Max Resource Two World Class Exploration Projects in South America – Richard Mills

2024.07.19

The term ‘Direct Shipping Ore’ aptly captures the simplicity of the DSO mining process and the streamlined pathway this iron ore takes from mine to market. DSO stands out as a premium product, a cut above in a world demanding efficiency and environmental sensitivity.

From a geological standpoint, DSO deposits are relatively rare, often formed through the chemical alteration of banded iron formations (BIFs) under specific environmental conditions. Brazil and Australia are by far the world’s largest producers and exporters of DSO.

DSO is high-grade hematite that can be shipped directly to refineries, circumventing the need for costly processing facilities and large operations, translating to significant cost savings and a smaller carbon footprint.

The energy consumed by processing DSO hematite (Benchmark 58-62% Fe) is 50% less than magnetite. Magnetite (35% Fe) requires large-scale, high-cost beneficiation.

An even smaller footprint can be achieved if the mine and crushing facilities are close to a steel mill. Often this is not the case.

Usually, after the DSO has been mined, crushed and screened, the mining company transports the ore by truck or rail to a port (typically 100’s of kilometers), where it is shipped to overseas steel mills.

If infrastructure doesn’t already exist, the mining company must build it. This requires significant capital for ports, roads, railways, haul truck fleet, etc., plus increased operating costs and additional permits, lengthening the time to make the mine operational.

Florália DSO Iron Ore Project

Contrast this scenario to the one envisaged for Max Resource Corp’s (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) purchase of 100% of the Florália DSO property.

In regard to the Florália purchase, Max has received conditional approval from the TSX Venture Exchange (“TSXV”) for the Transaction. Final acceptance of the Transaction is conditional upon satisfying the filing requirements outlined in Policy 5.3 of the TSX.V Finance Manual.

The property is within Brazil’s Iron Quadrangle, which hosts some of the largest iron mines in the world.

It is also within 20 km of major iron ore mines and steel mills, as seen on the map below. Local mining infrastructure includes railways, haul roads, mining services and personnel.

Brazil is the world’s second-largest producer of iron ore, at 16% of global production. Most of the country’s iron ore mining takes places in the state of Minas Gerais, home to Florália.

The Florália hematite property is located within a prolific iron ore mining district and nearby major iron ore mines, steel mills, railways, haul roads and mining services.

The local market for iron ore in the region is already set up for small miners, and Florália is in that category — too small for big players like Vale, who need a minimum 20Mtpa. But Vale is happy to let small miners operate and ship their ore directly to their local steel mills.

Most of the DSO (benchmark of 58-62% Fe) iron ore mines are spoken for; the land is tied up, almost all of it owned by private landowners/ wealthy families.

In Morgan Stanley’s latest iron ore price outlook, the firm’s strategists said, “they expect a return of more sustained upside and are targeting USD$120/t in Q3, 2024.”

Iron ore with 62% Fe is currently trading at $109.39 per tonne.

Florália DSO was minimally explored by previous operator Jaguar Mining, but Jaguar was more interested in gold. Things started to change when the landowners started mining it for gravel – a banded iron formation (BIF) was discovered.

According to a recent technical report:

The Florália Property is underlain by mafic to ultramafic volcanic rocks of the Nova Lima Group, forming a Greenstone Belt-type sequence and hosting gold deposits related to iron formations (Jaguar 2024) …which can reach up to 40 meters in thickness and are traced up to 1 km in strike.

2023 channel sampling of excavated mining pits defined a geological target estimated at 8 to 12Mt at 58% Fe (DSO) with low phosphorus and aluminum oxide.

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the target being delineated as a mineral resource.

“All the indications are that Florália is very typical of the ore mined in the area and that’s been delivered to Vale and other steel mills,” Max’s CEO Brett Matich told me over the phone recently.

The Florália exploration target represents only 10% of the property.

This iron ore project is well within Matich’s expertise. Before joining Max, Matich was CEO of ASX-listed Aztec Resources, where he oversaw the development of the Koolan DSO hematite deposit (29 million tons at 64% Fe resource).

Also, as CEO of TSXV-listed Cap-Ex Ventures, Matich developed an un-drilled magnetite prospect into a 7.8 billion ton at 29% Fe resource.

Aztec rose from an AUD$2 million market capitalization to a $300 million merger in 2007 (Aztec share price increased 1,500%) with Aztec shareholders receiving ASX-listed Mount Gibson Iron Ore shares in the merger. Mount Gibson shares then returned a 300% share price increase within 12 months of the merger’s completion.

The Koolan Island mine is still in operation with three years of mine life left. In a presentation, Mount Gibson describes Koolan Island as “Australia’s highest grade hematite Direct Shipping Ore (DSO) with direct port access to market (1HFY24 sales of 2.5 Mwmt @ 65.4% Fe).”

“Florália looks very similar, the same type of plan to Koolan Island, but the mining and capital costs are just so much less. In addition, the Florália property has the potential for fast-track development,” Matich said.

It’s worth comparing Florália to projects that are not near steel mills.

Comparables

Red Hawk Mining (ASX:RED)

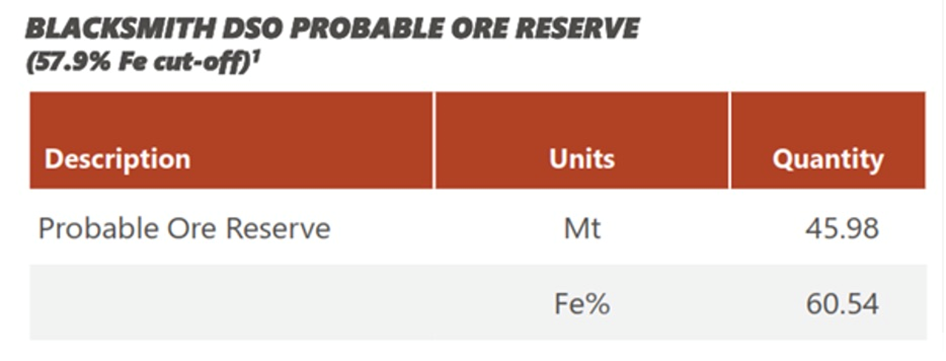

Red Hawk Mining released a prefeasibility study on its Blacksmith iron ore project located in the Pilbara region of Western Australia.

This AUD$170 million market cap company with typical Australian DSO hematite needs approximately 40Mt of reserves to work, because its capital costs are estimated at AUD$216 million. (The mineral reserve is pegged at 46Mt @ 60.5% Fe.) Out of this capex, 59% is for haulage and 14% is for port costs.

New infrastructure is not necessary at Max’s Florália project because it is within 20 km of major iron ore mines and steel mills.

As the images below show, Red Hawk must truck the ore 332 km from Blacksmith to Whim Creek (23 km on a private haul road and over 300 km on the Manuwarra Red Dog Highway), and a further 114 km from Whim Creek to Utah Point/ Port Hedland. The haul fleet ranges from 20 to 83 trucks, with 1.2Mtpa on the low end and 5Mtpa on the high end.

The difference becomes more acute when we get to the profit margins.

If Red Hawk produces 3Mt a year, it is looking at all-in cash costs (C3) of USD$70 per tonne at USD$105 iron ore, netting a USD$105 million profit per year. At USD$85, the company’s margin shrinks to USD$45 million a year.

While at Florália, if Max is successful in building a mine, operating costs should be less, because it does not require a large haul truck fleet and Max will not be stuck with the cost of having to build a port. Its all-in costs per tonne could be a fraction of Red Hawk’s.

Moreover, the projects with higher profit margins can more often continue operations when impacted by a potential drop in the price, as often happens within the volatile iron ore market.

Fenix Resources (ASX:FEN)

Fenix Resources’ flagship Iron Ridge project is a DSO deposit hosting a JORC-compliant resource of 9.8Mt @ 64.4% Fe. The company says it is some of the highest-grade iron ore in Western Australia.

Production commenced in December 2020 following three months of construction, and first sales were in February 2021, shipped from the company’s port facility at Geraldton. Approximately 3Mt of DSO grading 63% Fe ore have been exported to date.

Fenix has a market cap of AUD$273 million and 700 million shares outstanding. It trades at AUD$0.39/sh.

As of H1 2024, Fenix had a resource of 10.5Mt @ 64% Fe, revenues of AUD$126 million, and a post-tax profit of $22 million. At a sales price CFR (cost and freight) of USD$130/ton and direct production costs of USD$50/t, Fenix’s operating margin is AUD$90/t.

But Fenix has incurred capital expenditures of AAUD$12 million in building out the infrastructure, including a fleet of 200-tonne quad road trains, rail sidings, and logistics depot. The project anticipates a future inland port. At the port of Geraldton, Fenix owns three large on-wharf storage facilities, and has direct ship loading access at two berths. It’s a 477-km haulage distance from Iron Ridge to Geraldton.

Fenix also holds 2 additional DSO deposits. Shine has a haulage distance of approximately 497 km, has remaining payments of AUD$10 million and contains a Resource of 20mt at 61% Fe. Fenix’s Shine deposit has a haulage distance of approximately 300 km and contains a Resource of 15mt at 58% Fe.

None of this haulage infrastructure would be needed by Max at Florália.

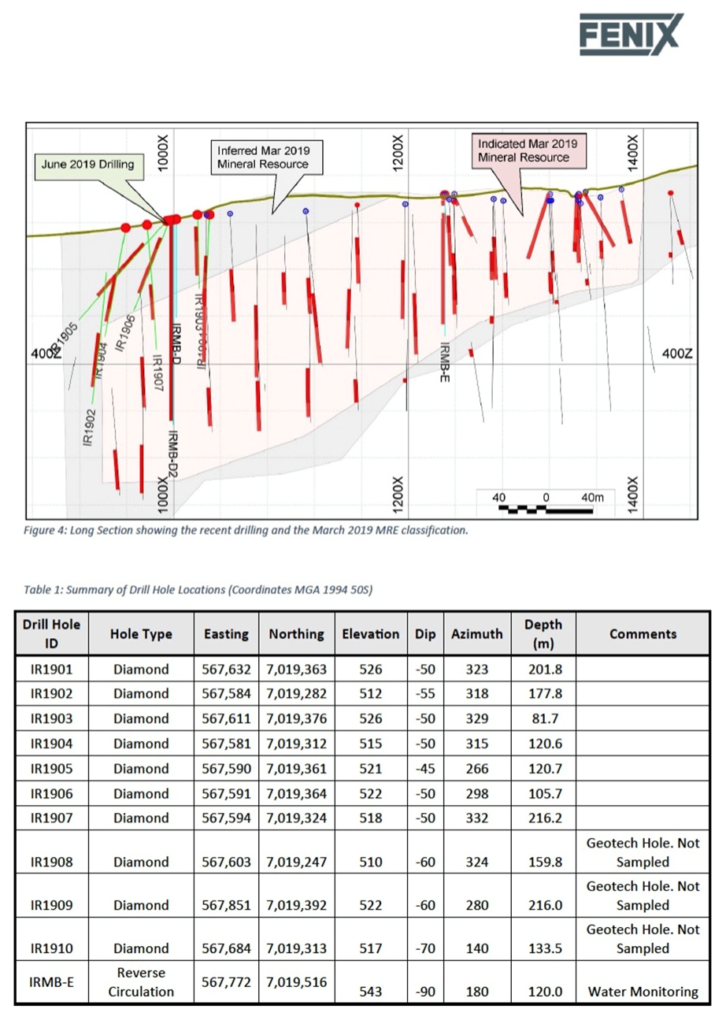

In 2019, Fenix drilled only 20 reverse-circulation holes and 8 diamond drills holes (4,750m) to assemble a resource of 9.2Mt @ 64% Fe.

CZR Resources (ASX:CZR)

CZR’s cornerstone project is the Robe Mesa deposit, described as a low strip ratio, low-capex DSO, with a rapid, low-cost path to production.

Robe Mesa has ore reserves of 33.4Mt at 55% Fe. The ore has low phosphorous and upgrades well by driving off, or calcining, the volatile components, principally water.

A Definitive Feasibility Study was released on Oct. 10, 2023.

The mine would produce 3.5-5Mt per annum for eight years at all-in-sustaining costs of USD$56.10 per dry metric ton. Using a base case USD$90/t as the iron ore price, CZR’s profit projection is AUD$50.85/t at the current exchange rate.

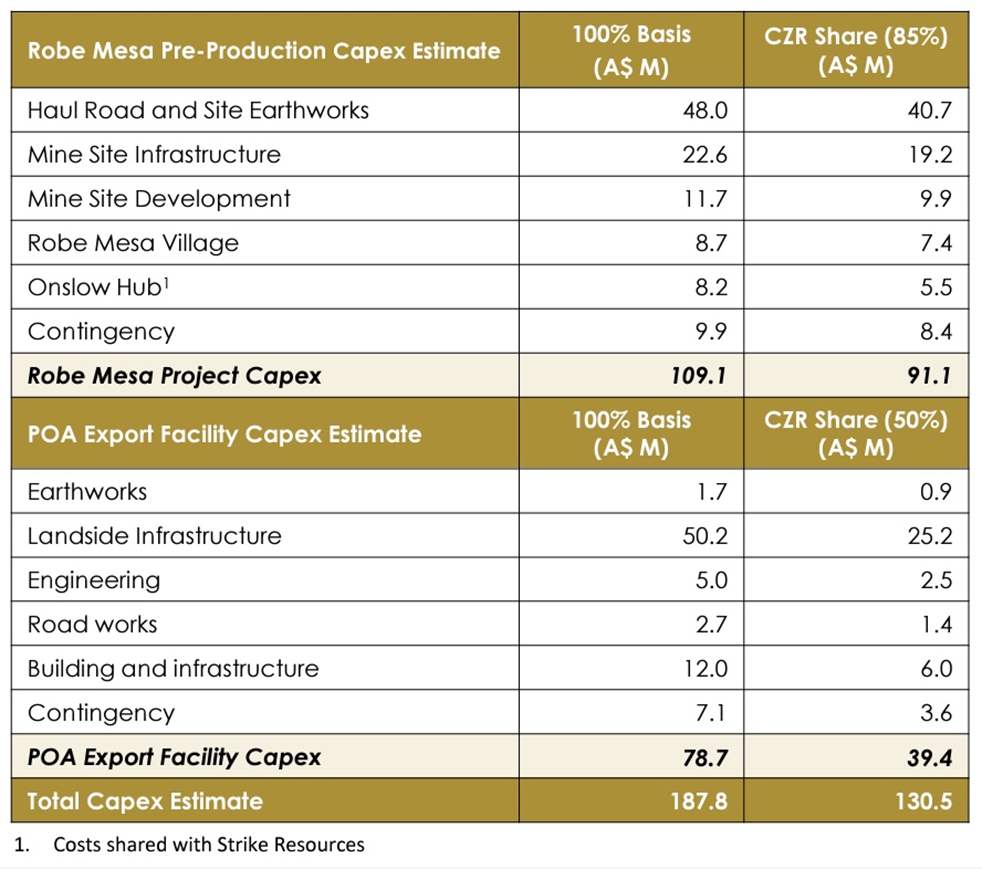

But like the above Florália comparisons, CZR is required to build substantial infrastructure. Through a joint venture, CZR plans to construct a 5Mtpa iron ore export facility at Port Ashton; it’s a 96-km haulage distance from Robe Mesa to the port. The mine capex is estimated at AUD$109.1 million and the port export facility is pegged at AUD$78.7 million, for a total capex of AUD$187.8m.

Macro Metals (ASX: M4M)

Macro Metals switched from Lithium to DSO resulting in a 300% increase in share price and a current market cap of A$104 million. Its advanced DSO portfolio consists of the following:

West Pilbara contains a Resource of 11.5Mt at 53% Fe with haulage distance of approximately 420 km to the Port of Ashburton.

Catho Well is located approximately 400 km from the same Port. Drilling results include 10m at 54% Fe, 10m at 50% Fe, 9m at 51% Fe, 8m at 52% Fe and 6m at 54% Fe.

Wiluna West has a haulage distance of approximately 700 km to the Port of Geraldton. Drilling results include 13m at 60% Fe, 7m at 56% Fe, 6m at 58% Fe and 6m at 59% Fe.

Century Global Commodities

The Joyce Lake DSO iron ore project is Century’s most advanced project and in December 2022 Joyce Lake’s Feasibility Study was published on SEDAR. An Environmental Impact Study, in compliance with federal and provincial guidelines, is also being prepared.

The project envisions an open-pit mine delivering high-grade iron ore to the crushing and screening plant, while stockpiling lower grade ore for crushing and screening at the end of the approximately seven-year mine life.

Crushing and screening would generate 65% sinter fines and 35% lump products for a total of 2.5 million dmt (dry metric tons) annually with an average grade of 59.94% Fe.

End products would be transported over a 43-km haul road from the mine site to a new rail siding near Astray Lake, which connects to an existing rail line for transport to the Port of Sept-Îles, Quebec, for shipment to China and other markets.

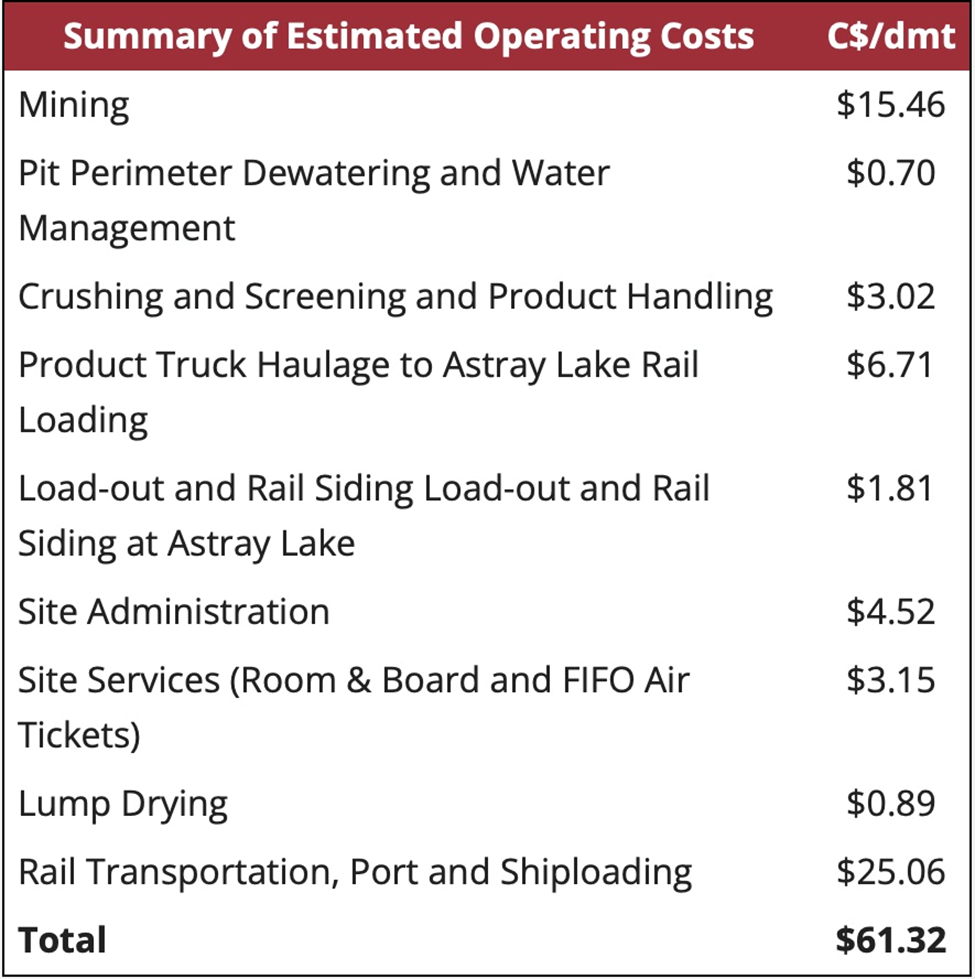

The capital cost to build the mine and associated infrastructure is estimated at CAD$270.4 million. That includes $20.7m in capitalized pre-stripping. The project has a high strip ratio of 4.25:1.

Its C1 operating costs are CAD$61.32/dmt. That includes about CAD$41/t related to remote site and haulage.

CESAR Copper-Silver Project

The CESAR Copper-Silver Project in Colombia is an , district-scale property on which Max has entered into an Earn-In Agreement (“EIA”) with Freeport-McMoRan Exploration Corporation (“Freeport”), a wholly owned-affiliate of Freeport-McMoRan Inc. (NYSE: FCX).

Under the terms of the EIA , announced on May 13, 2024, Freeport has been granted a two-stage option to acquire up to an 80% ownership interest in the Cesar Project by funding cumulative expenditures of CAD$50 million and making cash payments to Max of CAD$1.55 million.

To earn an initial 51% interest, Freeport is required to fund CAD$20 million of exploration commitments at Cesar over five years and make staged payments to Max totalling CAD$0.8 million. Max will remain the operator of Cesar during this initial stage. Once Freeport earns its initial 51% interest, Freeport can increase its interest to 80% by funding a further CAD$30 million in exploration commitments at Cesar over five years and making staged payments totalling CAD$0.75 million.

“Careful consideration was given in selecting the best suited earn-in party for Cesar, and access to Freeport’s global team and expertise is aimed at unlocking Cesar’s potential. Freeport has a track record of global copper discoveries that have proceeded to mine development and production. Max looks forward to advancing our Cesar Project with Freeport, one of the world’s largest copper producers,” commented MAX CEO, Brett Matich

“The Cesar Project is host to one of the world’s largest underexplored sedimentary copper-silver systems, and we believe Freeport’s endorsement of the Cesar Project is a testament to its potential for hosting a world class deposit,” he concluded.

The CESAR project is situated along the copper-silver-rich Cesar Basin. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejon, the largest coal mine in South America held by Glencore.

Despite the Spanish being there centuries ago, tunneling into the mountains looking for high-grade silver, and the equally-long-known-about massive outcrops exposing high-grade copper and silver mineralization pretty much throughout the entire basin, Vancouver-based Max Resource, led by CEO Brett Matich, was the first to recognize its potential.

The CESAR land package now spans more than 1,150 km of geology prospective for sedimentary-hosted copper and silver deposits and includes 20 mining concessions covering over 188 square km.

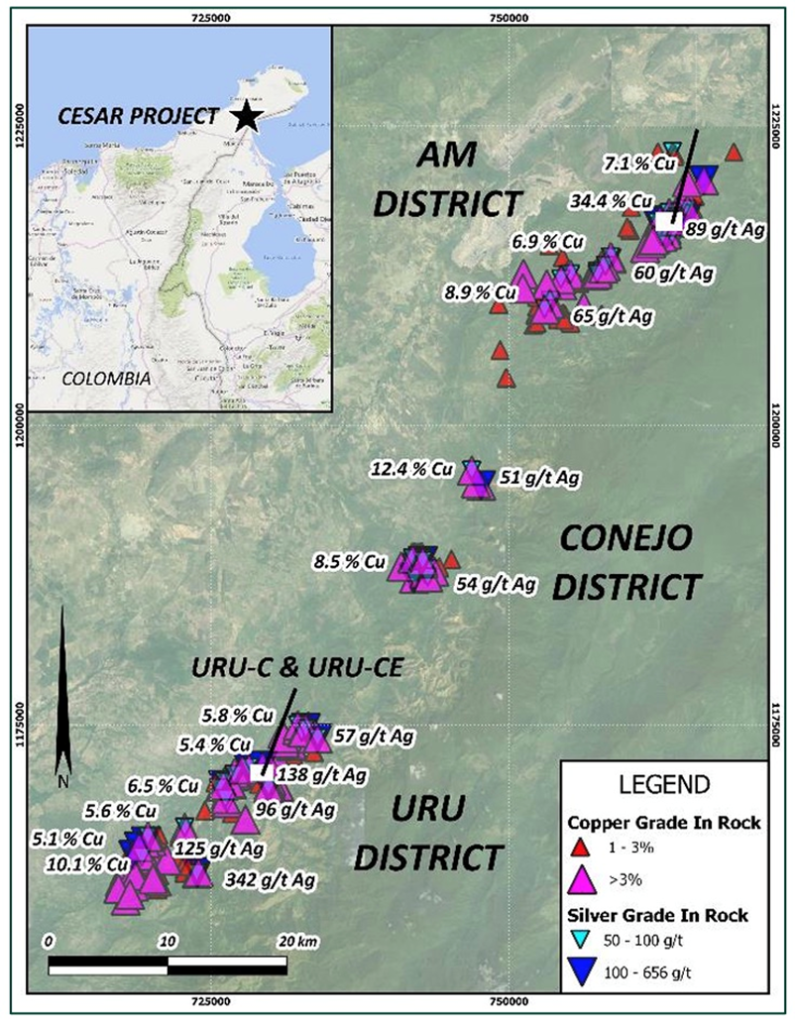

Max has made significant progress at CESAR; its field teams have so far identified 28 high-priority targets across the three districts of the 120-km Cesar copper-silver belt: AM, Conejo and URU.

The AM District starts in the far north of the Jurassic Cesar basin, classic stacked red bed outcrops with extensive lateral continuity have been channel chip sampled for over 15-km of strike. Fourteen targets (AM-01 to 14) have been identified, with highlight values of 34.4% copper and 305 g/t silver. The Company has confirmed that the stratiform mineralization continues at depth with two scout drill holes completed in 2023. Approved concessions cover 114km².

The Conejo District 40 km south of AM features high-grade copper-silver. The area spans 3.7 km, with samples averaging 4.9% copper. The mineralization is open in all directions. No drilling has been done to date.

The URU District is located approximately 60-km south from AM. Max has identified 12 targets (URU-1 to 12). The mineralization is hosted in intermediate volcanic rocks and is structurally controlled. Approved mining concessions cover 74km².

The 2024 exploration program at CESAR has two objectives: to prepare selected targets for planned drilling in 2025; and to conduct systematic reconnaissance exploration to identify new target areas for follow-up.

AM District

Within the 20-km cluster of mineralization shown on the map below (large red circles are >5% Cu, medium red circles are 1-5% Cu), there is 8 km between targets AM-01 and AM-02. Mineralization is sedimentary-hosted and the primary copper mineral is chalcocite.

Assay highlights include 2.2% copper and 128 g/t silver over 5.2m; and 4.8% copper and 53.6 g/t silver over 2.2m.

A priority target is AM-08, where the mineralization has two components: a structurally controlled/ volcanic host; and a stratabound/ sedimentary host. Hypogene minerals include chalcocite, bornite and chalcopyrite. Structurally controlled mineralization assays highlighted 15m @ 2.6% copper and 50.7 g/t silver, while strata-bound mineralization assays reported 1.1% copper and 17.2 g/t silver over 5.3m.

URU District

Max was the first company to drill for copper in the Cesar Basin. At URU, 12 holes over 2,244m were drilled at URU-C and URU-CE, located 750m apart. All 12 intersected mineralization, with six hitting significant copper-silver.

At URU-C, a 9.0m of 7.0% copper and 115 g/t silver surface discovery was confirmed at depth by drill hole URU-12, which intersected 10.6m of 3.4% copper and 48 g/t silver, including 18.5% Cu and 292 g/t Ag over 0.8m.

At URU-CE, 19.0m of 1.3% copper discovered in outcrop was confirmed by drill hole URU-9, which intersected a broad zone of copper oxide returning 33.0m of 0.3% copper from 4.0m, including 16.5m of 0.5% copper.

These broad associated alteration zones imply the potential for a bulk tonnage system.

The priority targets are URU-01 and URU-03.

URU-01 is hosted in porphyritic andesite. Hypogene minerals include chalcocite, bornite and chalcopyrite. Mineralization is observed in a major geological structure trending northeast. Highlight assay results include 8.3% copper and 146 g/t silver over 16.8m.

At URU-03, mineralization is strata-bound and primarily hosted in sandstones and siltstones. The main copper-forming mineral is chalcocite. Occurrences of barite associated with copper minerals and gold are proximal to main strata-bound mineralization. Highlight assays include 1.6% copper over 14.0m.

Conclusion

Florália DSO (benchmark 58-62% Fe) is a great fit for a junior and is an excellent project for Max because it fits so well into Matich’s wheelhouse. This is a high-grade iron ore deposit with potential for expansion, and due to its location infrastructure costs should be a fraction of a typical Australian hematite mine like Red Hawk’s Blacksmith.

Previous work defined a geological target estimated at 2,971,233 m3 to 4,496,333 m3 or 8,052,041 tonnes to 12,184,160 tonnes using a density of 2.71 g/cm3 at an average grade of 58% Fe.

Max cautions investors the potential quantity and grade of the iron ore is conceptual in nature, and further cautions there has been insufficient exploration to define a mineral resource and Max is uncertain if further exploration will result in the target being delineated as a mineral resource.

The mineralization at Florália is high grade, near surface, and there may not be a lot of drilling required to bring it into a 43-101 compliant resource.

Much of the iron ore is exposed in benches and can be bulk sampled. Max plans to start drilling in the fourth quarter of this year, and according to Matich, has the money to do so.

DSO iron ore projects like Florália are rare in that do not require tens or hundreds of millions worth of pre-production capex — buying a haul truck fleet, building roads, rail sidings, port infrastructure, etc.

That’s because the deposits require nothing other than the basic mechanical processes of crushing and screening ore to prepare it for export – no complicated and higher-cost beneficiation or treatment necessary. (NT News, June 24, 2024)

In Florália’s case, the DSO could be trucked directly to a steel mill approximately 20 km away. It has none of the infrastructure costs associated with the comparables above.

The 2024 exploration program at CESAR has started, with geophysical, mapping and geochemistry employed to identify multiple drill targets. So far 26 drill targets have been identified.

Colombian field crews are currently following up 14 priority targets (AM-01 to 14) identified along 15-km long mineralized corridor within the AM District.

The URU District has only two drill targets tested along the 20-km mineralized belt. At URU-C, a 9.0m of 7.0% copper and 115 g/t silver surface discovery was confirmed at depth by drill hole URU-12, which intersected 10.6m of 3.4% copper.

Max’s shareholders can look forward to an initial non-share dilution of $20 million first stage expenditures for the Cesar Project with the updated 2024 exploration program details to be released shortly.

In addition Max, through Max’s 100% owned subsidiary Bay Street, retains an underlying 3% NSR over 19 mining concessions covering 184-km² and 31 mining concession applications covering 796-km² of the Cesar Project.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.05 2024.07.19

Shares Outstanding 176m

Market cap Cdn$9.6m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

5 Comments

Leave a Reply Cancel reply

You must be logged in to post a comment.

Good article as always, been waiting ages for Max to get Cesar going.

When I interviewed Brett he did say news is coming soon regarding the 2024 exploration program on Cesar, with drilling in Q1 ’25.

Also that he wanted to drill Florila this year and have a resource estimate.

Rick

Jaguar wants to concentrate on gold exploration and mining. The deal is very straight forward for them, there are no onerous conditions, no earn in, no back loading and no money to be raised by MAX to get the deal done.

Jag knows Brett has the experience to pull this off, important to them because Jaguar gets a hefty 3% NSR.

As for Florilia’s capex the best comparison is Fenix resources (ASX:FEN). You can read about Fenix, and other comparables here;

https://aheadoftheherd.com/max-resource-two-world-class-exploration-projects-in-south-america-richard-mills/

There are a lot of small private mines in the area selling ore to the local steel mills. Being private, not pub.co’s, means self-financed.

Florilia will be contract mining. Meaning leasing the equipment used for mining, crushing and hauling. Contractors will not run the operation so MAX will need its own office, some personnel etc but contracting a company from the area already set up to mine is the way forward, and there are several..

And that of course means a considerably lower capex than the usual pub.co route.

We will be doing exploration/ drilling, putting together a 43-101 resource, according to Brett that’s a cost MAX has already covered.

At the end of Q1 MAX had $4m, at the end of Q2 $5m.

Jaguar did another very similar deal w/ another Brazilian company, I’m researching the particulars, as well I’m looking at finding the number of small private mines in the area, be great to get details on at least some of them.

Florilia drilling could start as early as late Q4 2024, and I’m guessing CESAR exploration plans/ budget news in early August.

CZR Resources has sold its Robe Mesa Iron Ore Project.

“CZR to receive $102m cash for its 85% interest in Robe Mesa, representing a

substantial premium to CZR’s market capitalisation (~$47M).

CZR is listed as a comparable in the link above. $MAX #DSO #IronOre

Rick

Aheadoftheherd.com

$MAX #Iron #BIF #BandedIronFormation

Hi aheadoftheherd.com admin, Your posts are always informative and up-to-date.