Aben continues to expand mineralization at Forrest Kerr

2018.10.16

Exploration is a hunt for minerals. If it was as easy as flying a helicopter survey, taking a few soil samples, and then punching in some corresponding holes, everyone would be successful at it. But it doesn’t work that way. The Earth guards her secrets closely, most geologists find nothing economic to mine in their entire careers, some find one mine, a few, the really good ones find several. When multi time successful geos are spending your money on exploration your odds of success go way up. That’s because what happened in the past, geologically speaking, provides only clues about where to look for metals today. Even with the best of tools, exploration is still about proving theories, sometimes getting it right, more often, getting it wrong. It’s like that children’s game of hide and seek, where the kid hiding keeps saying, “warmer” as the seeker gets closer. Getting it wrong is just as important as getting it right, because it means the explorer is able to rule out theories and zero in on proven scientific hypotheses.

It’s geo-chem and geo-physical studies combined with ground-based direct observation, what you see with the boots and hammer, essentially old-fashioned picking and turning over rocks that leads to a successful drill program – a good lesson for gold explorers is that while “the truth machine” (drill) reveals all, in-the-field exploration, and proper interpretation of results makes for a successful exploration program.

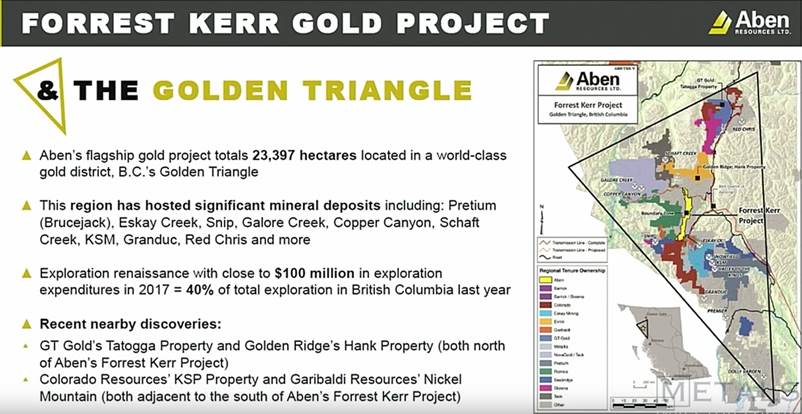

As we near the end of the exploration season in the Golden Triangle of northwestern British Columbia, this is what we have to keep in mind as Aben Resources (TSX-V:ABN) keeps plugging away at its Forrest Kerr property. The release of assays last week from its newly discovered South Boundary Zone means Aben is that much closer to understanding the structure of the ground it hopes to one day develop into a mine. As Jack Frost reaches down from the towering mountains with his icy fingers to shut down the drill rigs for winter we’ll summarize the company’s 2018 program thus far, while reminding shareholders 24 holes from Forrest Kerr are left to report, geo-chem/geo-physical study results are upcoming and there is news coming from Aben’s Yukon Project, the Justin.

South Boundary Zone

Aben’s goal at the beginning of summer was to expand the North Boundary Zone (NBZ) of Forrest Kerr beyond what was discovered last year. The company has done that, but it has also opened up fresh new ground, the South Boundary Zone (SBZ). The new assays, the type of mineralization reported, from the SBZ look very similar to the North Boundary Zone – giving credibility to the theory we introduced in our last article of a north-south mineralized zone of copper and high-grade gold.

Let’s compare the assays from the three discovery holes at the North Boundary Zone summer/fall 2017, with the results from the first three ever 2018 holes drilled in the South Boundary Zone.

The first thing on-site geologists noticed about the discovery holes at the NBZ was the visible pyrite and chalcopyrite – the source mineral for copper – in the drill core. However it wasn’t until the assays came back that Aben knew they also had high-grade gold.

Highlights included 6.7 grams per tonne gold, 6.4 g/t silver and 0.9% copper over 10 meters, including 18.9 g/t gold, 16.6 g/t silver and 2.2% copper over 3.0m in Hole FK17-04, which combined for an average grade of 0.26 g/t gold over 387m. Out of the nine-hole program, the best hit was in Hole FK17-05, which assayed at 21.5 grams per tonne gold, 28.5 g/t silver and 3.1% copper over 6m.

Fast forward to summer 2018, and the three holes at South Boundary – a newly discovered zone that had never been drilled before.

When the assays came back, the holes, drilled 1.5 km south of the North Boundary Zone, “intersected broad horizons of mineralized veins containing abundant pyrite and chalcopyrite,” reads the Oct. 16 news release. In terms of gold grades, the results were lower-grade than the NBZ discovery holes, but are representative of the same lithology (Triassic Stuhini or Jurassic Hazelton host rocks). Gold values ranged from trace amounts to over 5 grams per tonne in 1 or 2-meter intervals.

“Aben management is extremely encouraged that this first-pass drilling has intercepted broad zones of pervasive alteration(silica-sericite-pyrite-chlorite-potassic) with abundant quartz-sulfide veins and mineralized breccia zones indicating a strong and widespread mineralizing event,” the news release states.

The conclusion? The two zones – North Boundary and South Boundary – so far have different grades, but might be connected. Ie. copper-gold mineralization near surface. More holes will need to be drilled to solidify the connection. Change the degree of the drill bit and it could be a whole new ballgame in the SBZ.

Visualize the property as a steep valley, with the Forrest Kerr fault running on the west side of the valley and the Golden Triangle’s Red Line on the east side. At the very top of the drainage is the North Boundary Zone, and moving down the valley, you encounter what Aben is calling the South Boundary Zone.

How did Aben know to target the South Boundary Zone? Historical geochemical and geophysical studies were done that showed prospectivity “due to the elevated gold in rock and soil values that are coincident with an historic electromagnetic (“EM”) conductive geophysical anomaly,” states the Aug. 23 news release announcing the discovery of the SBZ.

The three collared holes (Ie. drilled from the same pad in different directions) hit quartz-sulfide veins at various depths that contained “abundant pyrite and copper (chalcopyrite) mineralization”.

Aben set up two crews to do new geochem work for a couple of months within the 2 by 4-kilometer ribbon thought to host gold-silver-copper. It also flew a new geophysical survey at 50m spacings running east-west across the valley. Results of either survey have yet to be published.

In an Ahead of the Herd interview, CEO Jim Pettit said he believes the updated geophysics will give Aben an even better understanding of the gold-bearing structures. “We want to know where it’s coming from, how it got there, and what’s feeding it so that we can follow our way back to the source,” he says on camera.

Listen to the two-part interview here:

https://www.youtube.com/watch?v=mNZtZazPodg

https://www.youtube.com/watch?v=iksECHZGVWE

Perhaps more importantly, Pettit notes this summer’s drill program had a modest goal of extending the North Boundary Zone by up to 200m, but instead, the company has hit a bonanza discovery hole at North Boundary, intercepted shallow, high-grade mineralization in three new holes at the NBZ, and discovered a new copper-gold mineralized zone 1.5 kilometers away Ie. the South Boundary Zone. Not bad for three months work.

And, the further south you go from the North Boundary Zone, the higher the grades of soil geochem results. In the graphic below, the red dots represent high-grade gold, over .02 parts per million. This means the mineralized system has a lot longer to run. Aben has only just started drilling 1.5 kilometers from the NBZ. It has another 2.5 km to explore in an area with excellent geochem anomalies. We should have more information about the geophysical characteristics soon as well.

North Boundary Zone

It didn’t take long for Aben to find success at the North Boundary Zone. After only two weeks, the drills hit quartz-sericite-pyrite, along with chlorite, calcite and hematite. Gold-bearing veins are usually accompanied by strong alternations in the wall rocks characterized by quartz, sericite and chlorite, along with abundant pyrite and arsenopyrite. The mineralization at the three discovery holes at North Boundary in 2017 was predominantly chalcopyrite, the mineral from which copper is extracted. High percentages (or tenors) of chalcopyrite often contain high-grade gold. Below is a summary of what was found at NBZ in 2017.

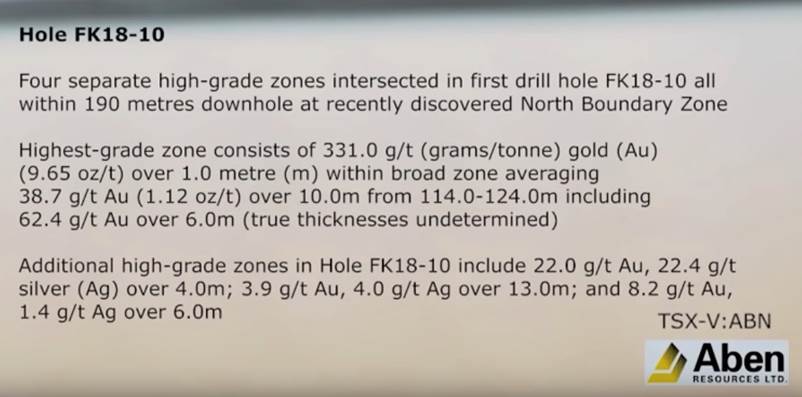

In August 2018, Aben encountered something altogether different at NBZ. Drilling 35 meters northwest and about 40 meters below last year’s three discovery holes, the drill in Hole FK-10 bored through four separate high-grade zones.

The highest-grade zone assayed at a whopping 331 grams per tonne (g/t), or 9.65 ounces per tonne, over 1.0m, within a broader zone of 38.7 g/t over 10m. The results from other high-grade zones in the discovery hole included 22.0 g/t gold and 22.4 g/t silver over 4.0m, 4.0 g/t silver over 13.0m, and 8.2 g/t gold with 1.4 g/t silver over 6.0m. The hole was drilled 230m north of a high-grade historic hole drilled by Noranda in 1991, which hit 326 g/t gold.

The find was accompanied by a frenzy of trading activity, with Aben’s stock gaining 45% on the day of the news release, at a volume of 22.5 million shares. The run continued until August 28, when ABN reached a near 52-week high of 45 cents a share.

Hole FK-10 was the first of eight holes drilled at the North Boundary Zone this summer. Step-out drilling continued into September, when assays from three holes were released. Highlights included 5.08 grams per tonne gold over 12.0m, 23.3 g/t over 2.0m and 10.62 g/t over 3.0m.

Though the grades were less impressive than the jewelry-box style gold encountered in the first hole, Aben says they are satisfied the results are more proof of a mineralized system extending for at least a kilometer and a half.

“Based on the geochemical and new geophysical data available to us we can clearly see the potential of the area that now includes the North Boundary Zone, the historic Noranda hole 230 meters to the south and the South Boundary Zone another 1.5 kilometers further south,” Pettit stated in the September 25 news release.

New drilling techniques

That release also pointed out that the complexity of the area’s geology prompted Aben to switch to Oriented Drill Core techniques. The new techniques were employed after drilling the first eight holes of the planned 10,000-meter drill program. In a nutshell, Oriented Drill Core is a more sophisticated way to identify targets, in areas like the Golden Triangle where there is very little surface outcropping – meaning information about potential mineralized structures are hidden. With Oriented Drill Core, Aben has a better idea of where to drill, to more accurately target the main faults thought to contain mineralization.

Mining supplier Boart Longyear provides a good explanation of Oriented Drill Core and why it’s used:

Oriented drill holes provide the perfect opportunity to measure the orientations of hydrothermal elements that influence the interpretation of surface chemistry, lithological and structural elements which in turn influence the construction of geological models. The volume of data available from downhole structural measurements allows for statistically meaningful observations about the ‘dominant’ orientation of hydrothermal elements as opposed to relying on spare outcrop data. Geologists frequently assume regional structural features influence deposit location and shape in some way. Reliable structural data in unweathered rocks allows explorers to test hypotheses regarding the relationships between mineral deposit formation and regional features used in the targeting stage.

Conclusion

Aben Resources has made good use of the 2018 drilling season by gathering a lot more information about the Forrest Kerr property located smack dab in the middle of the former Snip and Eskay Creek Mines, in BC’s Golden Triangle. Let’s face it, that’s what exploration is: an exercise in information-gathering.

It should be emphasized that Aben’s chairman Ron Netolitzky and director Tim Termuende are mining industry veterans with a lot of experience in this area. Netolitzky started working in the Triangle 30 years ago – a time when Vancouver stock market legend Murray Pezim was financing a lot of juniors. Since then a lot has changed. The area has roads, power, airstrips, new mines, and a new look at the geology thanks to geologists Jeff Kyba and JoAnne Nelson, who posited the Red Line theory.

Pettit’s enthusiasm about the Triangle comes through in Ahead of the Herd’s above linked to video interview:

“One thing about the Golden Triangle, it’s such a unique area in the world for high-grade. Something happened there over a couple of millenia, I think of it as a volcanic island chain that rammed into the continental plate. It’s a lot of very high grade, structurally controlled, volcanic environments and it’s all just folded and smashed together. We know we’ve got at least four ages of rock in this area and at least three different mineralizing events.”

With the window drilling closed at Forrest Kerr, Aben should be pleased with its results, which are starting to show some continuity. The 2 x 4-kilometer exploration zone looks to be connected, with pyrite and chalcopyrite mineralization found within 120 meters from surface, some of it higher grade than others, but all part of the same lithology, in the North Boundary and South Boundary zones. That’s a good sign.

The jewelry-box style mineralization encountered in the first hole at the North Boundary Zone clearly excited the market, but that’s tough to maintain. You can’t hit that kind of sweet core on every hole. Expecting to do so is unrealistic. That’s the thing about mining. Savvy junior mining investors know that exploration is a process, of hits and misses, and variations in between. The main point is, are the drills showing continuity and is there the potential for proving the theory, or theories, through more drilling? In Aben’s case, this certainly seems to be the case.

Keep in mind, we haven’t received all the assays from the holes drilled this year. There are 24 left to report, plus the results from the geophysical and geo-chem surveys. The news flow should continue well into November, and possibly December, giving ABN investors the opportunity for more catalysts that could see the stock do another run before the year is out. And, we have yet to see the results from Aben’s trenching program at its Justin property in the Yukon.

There is no possibility of Aben running out of cash, either. The treasury is flush with just over $7 million, thanks to a $4.2 million financing led by renowned junior resource investor Eric Sprott. Aben will not have to do another financing to raise funds for next year’s exploration season – another confidence booster.

I’m holding tight to my shares. The company has a lot of results still to come, and we’re expecting some pleasant surprises – hopefully similar to hole 10 with its bonanza gold grades, but more evidence of a shallow system of high-grade copper-gold mineralization would also be a win in my books. It’s this opportunity, and drilling their Chico property in February 2019, that keeps me excited about Aben, and why I own shares.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Aben Resources (TSX.V:ABN). ABN is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.