Storm Exploration focused on the Miminiska-Fort Hope greenstone belt – Richard Mills

2024.08.21

On Aug. 19, Storm Exploration (TSXV:STRM) announced that it has reached an agreement with Landore Resources Canada Inc. to extend, by up to 18 months, the dates for the remaining payments under the option agreement to acquire a 100% interest in the Miminiska and Keezhik properties.

The remaining payments to Landore are tabled below:

Landore retains a 2% Net Smelter Royalty. Storm Exploration can buy back 1% of the NSR at any time for $1,000,000.

“Landore’s management has been very accommodating in revising the agreement so that it makes sense for both parties,” Storm’s CEO Bruce Counts told me over the phone, Monday. “We finally have an agreement with First Nations’ but Storm also needed reset the terms of the terms of the underlying agreement with Landore. Fortunately, Landore’s management understands capital markets and how to make exploration work, so we really appreciate the fact they got down to renegotiating the deal with us and cleared the runway for us to get back to work.”

Storm Exploration came to my attention for the exploration agreement signed with the Eabametoong First Nation regarding Miminiska, Keezhik and Attwood, which sit on their traditional territory.

It is unusual for a mining company to prioritize First Nations consultation over other activities, and I think this speaks to the progressive mindset of CEO Bruce Counts and his management team.

Storm’s four properties are all are in the vicinity of historic Ontario gold camps, which combined have produced over 200 million ounces. The Fort Hope area is a greenstone belt with the potential to host a major gold camp.

High-grade gold has been confirmed by drilling at a number of locations on the Miminiska property, which is currently the company’s focus.

Historical assays include 5.75g/t Au over 20.84m and 13.95 g/t Au over 5.32m, with mineralization hosted in banded iron formation and associated shear zones.

Gold mineralization at Miminiska is hosted in a Banded Iron Formation (“BIF”), which which is an important class of gold deposits. The closest analog is the Musselwhite mine, located ~115 km to the northwest. Notably, the Miminiska prospect has similar geometry to the Lupin BIF mine, which produced 3.4Moz at 9.1 g/t Au before closure in 2005.

Storm plans to raise money for a drill program at Miminiska.

Ideally, between 2,000 and 2,500 meters would be drilled from six to 10 drill pads. It should be noted that the claims at Miminiska are patented claims, meaning that no drill permits are required. Normal drilling guidelines must still be followed and Storm needs the support of local first nations, which it already has.

Miminiska is about 12 km east to west and currently has two main targets: Frond and Miminiska. Outcrops on the shores of Lakes Frond and Miminiska were discovered in the 1940s, but so far only minor drilling has been done.

Storm Exploration optioned the property from Landore Resources in 2021.

Gold Standard

Gold Standard is an early-stage exploration project. The property is approximately 65 km north of Fort Frances and within the traditional territory of the Naicatchewenin and Nigigoonsiminikaaning first nations.

Assay results from grab samples collected at one of the shafts in 2022 by Storm Exploration included 166 g/t Au, 88.6 g/t Au and 83.4 g/t Au.

Storm has signed exploration agreements with the Naicatchewenin and the Nigigoonsiminikaaning, putting the company in a position to drill a large VMS target identified in 2023.

Keezhik

The 12,482-hectare Keezhik project is located along the same regional shear structure that hosts Newmont’s +6Moz Musselwhite mine. Multiple high-grade gold occurrences have been identified on the property with historical assays up to 47.7 g/t Au over 0.6m and 25.8 g/t Au over 1.3m returned from drill core.

Attwood

Attwood is a greenfields project covering geology that is prospective for precious and base metal deposits. The property includes 23,262 ha of mineral claims staked by Storm Exploration and has no royalties.

While there are currently no roads providing direct access to the properties, there is an all-weather forestry road that runs within 5 km of Attwood Lake. The company sees that location as a staging point for equipment, to be flown to the properties by helicopter.

Moreover, the Eabametoong First Nation is looking at the feasibility of extending the Ogoki forestry road to their community, which would greatly improve the value proposition of mining in their traditional territory.

Banded iron formations

Banded iron formations account for around 60% of global iron reserves, and can be found in Australia, Brazil, Canada, the United States India, Russia, Ukraine and South Africa.

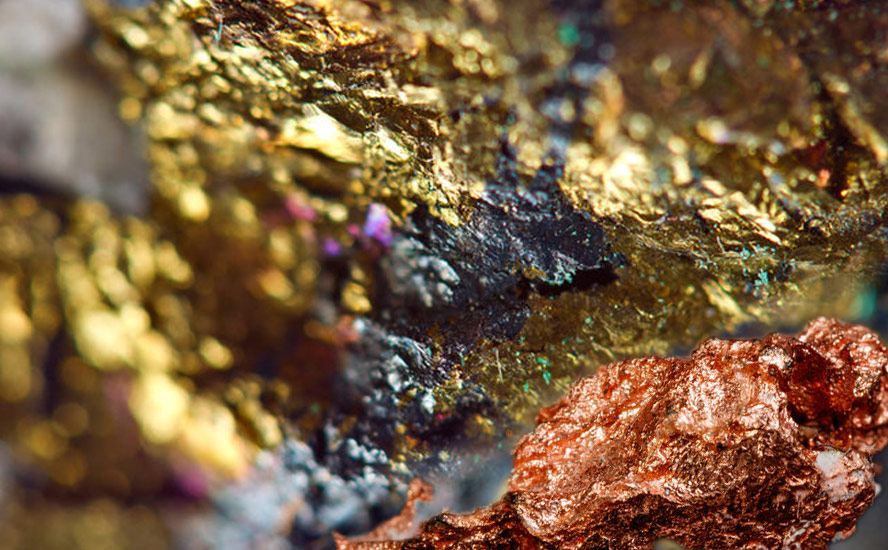

The gold in banded iron is associated with greenstone belts believed to be ancient volcanic arcs, or in adjacent underwater troughs. Greenstone belts often contain gold, silver, copper, zinc and lead ores.

The gold is usually found in cross-cutting quartz veins/ veinlets, or as fine disseminations associated with pyrite, pyrrhotite and arsenopyrite.

The host strata has generally been folded and deformed. In terms of mineralogy, gold-bearing BIFs may include native gold, pyrite, arsenopyrite, magnetite, pyrrhotite, chalcopyrite, sphalerite, galena, stibnite, and rarely, gold tellurides.

Perhaps the best example of a gold-bearing banded iron deposit is the shuttered Homestake Mine in South Dakota. The +40-million ounce deposit was the largest and deepest gold mine in North America before it closed in 2002.

The gold ore was contained almost exclusively within the Homestake Formation, a 20 to 30-meter layer of iron carbonate and iron silicate that had been deformed, resulting in upper greenschist facies of siderite-phyllite, and lower amphibolite facies of grunerite schists.

The Homestake Formation is within the Black Hills dome of western South Dakota, believed by geologists to have been created when two plates subducted under North America, forming the Rocky Mountains.

Canadian BIF mines include Detour Lake, Madsen-Red Lake, Pickle Crow, Musselwhite and Dona Lake in Ontario, and the Meadowbank and Meliadine mines in Nunavut.

Talking with AOTH, Storm’s CEO Bruce Counts said the Miminiska project bears all the hallmarks of a banded iron formation. The closest analog is Musselwhite, located ~115 km to the northwest. The prospect also has a similar geometry to the Lupin BIF mine, which produced 3.4Moz at 9.1 g/t Au before closure in 2005.

When Storm examined about 3,000 meters of drill core, they noticed a good correlation between arsenopyrite and gold, which as mentioned, is another characteristic of a BIF.

Drilling

Storm plans to raise money for a drill program at Miminiska.

“The focus of our initial drill program is to demonstrate that we can not only expand the mineralization that’s already been discovered, but we can extend it as well by drilling in new places down the limbs and into the nose of the fold of this banded iron formation,” Counts said, adding: “It’s a really important place to look for higher concentrations and greater thicknesses of gold mineralization.”

Ideally, between 2,000 and 2,500 meters would be drilled from six to 10 drill pads. It should be noted that the claims at Miminiska are patented claims, meaning that no drill permits are required. Normal drilling guidelines must still be followed and Storm needs the support of local first nations, which it has already has.

Drilling can be done almost year-round, with the exception of about 10 weeks from the middle of November until the end of January due to adverse weather conditions.

Conclusion

Banded iron formations are an important source of gold. They make excellent exploration targets because of their size/ scalability. Like VMS deposits, they are often found in clusters, something that is attractive to major gold companies looking for new deposits that can be developed into mines with longevity.

The Homestake deposit was the largest and deepest gold mine in North America before it closed in 2002. The banded iron formation mine produced 43 million ounces in 124 years of production, worth over a billion dollars.

BIFs are well known in Canada’s north — Agnico Eagle’s Meliadine and the past-producing Lupin mine are examples — but they are less prevalent in Ontario, despite the presence of Musselwhite, Madsen-Red Lake, Detour Lake, and Pickle Crow, all BIF deposits.

Storm Exploration aims to change that perception by developing the Miminiska banded iron formation hopefully to the point where a larger company takes the project on and advances it to production.

“People will start to pay attention more as they understand these projects and I know that they’re coming to light more and more particularly in the gold market,” Counts said.

Storm Exploration Inc.

TSXV:STRM

Cdn$0.04 2024.08.19

Shared Outstanding 52.1m

Market cap Cdn$2.0m

STRM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard does not own shares of Storm Exploration Inc. (TSXV:STRM). STRM is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of STRM

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

2 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

#StormExploration $STRM #Gold #BandedIronFormations #BIF #Gold #Greenstone

Gold is seemingly breaking records almost daily. Silver is threatening to bust out. Copper is, despite recent negativity, in a structural supply deficit that is only going to grow. China is threatening more, and tougher, trade restrictions on critical metals.

We live in a finite supply world.

Yet our demand is infinite.

And juniors, the owners of the world’s future mines, cannot get financed, or are doing them at lows we’ve never seen.

I’m going to finance a couple of these Co’s, those with superior, imo, projects. Ones that own their projects 100% and of course have competent management

I’m also looking at (and already own one), juniors that have, very smartly and timely, done recent earn in or JV deasl with a major mining company.

Maybe financing for junior’s will turn around. But those that get financed now, ones w/o already blown out share structures, will have a huge lead in giving their investors what has been historically been the best leverage to rising metal prices – junior’s.

And those junior’s that have a project interesting enough to attract a major’s attention, as an earn in or JV partner, those jr’s whose shareholders will suffer property dilution, not share dilution, will also do well with their senior partners funding exploration & development of any discoveries.

Rick