Gold marching towards $3,000 on safe-haven demand, driven by fears over tariffs and inflation – Richard Mills

2025.02.28

Gold came within $50 of $3,000 an ounce on Monday, Feb. 24, notching an incredible 11th record high in 2025.

Reuters reported the surge was driven by concerns over President Trump’s tariff plans, with additional support coming from inflows into the world’s largest gold ETF, SPDR Gold Trust.

Spot gold hit $2,956.15 in early trading Monday, the record, before settling to $2,950.34 an ounce as of this writing. US gold futures were 0.3% higher at $2,963.20.

Bullion was also helped by a sagging US dollar, which fell to its lowest since Dec.10. Gold and the USD typically move in opposite directions.

Trump last week warned of imminent new tariffs, which are viewed as inflationary and likely to start trade wars, increasing the demand for safe-haven assets like precious metals gold and silver.

“Investors believe that in the coming weeks and months or longer than that gold prices are going to continue to appreciate,” said Jim Wyckoff, senior market analyst at Kitco Metals.

“The path of least resistance for gold remains sideways to higher and as long as uncertainty persists, gold is likely to continue rising.”

The Financial Post reported that Among the biggest questions are how resilient the US and Chinese economies would be to a trade war, as well as the ripple-on effects for monetary policy if tariffs reignite inflation.

State Street Global Advisors’ George Milling-Stanley told Kitco News it is not surprising that renewed investment demand is driving gold prices back to all-time highs, as investors seek protection against inflation and market volatility. SSGA thinks gold could push past $3,000 an ounce in the not-too-distant future.

Some have speculated that the threat of tariffs from the United States could lead to shortages of deliverable gold and silver on the COMEX, a New York-based marketplace for trading contracts for metals like gold, silver, copper, and aluminum.

Fearing potential tariffs on gold by the Trump administration, traders are moving billions worth of gold (and surprisingly, silver), from the Bank of England to New York. Delivery times from the BoE have risen from a few days to 4-8 weeks, causing a gold shortage in London.

“People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” said one industry executive. “Liquidity in the London market has been diminished.”

An example is JP Morgan Chase & Co, which will deliver gold bullion valued at over $4 billion this month against futures contracts in New York. Bloomberg said the delivery notices totaling 3 million ounces were the second-largest ever in bourse data going back to 1994.

Tariff fears have caused the prices of COMEX gold futures to rip past spot prices in London. Similar pricing dynamics have emerged in the silver futures market, with the disparity so large that traders, hoping to cash in on the arbitrage opportunity, have started flying silver into the country. Bloomberg states:

The precious metal is usually too cheap and bulky to justify the cost of airfreight, and one industry veteran says it’s the first time they’ve seen it happen.

As reported by Natural News, gold futures prices are trading at a premium to spot prices, incentivizing shipments and driving COMEX inventories to a 16-month high. The website references a story first reported on by the Financial Times of London, revealing that traders have stockpiled an $82 billion gold reserve in New York since November’s U.S. election. This massive movement of gold has left the BoE struggling to meet demand, raising questions about the central bank’s ability to fulfill its obligations and sparking fears of a potential default.

Further, If the BoE is unable to meet delivery demands, the “paper” gold market—where investors trade gold contracts without taking physical possession—could face a catastrophic collapse.

Sprott Money explains how the situation could lead to the breakdown of the London/ NY Gold Pool — something that happened in 1968 when the rush to exchange dollars for gold broke the London Gold Pool.

The upshot? Now might be a good time to buy physical gold, because if the pool breaks, gold is going up:

Well, quite obviously, you should definitely get your hands on some physical gold while you can. The breaking of the London Gold Pool saw the gold price rise from $35 to $800 over the course of the decade that followed. What price follows the breakup of the current NY/London Gold Pool is unknowable. However, it’s unlikely to be $2820. That much is certain.

Central bank buying was one of the main factors for gold’s substantial 27% gain in 2024 — the most since 2010.

Central banks bought more than 1,000 tons of gold for the third year in a row, with the National Bank of Poland the largest buyer adding 90 tons to its reserves.

Last year’s investment demand for gold rose 25% to a four-year high of 1,180 tons, mainly because outflows from physically-backed gold exchange-traded funds (ETFs) dried up for the first time in four years…

Investment demand for bars rose 10%, while coin buying fell 31%.

According to the World Gold Council’s latest report, global gold demand including over-the-counter (OTC) trading rose by 1% to a record 4,984.5 tonnes in 2024. Excluding OTC trading, total gold demand hit 4,553.7 tons, the highest since 2022.

Gold buying accelerated after Trump won the election in November. According to WGC, via Reuters, purchases by central banks accelerated by 54% year on year in the fourth quarter to 333 tons.

Quoting data from the London Bullion Market Association, the average gold price in 2024 rose to $2,386 an ounce, 23% higher than the average price in 2023. The average gold price in the fourth quarter climbed to a record-high $2,663 an ounce.

The upward price trend looks set to continue. Kitco News talked to Joseph Cavatoni, market strategist at the World Gold Council, who said, “The growing government debt burdens and the dramatically changing geopolitical landscape suggest that central banks will continue to buy gold.”

Cavatoni noted that geopolitical uncertainty owing to the unpredictable Trump administration could lay the groundwork for further central bank demand, and he cautiously said CBs could repeat their 1,000-ton-plus net buying in 2025.

Cavatoni said that, overall, the broader trend is that given all the uncertainty in the marketplace, demand for gold will remain high through 2025, even at elevated gold prices.

Usually China and India make headlines for being the nations that consume the most physical gold — including gold bars and coins for investment, and gold jewelry for special occasions like weddings.

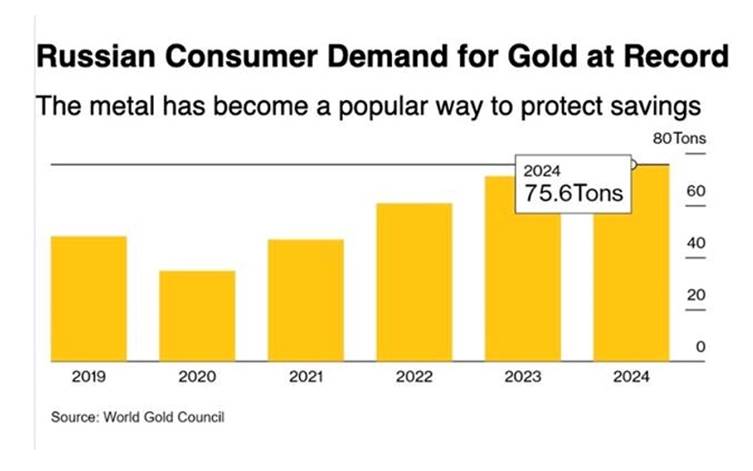

With all that is going on in Russia, it appears that Russians are embracing bullion in a big way. Bloomberg reported that Russians bought a record amount of gold last year as they sought to protect their savings amid sanctions, obtaining the equivalent of about a fourth of the country’s annual output.

Consumers purchased 75.6 metric tons (2.7 million ounces) of the yellow metal in bullion, coins and jewelry in 2024, the fifth biggest figure among all nations, according to World Gold Council data published Wednesday. That’s an increase of 6% on the previous year and more than 60% since President Vladimir Putin ordered his troops into Ukraine almost three years ago.

The news is even more compelling in that Russia’s central bank, despite being one of the largest gold buyers, hasn’t resumed purchases at significant volumes. According to Bloomberg,

Retail gold demand shifted upward after the Kremlin’s invasion of Ukraine as Russians started to find alternative ways of securing their savings instead of traditional investments in dollars or euros. Western sanctions last year intensified cross-border payment difficulties and led to some foreign currency shortages, while the ruble also fell to historic lows.

To spur gold sales, Russia canceled value-added tax on retail purchases of the metal right after the invasion following more than a decade of discussing such a move.

Gold supply crunch

Turning from gold demand to gold supply, it appears that AOTH’s predictions of peak gold are bang on.

The concept of peak gold should be familiar to most readers. Like peak oil, it refers to the point when gold production is no longer growing, as it has been, by 1.8% a year, for over 100 years. It reaches a peak, then declines.

At The Northern Miner’s International Metals Symposium in London on Dec. 2, a presenter from CRU Consulting said global gold production will peak at 3,250 tonnes, or 105 million ounces, this year, before entering a period of prolonged decline.

From 2025 onward, according to gold and base metals analyst Oliver Blagden, reserves will deplete, ore grades will decline and aging mines will close. Even if all planned projects come online, production could drop by up to 17% by 2030, Blagden noted.

China and Russia both face challenges in maintaining output levels, while in West Africa there has been a rise in resource nationalism, particularly Mali and Burkina Faso which have nationalized operations thus deterring foreign investment.

North America, while politically stable, remains the highest-cost region for gold mining.

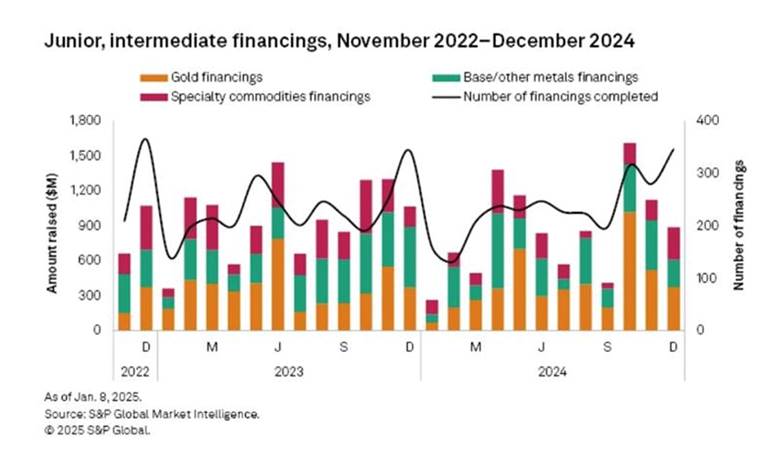

None of this is new to Ahead of the Herd. Regarding our wheelhouse, the junior mining sector, the Northern Miner quotes Blagden saying that, despite the industry being on strong financial footing, with 97% of gold producers operating at positive margins and average all-in-sustaining cost margins at 47%, there is not enough investment in exploration. He said high-grade, well-located projects are harder to find, and he called for miners to act decisively during this period of high profitability. “Without new projects, mines will close, production will fall, and profits will shrink,” he said.

According to S&P Global, funds raised by junior and intermediate mining companies fell in December to $890 million. Despite a 2% increase in transactions, fewer high-value gold and other metals financings weighed down the monthly totals, resulting in year-to-date financings dropping 12% to $10.27 billion, the lowest since 2019.

Some central banks are diversifying to currencies other than the US dollar following Russia’s invasion of Ukraine. When the United States punished Russia by freezing half of its $640 billion in gold and FX reserves, other countries thought “the same thing could happen to them”. Among the countries on a path to “de-dollarization” are Russia, China, India, Turkey and Saudi Arabia.

While the BRICS block of countries consisting of Brazil, Russia, India, China and South Africa has rejected the idea of forming a common currency to challenge the US dollar, they have also made significant strides in reducing dependence on the dollar by establishing a cross-border payment system and expanding the use of local currencies in trade, reports Natural News.

An October 2024 report by Ernst & Young India projected that coordinated BRICS policies could gradually diminish the dollar’s dominance in global trade and foreign exchange reserves. However for now, the US dollar remains the world’s primary reserve currency.

Trump has said that any country that tries to abandon the US dollar “should say hello to tariffs and goodbye to America!” he wrote on his Truth Social platform.

Remember, anything that puts downward pressure on the US dollar is good for precious metals.

Schiff Gold notes that gold rocketed to an all-time last year because central banks and foreign governments reduced their dollar holdings.

But the greater risk to the US federal government is the maturation of US government bonds, aka Treasuries:

According to Federal Reserve data, there will be roughly $28 trillion worth of US government bonds maturing over the next four years, i.e. now through the end of 2028.

That’s more than 75% of the government’s $36+ trillion national debt.

This is an absolutely staggering figure, averaging $7 trillion per year for the next four years.

And remember, we’re just talking about the existing debt that is set to mature. It doesn’t even include new debt that has to be issued over the next four years, which could easily be another $7-10 trillion.

This is an enormous problem for the Treasury Department, because they clearly don’t have $28 trillion to repay those bondholders.

Usually when a government bond matures, the investor simply rolls the proceeds into a new bond. This is referred to as the debt “rolling over”. The problem for the US government is that most of the bonds that are maturing over the next four years were issued when interest rates were much lower. If they were previously issued at 3%, for example, now the government has to refinance that debt at say 5%, meaning an extra 2% in interest charges per year.

That’s almost $600 billion in additional interest EACH YEAR on top of the $1.1 trillion interest bill that they’re currently paying.

The question is not only how will the government find the $28 trillion — likely they will print it, which is hugely inflationary — but who is going to buy the new bonds? Enter the de-dollarization trend.

The Treasury Department relies on foreign individuals and governments to buy US Treasuries, which helps fund the national debt. Traditionally, countries are forced to buy US government bonds because the dollar is the world’s reserve currency. Most commodity transactions are conducted in dollars. But over the past several years, a number of countries have started to trade in currencies other than the dollar.

Schiff Gold then poses the question: If you’re a foreign central bank and you have $100 billion of US government bonds that are about to mature, what are you going to do?

Are you going to reinvest that entire $100 billion back into a country that might already be threatening you with economic penalties?

Or do you quietly let the treasuries mature, take the money, and find someplace else to invest that $100 billion?

A lot of foreign governments and central banks are going to be giving serious consideration to option two.

But they are going to have to invest that money in an asset that, like US dollars, is widely accepted, and has universal value and marketability around the world.

Gold is one of those assets. And that’s why central banks have been buying so much of it for the past couple of years.

I think there’s an obvious case to be made, given the prospects of tariffs and further trade wars, or even just the threats thereof, they are going to keep buying gold and send the price even higher.

Back to gold’s record run, the possibility that gold and silver could themselves be tariffed as commodities — rather than exempted as currencies — helped drive spot gold to a fresh all-time high of $2,798.60/oz on Jan. 30 (Kitco News).

Gold analyst Adam Hamilton noted that since October 2023, gold has soared 59.6%. Hamilton doesn’t consider a bull market to be in a “monster upleg” until it exceeds 40% gains. He states:

During these past 16.2 months, gold’s upleg achieved no fewer than 50 new nominal record closes! In 2024, gold clocked in with phenomenal 27.2% gains handily besting the flagship S&P 500’s fantastic +23.3%…

The bottom line is American stock investors will almost certainly yet chase gold’s extraordinary monster upleg…

Gold’s huge gains over this past year or so were fueled by robust demand from Chinese investors, central banks, and Indian jewelry buyers. Given the underlying drivers of each and no mania-like extremes, that should continue on balance. Add missing-in-action American-stock-investor gold demand on top of that, and gold’s bull run is far from over. And gold stocks still have colossal mean-reversion catch-up rallying to do.

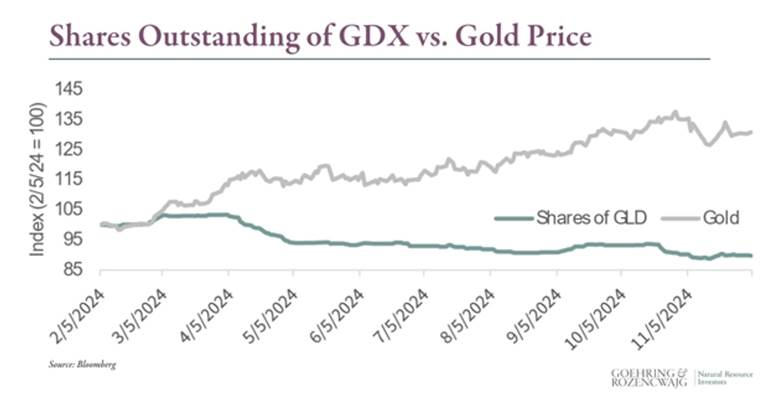

Wall Street commodities investment firm Goehring & Rozencwajg picked up on this theme of Western investors returning to the gold market. In a Q3 2024 commentary, G&R stated that, while central bank buying set the stage for gold’s recent rally, “the return of Western investors could amplify the narrative.”

The firm notes there is a strict divergence between the price of gold, the metal, and gold stocks: “Gold prices are in the midst of a substantial bull market, yet investors’ interest in gold equities remain eerily muted. By several metrics, gold stocks today are as cheap as they were in 1999–2000.”

Since gold’s breakout in March, GDX [gold equity ETF] shares have contracted by nearly 20% even as gold prices climbed over 30%, according to Goehring & Rozencwajg who studied the phenomenon.

See the chart below illustrating this anomaly.

Another surprising G&R insight is regarding the “Magnificent Seven” tech stocks:

While the QQQ ETF, which tracks the NASDAQ 100, is up 23% year-to-date, gold and gold equities, as measured by the GDX, have risen 38% and 34%, respectively. Yet the broader investing public remains fixated on tech, oblivious to the quiet outperformance of precious metals.

We believe we are witnessing the early stages of a gold bull market that will run for years. The current disinterest in gold equities represents a remarkable opportunity for contrarian investors. Gold stocks will likely be viewed as indispensable assets when this bull market reaches its zenith. For now, however, the prevailing disinterest offers a golden—if undervalued—opportunity.

Finally, mining legend Frank Giustra has been talking to the World Gold Council about how to attract the “TikTok Generation” to gold investing. In a Kitco News article, Giustra, CEO of the Fiore Group, said he spoke to WGC President David Tait about how fractional, blockchain-based gold could attract Generation Z, transform gold prices and revolutionize the future of precious metals:

“They’ve been at it for five years – working with the 20 biggest bullion banks. What they’re projecting now is that 2025 will be the year of laying the infrastructure because it’s all going to be connected through fiber optics. And then it will be launched in 2026 as digital gold.”

Giustra added that the impact of commercial banks getting involved will be significant. “The banks are going to love this because they’re going to be able to have their gold positions as collateral as with any other tier-one asset like Treasury bills. It’s going to make gold much more attractive to the world at large.”

PDAC primer

The demographics of mining investment are changing. At January’s Vancouver Resource Investment Conference (VRIC), we at AOTH noticed the attendees are getting younger and the company presentation audiences are no longer a sea of blue hair.

Mining companies are getting more comfortable with new technology like artificial intelligence, increasing the chances of making discoveries.

The annual PDAC convention in Toronto brings together 27,000 attendees from over 135 countries for its educational programming, networking events, business opportunities and fun. Since it began in 1932, the convention has grown in size, stature and influence. Today, it is the event of choice for the world’s mineral industry, hosting more than 1,100 exhibitors and 700 presenters.

PDAC 2025 runs from March 2-5 at the Metro Toronto Convention Centre. Be sure to check out AOTH advertiser Kodiak Copper Corp. (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD) in Booth 3119A to learn more about Kodiak’s flagship MPD copper-gold project in south-central British Columbia.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.