A viable alternative to LNG

2018.11.17

The politicians holding power in British Columbia and Ottawa have stacked their chips on the energy poker table, placing a foolish bet on liquefied natural gas as the solution to the planet’s energy dilemma.

The dilemma is this: on the one hand we need a lot more electricity for growing populations in developing countries, and to keep up the lifestyle we’ve become accustomed to in the West. We are addicted to oil, oil by-products and natural gas:

- Crude oil that is refined into gasoline, diesel, jet fuel, bunker fuel, heating oil, kerosene. Crude oil is either drilled vertically with pump jacks on the ground and through the construction of offshore oil platforms, or fracked.

- Natural gas that is either drilled through conventional oil and gas technology or fracked, using hydraulic fracturing and horizontal drilling. Natural gas fracking has gone gangbusters over the past decade, driving NG prices down and shoving coal miners out of business.

- A litany of other useful products including naptha, asphalt, petrochemical feedstocks, lubricants and waxes.

This list doesn’t include plastics made from crude oil, which have become so ubiquitous in modern society, they are now a scourge, with huge gyres of floating garbage, mostly plastic, littering our oceans, our beaches, and breaking down into tiny particles digested by sea life large and small.

On the other hand, we are facing a climate change crisis of apocalyptic proportions. The problem is so big, and with so many tentacles, that governments, driven by self-interest, are unwilling and unable to cooperate to find solutions (other than vague pledges to limit global temperature rises) – leaving businesses to pick away at the edges of it.

Companies like Tesla, GM and Chevy have come out with electric vehicles despite the North American public’s continued reliance on the internal combustion engine. Renewable energy firms are investing in R&D and making solar and wind power cheaper. And battery manufacturers are working on improving long-term energy storage to pair with emissions-free forms of energy.

In our last few articles we have eviscerated the prospect of a liquefied natural gas industry in British Columbia.

We have pointed out BC government hypocrisy in trying to kill an oil pipeline that will actually result in less tanker traffic than LNG carriers, and far fewer carbon emissions.

We have shown that the federal and provincial governments have colluded in preference of an LNG industry in BC – through a ban on oil tankers (excluding LNG carriers), and trying to bribe the oil and gas industry into cutting carbon emissions by handing them LNG on a platter: first the Pacific NorthWest LNG project in Prince Rupert that was kiboshed by Petronas, and next the LNG Canada project in Kitimat which looks to be going ahead. The latter received $275 million in federal funding and a tax break of $5.3 billion by the BC NDP.

And we have outlined all the negative effects of a full-blown LNG industry in British Columbia that will be reliant on fracking for 78% of the natural gas it puts into tankers and ships overseas.

So, if liquefied natural gas isn’t the way forward, because its benefits ($22 billion over 40 years) aren’t worth its costs (scary health effects including benzene poisoning, methane in water, cancer, mutations, respiratory problems; environmental costs that include billions of liters of contaminated water lost to fracking, greenhouse gas emissions including CO2 and even worse, methane, and earthquakes caused by both fracking and underground wastewater injection), what is the alternative?

At Ahead of the Herd, we think there is another option: lithium-ion storage batteries, and nuclear energy powered by uranium and thorium. Let’s take each in sequence.

Storage batteries

If the world is going to move away from fossil-fuel based power, there are only two alternatives: renewable energy which includes solar, wind, biomass and tidal; and nuclear energy, where the fuel source is either uranium or thorium.

The problem with renewable energy has always been its intermittency. Power can only be generated when the sun shines onto solar panels, or the wind blows hard enough to move the blades that activate the turbines. But what if the energy could be stored, for later use?

Over the years, the technology for storing energy produced by renewable power has improved. This has been motivated by the rapid increase in generating capacity of (mostly) wind and solar, which has driven the prices of these renewables down, to the point where they are now competitive with coal and natural gas – making them viable options for utilities.

Battery storage is catching up. According to the World Nuclear Association (WNA), building-scale battery storage became a defining energy technology trend in 2014, when a record 400 megawatts of storage capacity was added. Since then, the sector has grown by a whopping 50% a year, with the most common form of battery storage being lithium-ion batteries.

The WNA notes that pumped energy (a gravity-driven system that generates energy through water movement) is best suited to provide peak-load power for electricity generated by fossil fuels (coal, natural gas), but does not work well for intermittent/ unreliable power generation. This provides an opportunity for battery energy storage systems to penetrate the renewable energy storage market.

Recognizing the push to renewables (a third of German energy was produced by renewable energy plants last year, and 29% in the UK), some US states have legislated an increase in battery storage capacity. This includes California, Oregon, Massachusetts and New York. In California, “The stated purpose of the legislation is to increase grid reliability by providing dispatchable power from an increasing proportion of solar and wind inputs, replace spinning reserve, provide frequency control and reduce peak capacity requirements (peak shaving),” according to the World Nuclear Association.

The WNA says that lithium-ion batteries are the most popular technology for distributed energy storage systems. Over a third of the 1.5 gigawatts of battery storage in 2015 was lithium-ion. But that’s only 1% of what the International Renewable Energy Agency expects will be needed by 2030: 150GW to meet IRENA’s target of 45% of power generated from renewable sources.

Wired states that 95% of annual storage deployments in the United States are lithium-ion batteries.

Examples of large battery energy storage systems using lithium-ion batteries are: Toshiba’s 40MW system at the Tohoku Electric Power Company’s Nishi-Sendai substation in Japan; San Diego Gas & Electric’s 30MW of battery storage in Escondido, California; and STEAG Energy Services’ 90MW lithium-ion storage program in Germany.

The largest lithium-ion battery storage system was installed in South Australia earlier this year. Thirty percent of Tesla’s 100MW system is paired with the Hornsdale Windfarm about 230 km north of Adelaide; 70% of the battery’s capacity is contracted to the state power grid.

Energy storage is also becoming popular in households that have solar panels hooked up. Tesla’s Powerwall, which provides 24 hours of back-up power, is the most well-known product to North Americans but there are others. Green Tech Media reported recently that while Tesla leads the household battery storage market, its prices have increased and its lead over competitors has narrowed. These include Korea’s LG Chem, EnergySage and Germany company Sonnen.

A report earlier this year from GTM Research says global lithium-ion battery deployments will grow by an eye-popping 55% annually. That means the 2 gigawatt-hours (GWh) installed in 2017 will jump to 18GWh in 2022. Admittedly, it’s not hard to get that kind of a CAGR when starting from such a small base. By comparison, EV sales produced demand for 112 GWh the same year.

All of this demand for lithium-ion storage batteries, driven by their exploding use in electric vehicles, will mean ever-increasing need for lithium and other critical metals. Lithium carbonate and lithium hydroxide are used in the lithium-ion battery cathode. Cobalt, nickel and graphite are also needed for electrode materials.

Uranium reactors

Nuclear energy has been given a bad rap. Up until the 2011 Fukushima accident caused by a major earthquake/ tsunami off Japan, nuclear was perking along just fine, along with the price of uranium. Then came Fukushima, and the safety of nuclear energy began to be questioned. The uranium price imploded. Germany, foolishly in retrospect, stopped its nuclear program, forcing it to import dirty coal. Japan ordered all of its nuclear power plants be shut down for safety inspections. They have only recently started coming back online.

Of course, nuclear does come with risks, as do all forms of energy production. The nuclear reaction produces radioactive waste materials that take a long time to decompose. A leak in the nuclear plant can produce harmful radiation. But looking back at the 65 years we have been using this form of energy, the number of accidents can be counted on three fingers. Nuclear is generally very safe.

Read more at Nuclear Power, It’s No Contest

Looking forward, then, one of the solutions to the climate crisis is to keep using nuclear, and to augment existing facilities that are fed with uranium.

In the United States, where 30% of the world’s nuclear power is generated, the country went through 30 years during which no new reactors were built. There are currently 98 operating reactors in the US. Two new reactors are under construction, according to the WNA, at the Georgia Vogtle plant, budgeted at $28 billion.

The expense of new plants makes upgrading existing ones an attractive option. According to WNA some 140 uprates have been implemented, totalling over 6,500 MWe, with another 3,500 MWe under review. Plants are also running more efficiently due to improved maintenance, which has gone from 56.3% efficient in 1980 to 91.1% in 2008.

However, more can be done. WNA reports that Exelon, the largest US nuclear operator, wants to add between 1,300 and 1,500 MWe to its nuclear fleet, at a cost of around $3.5 billion. The Shaw Group is planning further uprates, at between $250 million and $500 million each.

Thorium reactors

Must we keep using uranium in our nuclear power plants, or is there another option? There is. It’s a little-known element known as thorium.

Some scientists believe thorium is key to developing a new version of cleaner, safer nuclear power.

While conventional nuclear plants are only able to extract 3-5% of the energy in uranium fuel rods, in molten salt reactors favored by thorium proponents, nearly all the fuel is consumed. Where radioactive waste from uranium-based reactors lasts up to 10,000 years, residues from the thorium reaction will become inert within 500. Lastly, because plutonium is not created as a waste product in a thorium reactor, it cannot be separated from the waste and used to make nuclear weapons.

Molten salt reactors (MSRs) are well suited to thorium fuel. In the Liquid Fluoride Thorium Reactor (LFTR), the fuel is not cast into pellets like uranium, but is rather dissolved in a vat of liquid salt.

According to ZME Science, since molten salt reactor technology was revived in the 2000s, interest has grown quickly, with four companies in the US announcing plans for MSRs, as well as in Japan, Russia, France and China. In Norway, Thor Energy started producing power from thorium at its Halden test reactor in 2013, with help from Westinghouse. The third phase of a five-year thorium trial operation got underway in January.

India’s thorium program is well advanced. The country envisions meeting 30% of its electricity demands through thorium-based reactors by 2050. With large quantities of thorium and little uranium, India wants to use thorium for large-scale energy production.

A key advantage of MSRs is the reactor cannot melt down, as we saw in Fukushima when electric pumps were inundated by the tsunami, failing to cool the fuel rods, which overheated and caused radiation emissions. MSRs can also be made cheaper and smaller than conventional reactors, since they do not have large pressurized containment tanks, meaning they could be used in factory settings.

The portability of MSRs is another major advantage over the capital-intensive, permanent nuclear power plants we currently have.

Think about British Columbia’s energy needs. Instead of meeting them with the Site C dam, which comes with its own environmental problems – flooding a 100-km stretch of the Peace River Valley – how about deploying thorium reactors?

The Site C dam is slated to provide 1,100 megawatts of capacity – enough to power half a million homes. The same goal could be reached by using a similar thorium reactor to that being developed by Indonesia – a molten salt reactor capable of delivering 1,000MW.

Another plus of thorium reactors is that nuclear waste (ie. plutonium) from uranium fueled reactors can be recycled to recover the fissile materials needed to create the nuclear reaction. In this way, thorium reactors not only generate less waste than conventional reactors, but also help to rectify the nuclear waste disposal problem.

To learn about the fascinating history of thorium and its potential for nuclear power generation, read our Uranium’s ugly stepsister

Nuclear sea-change

Whether the fuel is uranium or thorium, nuclear will still have its detractors. The anti-nuke movements of the 1970s and 80s are still very much alive. As renewables gain popularity, it is assumed that nuclear power will die off as the cost of solar and wind come down in price.

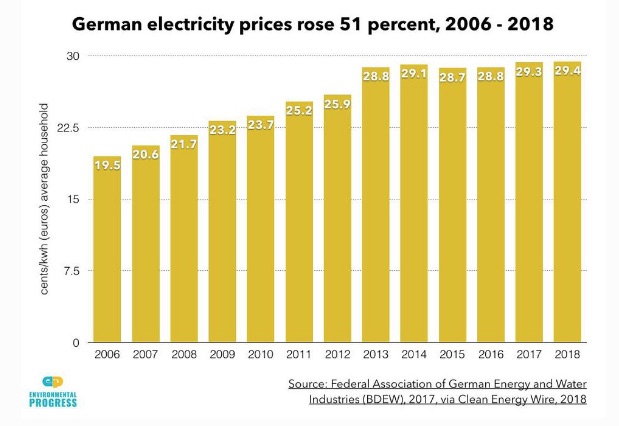

In fact solar and wind have become cheaper, but electricity prices haven’t. How can that be? The global cost of onshore wind now averages 6 cents a kilowatt hour (kWh) whereas solar PV has dropped to 10 cents a kWh. In comparison the cost of fossil-fuel based electricity ranges from 5 cents to 17 cents a kWh.

Yet according to a recent Forbes article, the unreliability of solar panels and wind turbines, along with their huge material requirements (a 1,200MW solar farm requires 1,000x more material to construct then a similar sized nuclear plant) and land footprints, have actually driven power prices up – so much so that consumers are calling for a return to nuclear. This is despite low prices for natural gas and renewables being heavily subsidized.

The way this works is that in places like California, Germany and Holland, which have installed a lot of solar and wind, they still need to rely on natural gas plants, hydro or some other form of power, to provide electricity when the wind doesn’t blow or the sun doesn’t shine. Yet when the solar panels and wind turbines are working, there’s excess power. Rather than storing it in batteries, they are payingneighboring nations or states to take their solar and wind energy! The costs of doing this are then passed on to the electricity consumer.

Forbes notes that in 2017, the places where renewables were most prevalent also had the most expensive electricity. Denmark had the highest rates, with 53% of its power coming from solar and wind, and Germany had the second highest at 26% renewables. It all comes back to renewable energy’s Achille’s heel: intermittency.

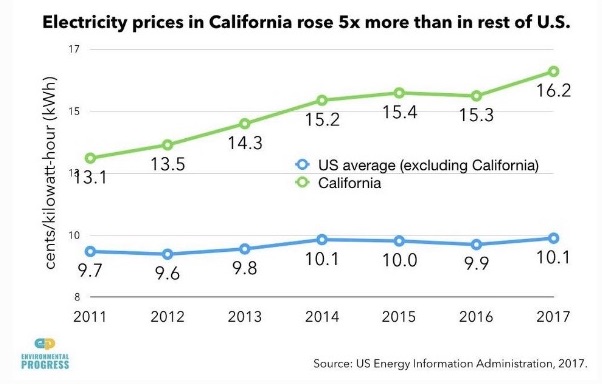

People are getting fed up paying too much for heat and light. Movements to bring back nuclear are afoot in the Netherlands, Germany, Taiwan and the United States. In the recent mid-term elections, voters in Arizona rejected a ballot initiative that proposed the closure of the state’s nuclear plant and replacing its power with solar and wind. It wasn’t even close – 70% to 30%. Forbes notes the result likely was influenced by the high price of electricity in California, where electricity rates rose five times faster than the rest of the country largely due to the closure of nuclear plants and the deployment of solar.

Even the Union of Concerned Scientists (UCS), which previously expressed concern about the safety of nuclear, is coming around. The group has put out a new report where it calls for struggling nuclear plants (due to low natural gas and coal) to remain open, citing their benefits to tackling climate change.

While nuclear only provides 20% of America’s electricity, it represents just over half of US carbon-free electricity.

“We’re in a place right now from a climate perspective we have to make some hard choices. We need every low-carbon source of power we can get,” says Steve Clemmer, co-author of the report and director of energy research and analysis at UCS.

Conclusion

People are concerned about climate change, but let’s be honest. They’re more concerned about how much they pay for electricity. So despite renewable energy’s promise to rid the world of fossil fuels, it is still too expensive. If the cost of switching to renewable energy is paying significantly higher energy bills, it’s not gonna fly.

Between lithium-ion battery storage and nuclear energy, we have what could be the solution for producing clean, emissions-free energy, thus preventing global temperatures from rising further. A recent report from the UN states we only have 12 years to keep temperatures from rising 1.5 degrees C, “beyond which even half a degree will significantly worsen the risks of drought, floods, extreme heat and poverty for hundreds of millions of people,” The Guardian reported. The time to act is now.

In the short term, nuclear plants powered by uranium should be brought back online if they’ve been shuttered, and older ones upgraded to a higher standard. Meantime, places in need of immediate power can use thorium-powered nuclear reactors. Molten salt reactors are far enough advanced that they could be deployed in much higher numbers than they are currently. In BC, they could replace expensive and environmentally destructive Site C.

Renewable energy should be encouraged and a lot of money pumped into R&D to improve large-scale battery storage capacity.

These are not pie-in-the-sky suggestions. The technology is here, and advancing quickly. Why not use it, rather than relying on fossil-fuel power to build an LNG industry in BC that will take us backward, not forward? As we explained in the last article, the only way to get LNG is to frack natural gas, which will poison billions of gallons of scarce fresh water, emit methane which is 86 times worse than CO2 in terms of trapping heat, cause earthquakes and put human health at serious risk.

Our options are actually quite limited when it comes to the globe’s energy dilemma. The answer is nuclear energy and lithium-ion battery storage technology. Now all we need to do is convince the politicians.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.