Skyharbour drilling in world’s highest-grade uranium jurisdiction

2018.11.03

The combination of hydraulic fracturing and horizontal directional drilling technologies in the 1990s led to a boon in natural gas and oil production from US shale oil and gas fields – one that continues today.

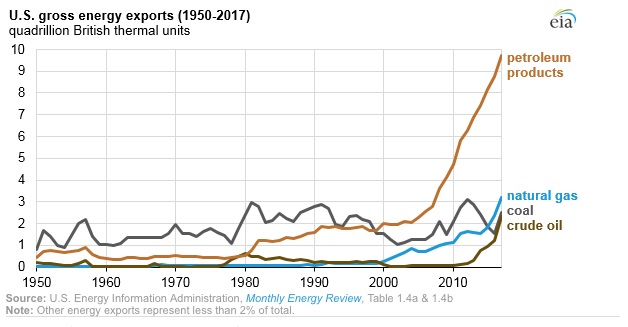

Heavy production in the Permian and other shale fields like the Eagle Ford and the Marcellus has transformed the United States from a net oil and gas importer to a net exporter (exports > imports) within a decade. The US became a net petroleum products exporter in 2011 and a net natural gas exporter in 2017, states the Energy Information Administration (EIA).

As the graph below from the EIA shows, US energy exports bumped along for 50 years, between 1950 and 2000, but after 2000, exports of crude oil, natural gas and petroleum products take a sharp upward turn after 2010, the start of the so-called “shale revolution.” Oil exports really accelerated after 2015 when Congress lifted the 40-year ban on shipping oil abroad, tripling between 2016 and 2017 and hitting a record 3 million barrels a day in June 2018.

None of this is news. Big Oil and US politicians whose constituencies are beholden to oil and gas jobs/ tax revenue also point to the fact that this “energy renaissance” has come with a bonus: a significant reduction to greenhouse gas emissions, as the continued frenzy of shale drilling has pushed down the price of natural gas and incentivized utilities to switch from high-emissions coal-powered power plants to natural gas-fired plants.

We can’t argue with that. Carbon-dioxide emissions from electricity generation fell last year to their lowest level since 1987, the EIA reported this week. Much of that reduction is due to the switch from coal to natural gas.

NG and its super-cooled cousin, LNG, are often touted as a solution to climate change, since gas is seen to be much cleaner than coal and oil. But is it? This article will look at the actual emissions from natural gas production, including leaks of methane, a much more powerful greenhouse gas than CO2, into the atmosphere. We’ll also take a look at the viability of “clean coal” being heralded by Donald Trump, and then outline the case for what we here at Ahead of the Herd believe to be a much better alternative to both: uranium-fueled nuclear power.

NG: Not all it’s fracked up to be

A report released earlier this year by London-based IHS Markit appears almost breathless in its support for the US natural gas industry, written during the 10-year anniversary of the unconventional (shale) gas revolution that has upended world energy markets.

According to the report, natural gas production in the US rose by over 40% between 2007 and 2017, pushing natural gas prices down by more than two-thirds. 1,250 trillion cubic feet of NG is now economic below $4 per MMBtu (Henry Hub pricing), compared to 900 trillion cubic feet in 2010.

Not only has shale gas turned Pennsylvania and New York from energy importers into exporters, there is seemingly much more to come. By 2040, IHS Markit expects natural gas will account for nearly half of all electricity generated in the United States. Right now NG represents 29% of US energy consumption, compared to 39% for petroleum and 14% for coal.

“U.S. power markets and the economy overall would look significantly different had the shale revolution not taken place,” states Sam Andrus, executive director, IHS Markit and co-author of the report. “The new outlook for natural gas cost and availability has created new possibilities for progress toward national goals of energy efficiency, cost efficiency, environmental protection and energy security. In short, the Shale Gale put a powerful new wind at America’s back.”

The Shale Gale. Catchy phrase. Clearly Mr. Andrus doesn’t know about “The Red Queen Syndrome”, referring to the character in Lewis Carroll’s children’s story ‘Through the Looking Glass’. Just as Alice in the story couldn’t keep up with the Red Queen – running faster and faster but staying in the same place – shale wells are very productive in their first year but deplete rapidly after that. A year after coming on-stream production can drop 20 to 40% from its original level. Drillers have to keep drilling faster just to keep pumping the same amount of oil as before, due to the rapid depletion rate. Within one or two years the well is done, capped and the drillers move on to the next one.

Here’s James Howard Kunstler, author of ‘The Long Emergency’ and his take on the situation:

“In order to keep production up, the number of wells will have to continue increasing at a faster rate than previously. This is referred to as “the Red Queen syndrome” which alludes to the character in Alice in Wonderland who famously declared that she had to run faster and faster just to stay where she is.”

Here’s something else, it’s a piece from an interview with energy expert Bill Powers:

“My thesis is that the importance of shale gas has been grossly overstated; the U.S. has nowhere close to a 100-year supply. This myth has been perpetuated by self-interested industry, media and politicians. Their mantra is that exploiting shale gas resources will promote untold economic growth, new jobs and lead us toward energy independence.

In the book, I take a very hard look at the facts. And I conclude that the U.S. has between a five- to seven-year supply of shale gas, and not 100 years. That is far lower than the rosy estimates put out by the U.S. Energy Information Administration and others. In the real world, many companies are taking write-downs of their reserves.” Bill Powers, author of ‘Cold, Hungry and in the Dark: Exploding the Natural Gas Supply Myth’ in an Energy Report interview

According to the EIA, “peak tight oil” could come as early as 2022. And that’s assuming no supply risks. But as oil industry watchers know, the United States is having trouble keeping up with all the shale oil and gas being pumped through its formations. A lack of infrastructure (pipelines and railroads) has kept a lid on MidWest oil prices, and a shortage of manpower and oilfield services is limiting production growth.

When shale gas producers have a gas glut, they simply flare it – not good for the environment, as we’ll discuss shortly.

Then there’s the adverse environmental effects of fracking. As use of this technology has increased worries are growing about fracking’s impact on our fresh water supply; it’s easy to see why:

- Fracking just one well can use 2 to 8 million gallons of water with the major components being water (90%), sand or proppants (8-9.5%), and chemicals (0.5-2%). One 4-million-gallon fracturing operation would use from 80 to 330 tons of chemicals and each well will be fracked numerous times. Many of these chemicals have been linked to cancer, developmental defects, hormone disruption, and other conditions.

- Cracked wells and rock movement frequently leak fracking fluid and gases into nearby groundwater supplies. Fracturing fluid leak-off (loss of fracturing fluid from the fracture channel into the surrounding permeable rock) can exceed 70% of injected volume.

- Methane concentrations are 17 times higher in drinking-water wells near fracturing sites than in normal wells. Hydraulic fracturing increases the permeability of shale beds, creating new flow paths and enhancing natural flow paths for gas leakage into aquifers.

Fracking has also caused benzene poisoning among pregnant native women in north-eastern British Columbia – natural gas country – and is known to cause earthquakes.

LNG is often touted as the holy grail of clean resource development. British Columbia is staking its economic future on foreign companies coming to frack natural gas from the tight Montney gas play in northeastern BC. Selling LNG to China and India will help them to make the switch from coal to LNG, thus saving the planet. Or so the argument goes. But LNG uses a lot of energy. To turn it into liquid form, the gas must be cooled to 163 degrees below zero. To do that requires a great deal of power, with massive compression units running 24/7. Where does that power come from? In most cases, the same fracked natural gas is used to run the compression units, which pretty much defeats the purpose of LNG as “clean”.

But this is the direction the industry is going. According to a new study by Wood Mackenzie, LNG will be the biggest source of carbon emission growth by 2025 – due to strong demand from Asian buyers.

For more read our LNG: Another environmental disaster coming to BC

Methane: NG’s dirty secret

Let’s take a harder look at the claim that natural gas has been responsible for lowering America’s greenhouse gas emissions over the past decade since shale gas fracking began in earnest.

The report ‘Leveraging Natural Gas to Reduce Greenhouse Gas Emissions’, by the Center for Climate and Energy Solutions (CCES) acknowledges that switching from coal to natural gas in the US has contributed to a decline in greenhouse gas emissions. However, the report also notes that natural gas is mostly methane (CH4), a potent greenhouse gas that is over 25 times more efficient than carbon dioxide at trapping heat in the atmosphere over a 100-year period. (the Intergovernmental Panel on Climate Change (IPCC) says methane is 86 times more damaging than CO2 over a 20-year period)

Excerpts from the CCES report:

The direct release of methane during production, transmission, and distribution may offset some of the potential climate benefits of its expanded use across the economy.

Substitution of natural gas for other fossil fuels cannot be the sole basis for long-term U.S. efforts to address climate change because natural gas is a fossil fuel and its combustion emits greenhouse gases. To avoid dangerous climate change, greater reductions will be necessary than natural gas alone can provide.

It’s also become apparent that NG alone can’t take credit for the reduction in greenhouse gases in the United States. According to the EIA, the strongest driver of the reduction in GHGs is neither the shift from coal to natural gas nor the rise in renewable power. Instead, over half the half the decline occurred due to a decline in the industrial demand for electricity – owing to a move away from energy-intensive industries. Examples of these would be the manufacture of metals, chemicals, paper, petroleum and coal products versus cleaner industries like transportation equipment manufacturing, according to the EIA’s 2017 ‘Manufacturing and Energy Consumption Survey’.

As proof, Forbes quotes a senior energy and environmental analyst saying that if decreased electricity demand from industry hadn’t occurred, US power emissions would have been 654 million tonnes last year – more than the 645 million tonnes that the power sector saved by shifting to natural gas and renewables. In other words, the increase in power sector emissions – largely driven by natural gas – offset the reduction in GHGs from switching to cleaner fuels, when decreased industrial demand is stripped out of the equation.

Carbon Brief puts another angle on the GHG reductions. It names three factors as responsible: increase in gas electricity generation (displacing high-carbon coal), wind generation, and reduction in industrial energy use as noted above.

Other important factors include reduced miles driven, increased vehicle fuel economy and lower emissions from air travel via reductions in CO2 per passenger mile. Solar power accounts for a small, but growing part of emissions reductions, representing 3% of the reduction in 2016.

To determine the emissions impact of natural gas, one really has to differentiate between short-term and long-term. Short-term, methane emissions are bad, about 20 times more powerful per ton than CO2, but they dissipate relatively quickly. Long-term, CO2 is worse. From Carbon Brief:

If you care about avoiding warming later in the century (as the United Nations does with its 2°C warming by 2100 target), there is relatively little problem with short-term methane emissions, as long as they are phased out in the next few decades. If you care about short-term changes, however, methane is a much bigger deal.

As for how much methane leaks from the whole supply chain of natural gas production, the official figure from the EPA is only around 1.5% of total production, but an article by Yale University quotes a paper published in the journal ‘Science’ in 2014. The author “found that overall emissions were likely between 25 and 75 percent higher than reported by EPA, suggesting that actual natural gas leakage rates are probably somewhere between 2 and 4 percent of gas production.” Researchers have found leakages up to 10% in individual fields. Another source says fugitive methane emissions run from 1% to 9% of total life cycle emissions. In order for natural gas power plants to be cleaner than coal, methane emissions over the plant’s life cycle must be kept below 3.2%, according to one study.

Most methane leaks come from flaring excess NG instead of putting it into a pipeline. Think methane emissions are no big deal, just a cost of doing business? The journal ‘Nature’ earlier this year published a study saying that the oil and gas industry emits some 13 million tonnes of methane a year, which is 60% higher than the EPA’s estimate.

As for the government’s take on methane, it’s not, shall we say, on the side of the planet. Last year the Trump Administration stopped a regulation put in place by Obama’s team requiring drillers on federal land to curb methane leaks. In September 2018, “the Interior Department snuffed out new rules aimed at lowering the oil and gas industry’s methane emissions,” Grist reported. The relaxation of fugitive methane emissions could easily make natural gas even dirtier than coal:

Trump’s own EPA estimates that its rule rollback will result in the emission of an additional 484,000 tons of methane, volatile organic compounds, and other hazardous pollutants over the next five years. Meanwhile, the death of Interior’s methane rule will add another half-million tons of pollutants to the air. In the process, it will erode the pillars of the once-vaunted natural gas bridge.

Clean coal? No such thing

What about clean coal? Is it possible to re-tool the US coal industry into a powerhouse for the production of non-polluting coal while saving thousands of coal jobs that are threatening to get axed as demand for coal continues to wane? The answer is not promising, despite “beautiful clean coal” being part of Trump’s legislative agenda to bring back jobs to the ailing industry.

The term refers to coal plants that capture CO2 from smokestacks and bury it underground. It has also been used to describe plants that emit less carbon than older ones. But they still pollute the air, just less so. Among the noxious stuff coming out of these stacks are carbon dioxide, mercury, sulfur dioxide, arsenic and particulate matter – all of which are harmful to human health.

And coal-mining itself is very carbon-intensive, in terms of the surface and underground equipment needed, much of it run with diesel fuel.

The New York Times reported that while carbon capture could be useful in limiting emissions not just from coal plants but steel and cement plants, the problem is companies don’t have any incentive to install the necessary equipment (like scrubbers) without stricter rules or a carbon price – both of which the Trump Administration opposes.

The only clean-coal plant to get up and running is NRG Energy’s Petra Nova in Texas, which has a carbon-capture system added to it, Bloomberg reports, thanks to a $190-million grant from the Obama Administration. Southern Co. abandoned the clean-coal section of its Kemper plant in Mississippi, due to cost over-runs and problems building heat-resistant structures.

The plants are so expensive to build it could take up to 20 years to pay back the debt, but investing in a dying industry where coal may be hard to come by hardly makes economic sense. Overseas, clean coal projects are finding it tough to get financing, as banks prefer to support cleaner-energy projects.

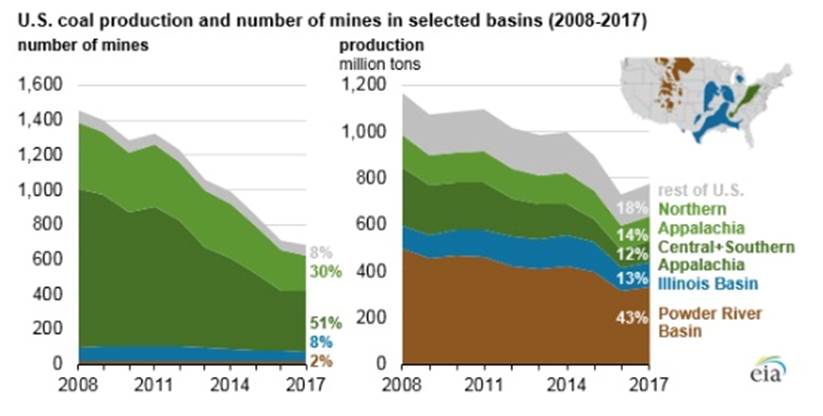

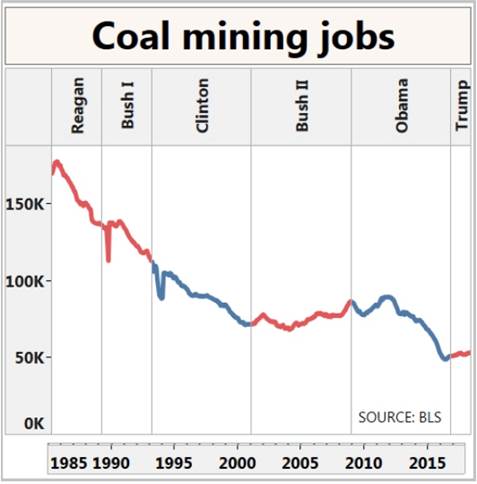

It’s time for the United States to forget about clean coal, dirty coal, or any other kind of coal. That ship has sailed and it ain’t coming back. The charts below say it all.

Going nuclear

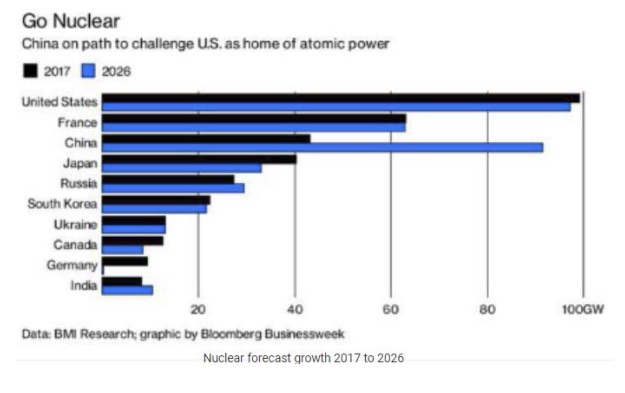

The global demand for electricity is expected to increase by 76% by 2030, and while everyone knows about the electric vehicle “revolution”, what is not often talked about is how will all that extra power be generated. Much of it will have to come from nuclear.

Politicians and business leaders have realized that no longer can we continue to pursue an energy matrix driven by fossil fuels (oil, natural gas and coal), while at the same time protecting the environment. Stopping the warming to the point when feedback loops like disappearing sea ice/warming ocean water, or melting permafrost and the escape of methane, push us past the point of no return (generally considered to be an increase of 2 degrees C) has become something of a religion for environmentalists.

There are two routes to slowing global warming: conserving energy and changing the energy mix from fossil fuels to renewable energy sources and nuclear, which don’t add to greenhouse gases already present in the atmosphere. The electrification of the global transportation system dovetails with this way forward.

In 2017 73.5 million cars were produced worldwide. If half of those vehicles sold are electric, that’s 37 million electric vehicles (EVs), all demanding power from the electricity grid. BP says 300 million EV’s will be part of the global vehicle fleet by 2040, Morgan Stanley says 1 billion EV’s on the road by 2047. How on Earth are we going to produce all that electricity, without using fossil fuels? How many tonnes of coal would we have to burn? How many rivers would we need to dam? How much natural gas would we need to find and frack, along with the fresh water that becomes polluted from the process?

Renewables are great, and pretty cool, but how many acres of solar panels would we have to lay down to capture enough sunlight to continuously power up to a billion EVs? How many noisy, ugly, bird-murdering wind farms would we have to build? The intermittency factor of renewables is obviously a major impediment to using it as base-load power, despite the price per kWh for wind and solar dropping.

Of course, we already have a clean energy source, that has become somewhat sullied after the Fukushima disaster in 2011. Despite the incident at the nuclear power complex following the Japanese earthquake/tsunami, and a few radiation escapes that can be counted on one hand since nuclear power plants started in the 1950s, nuclear remains our cheapest, safest, and most energy-efficient source of power generation.

Here are the reasons why:

- One pound of yellowcake (U3O8 – the final product of the uranium milling process) has the energy equivalence of 35 barrels of oil. One 7-gram uranium fuel pellet has an energy to electricity equivalent of 17,000 cubic feet of natural gas, 564 liters of oil or 1,780 pounds of coal.

- Nuclear power’s life-cycle emissions range from 2 to 59 gram-equivalents of carbon dioxide per kilowatt-hour. Only hydropower’s range ranked lower at 2 to 48 grams of carbon dioxide-equivalents per kilowatt-hour. Wind came in at 7 to 124 grams and solar photovoltaic at 13 to 731 grams. Emissions from natural gas fired plants ranged from 389 to 511 grams. Coal produces 790 to 1,182 grams of carbon dioxide equivalents per kilowatt hour.

- Nuclear energy is the only proven technology that can deliver baseload electricity on a large scale, 24 hours a day, 7 days a week, regardless-of-the-weather, without producing carbon dioxide emissions. Nuclear power plants emit no carbon pollution; no carbon monoxide, no sulfur oxides and no nitrogen oxides into the atmosphere.

- Natural gas accounts for 80% of the cost to produce power from an NG power plant. Uranium accounts for 5-10% of the price of nuclear energy

- In terms of power production costs, when comparing nuclear to gas, nuclear to coal or nuclear to hydro, only coal is cheaper.

- Nuclear energy is reliable. Nuclear power plants do not depend on weather conditions to produce electricity nor do they need costly electricity storage options.

- One ton of uranium produces more energy than several million tons of coal and oil. Fuel transportation costs are less and there is less impact on our environment from mining or fracking shale gas.

- Nuclear power plants require very little space and can be situated close to where their power output is needed.

For more read The Civil Nuclear Energy Renaissance and Nuclear Power, It’s No Contest

Uranium supply and demand

Where uranium is mined

More than two-thirds of uranium comes from Canada, Australia and Kazakhstan, a former Soviet republic. The largest proportion comes from Kazakhstan, followed by Canada, Australia and Niger, according to the World Nuclear Association.

The top uranium mining companies are, in descending order, Kazatomprom, Cameco, Orano (formerly Areva) and Uranium One.

Recall that Uranium One and its relationship to the Clinton Foundation have been in Republican cross-hairs since 2013, when the Canadian company with a mine in the Powder Basin of Wyoming, was partially taken over by Rosatom, the Russian state-owned uranium mining company. Rosatom now owns 51%.

The controversy is over whether Hillary Clinton, then Secretary of State, was aware of, or presided over, a flow of cash that was funnelled into the Clinton Foundation at the time of Rosatom’s purchase of a majority stake in Uranium One. Former US President Bill Clinton also reportedly received half a million dollars for a speech he gave in Moscow, from a Russian bank with links to the Kremlin that was promoting Uranium One stock, according to a New York Times story:

Whether the donations played any role in the approval of the uranium deal is unknown. But the episode underscores the special ethical challenges presented by the Clinton Foundation, headed by a former president who relied heavily on foreign cash to accumulate $250 million in assets even as his wife helped steer American foreign policy as secretary of state, presiding over decisions with the potential to benefit the foundation’s donors.

Demand for uranium, the nuclear fuel, is directly tied to the need for nuclear power, which is growing exponentially especially in Asia due to the problems with air pollution from coal-fired power plants.

There are currently 452 operating nuclear reactors and 56 new ones under construction globally. According to the World Nuclear Association, China with its appalling air pollution is the leader with 17 new reactors under construction and 184 planned or proposed. Up until recently Japan was out of the nuclear mix, with all but a handful of nuclear reactors shut down for safety checks following damage to the Fukushima Daiichi plant during the 2011 earthquake/ tsunami. But Japan which has no oil and gas of its own and depends heavily on nuclear, now has 9 reactors back in operation – a tripling from 2017 – and aims for nuclear to represent just under a quarter of its power mix by 2050. Japan’s Abe Administration is pro-nuclear. Russia is building 9 new reactors and India is constructing 7.

According to nuclear consultant UxC, this means the global capacity for nuclear power is expected to grow by 27% between 2015 and 2030. And that means a whole lot more uranium. How much? UxC estimates annual uranium demand will spike by nearly 60%, from the current 190 million pounds of U3O8 to 300 million pounds by 2030.

But there’s a problem. Uranium supply has been steadily dropping since 2016. That year total mined supply was around 163 million pounds, in 2017 it was 154 million, and this year it’s estimated to be under 135 million. With current U3O8 demand at 192 million pounds, that leaves a shortfall of at least 57 million pounds.

For more on the uranium market, read our Why the uranium price must go up

How are we going to fill the 57 million-pound uranium shortfall? Some of it could be met with secondary supply ie. uranium that is stockpiled by governments and utilities for strategic reasons. However, much of this supply is locked up and not available for the market. It’s not “mobile”, meaning it cannot be counted on to add to primary mined supply.

A bear market in uranium since 2012 has dropped the price to a point where uranium is no longer profitable to mine for most producers. Hence the shutdowns of major uranium mines like McArthur River, Langer Heinrich, and curtailment of production from Kazatomprom.

On top of that, big funds are emerging to buy uranium from the spot market. Top producers like Cameco are also buying from spot in order to keep fulfilling its long-term contracts despite cutting production. In the next seven years three-quarters of uranium contracts will expire. Recontracting will have to take place before then, or before all the uranium in the spot market disappears. Utilities need to re-sign long-term contracts to ensure their uncovered demands are met, and as shown above, uncovered demand is increasing. The shift in the spot market is key; with so much buying going to come into the spot market, it’s only a matter of time before the price responds in kind.

Skyharbour Resources

The uranium bear market of the last seven years has decimated share prices, meaning very attractive entry points. Saskatchewan’s Athabasca Basin hosts the world’s highest-grade uranium jurisdiction, where the largest uranium mine (McArthur River) is, along with Cameco’s Cigar Lake Mine, and some very notable recent high-grade discoveries including Fission Uranium’s Patterson Lake South/Triple R, Rio Tinto’s Roughrider deposit and NexGen Energy’s high grade Arrow deposit.

A lot of exploration is happening around the Basin, and one of the best companies to have amassed a large, prospective land position is Skyharbour Resources (TSX-V:SYH).

Skyharbour acquired its flagship Moore Project through an option agreement with Denison Mines back in 2016. Moore hosts the Maverick Zone, where historical drill results feature 4.03% equivalent U3O8 over 10 meters, including 20% eU3O8 over 1.4m starting at a depth of 265m, as well as 5.14% U3O8 over 6.2m. Recent drilling by Skyharbour returned 21% U3O8 over 1.5m, at a depth of 265m.

Skyharbour’s current drill program at Moore is aimed at testing new “basement” targets at the Maverick corridor. Since mid-2000, the focus at Moore has been on the 4-kilometer Maverick structural corridor where pods of high-grade unconformity-type uranium mineralization has been intersected. During the winter and summer of 2017, just under 10,000 meters of drilling was completed. Highlights included 20.8% U3O8 over 1.5m, 9.12% U3O8 over 1.4m, and 2.23% over 9.3m U3O8, all at between 250 and 275m depth. About half of the 4-km corridor has been drill-tested.

Skyharbour also owns 100% interests in the Falcon Point, Yurchison and Mann Lake uranium projects on the east side of the Basin.

While Skyharbour is a top-tier uranium explorer, with the expertise to back that up, the company is also a prospect generator, meaning its strategy is to ink option agreements on its secondary properties thus allowing other companies to come in and incur exploration expenditures in return for earning stakes on those properties.

I’ve got surging global demand for electricity (an increase of 76% by 2030), including the move from gas/diesel-powered vehicles to EVs, and the switch from fossil fuel-powered electricity to nuclear power on my mind. I’m also thinking about ways to play the coming uranium bull market, and I see investing in junior uranium companies as historically offering the most leverage to a rising commodity price. Which is why I have SYH and its current exploration program on my radar.

Richard (Rick) Mills

Ahead of the Herd is on Twitter

Ahead of the Herd is now on FaceBook

Ahead of the Herd is now on YouTube

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Skyharbour Resources (TSX.V:SYH). SYH is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.