Three discoveries in one of Canada’s most prolific silver districts — Yukon’s Keno Hill — piquing investor interest in Haldane – Richard Mills

2025.03.05

“Our success rate in drilling new targets has been pretty good”: Silver North’s CEO Jason Weber, on making discovery after discovery after first-time drilling.

Silver North Resources (TSXV:SNAG, OTCQB:TARSF) in November announced the Main Fault discovery at its Haldane silver project within the historic Keno Hill Silver District in the Canadian Yukon Territory.

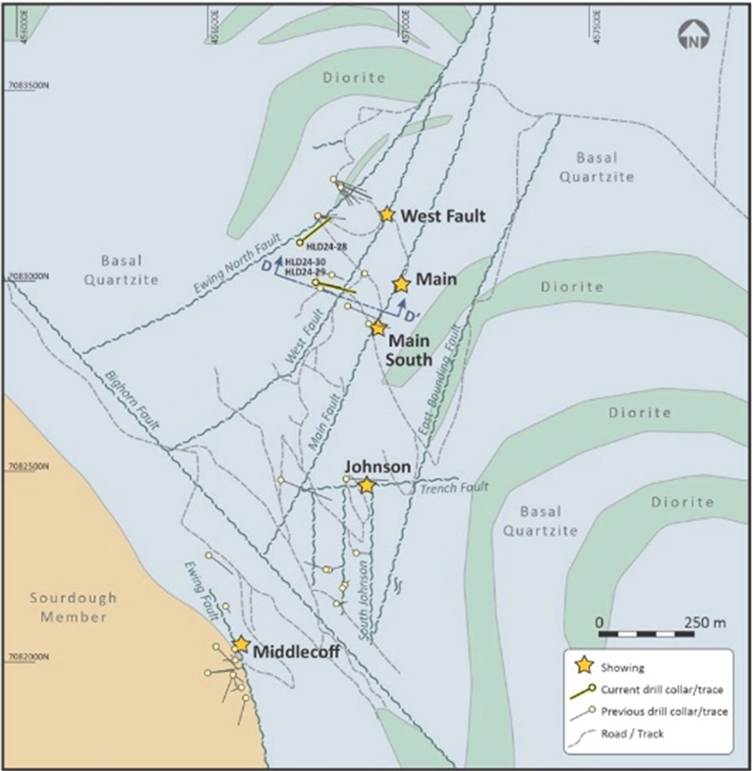

Drilling confirmed that the Main Fault, marked by a series of silver-bearing surface showings, is a productive structure hosting multiple high-grade silver-bearing veins and breccias. 732 meters of drilling was completed in three holes testing the West Fault and Main Fault targets.

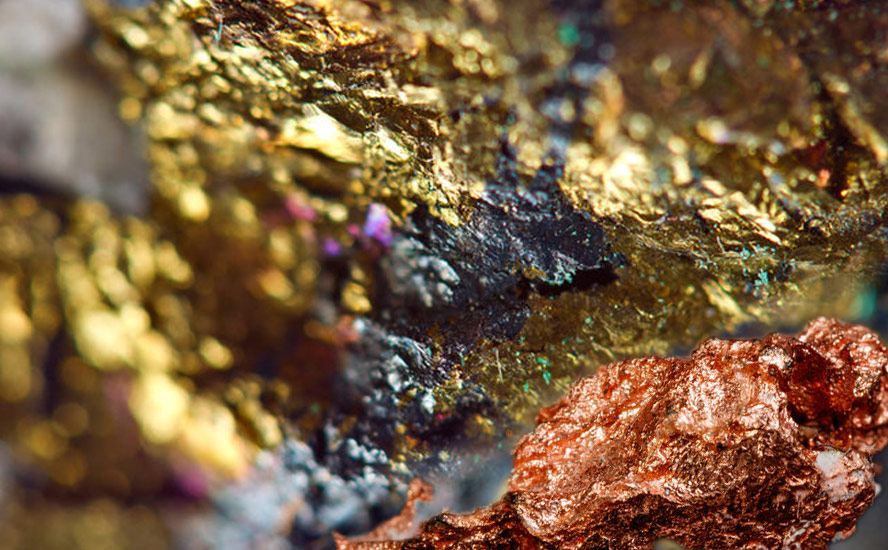

The 8,579-hectare Haldane property is located 25 km west of Keno City, YT, adjacent to Hecla Mining’s producing Keno Hill silver mine, and hosts numerous occurrences of silver-lead-zinc-bearing quartz siderite veins as seen elsewhere in the district.

Main Fault is the third discovery Silver North has made since acquiring the Haldane property.

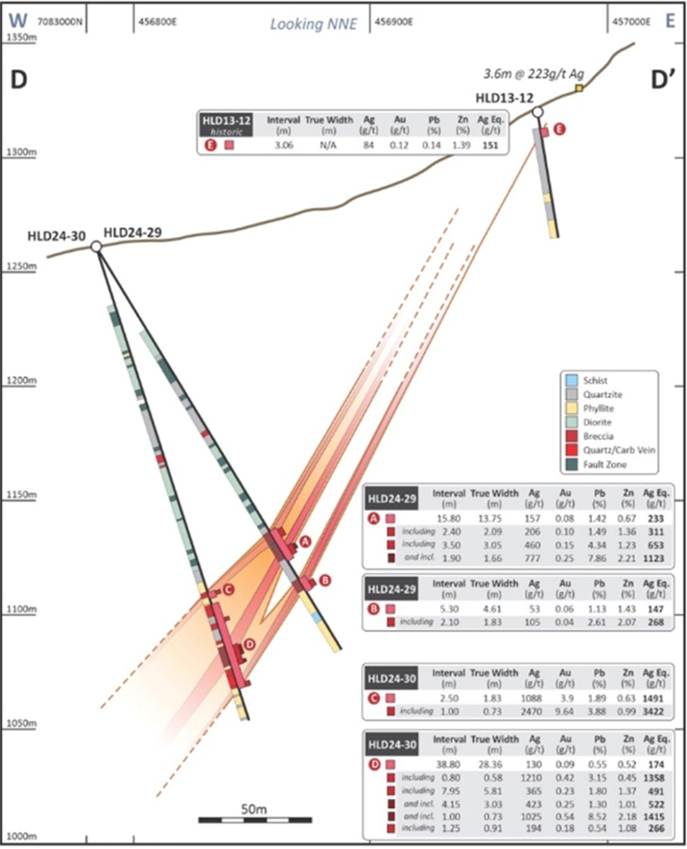

The Main Fault, thought to be a parallel structure to the West Fault, was targeted in the 2024 drill program based on surface sampling of the fault at the Main and Main South showings where oxidized vein samples on surface average 151 g/t silver over 7.6m and 223 g/t silver over 3.6m. Two holes tested this target (HLD24-29 and 30), successfully intersecting a wide structural zone consisting of three siderite-sulfide vein faults and breccias with an interstitial stockwork of siderite-bearing veinlets and brecciated host rocks that forms the overall structural zone.

The corporate presentation shows historical small-scale mining — underground workings developed at the Middlecoff and Johnson veins — produced 24.7 tons of 3,102 g/t silver and 59% lead, and 2.1 tons of 4,600 g/t silver.

The property showed the potential to double the combined strike length of known veins currently totaling 12 km, with new discoveries in 2019 and 2020 at West Fault and Bighorn.

The company found almost 2 ounces (1 troy oz = 31.2 grams) of silver in soils at Bighorn with high lead concentrations.

In a recent talk with CEO Jason Weber two takeaways from Silver North’s progress to date jumped out at me.

First, discovery after discovery from first-time drilling makes Haldane a very prospective project. Rarely is a discovery made after completing just three drill holes.

“Our success rate in drilling new targets has been pretty good,” Weber commented with understatement. “We drilled Bighorn, where drilling had never been attempted and with the very first hole we hit silver veins, then at West Fault we made a new discovery a few years later, and now here at Main Fault, so I think it just speaks to the prospectivity of the Haldane property.”

My second takeaway is the fact that the holes at Main Fault were drilled shallower than at West Fault, and SNAG is intersecting multiple veins with each hole.

The Main Fault, thought to be a parallel structure to the West Fault, was targeted in the 2024 drill program based on surface sampling of the fault at the Main and Main South showings where oxidized vein samples on surface average 151 g/t silver over 7.6m and 223 g/t silver over 3.6m. Two holes tested this target (HLD24-29 and 30), successfully intersecting a wide structural zone consisting of three siderite-sulfide vein faults and breccias with an interstitial stockwork of siderite-bearing veinlets and brecciated host rocks that forms the overall structural zone.

In hole HLD24-29, the widest structural zone returned 13.75m true width of 157 g/t silver, 1.42% lead and 0.67% zinc and blossomed to 28.36m (true width) of 130 g/t silver, 0.55% lead and 0.52% zinc 50 meters down dip in hole 30. High-grade oxidized and brecciated siderite vein fault material at the upper boundary returned 1.83m (true width) of 1,088 g/t silver, 3.90 g/t gold, 1.89% lead and 0.63% zinc including 0.73m (true width) of 2,470 g/t silver, 9.64 g/t gold, 3.88% lead and 0.99% zinc in hole HLD24-30. It is notable that these upper boundary intersections are unusually high in gold compared to other intersections at the Haldane property.

Silver North offers investors exposure to one of the most prolific silver districts in Canada and the world — Keno Hill — which is seeing major investment from Hecla Mining, the largest silver producer in the United States, following Hecla’s 2022 takeover of Alexco Resources.

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

Keno Hill Silver District — a short history

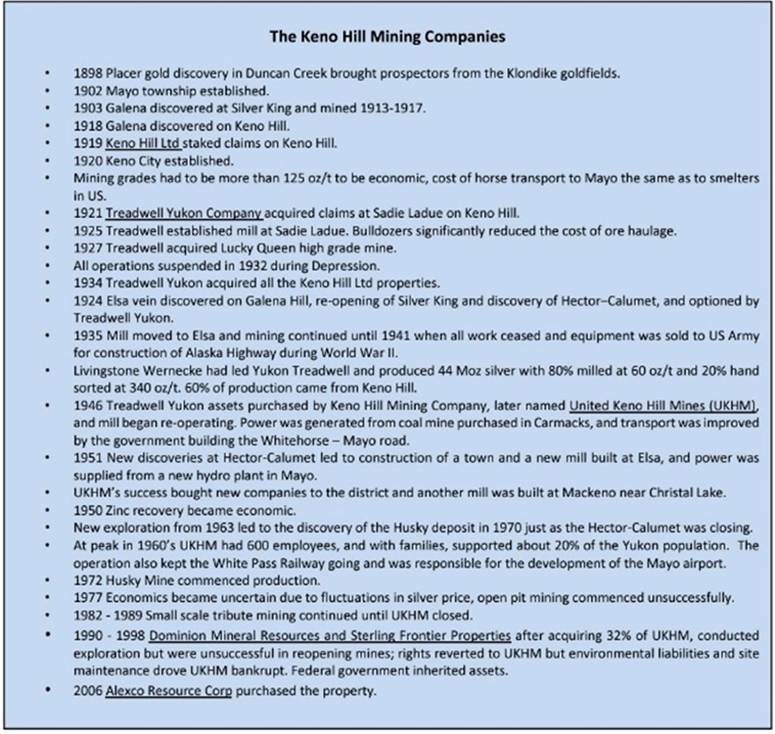

Keno was not only Canada’s second largest primary silver producer and one of the richest silver-lead-zinc deposits ever mined, it was also a mainstay of the Yukon economy, keeping the territory flush from the 1920s to the early ‘60s following the decline of the Klondike Goldfield.

At its peak, Keno Hill supported about 15% of the territory’s population and produced more wealth than the Klondike, one of the richest placer gold districts in the world.

According to the Yukon government, from 1913 to 1989, 4.87 million tonnes were mined at an average grade of 1,389 grams per tonne silver, 5.62% lead and 3.14% zinc. Over 65 deposits and prospects have been identified in the district. Most occur within the Keno Hill quartzite as structurally controlled veins close to the Robert Service Thrust Fault.

The district is about 450 km north of the Yukon capital, Whitehorse.

Following a small amount of hand mining between 1913 and 1917, larger scale production was almost continuous from 1919 to 1989, except during World War II. Two companies produced most of the ore, Treadwell Yukon Corp. from 1925 to 1941, and United Keno Hill Mines between 1947 and 1989. (Both companies went bankrupt due to periods of sustained low silver prices.)

Silver production is recorded from 35 mines with seven producing over 10 million ounces each, with the largest being Hector‐Calumet (96 Moz) and Elsa (30 Moz). — Mineralogical Association of Canada, ‘The Keno Hill silver mining district’ (2016)

The Mineralogical Association of Canada (MAC) points out that between 1913 and 1989, the Keno Hill Silver District produced more than 214 million ounces from greater than 35 mine sites containing some of the richest silver-lead-zinc veins in the world, averaging 44 ounces per tonne silver, 6.7% lead and 4.1% zinc.

The Bellekeno mine that commenced production at the beginning of 2011 was Canada’s only operating primary silver mine and until 2013 produced 5.2Moz silver at an average grade of 25 oz/t.

Two important new discoveries were at Flame & Moth and Bermingham.

Although staked for its silver mineralization, the Keno Hill property is located within the Tintina gold belt, a zone of gold deposits associated with Cretaceous Tombstone suite granitic intrusions. Significant deposits hosted within the Tintina gold belt include Victoria Gold’s nearby Eagle Gold & Dublin Gulch, Golden Predator’s Brewery Creek, Rockhaven’s Klaza project, in addition to numerous prospects including Gold Dome, Clear Creek and Red Mountain and others. — Metallic Minerals website

According to the MAC,

Mineralization in the District is of the polymetallic silver-lead-zinc vein type where multiple pulses of hydrothermal fluids or fluid boiling, probably related to repeated reactivation and breccia formation along the host fault structures, have formed a series of vein stages with differing mineral assemblages and textures. Supergene alteration may have further changed the nature of the mineralogy in the veins. Much of the supergene zone may have been removed due to glacial erosion. In general, common gangue minerals include (manganiferous) siderite and, to a lesser extent, quartz, and calcite. Silver predominantly occurs in argentiferous galena and argentiferous tetrahedrite (freibergite).

In some assemblages, silver is also found as native silver, in polybasite, stephanite, and pyrargyrite. Lead occurs in galena and zinc in sphalerite, which can be either an iron-rich or iron-poor variety. Other sulphides include pyrite, pyrrhotite, arsenopyrite, and chalcopyrite. The Keno Hill mining camp has long been recognized as a polymetallic silver-lead-zinc vein district with characteristics similar to other well-known mining districts in the world.

Conclusion

A junior resource company’s place in the food chain is to acquire projects and make discoveries. Silver North has checked that box.

Silver North’s goal was to find Keno-type mineralization and at least 300 grams-per-tonne rock over a comfortable mining width of 4 meters. They achieved that with the West Fault discovery of 311 g/t Ag over 8.7m.

The Main Fault, thought to be a parallel structure to the West Fault, was targeted in the 2024 drill program based on surface sampling of the fault at the Main and Main South showings.

In hole HLD24-29, the widest structural zone returned 13.75m true width of 157 g/t silver, 1.42% lead and 0.67% zinc and blossomed to 28.36m (true width) of 130 g/t silver, 0.55% lead and 0.52% zinc 50 meters down dip in hole 30.

It is notable that these upper boundary intersections are unusually high in gold compared to other intersections at the Haldane property.

“The Main Fault is really significant in that it’s one of the widest zones we’ve ever seen and it’s got multiple structures in it so when you start to put that together with future drill programs we’re not drilling a 225- or 250-meter hole to get one vein, we’re drilling maybe that same depth but we’re hitting a big wide zone that might have three separate veins in it and so when you think about how are you going put together a meaningful silver resource, you can just see it’s going happen that much faster with a target like Main Fault,” Weber said, adding “we’re really excited just about the overall width and continuity of this discovery because we know from elsewhere in the district that the grades can get better.” (even than 1,088 grams silver over 1.8m — Rick)

Silver North’s underexplored Haldane project demonstrates high-grade, high-width potential akin to the veins being mined at Keno Hill.

Hecla is a good model for Silver North Resources to follow as it goes about developing its Haldane silver project which is 25 kilometers west of the Keno Hill deposits. Silver North says Haldane has the same rocks as Hecla’s high-grade Keno Hill silver mine. It hosts numerous occurrences of silver-lead-zinc-bearing quartz siderite veins as seen elsewhere in the district.

In July 2022, Alexco Resources received an offer from Hecla Mining to purchase all of its shares, a takeover bid valued at ~$72 million.

At the time, Hecla’s CEO Philips Baker said integrating Alexco’s Keno Hill project in the Yukon could make Hecla the largest silver producer in Canada as well as the United States.

The following year, Hecla invested further in the Yukon, purchasing ATAC Resources and their Rackla and Connaught properties — discoveries made during the 2010 White Gold area play.

Hecla Mining is now the biggest player in the district with a 400 tonne-per-day mill. Hecla commenced production at Keno Hill in mid-2023. The mine was expected to produce 2.7 to 3 million ounces in 2024. Five deposits are present at Keno Hill: Bellekeno, Flame & Moth, Lucky Queen, Bermingham and Onek.

Hecla’s Yukon mine hosts enough high-grade reserves for 11 years of mining; drilling shows promise for near-future growth.

In March of 2024, Hecla filed a technical report outlining 55 million ounces of silver reserves at Keno Hill — a 45% increase since gaining ownership of the project.

It’s remarkable that, even after 100 years of mining, the Keno Hill Silver District is still unearthing new discoveries that Hecla is delivering on.

Meanwhile, Silver North Resources has been working the nearby Haldane project making discovery after discovery — three in five years — Bighorn, West Fault and Main Fault — with very few holes drilled.

CEO Jason Weber and his team are extremely skilled, lucky and elated in having acquired a project with an environment so highly mineralized.

SNAG made three discoveries with three small drill programs and they’re not hitting single, narrow veins but multiple high-grade structures. Weber modestly noted they achieved some good grades but they’re probably not the best in the district — suggesting plenty of exploration upside.

Silver North Resources

TSXV:SNAG, OTCQB:TARSF

Cdn$0.095 2025.03.04

Shares Outstanding 43.3m

Market cap Cdn$4.5m

SNAG website

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

#KenoHillSilverDistrict #Silver #SilverNorthResources $SNAG