Stock buybacks – Richard Mills

2024.08.11

When Ronald Reagan became president in 1981, he appointed John Shad to head the Securities and Exchange Commission – the body that polices US stock markets. Shad’s appointment was the first time in 50 years that a financial executive headed up the SEC.

The SEC’s role since the stock market crash of 1929 was to regulate stock markets and especially to prevent another Great Depression from happening. The 1934 Securities Act didn’t ban stock buybacks but it barred companies from doing anything to manipulate their stock prices. Companies therefore stayed away from the practice of buying their own stock, fearing it would put the company on the SEC’s radar.

Under Shad’s leadership the SEC in 1982 adopted rule 10b-18, which allowed stock buybacks as long as certain guidelines were adhered to, such as not purchasing more than 25% of its average trading volumes in a single day.

Vox quotes William Lazonick, an economics professor at the University of Massachusetts, who said Shad’s appointment to the SEC and the passing of rule 10b-18 brought about a major shift in the agency:

“Everything they did from that point forward … was turning the SEC from a regulator of the stock market to a promoter of the stock market,” he said.

US lawmakers on both sides of the aisle have spoken against stock buybacks.

So what are stock buybacks and why are they controversial?

Buybacks have been a popular tool for management to stuff cash back into the company, indirectly, by reducing the share float (outstanding shares). Purchasing company stock generally inflates the share price and boosts earnings per share – a key metric on which CEO bonuses are calculated.

After the SEC changed the rules to allow buybacks, hundreds of companies starting using them. In 1997 buybacks surpassed dividends as the main way companies redistribute funds to investors.

Are share buybacks good or bad for shareholders? The answer is, in my opinion, cut and dried – the few positives do not outweigh the many negatives.

On the positive side of the ledger, reducing a company’s outstanding shares makes each dollar of earnings more valuable on a per share basis, which is good for investors.

Another plus for shareholders: corporate executives seemingly know how much their company is worth so if they are buying back shares, it’s a signal that the stock is undervalued – otherwise, why would they buy high?

Bloomberg states that buybacks can contribute to bull markets, noting that in some years, shares bought in buybacks outnumbered shares purchased by mutual funds by six to one. Really though, the most insightful thing to say about share buybacks is that they’re good for management, not necessarily shareholders.

Why? Buybacks make it easier for executives to hit targets by reducing the number of shares. Management receives compensation – usually in the form of stock options – that is tied to the company’s stock price. The higher the stock price the more they make cashing out their options. When a stock buyback occurs the short-term implications on the stock price are positive. If a company’s stock is suffering from low earnings per share (EPS) and price earnings ratio (PE), buying back stock can give the company a temporary boost because these ratios are based on the number of outstanding shares. Earnings don’t change but the EPS looks better because the firm has reduced the number of shares outstanding, so management meets goals for profit growth and earns bigger bonuses.

There are plenty of negatives to share buybacks, with the most obvious being that buying back shares means that executives are foregoing the opportunity to put that extra cash back into the business instead, which could potentially grow the company. Studies have linked increased spending on buybacks to decreased corporate investment – such as expansion plans, more hiring or raises. Buybacks have been used as a punching bag for Democrats in particular who argue that buybacks enrich companies and wealthy shareholders at the expense of workers, who miss out on companies spending their excess profits on hiring more employees or issuing raises.

Share buybacks are therefore thought to exacerbate inequality. A Gallup poll quoted by Vox shows only half of Americans own stocks, with the richest 10% owning 80% of all shares and the bottom 80% of income earners owning just 8%.

As for how share buybacks fit into the current financial paradigm, they have become exceedingly popular as companies look for ways to stash their extra cash brought about by pro-business tax legislation.

In December 2017 the Trump administration passed the Tax Cuts and Jobs Act. The legislation slashed the corporate tax rate from 35% to 21% and the top individual tax rate shrunk to 37%.

But the most important change concerned the repatriation of profits that US corporations were holding overseas. Under the act, companies were incentivized to bring their overseas profits to the United States, where they would be taxed at a one-time rate of 15.5%, which is lower than the regular corporate tax rate of 21%. Previously, companies would “defer” (really, avoid) US tax on profits held in low-tax jurisdictions like Switzerland and Ireland, until they brought their profits into the US, where they would be taxed at 35%.

In 2018, US multinationals took full advantage of the “tax holiday”, sending home over half a trillion dollars held overseas, to be taxed at the lower rate.

Suddenly these companies found themselves flush with cash, and they needed to find a way to spend it. The options are typically to: Plough funds back into the company via capital expenditures like new buildings, products or equipment; distribute the money back to shareholders in the form of dividends; share buybacks which don’t go directly to shareholders, but reduce the number of outstanding shares, thereby making the share float less diluted.

In 2018 US companies set a record $1.1 trillion in stock buybacks.

There is clearly a strong connection between repatriation, stock buybacks, and higher-than-normal corporate earnings. Is it any coincidence that half a trillion dollars worth of overseas profits were brought home in 2018, during which time the United States saw the most share buybacks in history, along with sky-high corporate earnings (data firm Refinitiv estimates profit growth among S&P 500 companies at 23% in 2018) and a booming stock market? I don’t think so.

Fast forward + Insider selling

If so many of these top companies are buying their own shares, boosting their earnings per share, padding their bottom lines and inflating their stock prices, their leadership must be brimming with confidence that all was well with the economy, right?

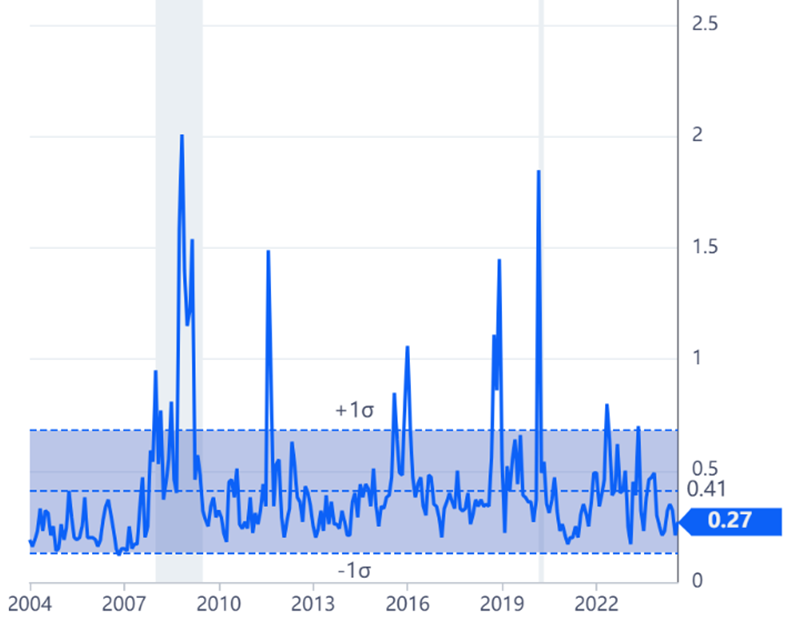

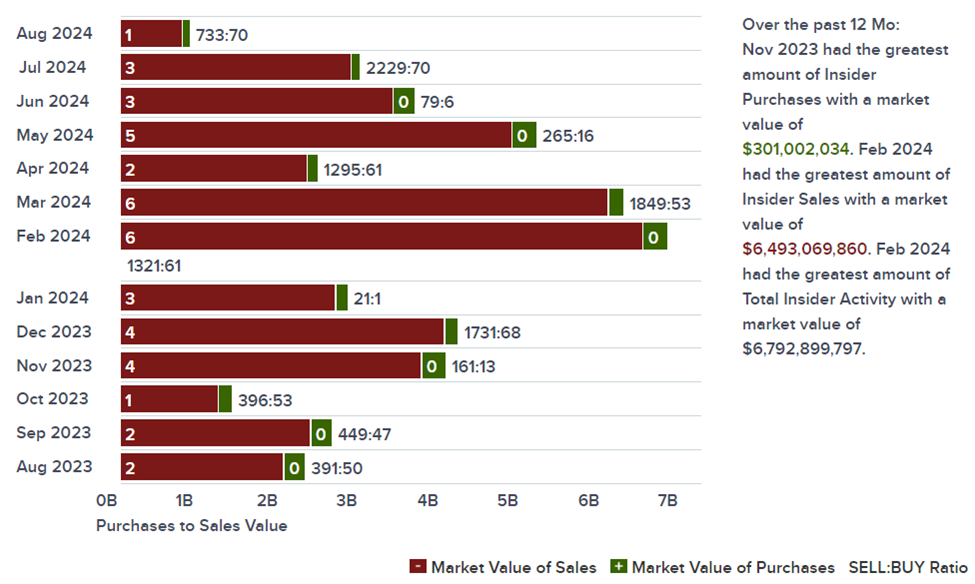

In fact, nothing could be further from the truth. A little research shows that executives were actually dumping their own company’s stock, capitalizing on the price bump resulting from torrid buyback programs. In the below chart the red line is selling, the blue buying.

Why would an executive sell his/ her shares if they didn’t see bad news on the horizon? The answer is, they wouldn’t. While some try to defend the practice as “portfolio diversification” or some malarkey, the reality is, no-one purposefully dumps shares if they have faith in the company and its stock price. The only reason to sell is to cash out. Here is a former SEC Commissioner (Robert Jackson) disparaging insider selling:

“When executives unload significant amounts of stock upon announcing a buyback, they often benefit from short-term price pops at the expense of long-term investors,” he said in a letter quoted by CNN, adding that “insider selling on buybacks is associated with worse long-term performance.”

He added: “CEOs don’t sell valuable things cheaply. Executives are using buybacks as a way to cash out.”

Vox noted that “activist investors” who buy large blocks of shares to get seats on a company’s board, is another distasteful way for such investors to influence the direction of a company through buybacks.

The publication stated that billion hedge fund manager Carl Icahn convinced Apple to increase its stock buybacks in 2013, the same year he bought into the company. Three years later he sold his stock and made $2 billion.

Could it be that these corporate insiders, who really are “the smartest guys in the room” with knowledge nobody else has regarding the future of their companies, be selling because they see the big red sign flashing ‘R’ for recession? That the time to sell is now?

Research by the SEC, in a team led by Commissioner Jackson, showed that executives often use buybacks to cash out their holdings of company stock. Vox reports the 2017 study looking at 385 buybacks since 2017 found that in half, at least one executive sold shares in the month after the buyback announcement. Twice as many companies had insiders selling stock within eight days after the announcement, as they would on as normal trading day.

Conclusion

The continued stock market bull we are seeing playing out week after week lulled many an investor into a false sense of security. Fortunately we know there are many recessionary signals that we as smart commodity-focused investors need to pay attention to. Insiders dumping shares is one.

We also know that a big surge in stock buybacks occurred in 2007, a year before the Great Recession. Looking at Visual Capitalist’s historical buyback chart is instructive because we see the same pattern emerging, of a dramatic rise in buybacks, in line with high corporate profits amid the stock market bull. In 2009 those buybacks fell off a cliff, as companies saw earnings drop while global growth stagnated.

Are we riding the rapids towards another waterfall?

Investors are challenged as to when is the best time to buy and sell their stocks. Timing the market is hard, but a major red flag should be when a key insider dumps their shares.

Should investors, today, be worried about insider selling?

USA Overall Market was 0.27 as of 2024-08-01. Historically, Insider Buy/Sell Ratio – USA Overall Market reached a record high of 2.01 and a record low of 0.12, the median value is 0.34. Typical value range is from 0.2 to 0.66.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

#SEC #Buybacks #S&P500