Max closes purchase of Florália Hematite (DSO) Iron Ore Project in Brazil – Richard Mills

2024.10.12

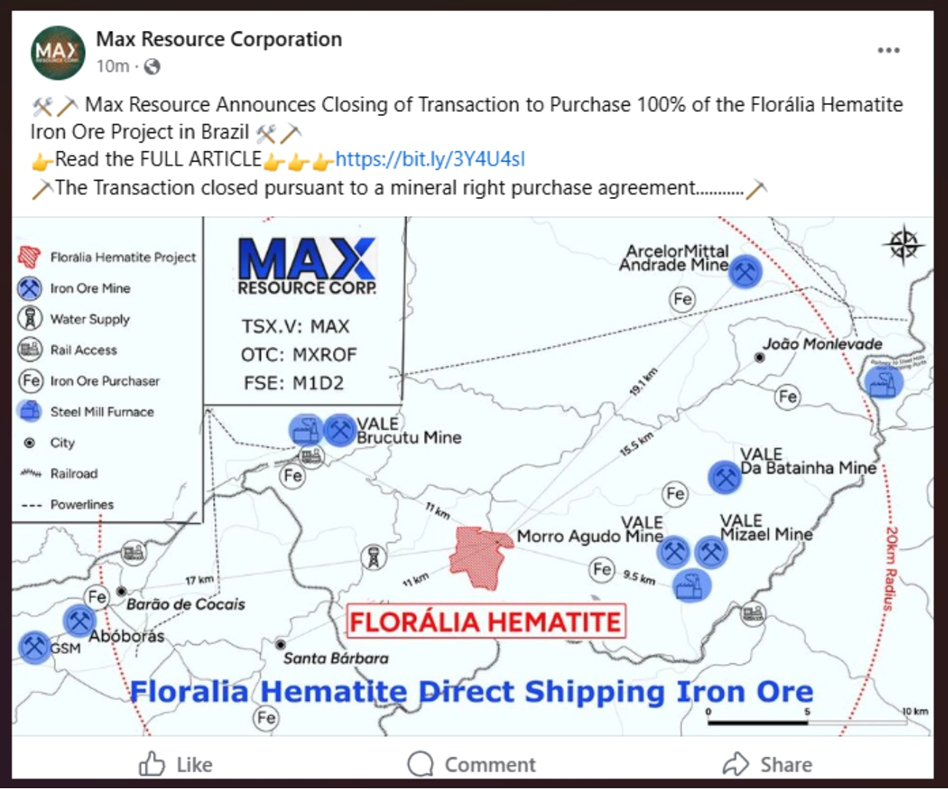

Max Resource Corp. (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) on Friday announced it has closed the transaction to purchase the Florália Hematite Iron Ore Project, located 70 km east of Belo Horizonte, Brazil.

The transaction closed pursuant to a mineral rights purchase agreement entered into with the company’s Brazilian subsidiary, Max Resource Brazil Ltd. (Max Brazil and, together with the company, the “Max Entities”) Jaguar Mining Inc. (TSX:JAG), and Jaguar’s Brazilian subsidiary, Mineração Serras Do Oeste Limitada (together with Jaguar, the “Jaguar Entities”).

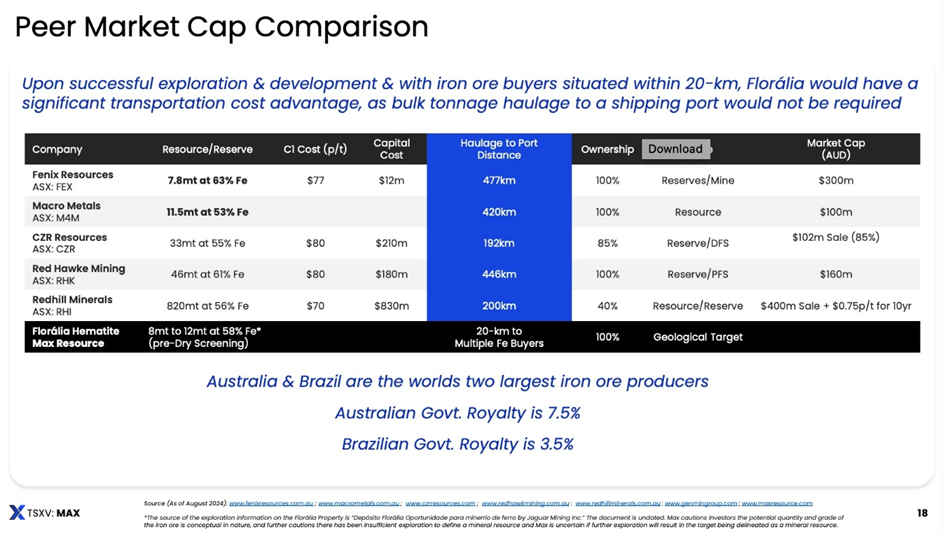

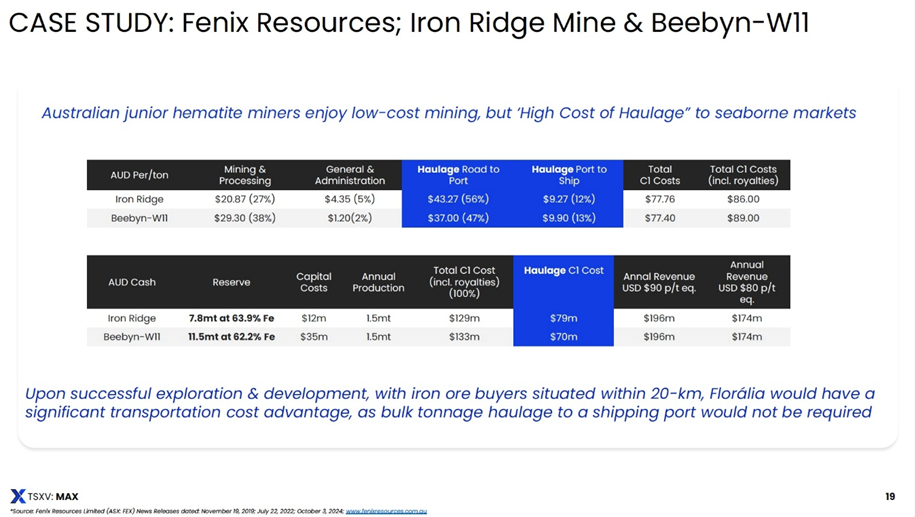

“The Florália Hematite Iron Ore open pit reveals sizable, sub-horizonal plunging bands of hematite iron ore which appear to extend in all directions. Upon successful exploration and development, with iron ore buyers situated within 20 km, Florália would have a significant transportation cost advantage, as bulk tonnage haulage to a shipping port would not be required,” said Max’s CEO, Brett Matich, in the Oct. 11 news release. He added:

“Our Brazilian exploration team has commenced the 2024 program, starting with a drone magnetic survey, channel sampling of roads cutting through the mineralization, and subsequent auger and diamond drilling. I look forward to updating shareholders in the coming weeks,” Matich concluded.

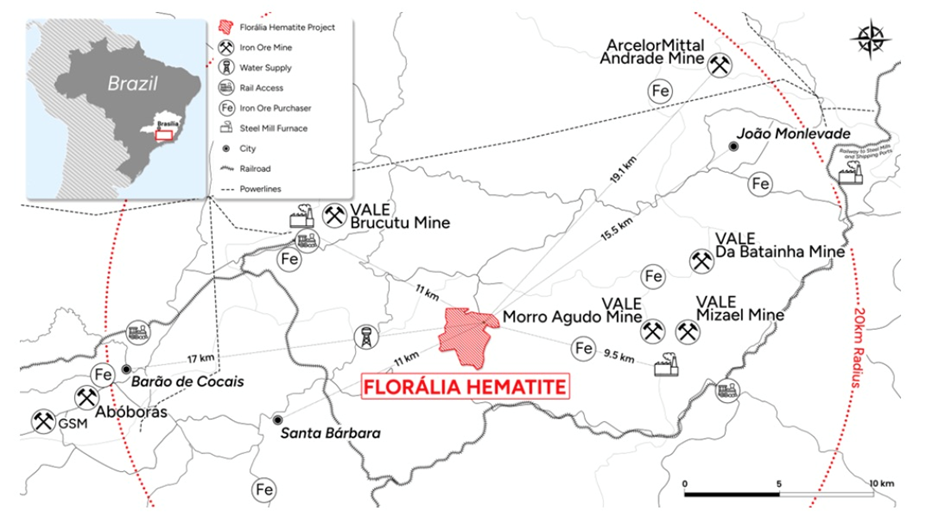

Florália is within Brazil’s Iron Quadrangle, which hosts some of the largest iron mines in the world.

As mentioned by Matich, it is also within 20 km of major iron ore mines and steel mills, seen on the map below. Local mining infrastructure includes railways, haul roads, mining services and personnel.

Brazil is the world’s second-largest producer of iron ore, at 16% of global production. Most of the country’s iron ore mining takes places in the state of Minas Gerais, home to Florália. Australia is the largest iron ore producer but the Australian government taxes it at a higher rate than Brazil, taking a 7.5% royalty versus Brazil’s 3.5%.

The local market for iron ore in the region is already set up for small miners, and Florália is in that category — too small for big players like Vale, who need a minimum 20Mtpa. But Vale is happy to let small miners operate and ship their ore directly to their local steel mills.

Selling iron ore to the local steel industry can reduce production costs by more than 50%.

Most of the DSO (benchmark of 58-62% Fe) iron ore mines are spoken for; the land is tied up, almost all of it owned by private landowners/ wealthy families.

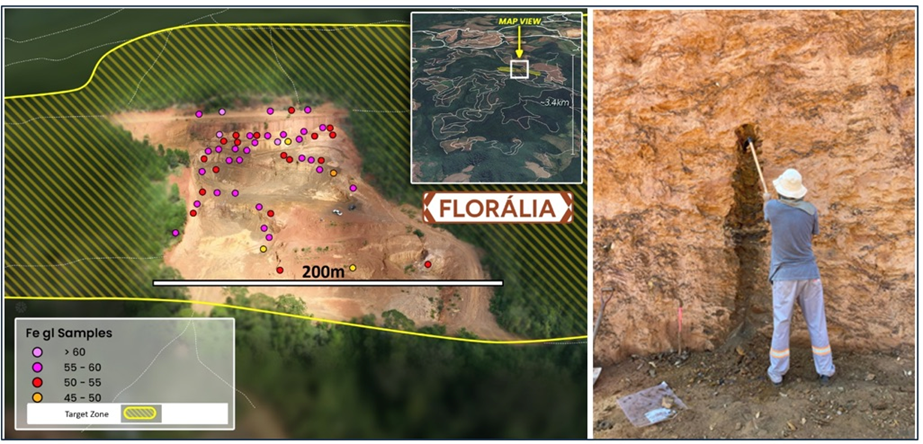

In 2023, Jaguar Mining conducted a limited program consisting of 41 channel samples collected from the historic open cut collectively over 151 meters. This resulted in the definition of a geological target estimated at 2,971,233 m3 to 4,496,333 m3 or 8,052,041 tons to 12,184,160 tons using a density of 2.71 g/cm3 at an average grade of 58% Fe (pre-dry screening).

The Florália exploration target represents only 10% of the property.

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the target being delineated as a mineral resource.

The Florália Hematite open cut is of significant size consisting of five benches rising to 48m and 160m in width revealing plunging bands of hematite iron ore at the base, and sub-horizontal banding at the top of the open cut and is open in all directions.

The objective is to outline the sub-horizontal footprint and estimated thickness of the mineralization extending beyond the current geological target of 8 to 12 million tonnes at 58% Fe. Among the current and planned activities are:

- Hi-Res drone magnetic and LiDAR survey, 140 line-km/50m spacing (underway).

- Channel sampling (~15m) across roads cutting through the hematite iron ore mineralization (underway).

- Bulk sample for metallurgical test work (underway).

- Commencement of a feasibility study (underway).

- Infill auger drilling.

- Diamond drilling.

Link to a video of a drone survey of Florália Hematite Iron Ore Project

In consideration for the acquisition of the Florália Hematite Project, Max made cash payments of US$300,000 to the Jaguar Entities. Max will pay an additional USD $700,000 in remaining cash payments, including two payments of USD $200,000 and one payment of USD $300,000. Total acquisition cost of US$1 million.

In connection with the transaction, the Max Entities and Jaguar Entities entered into a net smelter returns royalty agreement, pursuant to which the Max Entities granted to the Jaguar Entities a production royalty equal to 3.5% of the NSR from the Florália Hematite Project. The royalty will paid at the end of every quarter following the first sale of any minerals and mineral byproducts produced by the Max Entities from the Florália Hematite Project.

Max also announced that it has granted 4,000,000 Performance Share Units (PSUs) to certain directors and officers of the company pursuant to the company’s omnibus equity incentive compensation plan. The PSUs are intended to incentivize Max’s board and management as it develops the Florália Hematite Project. The PSUs will vest upon the company achieving performance milestones.

The company has granted a further 2,285,000 PSUs, with additional performance criteria for vesting being the recommendation of a further drill program based upon the success of the phase 1 drill program.

All PSUs will lapse if the performance milestones are not achieved within 36 months from the grant date.

This iron ore project is well within Matich’s expertise. Before joining Max, Matich was CEO of ASX-listed Aztec Resources, where he oversaw the development of the Koolan DSO hematite deposit (24.99 million tons at 64% Fe resource).

Also, as CEO of TSXV-listed Cap-Ex Ventures, Matich developed an un-drilled magnetite prospect into a 7.8 billion ton at 29% Fe resource.

Iron ore market

Iron ore with 62% Fe is currently trading at $105.81 per tonne, after hitting a nearly three-month high on Sept. 30 due to China’s latest property stimulus. The steelmaking ingredient on Oct. 7 advanced as much as 2.6% in Singapore, one of two markets (the other being China) that drive the iron ore price.

Source: Market Index

Iron ore is mined in around 50 countries worldwide and used to make steel that goes into buildings, cars, white goods, etc.

Global economic growth is the primary factor that drives its supply and demand. When economies are growing, the need for steel in construction increases which drives the price up.

Growth in China (the world’s largest consumer of metals) has affected the price of iron ore so much recently that the spot price can almost be considered a proxy for China’s economic health. — Market Index

Because the iron ore price is volatile, it is imperative that an iron ore producer’s cost are low enough to withstand downturns in the commodity’s price cycle. The lower its costs per tonne, the more insulated a producer is from downward price corrections.

Peer comparison

The DSO nature of the Florália Hematite Iron Ore Project and its close proximity to steel mills makes for attractive economics. Australian junior hematite miners enjoy low-cost mining but high haulage costs to seaborne markets, as shown on the slides below.

Conclusion

Florália DSO (benchmark 58-62% Fe) is a great fit for a junior and is an excellent project for Max because it fits so well into Matich’s wheelhouse. This is a high-grade iron ore deposit with potential for expansion, and due to its location infrastructure production costs would reduce production in excess of 50% of a typical Australian hematite mine.

Previous work defined a geological target estimated at 2,971,233 m3 to 4,496,333 m3 or 8,052,041 tonnes to 12,184,160 tonnes using a density of 2.71 g/cm3 at an average grade of 58% Fe.

The mineralization at Florália is high grade, near surface, and there may not be a lot of drilling required to bring it into a 43-101 compliant resource.

Much of the iron ore is exposed in benches and can be bulk sampled. Max plans to start drilling in the fourth quarter of this year, and according to Matich, has the money to do so.

DSO iron ore projects like Florália are rare in that do not require tens or hundreds of millions worth of pre-production capex — buying a haul truck fleet, building roads, rail sidings, port infrastructure, etc.

That’s because the deposits require nothing other than the basic mechanical processes of crushing and screening ore to prepare it for export – no complicated and higher-cost beneficiation or treatment necessary. (NT News, June 24, 2024)

In Florália’s case, the DSO could be trucked directly to a steel mill approximately 20 km away. It has none of the infrastructure costs associated with the comparables above.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.08 2024.10.11

Shares Outstanding 179.8m

Market cap Cdn$14.3m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

#IronOre $MAX #DSO #Hemitite #DirectShippingOre #Vale

https://aheadoftheherd.com/max-resource-discovers-manto-style-mineralization-at-sierra-azul-richard-mills/

Max Resource discovers Manto-style mineralization at Sierra Azul

#Copper #Silver #Manto #Freeport