Kodiak Copper presents compelling investment opportunity – Richard Mills

2024.12.17

Kodiak Copper (TSXV:KDK, OTCQB:KDKCF, Frankfurt:5DD1) was established by chairman Chris Taylor of Great Bear fame. The founder and CEO of Great Bear Resources presided over its acquisition by Kinross Gold in 2022 for $1.8 billion.

Kodiak, a Discovery Group company, is led by Claudia Tornquist, previously a general manager at Rio Tinto, working with Rio’s copper operations. She was also the former director of Kennady Diamonds, leading the $176M sale of the company to Mountain Province Diamonds.

Kodiak, GT Gold and Copper Mountain analogs

Comparing Kodiak Copper to GT Gold (TSX.V:GTT) and Copper Mountain Mining (TSX.V:CUM) is interesting from an investor’s perspective. Would an investor have made money if they had got in early enough, before the stock price rose following publication of key milestones — a resource estimate in the case of GT Gold and commercial production, actually the restart of an old mine, for Copper Mountain Mining?

The Copper Mountain mine site is located approximately 15 km southwest of Princeton, British Columbia. The deposit was mined by underground methods between 1923 and 1957. Open-pit mining commenced in 1968 and the mine closed in 1996. It was re-opened in June 2011.

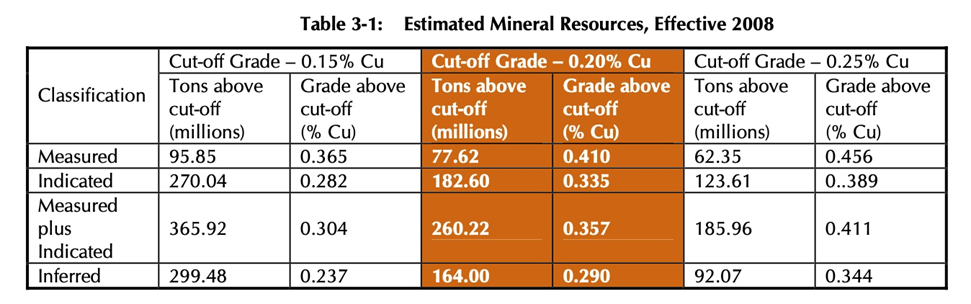

A technical report dated Sept. 11, 2008, shows an estimated resource of 260.22 million standard tons at 0.357% grade above cut-off of 0.2%, (measured and indicated), and 164Mt at 0.290% grade above cut-off in the inferred category.

A historical stock chart of Copper Mountain Mining shows the most dramatic price increase when the mine started production in June 2011. The stock price ran from about $1.00 a share in 2008-09 to an all-time high of $8.25 in May 2011 — a month before the mine re-opened.

An investor who bought the stock in early 2008 for $1.00 would’ve had good reasons to hold it, based on the fact that it was a brownfield (previously mined) operation that could be put back into production relatively easily with the right management team and at the right copper price.

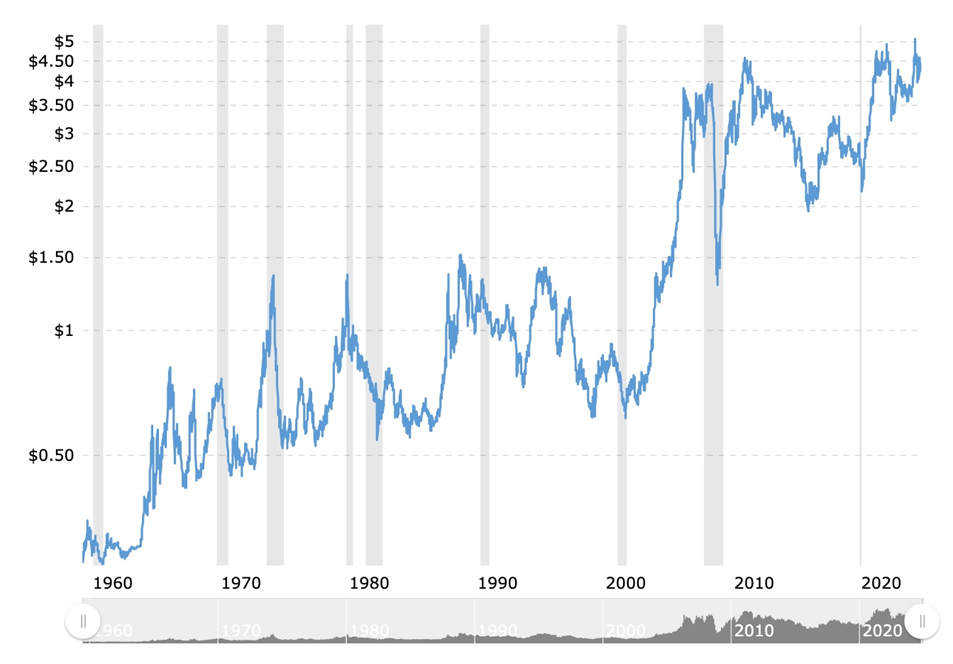

Indeed the historical copper price chart below shows a tight correlation between CMMC’s share price and the price of copper. Copper dropped suddenly in 2008 from $3.94 on April 7 to $1.29 on Dec. 22, likely due to the financial crisis. It makes sense, then, that the release of Copper Mountain Mining’s technical report in September 2008, including a new resource estimate based on 2007 drilling, didn’t move the stock price.

The release of an updated resource in early March 2009, 20% above earlier estimates, also failed to incite share buying. According to the above chart, CMMC was trading at just $0.53 then.

A good entry point for investors who bought the mine restart narrative.

Two years later, copper was back up to $3.95. In fact Copper Mountain’s restart of the mine in June 2011 was well-timed. It corresponded to a copper price of $4.10 that month, only 44 cents away from the Feb. 7, 2011 peak of $4.54.

An investor who had bought the stock any time before 2010 would’ve had ample opportunity for price appreciation. Acting on the updated resource estimate with a buy in March 2009, continually averaging in, and holding until mine re-opening would have rewarded an investor with a homerun sized gain.

Our conclusion? When a mine re-opens, resource estimates and other technical reports may serve as weaker catalysts than the copper price, which is logical given that the mine’s production and profit potential are directly related to price performance, but when investors see the cash flow ‘light at the end of the tunnel’ significant stock price gains can be made.

In June of 2023 Copper Mountain Mining was sold to Hudbay Minerals for close to CAD$600 million. The operation is now 75% owned by Hudbay and 25% by Mitsubishi Materials.

GT Gold (TSXV:GTT)

GT Gold began exploring its Tatogga project in northwestern BC in 2016. The Saddle South discovery was prospective for gold and silver. While drilling over the next two years outlined a strong mineralized system, it was the much bigger but lower-grade Saddle North porphyry copper-gold deposit that piqued a major’s interest.

A 2017 discovery hole at Saddle North cut 210 meters averaging 0.16% copper, 0.14 grams per tonne gold and 0.28 g/t silver. The grades got stronger the deeper the hole went.

A 2018 hole that undercut the 2017 discovery hit 822 meters averaging 0.26% Cu, 0.42 g/t gold and 0.62 g/t — confirming that the junior was onto a large porphyry reminiscent of the Red Chris mine about 20 km to the southeast.

Intrigued, Goldcorp grabbed an early 10% stake (like Tech has done with KDK), spending CAD$17.9 million in 2019. An additional $8.9M boosted Goldcorp’s stake to 14.9%. (Newmont acquired Goldcorp on April 18, 2019).

With Newmont’s backing, GTT continued to explore Saddle North, resulting in a maiden resource estimate in July 2020.

Based on 41 drill holes, Saddle North hosted 298 million tonnes of indicated resources averaging 0.28% Cu, which translated into 1.81 billion pounds of copper, 3.47 million ounces of gold and 7.58Moz of silver. Inferred resources were 543 million tonnes averaging 0.25% Cu, yielding 2.98 billion pounds of copper, 5.46Moz of gold and 11.64MOz of silver.

Less than five years after its founding, GT Gold and its Tatogga project was bought out by Newmont, which spent $393 million to acquire the 85.1% of GTT’s shares it didn’t already own.

GT Gold is an example of a company with huge potential to make big money for investors who got in early.

From the chart below, an investor who bought GT Gold for $0.51 in July 2017 and held on until the 2017 Saddle North discovery would have quintupled (5X) their investment. The stock bumped along between $0.50 and $2.50 for the next two years; it was $2.18 at the time of the resource estimate in July 2019 — testing the mettle of investors who had held the stock during the first and second discovery phases when the stock reached peaks of $2.75 and $2.11.

Smart investors though who saw the potential would have bought on the dips and on positive news releases. Those who saw the chance for a takeover by Newmont would have been rewarded handsomely when it happened on March 10, 2021 with Newmont offering $3.25 a share.

The investor who got in at $0.51 and sold at the buyout price of $3.25 would have realized a 537% gain.

Conclusion

Investing in junior mining companies isn’t for the faint of heart, nor the “get rich quick” crowd. It takes time, skill and perseverance to identify a company, do your due diligence, and then have the faith and PATIENCE to stay with it through the often-bumpy ride from discovery to buy-out, or in the case of Copper Mountain Mining, from resource estimate to restart.

If management thinks it’s light on tonnage, KDK will do more drilling to build more critical mass. It won’t stop until it builds enough tonnage to potentially interest a major.

GT Gold proves that a junior can make money by putting out a resource estimate, as can investors who play the game right. It wasn’t until Newmont paid $393 million to acquire 85% of the shares it didn’t own that the stock really took off, from $1.92 to $3.21 on March 10, 2021. That’s a 67% gain, but very few investors would have bought and sold on the same day. The most handsomely rewarded would have been those that got in four or five years earlier at <0.50 cents to $1.00.

We see no reason why investors won’t do very well for themselves owning KDK; in our opinion, it’s an example brought to you by AOTH, of what patient investors, who actually know how to invest in this sector, are paying attention to.

Kodiak’s management team, and the Discovery Group, have a successful, an envious, track record of shareholder returns.

Copper market fundamentals are currently strong, with analysts predicting increasing demand facing the headwinds of structural supply deficits.

A key focus of Kodiak’s 2024 drill program was to identify additional near-surface and high-grade mineralization. Drill results from the Adit Zone to date have clearly achieved this.

The holes significantly extend the copper envelope at Adit and when combined with historical drilling, Kodiak’s new results have outlined a sizeable near-surface, high-grade area of mineralization.

Kodiak Copper’s MPD project has all the hallmarks of a major copper/gold porphyry system with the potential, in my opinion, to become a world -class mine.

Kodiak Copper

TSX.V:KDK, OTCQB:KDKCF, Frankfurt:5DD1

Cdn$0.41 2024.11.29

Shared Outstanding 75.9m

Market cap Cdn$32.7m

KDK website

Subscribe to AOTH’s free newsletter

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard does not own shares of Kodiak Copper (TSX.V:KDK). KDK is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of KDK

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

2 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

$KDK #Copper #Newmont

Hello Kodiak Copper,

My name is David Kumwimba, resident in the DRC Congo in the province of Haut Katanga,

We need a partnership, we have 3 mining squares and a copper cathode production plant which needs financing to relaunch and opportunities and if you can also come to DRC Congo.