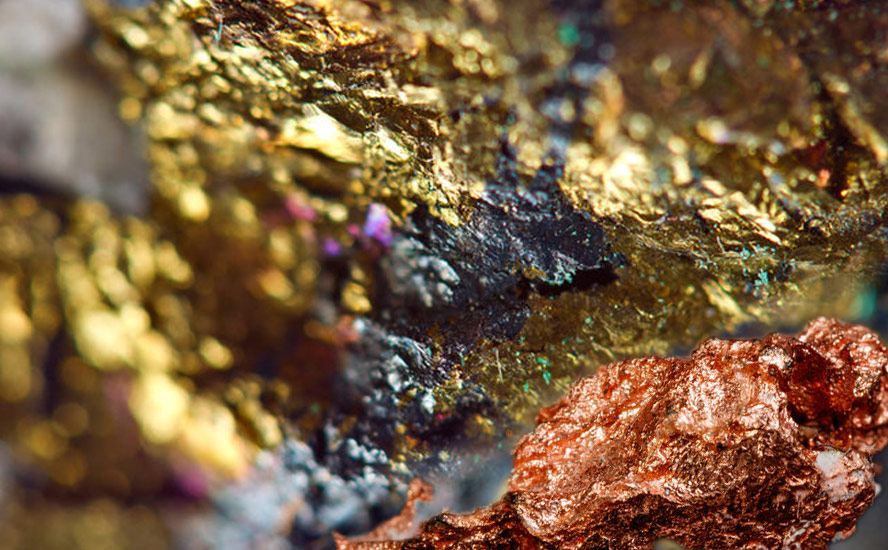

Gold Mining Market (2025 – 2033)

From Grand View Research

This price is heavily influenced by macroeconomic factors such as inflation, interest rates, and currency fluctuations, particularly the strength of the U.S. dollar. During periods of high inflation or economic uncertainty, investors flock to gold as a traditional store of value, driving up its price. A higher market price for gold directly increases the profitability of mining operations, making it economically viable to exploit lower-grade ore bodies and finance capital-intensive exploration and development projects in more remote or challenging locations. This price signal is the fundamental engine that powers investment and expansion within the sector. In 2025, global mine production stayed near the usual range of around 3,500 tons, and the distribution of this output shows how much the market depends on a few powerful producers. According to World Gold Council production updates, China mined about 380.2 tons of gold in 2025, while Russia followed with close to 330 tons. These two countries alone account for a major share of global supply, and their consistent production encourages mining companies across the world to keep expanding exploration and refining strategies to remain competitive.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.