 2030 is likely to be electric.

It is in this context that a new US lithium mine is being proposed next to Albemarle’s Silver Peak Mine in Clayton Valley, Nevada. The timing is excellent. Silver Peak, the only American lithium mine, failed to increase production 2012-16 and its lithium grades are rumored to be dropping.

Cypress Development Corp (TSX-V:CYP) has discovered a different type of deposit than the usual brine or hard rock lithium deposits, which must either be mined using drill and blast methods, or pumped into shallow ponds and allowed to evaporate, allowing lithium carbonate to settle out.

In just two years Cypress has gone from exploring its Clayton Valley Lithium Project, resulting in a monster resource estimate, to releasing an attractive PEA last fall.

Cypress is working to derisk the project, which features an Indicated Resource of 3.835 million tonnes LCE (lithium carbonate equivalent) and an Inferred Resource of 5.126 million tonnes LCE.

The metallurgy for extracting the lithium from claystones is currently being perfected; the results are expected to form a key piece of the upcoming prefeasibility study.

While there are risks to the project, the upside is massive: Cypress has more than enough to supply America’s current lithium needs, and then some.

Rare earths

The rare earths needed for electric vehicles are neodymium and praseodymium – used for making the magnets in electric motors and generators. Rare earth elements are also used in renewable energies like wind turbines, smart phones, and a plethora of defense applications.

China typically supplies about 80% of the global rare earths market, or 156,000 tonnes. The only supplier outside China right now is Lynas Corp, which mines REEs from its Mount Weld Mine in Western Australia and processes them in Malaysia. Molycorp operated the Mountain Pass Mine in California up to 2015 when it closed due to low rare earth prices. It has since restarted after being sold to a US-led consortium out of bankruptcy, but does not yet process the rare earths on US soil – instead sending them to China. The consortium plans to rectify that in the near future. Still, it doesn’t change the fact that the US is almost 100% dependent on China for its REEs.

Rare earths are central to the whole spectrum of defense technologies that are vital to every military. Without them, countries would be unable to produce much of the military hardware and equipment required for national defense. In most case there are no substitutes.

Rare earth exploration stocks went on a tear from 2010 to 2015 after China restricted its exports of REEs. They abruptly crashed after China was forced by a World Trade Organization ruling to lift the restrictions. That resulted in a torrent of Chinese rare earth exports into the market and the inevitable collapse in prices.

Today, however, the rare earth market is building up again, thanks to new restrictions on Chinese supply and a more acute need to take away the Chinese monopoly and re-gain control of elements critical to national defense.

Last week it was reported that the Chinese government published new guidelines designed to eliminate illegal mining and encourage more high-end processing. Those sterile words are code for “less polluting”. The process of extracting rare earth oxides from ore and refining them into useable products has come at a high price to the environment in China.

Could this latest crackdown be China’s attempt to manipulate the REE market again? We can almost certainly bet on it. But we have another factor that could play into a rare earth revival, and that is a new high-tech arms race that is developing between the superpowers.

Donald Trump’s threat to withdraw from the 1987 INF Treaty with Russia may be the catalyst that starts a new arms race between the United States, Russia and China as each projects military power in defense of spheres of influence outside their borders.

An arms race requires rare earths – something the US is in very short supply of. Not only that, the United States is dependent on China for the mining and refining of rare earths it needs to expand and modernize its military.

Fortunately, we have a company that could help with that problem. First Legacy Mining Corp, now Defense Metals Corp (TSX-V:DEFN) after a name change, entered into an option agreement with Spectrum Mining Corp, for its Wicheeda Lake claims, in November 2018.

Wicheeda Lake is a very attractive light rare earth deposit.

This deposit is less than a two-hour drive from Prince George, BC, a major logistics center. Roads run right to the deposit. It has power, water and a rail yard very close by. It also has access to workers who are experienced miners and others experienced in chemical handling.

We think this is the perfect Rare Earth/Niobium deposit. It has exceptional mineralogy, easy metallurgy and location, location, location. It has all the infrastructure necessary for a very low capex (capital expenditure) to be put into production. And the timing couldn’t be better; the US and Europe are both overwhelmingly dependent on their REE supply from China and are looking to correct that problem.

Rare earths were included in a list of 37 minerals deemed critical to national security and economic prosperity, as part of an executive order issued by President Trump in late 2017. The order is “A federal strategy to ensure secure and reliable supplies of critical minerals.”

Gold

Gold isn’t important for electrification of transportation, but we continue to follow, and be bullish on, gold juniors, since they offer the best leverage to a rising gold price.

Since the stock market rout began in September, gold has seen a bump – gaining 9% between its 2018 low of $1,175.29 on August 14, and Tuesday’s spot price of $1,284.80.

The metal has also been helped by speculation that the US Federal Reserve will either hold off raising interest rates in 2019, or limit them to two raises. Higher interest rates push gold prices down, since investors prefer to park their money in bonds and other income-yielding instruments rather than gold, which pays no dividends.

The gold price is up, but investors are also grabbing as much paper gold as they can. According to the World Gold Council, holdings of gold exchange-traded funds (ETFs) were up 3% in 2018, with December being the third straight months of net inflows (more gold ETFs bought than sold).

It’s interesting to note that outflows from North American gold ETFs caused by a strong US dollar throughout 2018, were more than offset by inflows to European gold ETFs, due to concerns over Brexit.

Central banks are also backing up the truck and loading up on gold. Bloomberg reports that after a two-year hiatus, China is again adding to its gold reserves.

According to HSBC, fresh safe haven demand due to continuing concerns about equities, along with higher volatility and economic uncertainty, will push gold higher in 2019, proving that contrary to some opinions, gold is still a safe haven.

Out of the hundreds of junior gold stocks hoping to drill a discovery hole, we’ve chosen Aben Resources (TSX-V:ABN). The Canadian company has three separate projects on the go: Forrest Kerr in the “Golden Triangle” of northwestern BC, the Chico Gold Project in Saskatchewan, and the Justin Gold Project in the Yukon.

Last summer Aben focused on Forest Kerr, located right in the middle of the historic Snip and Eskay Creek mines. Drilling in the North Boundary Zone, discovered at the end of 2017’s drilling season, intersected multiple high-grade zones and precious metal values, near surface. The highest-grade zone assayed at a whopping 331 grams per tonne (g/t), or 9.65 ounces per tonne, over 1.0m, within a broader zone of 38.7 g/t over 10m.

Aben should have a very strong and early as possible start on Forrest Kerr this year. They have a lot of information to compile over the winter, five-year drill pad and drilling permits have been received, and money is in the till for their 2019 exploration program.

This is also expected to include drilling at Chico in Saskatchewan, and Justin in the Yukon. It’s important to note that unlike a lot of Canadian gold explorers, Aben is not only a winter play; it has turned into a year-round play with three very good projects.

Conclusion

After an ugly end to 2018, stock market investors are understandably cautious in where they go next. Despite a better start to the markets in 2019, there is still a lot of uncertainty. But investors can get behind a good narrative, and we believe the theme for 2019 is commodities.

We have pinned our thesis on three key points: 1/ Commodities are cyclical, and the timing is right to get in now; 2/ The US dollar is falling, and will likely continue to fall or be range bound going forward. A resolution to the trade war between the US and China, and a looser monetary policy by the Federal Reserve (both of which are likely) would weigh on the dollar and be good for commodities; 3/ The need for infrastructure spending is not going to let up. Despite the Chinese economy weakening, Beijing will continue to demand iron ore and base metals for its Belt and Road Initiative and other ambitious megaprojects. India and other developing nations are also in the mix.

The electrification trend we outlined as key to our investment thesis calls for a slew of battery metals – lithium, graphite, nickel and cobalt – along with tonnes of rare earths and copper. And we haven’t forgotten about how we’re going to get all that extra energy needed to make the shift from fossil fuels to electric vehicles: nuclear energy. For this we need uranium.

Put it all together, and 2019 looks to be an excellent year for commodities.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Aben Resources (TSXV:ABN).

ABN is an advertiser on his site aheadoftheherd.com

Cypress Development Corp (TSX.V:CYP) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares in CYP.

Defense Metals (TSXV:DEFN) is an advertiser on Richard’s site aheadoftheherd.com

Rockridge Resources (TSX-V:ROCK) is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares in ROCK.

Richard owns shares of Skyharbour Resources (TSXV:SYH). SYH is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.