Surge Copper: 3 great scenarios

2018.10.23

Earlier this year Gold Reach Resources changed its name to reflect a renewed emphasis on copper exploration in northwest BC, where a rich endowment of mineralization that has become home to some of the largest and most productive mines in the province – such as Premier, Snip and Eskay Creek. Other significant and well known deposits include Brucejack, Galore Creek, Copper Canyon, SchaftCreek, KSM, Granduc, and Red Chris.

The new company is now called Surge Copper (TSX-V:SURG), with its flagship project, Ootsa, located within the Skeena Arch, a geological trend on the southern edge of what has become known as “The Golden Triangle”.

Lately the Golden Triangle has heated up as an area play, led by Pretium Resources which put its high-grade Brucejack gold mine into production last summer. Garibaldi Resources came up with a surprising nickel discovery in 2017 as well, while other juniors such as GT Resources and Colorado Resources returned some good hits, which has put some lead back in the pencils of junior mining investors looking for good projects with compelling risk to reward ratios.

For more on the Golden Triangle, read Ahead of the Herd’s exclusive article focusing on “The Red Line”, which puts a new spin on the area’s geology.

What is special about Surge Copper is that the company really has three scenarios that could play out for it, which is more than can be said for many juniors who usually just have the one option of their company being bought out by a larger mining company, or one or more of its projects getting spun out.

The proximity of Surge Copper to the currently-shuttered Huckleberry Mine means it is an ideal takeout target for Imperial Metals should Imperial need more mineralization to feed its aging mine, which is estimated to have about five more years of minelife. However, Surge also has enough reserves for a stand-alone operation, which could either interest an investor wanting to partner with it if Surge Copper goes mining, or a major who buys the company outright. All three scenarios are good for SURG investors, who are bound to see a dramatic share price rise if any of these possibilities takes place. Before we get into these scenarios, let’s summarize what Surge Copper has so far in the ground, and what it expects to do during this summer’s exploration season.

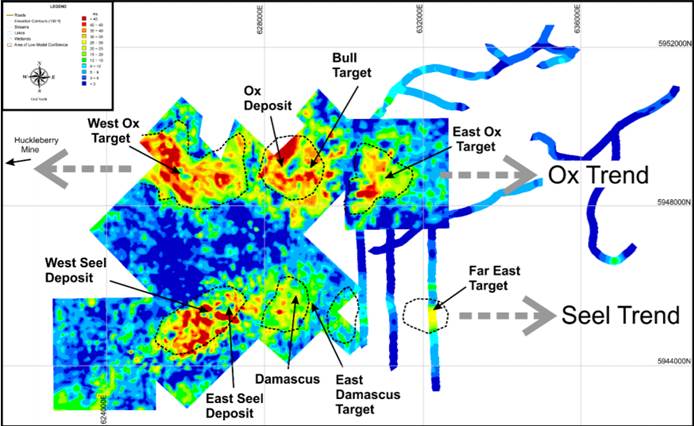

Ootsa

Surge Copper’s Ootsa property is an advanced stage copper-gold exploration project containing the East Seel, West Seel and Ox porphyry deposits. It is located adjacent to the Huckleberry open-pit copper mine owned by Imperial Metals. Surge Copper completed a PEA in 2016 showing the potential for a 12-year mine that would produce 324 million pounds of copper, 185,000 ounces of gold, 15.8 million pounds molybdenum and 3 million ounces of silver. A resource estimate done the same year shows 1.1 billion pounds of copper and over a million ounces of gold, in the measured and indicated categories. Exploration drilling in 2018 will focus on several copper-gold porphyry targets surrounding the East and West Seel deposits. The goal is “to create increased flexibility in future project development and help establish the viability of Ootsa as a stand-alone operation,” the company states. More on that later.

Geologically, the 72,710-hectare property consists of three distinct styles of mineralization. The Ox deposit is an 83 million-year-old porphyritic intrusion into sedimentary and volcanic rock. Around the margins of that intrusion are groupings of brecciation and stockwork veining that has formed a large disseminated copper-molybdenum deposit. Ox contains very similar mineralization to what has been mined next door at the Huckleberry Mine, owned by Imperial Metals, which shut down in the summer of 2016 due to low copper prices. Imperial also runs the Red Chris and Mount Polley mines in British Columbia.

The other two deposits are East Seel and West Seel. Both deposits are similarly-aged porphyries – a geological term that refers to igneous rocks containing large-grained crystals such as feldspar or quartz dispersed in a fine-grained silicate matrix. Unlike Ox, which is mostly copper and molybdenum, East and West Seel contain high levels of gold in addition to copper, with West Seel also containing appreciable molybdenum and silver. East Seel contains highly magnetic rock, with a magnetite association, and is similar to what you’d see in other copper-gold porphyries in BC such as Red Chris, Mount Polley or Copper Mountain, near Princeton.

Porphyry-style mineralization by definition is large and bulk-mineable, with a series of sulfide-rich veinlets often running through the rock. The material is either bulk-mined underground or in an open pit, where the ore is crushed and run through a flotation cell, which turns it into a concentrate.

East Seel is considered to be the deposit with the highest grades, where 40 to 50-meter intersections of nearly 0.75% to 1% copper grades have been assayed. Surge Copper’s goal is to better understand those high-grade trends and to extend some of them to depth.

Historical exploration

Just before the name change, Gold Reach Resources put out a summary of exploration done to date on the Ootsa property. In all, the re-named company has drilled over 122,066 meters of core and, as explained above, discovered three sources of mineralization, at Ox, East and West Seel. Enough near-surface mineralization has been discovered to construct an NI 43-101-compliant resource estimate of 224 million tonnes, measured and indicated. The resource contains 1.1 billion pounds of copper, a million ounces of gold, together with 104,000 pounds of molybdenum and 20.4 million silver ounces.

Drilling highlights include:

- 146.3 meters grading 0.51% Cu and 0.59 g/t Au from East Seel (Hole S13-148)

- 537 meters grading 0.27% Cu, 0.19 g/t Au, and 0.055% Mo from West Seel (Hole S12-118)

- 108.7 meters grading 0.44% Cu, 0.04% Mo, and 0.06 g/t Au from Ox (Hole Ox13-110)

In February 2016 the project was further advanced to a preliminary economic assessment (PEA), which envisioned a polymetallic mine that would produce, in total, 324 million pounds of copper, 185,000 ounces of gold, 15.8 million pounds of moly, and 3 million ounces of silver, over a 12-year lifespan. While still an early-stage exploration play, Surge Copper expects a fully-developed mine would produce at between 15,000 and 20,000 tonnes per day, around the same size as the Huckleberry Mine or Mount Polley Mine, in terms of milling rates.

2018 exploration

Surge Copper has plans to expand the current mineralized zones and its 2018 exploration plan involves exploring around the edges of the East and West Seel deposits. The goal is to add another 20 to 24 million tonnes to the current 224 million tonnes of M&I resource in the ground, which would enable Surge to comfortably run a stand-alone operation Ie. a mine that could function without any involvement from neighboring Huckleberry Mine.

A new five year-exploration permit has been received and allows 150 new drill holes, enables the company to maintain its exploration camp, and conduct additional trenching, line cutting and geophysical surveys. Assuming funding is received, exploration is scheduled to start in June (a $48,000 private placement was just completed) The company gets a 30% exploration tax credit from the provincial government because it’s in terrain affected by the pine beetle infestation.

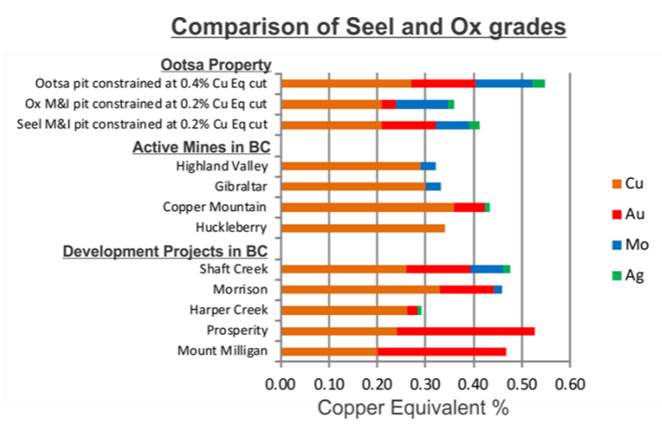

According to Shane Ebert, Surge Copper’s president and CEO, while the company would love to hit some high-grade intercepts, just continuing to pull out core at the current 0.4% copper grades would be enough to build toward a stand-alone mine – as long as it’s near surface.

“If we hit high grade, great, but we don’t need anything that we don’t already have here. This thing would work quite well with what we’re finding, if we can continue to find more,” Ebert told Ahead of the Herd in a recent interview. “The whole Huckleberry District just seems to be around this level, on a copper equivalent basis where it’s often within the 0.3% to 0.4% range, and that’s what we get. On an equivalent basis we average around 0.4%, and it’s those types of grades that make good sense in today’s metal price and exchange rate environment.”

At East Seel – the highest-grade deposit – Surge is targeting its first few holes on the best zones, in order to figure out how to best optimize the tonnage around the edges.

“We’ve got a few areas where I think we can convert what’s modeled as waste into mill feed or ore. But mineralized versus non-mineralized, that affects the economics quite a bit, so if we can take some of the zones where we just have a low drill density and mineralization got cut off prematurely, and get more credit for that, that’s going to make a difference with our stripping ratios and economics.” said Ebert.

Surge Copper will also be conducting exploration on a geophysical target that could be the faulted offset of the East Seel deposit – a target that is largely unexplored.

On West Seel, where 134 million tonnes measured and indicated has been identified, Surge is planning to optimize the surface mineralization before exploring further down-depth, later on. The deposit has some large open zones that are fairly deep.

“Again it’s a scenario where we’ve got most of the deposit defined, but a kilometer-plus of geophysical anomaly continuing out around the deposit that has very little work done on it,” Ebert said. “We want to put a few holes there as well, and start to learn more about the rocks around it, to see if we can’t hit mineralization, or identify alteration vectors that help us pinpoint where to look for additional zones of mineralization .”

Scenario 1: Striking a deal with Imperial

Perhaps the most compelling aspect of Surge Copper, from an investment point of view, is the possibility that it could make an arrangement with Imperial Metals if the Huckleberry Mine restarts. A lot of junior mining companies with properties surrounding existing mines leverage a big part of their valuation on the neighboring miner buying them out. But often what happens is the miner has no need for the surrounding property, since they have plenty of unexplored ground on their own site. Could this be the case here? Let’s examine what we know. A technical report from Imperial Metals on the Huckleberry Mine’s Main Zone shows an M&I resource of 180.7 million tonnes with grades of 0.315% copper. The report was updated in 2016 when copper prices were under $2.50 a pound. It states that the Main Zone has the potential to extend Huckleberry’s life by six to seven years. Recall that the mine shut down in August of 2016. If Imperial were to recalibrate its economics at the current $3.09 per pound copper price, would the minelife be extended? It seems likely that it would be – since at higher prices, less material needs to be mined per year to remain profitable.

In other words, at current copper prices, Imperial might not need Ootsa. However, as Ebert points out, five years worth of reserves is not a lot, and it will take time for the Ootsa project to get developed and permitted. If Imperial thinks it can keep mining at Huckleberry without any help from Surge Copper, it better get exploring. According to Imperial, exploration in 2016 was conducted at its Whiting Creek prospect, where there is potential to find mineralization. Three drill holes intersected copper and moly mineralization, with two holes near surface and one at a depth of about 185 meters. The question is, will Imperial keep exploring Huckleberry even though the mine is on care and maintenance? It seems unlikely. Imperial’s financial position is, to put it kindly, tenuous, so punching holes in the ground on a property that is making no revenue would not make a lot of sense. According to Imperial’s first quarter financial statement, the company had a net loss of C$16.1 million.

Another factor that could invite a meeting of the minds between Imperial and Surge Copper is a third-party investor that has agreed to invest up to $50 million if Surge is able to cut a deal with its next-door neighbor. The un-named company is looking to move Surge Copper forward and was among the parties pushing for a renaming and rebranding. According to Ebert, Imperial is aware of their interest in investing in an arrangement between Imperial and Surge.

Scenario 2: Stand-alone with backing

If Surge Copper is unable to entice Imperial Metals into some kind of arrangement – ranging from a toll milling agreement to a partial buy-in or takeout – then the company is prepared to go it alone. While the $50 million investment from a third party is currently contingent on a deal with Imperial, the investor has expressed interest in backing Surge Copper if it plans to become a mine builder, especially if exploration expands the resource. Right now the PEA specifies a mine life of 12 years, but that’s just with the lowest strip ratio portion of the near-surface resource. The Ootsa Project has potential for much larger resources at slightly higher stripping ratios. If Surge can extend shallow targets and find additional deeper mineralization with the drills, it could significantly increase the life.

According to Ebert, the company has already received interest in the go-it-alone scenario, with a phased plan to grow the resource. “That’s another strategy for sure, find a bit more and make the numbers look good. There’s a lot of people looking for these projects in areas that make sense,” he said.

Scenario 3: Stand-alone with buyout

A third scenario would see Surge Copper get purchased by a major or mid-tier. While this is the goal of most junior explorers, for many it’s an impossible dream. Either the deposit is too small, they can’t draw enough interest from the market to continue exploring, or metals prices drop to the point where the treasury dries up.

Surge Copper though has what many other don’t. It’s in a well-known, historically prolific mining belt – the Golden Triangle/Skeena Arch – adjacent to an existing mine, with infrastructure including roads, water, and close proximity to power (the Huckleberry mill is 6 kilometers from its deposits). Compare those pluses to other copper projects in BC, that might be bigger or higher grade, but are more remote. These include Schaft Creek and Galore Creek which are literally in the middle of nowhere, despite the installation of the Northwest Transmission Line. They are also in rugged, mountainous terrain, versus Ootsa which is in low to moderate topography. The capital expenditures on these projects makes investors wary. Surge Copper’s is a reasonable C$64 million if the adjacent mine infrastructure can be used.

And Ootsa isn’t exactly small. At its current resource estimate, it has more in the ground (granted they are resources not reserves) than Huckleberry, and would run the same rate of production, about 20,000 tonnes a day.

Surge Copper has two more things going for it that could interest a buyer: its board and its agreements with First Nations. As anyone who’s worked in BC knows, to develop a mine, you need to have the local native populations on board. Just ask Taseko Mines and KGHM, who both had their mine projects rejected (New Prosperity and Ajax) due to First Nations and environmental opposition.

Surge Copper has inked agreements with three First Nations groups, including the Cheslatta Carrier Nation based in Burns Lake, and the Wet’suwet’en whose traditional territory is around Smithers. Director Terry Kuzma, a registered professional forestry with 25 years experience in forestry, helped put together the social license and First Nation agreements for AuRico Metals’ Kemess underground copper-gold mine in northern BC – before AuRico was taken over by Centerra Gold in January.

It’s also important to point out that three members of Surge Copper’s board are from the Prince George area, including Pat Bell, BC’s former mines minister. Surge just brought on Randall Thompson as a director as well. From 2012 to 2017 Thompson was president and COO at the Huckleberry Mine, where he supervised a $100 million expansion. Thompson also supervised the construction of a $450 million mine in Saudi Arabia and recently worked for the Silvertip mine in northern BC before it was absorbed through a takeover of JDS by Coeur Mining.

Conclusion

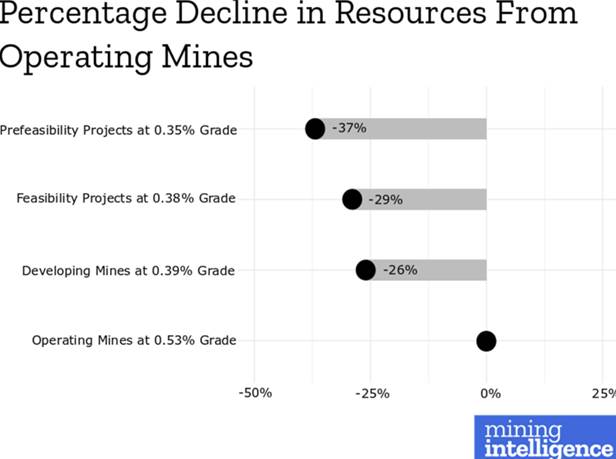

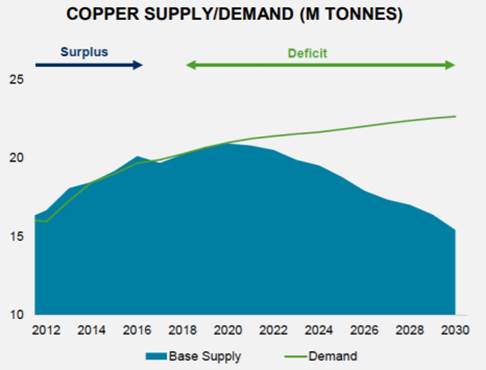

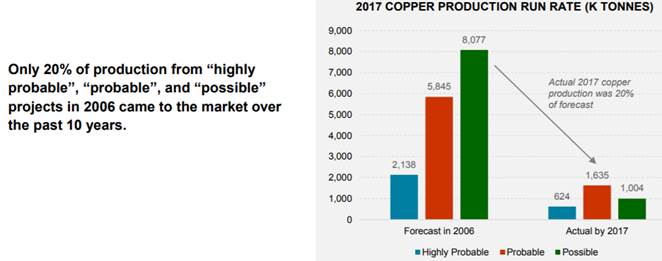

Surge Copper is at something of a crossroads, with three paths open to the company, as it embarks on a new phase of exploration at its Ootsa project in the highly prospective Golden Triangle. Which one will it take? The decision is unlikely to be made soon, since Imperial Metals is seemingly in no hurry to re-start Huckleberry Mine or to sit down with Surge Copper and negotiate a deal over future mill feed. Rather, Surge has some time to expand its already sizeable resource and possibly interest more investors and potential acquirers. The timing is good. As copper prices continue to do well amid strong demand from China, Europe and the United States, mining companies will be on the hunt for good projects in safe jurisdictions. Ootsa certainly ticks those boxes, especially with a copper supply shortfall predicted for after 2019 or 2020.

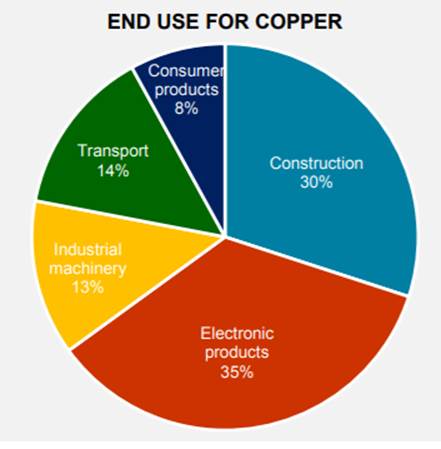

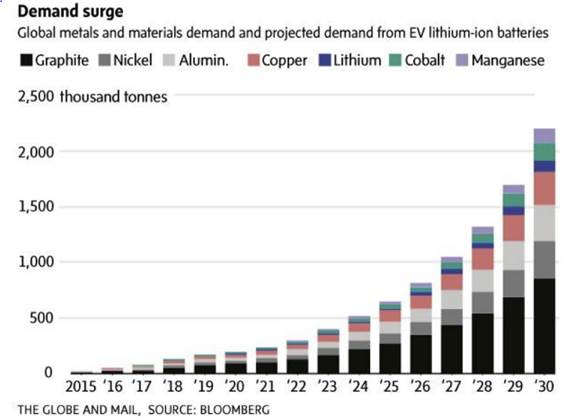

Combine that with increasing demand for copper used in electrical vehicles, along with all the other industrial uses of the red metal, and it appears there’s never been a better time to be a copper explorer in British Columbia.

For all of these reasons, I’ve got SURG on my radar screen.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Surge Copper Corp. (TSX.V:SURG).

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.