Aben drills targeting hi grade gold in Golden Triangle and Yukon

2019.04.03

Aben Resources (TSX-V:ABN) is prepping for what is sure to be a busy season of drilling at two highly prospective gold projects, one in northwestern BC and the other in the eastern Yukon.

Vancouver-based Aben has for the past couple of years been advancing their Forrest Kerr and Justin properties, and while the company has seen some great results at Forrest Kerr, this year will be different in that a plan is in the works for over a million dollars to be budgeted for Justin, which butts onto Golden Predator’s (TSX-V:GPY) 3 Aces project.

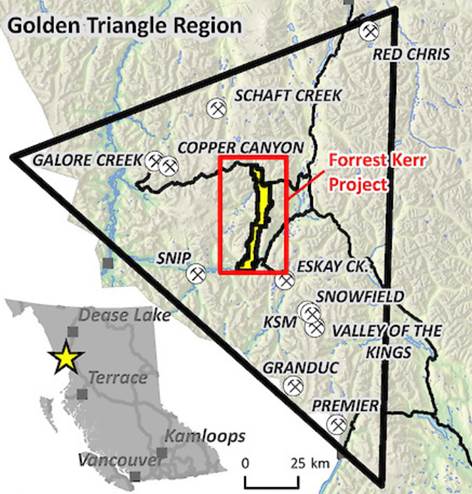

There will also be a renewed focus on Forrest Kerr, located in BC’s Golden Triangle smack dab between the past-producing Snip and Eskay Creek mines, where Aben is planning an initial 5,000 meters to follow up on last year’s expansion of the North Boundary Zone. The company has the opportunity to execute on a number of target areas thanks to the authorization of 40 new drill pad locations versus just nine in 2018.

For an overview of Aben’s exploration program this summer, view a recent video featuring Aben’s President and CEO, Jim Pettit.

Forrest Kerr

When Aben acquired the Forrest Kerr set of properties they came with a significant amount of exploration – 120 holes and about 20,000 soil samples. The most promising intersection was in the Boundary Zone hole, which returned 33.4 grams per tonne (g/t) gold over 11 meters including 326 g/t gold over 0.45m.

However, the high grades were not followed up on due to high drilling costs, limited accessibility, and glacier coverage in the Golden Triangle. Recent glacial recession and significant improvements to infrastructure – construction of the 335-km Northwest Transmission Line, a new three-dam hydroelectric facility (AltaGas’ Forrest Kerr, the largest run-of-river project in the province and an engineering marvel), and the paving of the Stewart-Cassiar highway north from Hazelton – have lowered exploration costs and made the project more accessible.

Aben was interested in the 23,000-hectare land package because of the Kerr fault – a large structural feature that is thought to be a significant gold source for Golden Triangle plays.

According to the corporate presentation:

Aben’s Forrest Kerr claim package …. consists of a 40 km long north-south belt overlying rocks of the Hazelton and Stuhini Groups, a complex assemblage of volcanic accumulations with intervening sedimentary sequences which are host to significant gold deposits in the Golden Triangle.

In 2017 Aben decided to begin exploring around the Boundary Zone, where the highest grades had been found. The results of a nine-hole drill campaign were extremely positive. Continuous mineralization was identified in the first three holes of the new North Boundary Zone. Highlights included 21.5 g/ t gold, 28.5 g/t silver and 3.1% copper over 6m; 2.91 g/t gold, 5.2 g/t silver and 0.6% copper over 14m.

Fast forward to last summer, when Aben hit a discovery hole early in the drilling season, by positioning the drill 35m northwest of the three 2017 holes (the North Boundary Zone) to investigate the possibility of mineralization at depth.

There was, and not just mineralization, but jewelry-box-style mineralization.

Featuring four high-grade zones all within 190 meters downhole, the highest-grade zone assayed at an impressive 331 g/t over 1.0m, within a broader zone of 38.7 g/t over 10m. Other results from the discovery hole included 22.0 g/t gold and 22.4 g/t silver over 4.0m, 4.0 g/t silver over 13.0m, and 8.2 g/t gold with 1.4 g/t silver over 6.0m.

Guided by chief geologist Cornell McDowell, Aben decided to test new ground 1.5 km south of the North Boundary Zone, going by soil geochemical anomalies and “elevated gold in rock and soil values that are coincident with an historic electromagnetic (“EM”) conductive geophysical anomaly,” the company stated in a news release.

Watch an interview with Aben’s VP Exploration Cornell McDowell

Restricted to one pad location/drill, the crew still managed to tap into mineralization that appeared similar to the three holes that defined the North Boundary Zone ie. containing ample chalcopyrite – the copper mineral – and gold pathfinder minerals.

The three collared holes (ie. drilled from the same pad in different directions) hit quartz-sulfide veins at various depths, with enough gold, silver and copper values to coin the new South Boundary Zone.

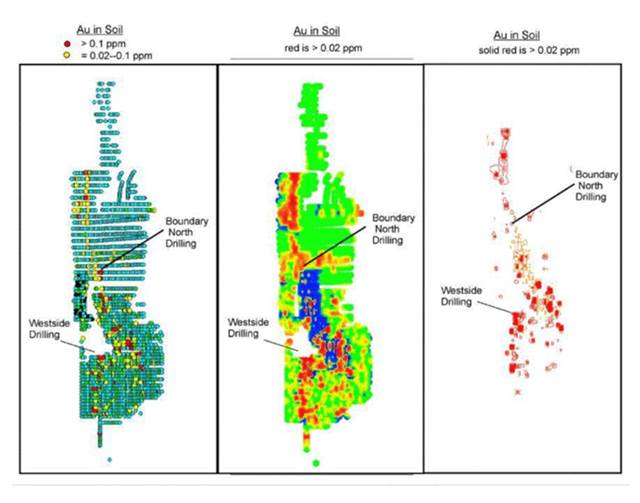

The rock pulled up from South Boundary has lower grades than North Boundary, but it’s still between 6 and 15 g/t, within broad intersections. That’s exciting for Aben, especially considering the soil anomalies light up like a Christmas tree as you move south, down the drainage. (see the “Au in soil” middle map below)

Here’s Jim Pettit, talking about Aben’s successful extension of the North Boundary Zone, keeping in mind that due to the handful of pad locations (9), Aben could only drill at so many angles, into the underlying mineralized structures:

“North Boundary only had three holes in it, now it’s got a lot more, over 20 holes. We’ve expanded it north and south, it’s elongated. A little bit to the east going uphill, not so much to the west going downhill towards the Kerr fault, but we do know much more about it. We’re using oriented core drilling, which is a technique to give us an idea of the orientation of what we’re looking at. We’re still very much looking at structure to give us an indication of what’s going on in that zone because it’s very complex.”

Aben’s 50-kilometer-long property runs along the Kerr fault, which acts as a major geological “engine” for the whole region, giving Aben tremendous discovery upside due to the amount of geological activity in the area.

The fact that the Kerr fault – a 40-km-long trend – transects Forrest Kerr is important, because it divides the Mesozoic stratigraphy (rock layers) to the east from the older Paleozoic stratigraphy to the west. The fault acts as a conduit for the hydrothermal fluids that rushed towards the surfaced due to volcanic activity.

Heavy dotted line is Kerr Fault. Lesser dotted lines are sub-faults and splays. Recent geologic studies by BC Geological Survey personnel concluded that most of the major deposits in the region occur within 2 km of the regional stratigraphic contact (the red line representing the Hazelton/Stuhini contact).

Aben is looking for “splays” that run off the Kerr fault, since these splays – which are like subsidiary faults that branch off the main fault – are known to host mineralization, sometimes with bonanza grades.

As for what’s in store for Forrest Kerr this summer, Pettit said that Aben will, now that they have 40 new drill pad locations, do extensive drilling in the South Boundary Zone to follow up on that 2018 discovery. Pettit also said that ABN has three targets that will be drilled in the North Boundary Zone (NBZ): An area north of the North Boundary Zone that has seen limited drilling based on good information; following up the 2017 and 2018 discoveries at the NBZ and drilling beneath the very high-grade ‘Noranda hole’ 230m south of North Boundary, drilled by Noranda in 1991, which hit an eye-popping 326 g/t gold and 10m of 38 g/t.

Regarding the Noranda Hole Pettit had this to say “We’d like to get in there and do what we did to the North Boundary Zone because that was extremely high grade when Noranda drilled it. I think there’s potential to go underneath and really hit something good.”

To further refine those 2019 targets, Aben is planning to first do an extensive airborne magnetic survey using a helicopter, and drones in specific areas. The survey is aimed at gleaning more information about Forrest Kerr’s large, complicated structures.

“There’s so many faults and fissures and fractures, are they all related to the Kerr fault? Absolutely. There’s a lot of sub-splays that have come off of that, and sub-faults. Getting a handle more on the orientation of those, is going to help a lot,” says Pettit.

Justin

In 2010 Aben Resources was picking up properties all over the Yukon. Aben and Eagle Plains Resources (TSX-V:EPL) let lapse most of them but hung onto one they figured was most prospective: Justin. The 7,411-hectare land package is contiguous to Golden Predator’s (TSX-V:GPY) 3 Aces project, which includes six mineralized areas that extend over a 35-kilometer gold trend.

According to Aben, Justin has the potential for both high-grade and bulk tonnage mineralization – epithermal, skarn and sediment-hosted – throughout a 3.5 kilometer by half a kilometer trend encompassing the Confluence, Main, Kangas and POW zones. The latter was drilled in 2011-12.

“It’s a classic intrusion-related gold system. You’ve got this younger intrusion coming up into the area, and it’s a massive area. Generally, you would get bulk tonnage from those,” Pettit said in a 2018 AOTH interview, comparing it to Kinross’ 4.3 million-ounce Fort Knox operation in Alaska, Golden Predator’s Brewery Creek mine, and the Coffee gold deposit in the Yukon. The latter owned by Kaminak Gold was acquired by Goldcorp in 2016 for CAD$520 million.

In 2017 ABN discovered the Lost Ace Zone which is just west of the POW Zone. The gold-bearing vein system occurs in a geological setting that is very similar to mineralization present on Golden Predator’s 3 Aces project, located immediately northwest of the Justin claim group.

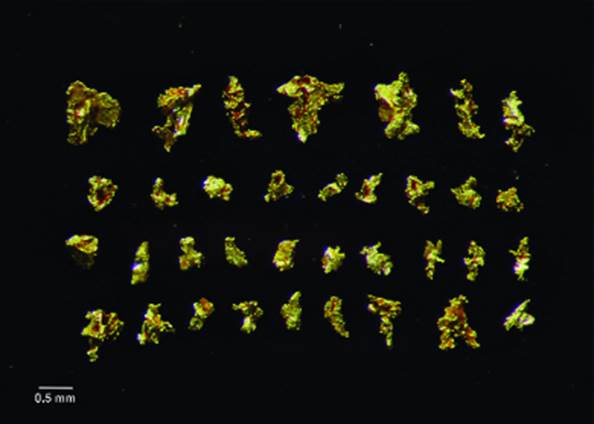

A 3.8-kg bulk soil sample collected for gold grain count analysis and classification from a location 115 meters upslope from Lost Ace returned 1,135 visible gold grains. Of the 1,135 gold grains recovered, 1,049 were classified as pristine – meaning the gold mineralization was likely carried to surface by the magma intrusion.

As seen from the image below, the gold grains are jagged versus smooth, indicating the gold has remained in place and not moved anywhere.

Last summer Aben completed a trenching program at Lost Ace whose results were posted in January 2019. The series of 250m-wide trenches delivered samples of mineralization that are remarkably similar to 3 Aces.

Highlights included 88.2 g/t gold over a meter, within 20.8 g/t over 4.4 m. “It is begging for drilling,” says Pettit.

According to Aben’s news release:

“Mineralization at Lost Ace is interpreted to be orogenic-style quartz-gold veins that bear a strong resemblance to and share similar geologic setting with Golden Predator’s adjacent 3 Aces Property. Previous exploration at Justin has successfully discovered Intrusion related sheeted veins & vein breccias along with gold bearing skarn mineralization. The new discovery at Lost Ace highlights the existence of a multi-phase hydrothermal system with the potential for overprinting mineralizing systems.”

Overprinting occurs when rock of different ages is jumbled together, meaning younger rock can end up on top of older rock.

That would explain the two distinctly different types of mineralization found at Lost Ace. Pettit explains:

“I think these two systems could be associated, where what we’re seeing at surface, is more like an orogenic high-grade vein system, brought up possibly from the uplifting of the older quartz veins by the younger magma intrusion. It could be some sort of an enriching event.”

To test that theory, Aben plans to bring in a rotary air blast (RAB) drill, a small, mobile drill that can explore the 250m area – likely punching in about 20 holes, 50m deep. A diamond drill will also follow up on the Properties best targets.

Conclusion

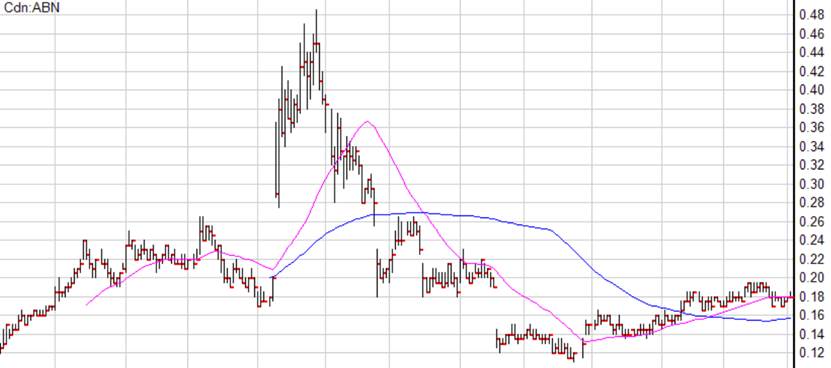

In early 2018 my readers were given an opportunity to get into ABN at a very good price (0.15). They had ample opportunity to ride the stock into the high $0.40’s, to reap their rewards along the way up, and on the way down as the top was recognized.

When Aben fell back to 0.115 in January of this year I said I liked it again.

I can’t wait to see what Aben uncovers through two exciting drill programs this summer. I’ll let readers know as soon as drilling starts, either at Justin or Forrest Kerr, and I expect plenty of news flow for investors to realize some nice share price gains:

- Results from Forrest Kerr’s new 5,000m+ drill program

- Possible connection between the North Boundary and South Boundary zones

- Results from Justin’s new +$1m drill program

- Potential for expanding the intrusion-related gold system

At Ahead of the Herd we believe 2019 is going to be an excellent year for ABN.

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as

to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Aben Resources (TSX.V:ABN), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of ABN

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.