Aben starts drilling at Yukon play

2019.06.13

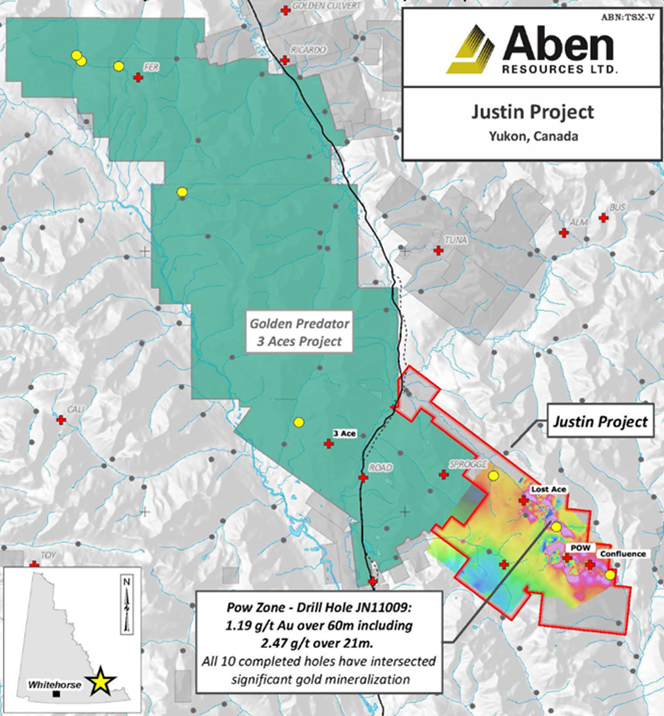

Drilling has commenced at the Justin project in the Yukon – one of two gold properties being worked this summer by Aben Resources (TSX-V:ABN).

Up to 10 holes (1,350m) of drilling is planned for the POW Zone, to further test the intrusion-related gold system. Back in 2011-12, drill crews unearthed intercepts at POW ranging from trace values to highs of 1.19 g/t Au over 60.0 m (including 2.47 g/t Au over 21.0m) and 1.49 g/t Au over 46.4m.

The second phase of drilling at Justin will target the Lost Ace Zone, where 2018 trenching returned gold values ranging from trace to 20.8 grams per tonne (g/t) gold over 4.4 meters, including 88.2 g/t gold over 1.0 m. Lost Ace is just two kilometers west of the POW Zone, discovered in 2010.

Aben has already completed its first hole at Justin and is working on the second. The plan is to diamond-drill the POW Zone with holes up to 250m deep.

When the rotary air blast (RAB) drill arrives, the small, mobile unit will explore the Lost Ace Zone – punching in 20 holes, 50m deep. A RAB drill is considered to be a cost-effective tool for quickly evaluating surface and near-surface gold mineralization. It is often used as the next level of exploration after trenching.

For more details read the June 10 news release

The gold-bearing vein system, discovered by Aben in 2017, occurs in a geological setting that is very similar to mineralization present on Golden Predator’s (TSX-V:GPY) 3 Aces project, located immediately northwest of the Justin claim group.

The 2,000m drill program at Justin will involve 1,350m of diamond drilling and 600m of rotary air blast drilling.

According to Aben, Justin has the potential for both high-grade and bulk tonnage mineralization – epithermal, skarn and sediment-hosted – throughout a 3.5 kilometer by half a kilometer trend encompassing the Confluence, Main, Kangas and POW zones. The latter was drilled in 2011-12.

“It’s a classic intrusion-related gold system. You’ve got this younger intrusion coming up into the area, and it’s a massive area. Generally, you would get bulk tonnage from those,” CEO Jim Pettit said in an AOTH interview, comparing it to Kinross’ 4.3 million-ounce Fort Knox operation in Alaska, Golden Predator’s Brewery Creek mine, and the Coffee gold deposit in the Yukon. The latter owned by Kaminak Gold was acquired by Goldcorp in 2016 for CAD$520 million.

The theory Pettit and the team at Aben is operating under, based on geophysical survey results, is younger rock pushed its way up through older rock, resulting in a remobilization of mineralized fluids. Geologists call this “overprinting”. That would explain why there is high-grade “orogenic” gold at or near surface – up to 82 grams per tonne found during trenching, and why Golden Predator’s next-door 3 Aces property shows similar mineralization.

The reason for using the RAB drill is to test that hypothesis.

Exploration work at Justin is expected to take three to four weeks. After that, Aben will pivot west, to British Columbia’s highly-prospective Golden Triangle and its Forrest Kerr project.

Read more about Forrest Kerr at Aben drills targeting hi grade gold in Golden Triangle and Yukon

Healthy gold market

The action at the drill bit is taking place at the perfect time for the gold market. As we have written, there a number of factors in place that should support the gold price going into the summer.

They include disturbing numbers coming in about the US economy, signaling a recession is around the corner, such as the yield curve inversion, a weakening labor market even though unemployment is at record lows, and a US dollar that has remained relatively high, the US dollar index (DXY) trading within a narrow $4.00 range for the last year.

The latest bogeyman to come forward is the inflation rate, or more to the point, the lack of inflation. When the US Commerce Department reported the first-quarter inflation growth numbers at the end of May, they were surprisingly soft.

The personal consumption expenditures (PCE) price index, which is the index the US Federal Reserve goes by in measuring the country’s inflation level, was running at just 1% in Q1 – 50% lower than the Fed’s 2% target and the smallest increase in four years – due to slowing demand for US goods and services.

GDP also dropped a point, to 3.1% on an annualized basis, from the earlier 3.2%.

The inflation rate is a key indicator that the Fed rests its decision on whether to lower, raise, or hold interest rates steady. The Fed was previously going to keep raising rates in 2019 but has since paused the increases, taking a wait and see approach. Now the slowing economy has some analysts predicting a rate cut.

“The low inflation readings are likely to be persistent,” Yahoo Finance quoted an economics professor at Loyola Marymount University, California. “With both inflation and economic growth going in the wrong direction, the Fed is likely to cut rates later this year.”

Gold is unique for being both an investment commodity and a raw material used in jewelry, for example. In this way the precious metal is subject to the laws of supply and demand.

We know that gold buying in 2018 was very strong, especially from central banks which bulked up their foreign exchange and bullion reserves due partly to trade war fears. Demand is still robust, but for a different reason. According to Gold Focus, a consulting firm, gold consumption this year will be 4,370 tonnes, the most since 2015 and slightly more than 2018, 4,364 tonnes.

It predicts purchases of gold jewelry to rise 3% this year, driven by a 7% increase in India and 3% in China, the two largest markets for gold’s “love trade”. (vs the “fear trade” for investors who buy gold as a hedge against inflation and economic/ political turmoil).

Throw in safe haven demand such as the trade war, recent saber-rattling over Iran, and skirmishes between the US and China in the South China Sea, and you have the set-up for a buoyant gold price throughout exploration season.

That keeps existing gold investors’ powder dry and sparks the interest of would-be stockholders to look closely at a junior like Aben, which is mining the right commodity in the right jurisdiction at the right time.

I continue to watch Aben Resources closely and maintain my belief that Justin is a sleeper play that just might surprise… stay tuned.

Aben Resource Ltd

TSX-V:ABN Cdn$0.24.5 June 13th

Shares Outstanding 111.6m

Market cap Cdn$27.1m

Aben website

*****

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Aben Resources (TSX.V:ABN), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of ABN

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.