What should investors own in a recession? – Richard Mills

2025.03.13

Donald Trump’s erratic and aggressive economic policies have created uncertainty in the markets. Within three weeks, the “Trump bump” period that occurred following his election in November has been replaced by a “Trump slump”, with some already calling for a recession.

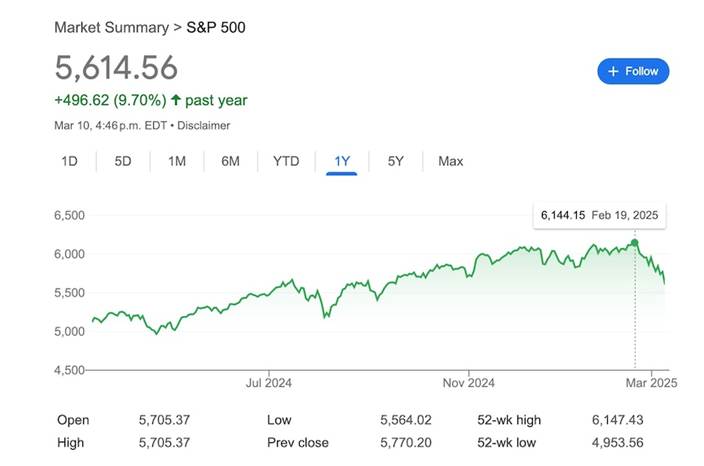

As investors know, the stock market hates uncertainty. Trump immediately started his second term by threatening tariffs on both friends (Canada, Mexico, Europe) and foes (China). A lot of traders didn’t take the threats seriously and the S&P 500 continued to perform at high levels, reaching a one-year peak of 6,144 on Feb. 19.

Then the Trump administration announced on Feb. 1 it would levy 25% tariffs on all imports from Canada and Mexico and 10% on imports from China.

The heavy-handed flip flop, on again off again tariff measures, along with Trump’s aggressive posture towards Ukraine, and the litany of Elon Musk-driven government cuts have united with a suddenly weakening economy to undermine investor sentiment, Bloomberg reported on March 9.

The once-booming S&P 500 has erased all its gains and is now trading at levels before Trump was re-elected. Bloomberg goes a gigantic step further, noting the US is no longer seen as the dominant player in financial markets, with investors now considering other options.

As evidence, the article presents the following:

- The S&P 500 Index has underperformed relative to the rest of the world, and the US share of world market capitalization has slipped, while European stocks, currency, and government bond yields have risen.

- The dollar has weakened, and Treasury yields have tumbled, with investors increasingly looking to invest elsewhere, such as in European markets, due to a shift away from US economic and market exceptionalism. The world’s primary reserve currency is now almost 4% below the post-election peak it reached in January. The slide accelerated last week, pushing the Bloomberg Dollar Spot Index to its lowest since early November.

- The moves in European markets were a big driver. As German benchmark yields rose to the highest since 2023, the euro gained nearly 5% last week for its best run since 2009.

- Accelerating the shift away from US assets: Germany’s plan to massively increase spending, announced last week, is being lauded as a sea change in European policymaking, lifting the region’s stocks, currency and government bond yields. Meanwhile, the emergence of AI startup DeepSeek in China is raising questions about America’s supremacy in the tech sector.

- Add it all up, and the aura of US economic and market exceptionalism, which dominated for more than a decade, is looking shaky.

- The once-unstoppable S&P 500 Index, less than a month removed from a record high, just logged one of its worst weeks of underperformance relative to the rest of the world this century. The US share of world market capitalization has also slipped since peaking above 50% early this year. The S&P 500 is now trailing European benchmarks and the Hang Seng Index which is up ~20%.

“For the first time you are getting compelling arguments to invest elsewhere,” says Peter Tchir, head of macro strategy at Academy Securities. “That’s been a shift. America was the only game in town and capital flows came here without much thought, and that might be reversing or at least changing.”

Regarding the US economy, more bad news has emerged, with jobs data last Friday painting a mixed picture – job growth steadied last month while the unemployment rate rose. JP Morgan Chase & Co. said they see a 40% chance of recession this year “owing to extreme US policies.”

A piece in the Saturday Globe and Mail draws attention to softening economic indicators especially manufacturing. On the same day that Trump introduced tariffs, March 4, the Institute for Supply Management (ISM) released its monthly index of manufacturing activity showing that orders were dropping so rapidly the sector will soon be contracting. Managers expect to pay much higher prices, suggesting that inflation could further constrain sales and output.

The Atlanta Fed’s “nowcast” on the state of US economy estimates that US manufacturing is shrinking at an annual rate of nearly 3% “which could translate into a very serious recession.”

In an op-ed, The Economist writes that Trump’s “American Dream” of tariffs preserving jobs and making America richer is clashing with reality, as “investors, consumers and companies show the first signs of souring on the Trump vision.”

For one thing, by imposing 25% tariffs on goods from Canada and Mexico, “Mr. Trump is setting light to one of the world’s most integrated supply chains.”

The S&P 500 rose 4% in the week after the vote in November, on anticipation of Trump slashing red tape and implementing generous tax cuts like he did in 2017. But the budget blueprint passed in Congress in February only keeps the tax cuts from 2017, it doesn’t expand them, though it does add trillions to the national debt, the op-ed states. Trump’s tariffs would return the average effective duty to levels not seen since the 1940s.

No wonder that the markets are flashing red, measures of consumer sentiment and small business confidence have slipped, and inflation expectations are rising.

Trump unsurprisingly is downplaying the negative impacts of his economic policies. “There’ll be a little disturbance,” he warned blithely in his address to Congress on March 4. “But we’re okay with that.”

Finally, The Economist argues, if Trump imposes reciprocal tariffs, as he has promised on April 2, That would create 2.3m individual levies, requiring constant adjustment and negotiation, a bureaucratic nightmare that America unilaterally abandoned in the 1920s. Reciprocal tariffs would strike a fatal blow to the global trading system, under which every country has a universal rate for every good that is not within a free-trade agreement.

As if that were not bad enough, tariffs will harm America’s economy, too. The president says he wants to show farmers that he loves them. But protecting America’s 1.9m farms from competition will inflate the grocery bills of its nearly 300m consumers; and compensating them for retaliatory tariffs will add to the deficit. Whatever Mr Trump believes, economic growth will suffer because tariffs will increase input costs. If businesses cannot pass them on to consumers, their margins will wither; if they can, households will experience what amounts to a tax rise.

Mr Trump’s policies set up an almighty clash with the Federal Reserve, which will be torn between keeping rates high to curb inflation and cutting them to boost growth.

History repeats

Donald Trump’s antics may seem to be unlike any other president before him, but a closer look at history shows that may not be the case.

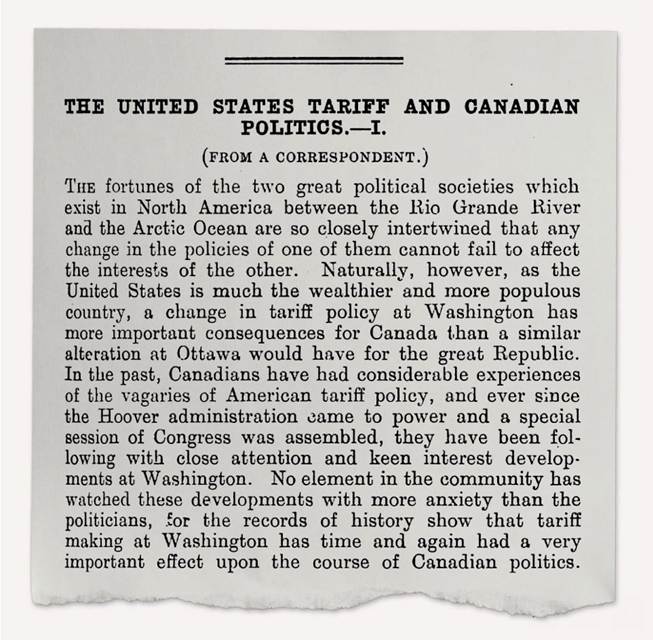

Another Economist article notes the last time America had “tariff-mania” was during the Depression. The Tariff Act of 1930, better known as the Smoot-Hawley tariff, “sparked a trade war between America and its allies, deepening the Depression and causing the world to break up into rival blocs.”

The bill by Senator Reed Smoot and Congressman Willis Hawley proposed to increase taxes on agricultural imports to better compete with European agriculture. As the historical Economist blurb below shows, the tariff greatly affected Canada and can be considered a form of déjà vu.

As the Depression deepened, more industries lobbied Congress to add tariffs to the bill. In 1930, Canadian Prime Minister Mackenzie King retaliated by raising tariffs on America and lowering them for the rest of the British empire.

Another historical blurb reads:

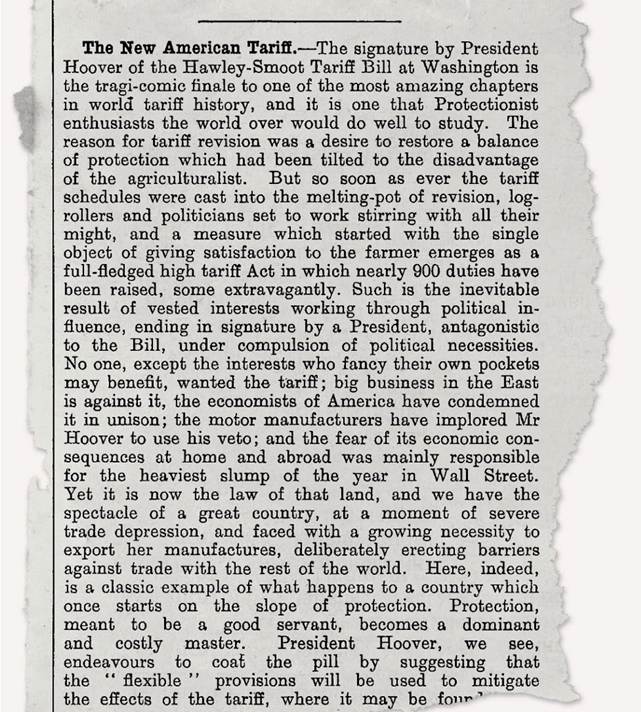

“The signature by President Hoover of the Hawley-Smoot Tariff Bill at Washington is the tragi-comic finale to one of the most amazing chapters in world tariff history, and it is one that Protectionist enthusiasts the world over would do well to study. The reason for tariff revision was a desire to restore a balance of protection which had been tilted to the disadvantage of the agriculturalist. But so soon as ever the tariff schedules were cast into the melting-pot of revision, log-rollers and politicians set to work stirring with all their might, and a measure which started with the single object of giving satisfaction to the farmer emerges as a full-fledged high tariff Act in which nearly 900 duties have been raised, some extravagantly.”

King’s efforts were not enough to satisfy voters and his party was crushed in a snap election by the Conservatives, who vowed even steeper retaliatory tariffs, writes The Economist.

Meanwhile, the tariffs that the US had implemented did not have the desired effect. According to the op-ed, America’s economy suffered as a result. Global trade was being hammered by the Depression, causing the value of American imports and exports to fall by nearly 70% between 1929 and 1932. Smoot-Hawley contributed to a fair share of the drop…

Whatever motivated them, Americans turfed Hoover out of office in November 1932. Both Smoot and Hawley lost their seats that year. The economic effects of the Depression, and the tariffs that America’s trading partners had raised put Democrats in power, and they were skeptical of tariffs. In 1934 Roosevelt secured from Congress the authority to negotiate with other countries over tariff rates and began the slow process of reducing trade barriers…

“Protection”, we wrote at the time of the Smoot-Hawley tariff, “meant to be a good servant, becomes a dominant and costly master”. Just as the trade wars that Hoover’s tariffs fuelled were hard to contain, so too might be Mr Trump’s. And it is the consumer that will foot the bill…

Writing about Smoot-Hawley in 2008, we said that there were “plenty of reasons to think that the terrible lesson of the 1930s will not have to be learnt again”. Mr Trump’s return to protectionism shows that America is in need of a refresher course.

Recessions

A recession is a significant and widespread decline in economic activity typically lasting more than a few months. It is often defined in the media as two consecutive quarters of negative GDP growth (Investopedia).

Riskier assets like stocks and high-yield bonds tend to lose value in a recession, while gold and US Treasuries appreciate.

At AOTH we are always thinking ahead, so how might an investor watching the chaos unfold in Washington protect his or her investments? We see three strategies: bonds, defensive stocks, and precious metals.

Bonds

Traders prefer shorter-term Treasury notes to longer-term bonds and they are piling into short-dated Treasuries, states Bloomberg, pulling the two-year yield down sharply since mid-February, on expectations the Federal Reserve will resume cutting interest rates as soon as May to keep the economy from deteriorating.

The Federal Reserve often cuts interest rates to stimulate economic growth, resulting in higher bond prices. (prices move in the opposite direction of yields).

“Just a couple of weeks ago we were getting questions about whether we think the US economy’s re-accelerating — and now all of a sudden the R word is being brought up repeatedly,” said Gennadiy Goldberg, head of US interest rate strategy at TD Securities, referring to the risk of a recession. “The market’s gone from exuberance about growth to absolute despair.”

Defensive stocks

Morningstar maintains that bonds have been the best place to be in most previous recessions. This is because the Federal Reserve often cuts interest rates to stimulate economic growth, resulting in higher bond prices. (prices move in the opposite direction of yields)

On the flip side, it says that stocks are usually one of the worst places to be, given that when there is a decline in economic activity, it is usually accompanied by weaker revenue and earnings growth, pulling down stock prices.

As a result, stocks had negative returns in most (but not all) previous recessions dating back to the Great Depression. Some of the worst recent results were during the global financial crisis, when stocks lost an annualized 24% between late 2007 and mid-2009.

But how about safer, so-called defensive stocks?

Morningstar identifies larger companies which tend to have more stable earnings, diversified business operations, and the financial wherewithal to sustain their operations even during recessions.

By sector, Morningstar says healthcare and consumer staples stocks have been the most resilient performers during recessions. By contrast, energy and infrastructure stocks have been the hardest hit. Technology and communications stocks have a mixed record.

Dividend stocks have also held up relatively well. This is because they generally have three things going for them: peace of mind knowing that the company is financially sound; dividends provide a return on investment regardless of whether the stock is rising or falling; and dividend stocks tend to outperform non-dividend stocks during downturns.

According to Investopedia,The safest stocks to own in a recession are those of large, reliably profitable companies with a long track record of weathering downturns and bear markets. Companies with strong balance sheets and healthy cash flows tend to fare much better in a recession than those carrying heavy debt or facing big declines in the demand for their products.

Historically, the consumer staples sector has outperformed during recessions, because it supplies products that consumers tend to buy regardless of economic conditions or their financial situation. Consumer staples include food, beverages, household goods, alcohol, tobacco, and toiletries.

In contrast, appliance retailers, automakers, and technology suppliers can suffer as consumers and companies cut spending…

Additionally, keeping cash reserves in the bank or high-yield savings accounts for liquidity is also good for emergencies or buying opportunities if the market dips further.

Precious metals

Historically, gold and silver thrive when global economic conditions get worse. According to Morningstar, gold has been a winning asset class during recessionary periods, with positive returns during the eight most recent recessions since 1993.

Gold, of course, is a hedge against inflation because unlike fiat currencies, it doesn’t lose value when prices of goods and services rise.

“Historically, gold has been seen as a hedge against economic instability, inflation, or a declining currency,” says Matthew Argyle, a certified financial planner and owner of Encore Retirement Planning, in a CBS News piece. “Put another way, gold is like economic disaster insurance.”

The worse the recession is and the more inflation, the better gold will do.

The article notes that during the recession of 1973-75, gold surged 87%, in 1983 following the recession of 1981-82 it rose 20%, and during the covid-19 pandemic recession from January to August 2020, gold increased 28%.

A Reuters poll found the likelihood of the United States, Canada and Mexico entering a recession is growing in all three nations due to Trump’s tariffs slowing economic growth and causing inflation.

Gold came within $50 of $3,000 an ounce on Monday, Feb. 24, notching an incredible 11th record high in 2025. And today, 2025-03-13 gold is again flirting with US$3,000.00.

Reuters reported the surge was driven by concerns over President Trump’s tariff plans, with additional support coming from inflows into the world’s largest gold ETF, SPDR Gold Trust.

Bullion was also helped by a sagging US dollar, which fell to its lowest since Dec.10. Gold and the USD typically move in opposite directions.

“The dollar index climbed for the second straight day on Thursday, nearing 103.9, as investors were digesting recent PPI data and trade developments. Producer price inflation came in below expectations, with the headline figure remaining flat and the core rate declining by 0.1% month-over-month, mirroring the softer-than-expected CPI report released yesterday. Meanwhile, initial jobless claims stood at 220K, slightly below estimates but largely in line with recent trends. On the trade front, tensions escalated further as President Trump threatened to impose a 200% tariff on wine and other alcoholic beverages from the EU in retaliation for the bloc’s newly announced countermeasures. Looking ahead, investors await the Fed’s policy decision next week, with markets widely anticipating that the central bank will hold interest rates steady while providing updated economic projections.” Trading Economics

The US Dollar Index DXY was at 103.85, down from a Year to Date high of 109.96 on Jan. 13, for a loss of 6.3%.

Investing.com said DXY was near a four-month low.

State Street Global Advisors’ George Milling-Stanley told Kitco News it is not surprising that renewed investment demand is driving gold prices back to all-time highs, as investors seek protection against inflation and market volatility. SSGA thinks gold could push past $3,000 an ounce in the not-too-distant future.

According to the World Gold Council’s latest report, global gold demand including over-the-counter (OTC) trading rose by 1% to a record 4,984.5 tonnes in 2024. Excluding OTC trading, total gold demand hit 4,553.7 tons, the highest since 2022.

Gold buying accelerated after Trump won the election in November. According to WGC, via Reuters, purchases by central banks accelerated by 54% year on year in the fourth quarter to 333 tons.

The average gold price in 2024 rose to $2,386 an ounce, 23% higher than the average price in 2023.

The upward price trend looks set to continue. Kitco News talked to Joseph Cavatoni, market strategist at the World Gold Council, who said, “The growing government debt burdens and the dramatically changing geopolitical landscape suggest that central banks will continue to buy gold.”

Cavatoni noted that geopolitical uncertainty owing to the unpredictable Trump administration could lay the groundwork for further central bank demand, and he cautiously said CBs could repeat their 1,000-ton-plus net buying in 2025.

Cavatoni said that, overall, the broader trend is that given all the uncertainty in the marketplace, demand for gold will remain high through 2025, even at elevated gold prices.

Schiff Gold notes that gold rocketed to an all-time last year because central banks and foreign governments reduced their dollar holdings.

But the greater risk to the US federal government is the maturation of US government bonds, aka Treasuries:

According to Federal Reserve data, there will be roughly $28 trillion worth of US government bonds maturing over the next four years, i.e. now through the end of 2028.

That’s more than 75% of the government’s $36+ trillion national debt.

This is an absolutely staggering figure, averaging $7 trillion per year for the next four years.

And remember, we’re just talking about the existing debt that is set to mature. It doesn’t even include new debt that has to be issued over the next four years, which could easily be another $7-10 trillion.

This is an enormous problem for the Treasury Department, because they clearly don’t have $28 trillion to repay those bondholders.

Usually when a government bond matures, the investor simply rolls the proceeds into a new bond. This is referred to as the debt “rolling over”. The problem for the US government is that most of the bonds that are maturing over the next four years were issued when interest rates were much lower. If they were previously issued at 3%, for example, now the government has to refinance that debt at say 5%, meaning an extra 2% in interest charges per year.

That’s almost $600 billion in additional interest EACH YEAR on top of the $1.1 trillion interest bill that they’re currently paying.

The question is not only how will the government find the $28 trillion — likely they will print it, which is hugely inflationary — but who is going to buy the new bonds? Enter the de-dollarization trend.

Some central banks are diversifying to currencies other than the US dollar following Russia’s invasion of Ukraine. When the United States punished Russia by freezing half of its $640 billion in gold and FX reserves, other countries thought “the same thing could happen to them”. Among the countries on a path to “de-dollarization” are Russia, China, India, Turkey and Saudi Arabia.

Conclusion

Bonds, defensive stocks and precious metals, especially gold, are three ways to protect your wealth during what looks like a rapidly developing continent-wide recession involving the US, Mexico and Canada.

The “new NAFTA” US-Mexico-Canada Agreement (USMCA) appears to be not worth the paper it’s written on as Trump violates the spirit and the letter of the agreement by imposing punishing tariffs on two of its top three trade partners: Mexico and Canada. (China is the third)

But here’s something to mention, and end on.

The Trump administration believes it would have the upper hand in a trade war because exports of goods and services are less important to the US economy than they are to most of its trade partners. In other words, they would disrupt the economy, for sure, but they would harm Canada, Mexico and other targeted countries more.

Trade wars, though, are often expanded to include capital controls, and here is where the United States has a huge vulnerability.

A recent Project Syndicate article notes that foreign countries hold nearly one-quarter of US government debt. They use their trade surpluses with the US to buy Treasuries, thus boosting their dollar reserves.

But what if America’s major trading partners introduced a tax on the purchase of dollar-denominated securities issued by the US government or US firms?” ponders author Kenneth Jacobs.

A significant source of funding for Treasury auctions would evaporate, and the US government’s borrowing costs would rise. As more domestic capital flowed toward Treasury auctions, investment in other sectors would be crowded out, spreads would widen, and the cost of capital would increase. Mortgage interest rates, credit-card interest rates, and borrowing costs for businesses would rise, generating powerful market and economic headwinds. Even the threat of such a tax would affect US bond yields. It is not hard to imagine more subtle foreign dollar-reserve strategies that accomplish the same outcome.

“Some might argue that America’s trade partners are unlikely to take such a step, since it would also carry high costs for them, from lost earnings on their US dollar reserves to higher risks from shifting investments to other economies. But the costs for the US would be far greater, and they would emerge much faster. It is a lot easier to shift financial investments than it is to establish new trade relationships.

Even if a tax or other policy that discouraged the purchase of US securities led to a kind of “mutual assured destruction,” America’s trading partners might decide it is worth it, not least because they have few other options to push back against tariffs effectively. The more aggressively trade is weaponized, the more tempted they will be to use this tool and “go nuclear.” The politics are certainly appealing: “If the US taxes our goods, we will tax its debt” would be a compelling rallying cry for the leader of an economy under pressure from US tariffs.

America’s trading partners have a nuclear weapon they could launch against the United States if Trump’s tariffs go too far.

The problem for the US government is that most of the bonds that are maturing over the next four years were issued when interest rates were much lower. If they were previously issued at 3%, for example, now the government has to refinance that debt at say 5%, meaning an extra 2% in interest charges per year.

That’s almost $600 billion in additional interest EACH YEAR on top of the $1.1 trillion interest bill that they’re currently paying.

Plus paying higher interest rates on up to $10 trillion dollars in new debt over the next 4 years.

The question is not only how will the government find the $28 trillion — likely they will have to print a lot of it (it seems unreasonable to your author that the tariff targeted countries, or the BRICS, will be lining up to rollover or buy debt), which is hugely inflationary — but who is going to buy the new bonds?

America is making a lot of enemies and the assumption that these countries will continue buying US debt could end up being spectacularly wrong. In such an environment, gold is the natural safe haven for countries to invest their trade surpluses, leading to much higher prices.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

8 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

#Trumpbump #Trumpslump #recession #reciprocaltariffs #tariffs #Bonds #defensivestocks #preciousmetals

Thank you for a well written article!

Majority Thinks That Tariffs Will Hurt the Average American

As the world is bracing for more tariff announcements on April 2, a day dubbed “Liberation Day” by President Donald Trump, Americans are increasingly wary about the effects that new tariffs will have on the average American. According to a recent survey conducted by YouGov on behalf of The Economist, 61 percent of U.S. adults think that raising tariffs would hurt the average American, while only 14 percent of respondents think that it would have a positive effect on them.

That’s because Americans – still wary about inflation after three years of rising prices – broadly expect tariffs to further increase prices and thus inflict further financial pain on already inflation-stricken U.S. households.

https://www.statista.com/chart/34212/public-view-of-the-effect-of-tariffs-on-the-average-american/

Americans Are Spending Less, Saving More as Tariffs Loom

After years of seemingly defying inflation and driving U.S. GDP growth, U.S. consumer spending showed signs of weakness in the first two months of 2025. After dropping more than 0.6 percent in January, real personal consumption expenditure barely bounced back in February, edging up just 0.1 percent or $16 billion on a seasonally adjusted, annualized basis.

The weaker-than-expected spending increase was driven by a decline in service spending – the first since January 2022 and a warning sign that consumers may be starting to cut back on discretionary spending. At the same time, consumers increased spending on durable goods, possibly making purchases earlier than planned to avoid higher prices widely expected as a consequence of new tariffs.

https://www.statista.com/chart/34211/change-in-real-consumer-spending-and-personal-saving/

Consumer Confidence Plummets to Lowest Level Since 2022

Consumer sentiment in the United States fell to the lowest level in more than two years in March, as uncertainty over tariffs, their effect on inflation and the overall economy are clearly weighing on Americans’ minds. The latest results from the University of Michigan’s monthly Index of Consumer Sentiment showed a steep decline in consumer confidence for the third consecutive month.

https://www.statista.com/chart/16736/index-of-consumer-sentiment/

US headed for Recession?

“Consumer sentiment has fallen for three straight months, while consumer confidence, a competing metric, has declined for four to its lowest level in four years….Consumer spending accounts for roughly 70% of gross domestic product…..The subdued rise in real spending suggests first-quarter gross domestic product growth will be significantly weaker than the fourth quarter’s 2.4% increase. The question is whether the slowdown in the first two months of the year is a fluke or a longer-term trend that will define spending the rest of the year.”

https://www.barrons.com/articles/consumers-economy-recession-worries-a8f630e4

Manufacturing PMI in the United States decreased to 50.20 points in March from 52.70 points in February of 2025.

Manufacturing PMI in the United States averaged 53.11 points from 2012 until 2025.

https://tradingeconomics.com/united-states/manufacturing-pmi

“There’s no one agreed-upon definition of a recession, but the most commonly used metric is two back-to-back periods of negative economic growth,” said CBS MoneyWatch correspondent Kelly O’Grady. “That would mean that we would see negative growth in U.S. gross domestic product or GDP, over two consecutive quarters.” Mar 18, 2025

https://www.cbsnews.com/news/how-do-economists-identify-recession-stagflation/#:~:text=There'snooneagreedupon,overtwoconsecutivequarters.