Cypress Development putsout blockbuster PEA

2018.11.03

Successful resource investing is all about identifying prospective companies with an excellent project while their share prices are low enough to have the opportunity for a two, five, 10-times gain or more when things go right. Junior mining has so many small-cap companies chasing discoveries that investors need to be really smart about which companies they choose to buy into. The space is rife with charlatans and pump and dumpers so the maxim is always “buyer beware”.

Having said that, there are times in the market, or it’s more accurate to say, sub-markets according to commodity, when a company slips under the radar and isn’t being properly valued by investors – whether those investors are institutional or retail. In our opinion such is the case with Cypress Development Corp (TSX-V:CYP), which just put out a preliminary economic assessment (PEA) that should have had investors turning their heads so fast they got whiplash.

To summarize:

The PEA showed an outstanding net present value of $1.45 billion at an 8% discount rate, yielding an internal rate of return (after tax) of 32.7%. Payback is just under 3 years. The IRR is based on a lithium carbonate price of $13,000 a tonne, a conservative estimate that is around the same as lithium prices in China currently.

The proposed mine would produce an average 24,042 tonnes of lithium carbonate a year, and have a minelife of 40 years. The mine would be neither a hard-rock nor a lithium brine operation, but rather, would process the lithium from clays in Nevada’s Clayton Valley by leaching with sulfuric acid.

The IRR is all the more impressive considering that Cypress only spent a million dollars in exploration to achieve the numbers in the report. What’s more, the resource increased significantly from the original estimate released in May. The Clayton Valley Lithium Project now hosts 8.9 million tonnes of lithium equivalent (LCE), which is 2.5 million tonnes more than previously reported. This includes 3.835 million tonnes of LCE in the indicated category, and 5.126 million tonnes of LCE in the inferred category. The grades in the PEA are only slightly different, at 867 parts per million (ppm) indicated and 860 ppm inferred, versus the May resource estimate’s 889 and 888 ppm.

Ahead of the Herd got Cypress CEO Bill Willoughby on the phone Wednesday to discuss the PEA. The first question: What are we missing? The last buyout of a lithium junior, Lithium X by a Chinese company, valued the LCE in the ground (+2 million tons) at $120 a tonne – just over 2mt x $120.00t equaled a buyout amount of $261.00M. Divided by an outstanding fully diluted share count of 100m gave each shareholder $2.61 per share. Cypress has a market cap of $24 million and was trading at 0.32 cents a share at Fridays close.

CYP (TSX-V), CYDVF (OTCQB), C1Z1 (Frankfurt)

Shares Issued and Outstanding: 61.6 million

Fully Diluted Shares Outstanding: 79.1 million

“Things are not the same as when Lithium X got bought out. It’s 9 months later and the market has changed,” said Willoughby, referring to a drop in Chinese lithium prices (not the rest of the world) and the perception (wrong in our view) that the lithium market is going to be hit with a wave of fresh production that will swamp prices.

“The market sentiment is different now,” Willoughby continued. “Yes we have a great PEA, but I think the market has to digest the results.”

PEA highlights

Let’s take a closer look at those PEA numbers to show our readers just how good the report is and why investors who have written off the lithium market are missing the boat on what is the largest lithium deposit in North America – one that can be mined cheaply and profitably, churning cash of $150 to $200 million a year for the next four decades.

Resource investors are shying away from large capex (capital expenditure) projects in the billions that are too ambitious for juniors. Too many people have been burnt in the last mining down-cycle to trust that a micro-cap will be able to raise that kind of money or even interest a larger mining company in a buy-out.

In contrast, Cypress’ PEA has a capex of just under half a billion, a portion of which will go into a building a sulfuric acid plant. Slurried feed from a shallow open pit will be transported to the mill where lithium extraction is achieved through leaching at elevated temperatures with dilute sulfuric acid, followed by evaporative concentration, purification and crystallization of lithium carbonate. Processing costs are estimated at under $4,000 per tonne of lithium carbonate, and could be brought down further by further optimization of the mining schedule and processing, said Willoughby.

There is also the opportunity for additional cost recovery through the sale of electricity generated by the acid plant, and credits from sales of by-products, such as potassium and magnesium. According to Willoughby “we looked at adding possible by-product credits along with alternatives in processing and the acid plant, but for the PEA, only sales from lithium carbonate are assumed”.

The company has shown that lithium can be extracted from the claystones using a flow sheet whereby recoveries of 80% can be achieved in short leach times (4 to 8 hours) using conventional dilute sulfuric acid and leaching. The amount of sulfuric acid and reagents needed are relatively low, and being able to leach the lithium with acid avoids more costly processing associated historically with other claystone deposits, specifically those that needing high temperature roasting.

The company is weighing its next steps going forward, noted Willoughby, and the these will include more testing to demonstrate that a lithium carbonate product can be reliably produced. This will include further bench scale testing, followed by a larger bulk test using a pilot mill which Willoughby says they are already considering.

Lithium mining in Chile and for brines in general are sensitive to water use and disputes can and do arise concerning over water rights. According to Willoughby, water is a concern, but not in the same way as in a brine where 100% of the water is evaporated and lithium yields are typically 60%. For Cypress’ operation, the water use will be relatively small – at just 1,500 to 2,500 gallons per minute (gpm), and 60 to 70% of the water can be recycled through the leaching process. In the PEA, costs are allocated for fresh make-up water, delivered via pipeline from an offsite well field, for which Willoughby says they have several options.

Compare that to the situation in Chile. For decades the Chilean government granted water rights to lithium companies like SQM and Albemarle in the Salar de Atacama – the driest desert in the world – without considering the long-term consequences. Many of the aquifers have been overexploited. The government has finally got smart, and is preparing to put new restrictions on water use in the salar. Albemarle, SQM, Antofagasta and BHP are among the companies that will be affected by a ban on new permits to extract water from the southern portion of the salar’s watershed, which supplies BHP’s Escondida, the world’s largest copper mine, and Antofagasta’s Zaldivar Mine. Indigenous populations are also vying for access to water in the parched region. Reuters reports the problem is compounded by the fact that the government doesn’t know how much water lies beneath the cracked soil.

Turning to that huge maiden lithium resource Cypress first outlined in May, the company managed to increase it by 39%, to almost 9 million tonnes of LCE. According to Willoughby, the increase was mostly in the inferred category, and occurred following staking a key area south of the initial “starter” pit. The term “initial pit shell” in the PEA is a bit of misnomer, and, while the increase in resources makes Clayton Valley one of the largest claystone deposts, the additional tonnage doesn’t impact the PEA. The initial pit shell now contains about 500 million tonnes of claystone, more than enough to last Cypress 40 years of mining at the rate of 5.5 millon tonnes per year. “So what we can do now is go back and re-optimize that shell for the first years of the mine life,” Willoughby said.

Changed market will benefit CYP

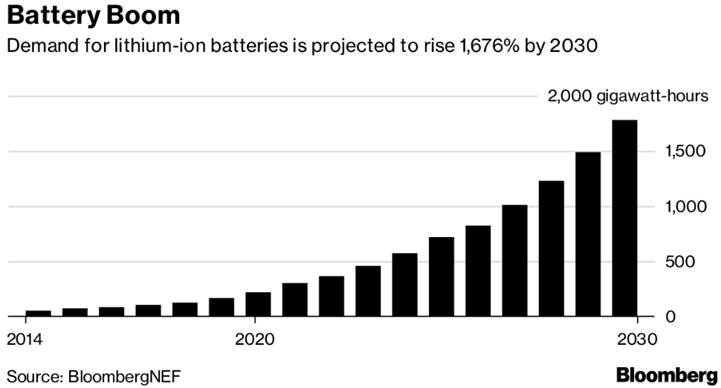

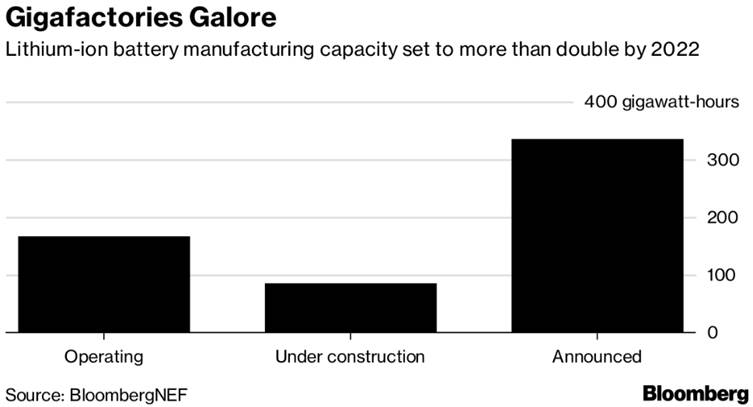

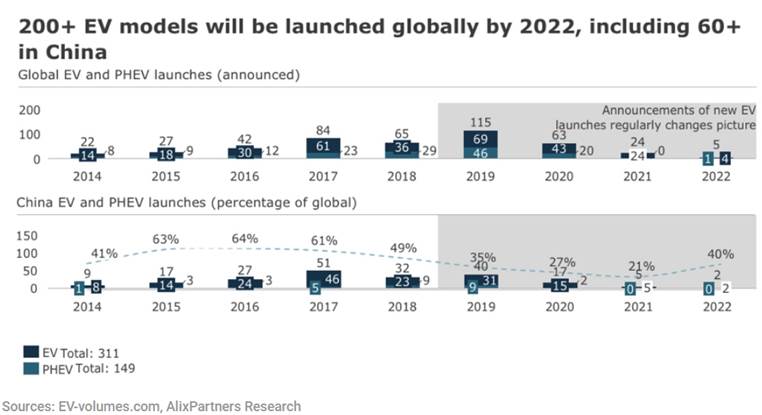

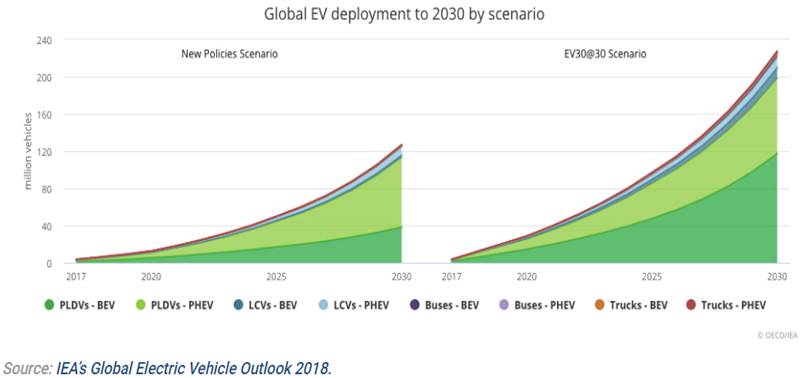

As Willoughby noted at the top, the change in the market for lithium might account for the muted reaction from the market to CYP’s stellar PEA. Indeed the market has changed, but in a good way for Cypress. Let’s take a look at the facts:

- Chile is having water problems and the government is cracking down on miners that use a lot of water, as noted above. Lithium miners are sure to be affected. It’s tough to mine lithium with brines when your water rights are restricted. No such problem exists for Cypress in the Clayton Valley.

- Chile’s South American lithium competitor, Argentina, recently announced austerity measures to strengthen the country’s ailing economy. Among them is a proposed export duty on goods and services until the end of 2020. Companies are looking at paying a 7.5% tax which applies to revenues, not earnings, so the impact on miners’ bottom lines is likely to be significant. We’ve seen this kind of resource nationalism before in Argentina. It will only drive investment out of the country and elsewhere – likely Chile.

- In April the lithium market got caught up in Donald Trump’s trade war. The US government slapped a 25% tariff on $50 billion worth of Chinese goods, mostly high-tech imports, including Chinese lithium and lithium-ion batteries (the US imports 70-80% of its required lithium). These protectionist policies could cut China out of the US lithium and battery market and open it up to North American suppliers. Cypress, with a large lithium deposit in Nevada, next to the only lithium miner in the US, Albemarle, faces no such tariffs.

- Speaking of Albemarle, the largest lithium miner in the world is currently building a battery research center near its headquarters at Kings Mountain, North Carolina. The R&D facility is part of Albemarle’s plan to remain the top producer byinvesting millions of dollars to engineer specialized types of the light metal for electric car batteries, according to a recent Reuters article. That can only be good for Cypress, considering that the lithium grades at Albemarle’s Silver Peak Mine next to Cypress are declining and the chemical company giant could use more feedstock to keep the mine going.

- SQM, the second largest lithium producer in the world, has a plan to overtake Albemarle as the lithium top dog, but its strategy is being thwarted in Australia, where the company has a partnership with Kidman Resources to develop the Mount Holland lithium project. In May Kidman announced an offtake agreement with Tesla. But that agreement, and the mine, are now in jeopardy after an Australia court asked the Australian Mines Minister to refuse Kidman’s request to be exempt from minimum expenditure obligations over 13 mining tenements held by its subsidiaries, MINING.com reported. The refusal means the 44,000 tonnes per year operation could be delayed for some time. That’s about 20% of the total lithium market that won’t come to fruition – sapping the lithium bears’ argument that a tsunami of supply is about to overwhelm the market and further depress prices.

- While lithium bears have been complaining about falling prices, the fact is that much of the new lithium supply from China is “technical grade” lithium not battery-grade. Technical grade lithium is cheaper and is used in applications for glass and ceramics. According to Benchmark Mineral Intelligence, a trusted specialty metals consultant, this means that only a small portion of Chinese lithium is meeting battery-grade specifications, and upgrading processing facilities is expensive.

- The US Government designated Lithium as a “Critical Mineral” of strategic importance in December 2017. A “Critical Mineral” designation favours domestic sources of Lithium across the supply chain. A December 2017 Executive Order Stated: “It shall be the policy of the Federal Government to reduce the Nation’s vulnerability to disruptions in the supply of critical minerals, which constitutes a strategic vulnerability for the security and prosperity of the United States.”

p>

p>

p>

p>

p>

“New Chinese supply from domestic feedstock sources already has a significantly higher cost base than in South America and adding additional purification and processing obstacles will only increase these costs further, making it all but impossible for prices to slump to pre-2016 levels,” BMI states in a blog post. p>

In other words, the price correction is overdone. BMI also notes that prices for lithium hydroxide – which are also used to produce cathode material in electric batteries, are not slumping. This is a big game changer for the industry. It means that while China used to be a significant supplier of battery-grade lithium, this is changing, opening the door to other lithium mines – namely, brine deposits in South America, hard-rock mines in Australia and elsewhere, and lithium clay deposits in the USA.

Bottom line – not all lithium coming into the market can be purified, in a cost effective manner, to produce an acceptable battery grade product. SQM one of the world’s largest miners reported in its last financials they received US$16,500.00 ton for its second quarter lithium sales. A far cry from the US$10,000.00 ton received in China.

Conclusion

Cypress has just released a PEA that by our standards, looks outstanding. The NPV and IRR are incredible especially for a project that only cost a million dollars and 23 drill holes to construct a resource and a preliminary economic assessment. At today’s numbers the mine would be cost-effective, at $3,983 a tonne (compared to around $5,000 a tonne for hard rock mining) and profitable.

At an estimated total cumulative cash flow of $6 billion, it would generate cash of between $150 million and $200 million a year. The updated mineral resource estimate makes the Clayton Valley Lithium Project a monster. The initial pit shell contains enough lithium to mine for 40 years.

On top of all the positive attributes of the PEA, all the changes in the lithium market going on right now are positive for Cypress. Think about it. Lithium miners in Chile face water problems, those in Argentina are getting whacked with a tax on revenues, and Tesla’s lithium mine in Australia faces a significant obstacle that could strip 44,000 tonnes a year out of the lithium – confounding the estimates of lithium bears who think oversupply is a problem.

The fact is, it’s not easy to mine lithium. You need the right project, the right company, and the right metallurgical process. All at a reasonable cost. Here at Ahead of the Herd we think Cypress has all of that and more in spades, which is why I continue to have CYP on my radar and own shares.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Cypress Development (TSX.V:CYP). CYP is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.