Cannabis space green shoots not what most think

2019.04.09

As signs of spring emerge in the Great White North, green shoots are also poking through the landscape from companies eager to supply the rapidly growing North American market for cannabis products.

This market involves everything from transportation, packaging, retail stores, cafes, and smoking paraphernalia, to oils, creams, greenhouse products and testing equipment. There will also be a greater need for investment banks and other lenders who can help cannabis companies to leverage their businesses.

The cannabis supplier market has so far been overlooked by retail investors, most of whom have gravitated towards the big licensed producers like Canopy Growth and Aurora – growers that saw huge gains in the lead-up to legalization last fall.

Looking forward though, will the big grow houses continue to spark investor interest? At Ahead of the Herd, we don’t think so. While large Canadian licensed producers will do well, the smaller ones will struggle, leading to a shake-out much like we saw in junior mining from 2012 to 2016. We see opportunity around the edges of the market, in niche sectors that won’t get clobbered from competition down south.

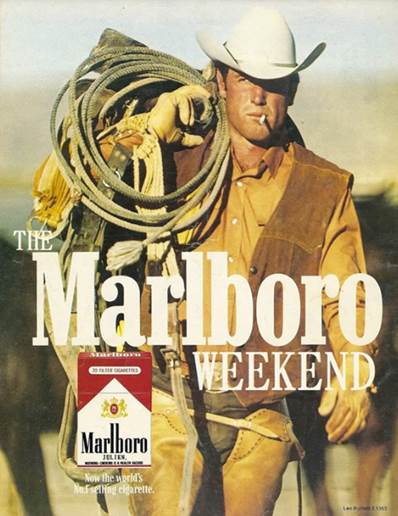

Indeed, marijuana producers in Canada “ain’t seen nuthin” if and when cannabis is legalized in the US at the federal level, and pot is opened up to Big Tobacco companies, who are experts in consumer product marketing. Think of “The Marlboro Man”.

This article will take a look at trends in this emerging sector and offer a few examples of companies with some bright ideas.

Next wave

“To me, that’s the next wave we’re going to watch, is the evolution of the way the industry gets serviced,” Dan Barclay, head of BMO Capital Markets global investment and corporate banking, was quoted in the Financial Post.

The marijuana-friendly Canadian bank is reportedly paying attention to the distribution system for cannabis, which fits with a report last fall from DBRS, a ratings agency, that predicts “new participants will enter the industry at different stages of the supply chain.”

LP stocks stagnant

Last September was the time to own, and sell, pot stocks. If you’re still hanging on to yours, I’m afraid you’ve missed the peak. One of the largest cannabis producers, Tilray, reached a market cap of $20 billion – more than companies in the S&P 500 – before massive selling wiped all those gains out a week later. Canopy Growth and Aphria also hit their all-time highs last September. For Aurora, October was the pinnacle of its chart. All of these stocks saw steep drops to December. They’ve since come up a bit, but the bubble appears to have popped. Licensed producer (LP) stocks have stagnated.

Perhaps a bit late, pot investors should have heeded the warning of Mitch Goldberg, president of investment advisory firm ClientFirst Strategy, writing a column about cannabis investing published Sept. 24, 2018 on CNBC.

In it, Goldberg states that “pot is a commodity” like any other, meaning the profits will go to the best growers. Failing to produce a marijuana crop at reasonable cost carries the same consequences as farmers whose orange crop fails or a coffee grower whose production costs exceed the selling price. “No company can escape the ups and downs of its input costs, whether that is agriculture or mining products,” he writes. “Why would cannabis-related companies be able to avoid the same issues?” Pot is also subject to booms and busts. Too much supply will cut the price, and vice versa, something Canadian pot consumers have yet to see here.

Big brand menace

Anybody who has watched the Netflix series ‘Madmen’ understands the power of the US tobacco industry. The fictional advertising firm Sterling Cooper’s anchor client is Lucky Strike. When the iconic American cigarette maker suddenly announces it won’t be renewing its contract, the firm is in deep trouble.

For decades, despite the Surgeon General’s warnings, Big Tobacco ruled the advertising roost. These days, the tobacco industry is struggling, with most of the developed world spurning the cigs and cigars. In North America, the trend is towards pot, and with legalization in 11 states and whisperings of a relaxation of federal prohibition, big cigarette makers are salivating.

They know that the cannabis industry, both in Canada and the US, has a problem: consumers don’t buy brands, they buy weed strains. What matters is the kind of marijuana, not the name on the packaging. In fact, few consumers even know, or care, who grew the product they’re about to smoke.

A survey taken on the day recreational marijuana was legalized, last October, found 95% of Canadian customers were “unaware of the brands they had just purchased.” This must partly be due to the fact that the Cannabis Law in Canada restricts how much the product can be marketed.

However even in the US, the land of unfettered capitalism, research says most Americans still buy weed from friends or dealers. Ads in legal marijuana states are often confined to roadside billboards, according to Investor’s Business Daily, which adds, “To stand out, top marijuana companies are turning to sleek packaging, cute names and even celebrities like Martha Stewart.” Something that cannot be done in Canada.

They’re all trying to reserve a position in the US cannabis market, which if full federal marijuana legalization kicks in, could be worth $80 billion by 2030.

How will such a behemoth of an industry look? Macquarie, the Australian bank, stated last November it’s likely to come down to a few key players.

“Since cannabis and hemp are ingredients, we believe the sustainable value will be in branded products and that brand building will be costly and unpredictable,” the Macquarie analysts said. Who has the deep pockets to accomplish such brand building? Big Tobacco.

Other than the multi-billion-dollar opportunity in branding cannabis products, these large cigarette companies have other reasons in doing so. Marketwatch lists seven, including declining sales.

Tobacco companies have large distribution networks already set up to target smokers and could easily switch to cannabis customers. Big Tobacco is also an expert lobbyist, and good at navigating regulations – something pot companies are still grappling with.

The popularity of smoking cigarettes has waned considerably, while marijuana is likely to see explosive growth. The health risks of cannabis are increasingly seen to be less than tobacco.

A recent Quebec Court of Appeal decision that went against Canadian subsidiaries of three large tobacco companies – ordering them to pay smokers about $17 billion in damages – is motivation to reduce their exposure.

Read an article by BNN Bloomberg to learn how Big Tobacco is diversifying into e-cigarettes and cannabis, including Altria Group’s $2.4 billion investment in Canadian cannabis producer Cronos Group, for a 45% stake. Altria, parent company of Philip Morris, is best known for Marlboro cigarettes.

Another key point about the challenges Canadian licensed producers face in gaining North American marketshare, is the government not willing to get out of the way. Unlike US states, the Canadian government is maintaining a vice-like grip on the way pot and pot products are produced and distributed.

And Canadian marijuana companies’ first-mover advantage (as the first G20 country to legalize) has been eroded by the Toronto Stock Exchange.

The TSX will delist any Canadian company with marijuana dealings in the US, due to the federal prohibition on cannabis. This puts Canada’s publicly traded licensed producers, and any other TSX-listed firm with a marijuana-related business, at a disadvantage to American companies, who can operate freely in Canada.

“It’s probably fair to say that Canadian operators are being hamstrung by policy,” George Allen, president of Acreage Holdings, a U.S. cannabis investment company listed on the Canadian Securities Exchange, told the Financial Post in a January article. “I respect what my peers in Canada have built in terms of footprint and scale, but in terms of its relevance to the U.S. market, especially once we’re federally legalized, they might as well be growing tomatoes.”

Regulation: blessing and curse

Goldberg, the above-cited CNBC author, advises clients not to underestimate the power of regulators, particularly with respect to cannabis products geared towards consumers versus medical marijuana patients.

“Alcohol and cigarettes certainly are regulated. You can’t even buy Sudafed without showing your ID to the pharmacy. Regulatory uncertainty in this market should remain a headwind for a long time,” he writes.

A headwind for some companies, a tailwind to others.

For companies that make consumable cannabis products like edibles and infused drinks, getting their product sold in the US could prove daunting. Even if the US government bends to full legalization, it seems extremely likely that any new cannabis products will have to be passed by the Food and Drug Administration (FDA), the USDA Food Safety and Inspection Service, etc. To think otherwise is just being naive.

Companies that manufacture and market equipment, or provide services, that will assist companies to overcome the expected onslaught of regulations that would accompany full legalization, would of course stand to benefit. This includes makers of cannabis test kits, and equipment that helps growers, distributors and retailers to meet federal standards.

As stated at the top, we at Ahead of the Herd believes the best investment opportunities in the cannabis space will come from small companies operating in niche sectors.

4 new players

3 Sixty Secure Corp delivers security solutions for the cannabis, law enforcement, oil and gas, mining, government and industrial sectors. 3 Sixty transports about $250 million worth of product a month and has expanded to serve more than 60 licensed producers in Canada.

FluroTech (TSX-V:TEST, OTCQB:FLURF) is the first-mover in cannabis testing with disruptive spectroscopy analytical testing devices. The company’s revenue model involves selling testing devices to licensed cannabis producers, retailers, companies that do drug testing, and law enforcement agencies. FluroTech was recently nominated for Best Testing Facility. The winner will be honored at the 2019 O’Cannabiz Awards Gala, April 25 in Toronto.

Vitalis provides a safer, cleaner way to extract plant oils using carbon dioxide. Based in Kelowna, BC, Vitalis’ pressure equipment meets ASME and CSA standards for boiler, pressure vessel and pressure piping code, and carry CRN and NB registration numbers as confirmation. Vitalis was awarded Top Extraction Equipment at both the 2017 and 2018 LIFT & Co. Awards.

Remo Nutrients provides plant feeds containing vitamins, minerals and extracts that help plants to achieve their maximum growth potential. Based in Maple Ridge, BC, Remo Nutrients has eight product lines that can be used in soil, soil-less and hydroponic settings.

At Ahead of the Herd we think the ‘green shoots’ in the cannabis space, the investables, are not what most believe. Canada’s rules/ regulations versus full legalization in the US with value added from marketing experts ‘BIG TOBACCO’ make it no contest. We believe, at least for Canadian listed companies, the future isn’t in being a regulated to death pot farmer but being a first mover operating in a niche sector where demand for your product or service can truly go global.

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

FluroTech (TSX-V:TEST, OTCQB:FLURF) is an advertiser on Richard’s site aheadoftheherd.com.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.