US government loosens foreign-content rules on EV batteries – Richard Mills

2024.05.05

The Biden administration has given electric-vehicle makers a two-year extension to shore up sources of graphite and other critical minerals considered difficult to trace to their origin.

On Friday, the Treasury Department said starting in 2025, plug-in cars containing critical minerals from companies controlled by US foes, including China, will be ineligible for up to $7,500 in tax credits.

But automakers will have until 2027 to curb the use of materials from so-called “foreign entities of concern” (FEOCs), provided they submit plans to comply with the rules after the two-year transition.

Bloomberg reports The two-year exemption speaks to the challenges automakers have had reducing their reliance on Chinese suppliers of materials such as graphite. The mineral used in battery anodes emerged as a geopolitical flash point last year when Beijing placed restrictions on exports, sparking fears of global shortages…

The rules release concludes two years of work on requirements that already have reduced the number of EVs eligible for tax credits. About 20 models qualify today, compared to as many as 70 previously.

IRA

The Inflation Reduction Act aims to grant incentives to companies that source their battery materials within the US and outside of China.

Passed by the Biden administration in 2022, the IRA provides US consumers tax credits of up to $7,500 per electric vehicle, provided the parts or materials are sourced from the United States, or from countries with which the US has a free trade agreement. This includes graphite, lithium, cobalt and other critical minerals.

As well as offering consumer incentives, the IRA subsidizes up to 30% of manufacturing costs related to battery cell assembly and battery pack production, helping to encourage carmakers and battery suppliers to invest in US-based supply chains.

The dilemma facing the US government is it wants to create a US-centered electric vehicle supply, but by imposing restrictions on China, which dominates the mining and processing of most metals needed for vehicle electrification, it is making things a lot tougher for EV- and battery-makers to source the raw materials, because the ‘Rest of the World’ don’t mine enough of them, process them into usable materials and manufacture the necessary components.

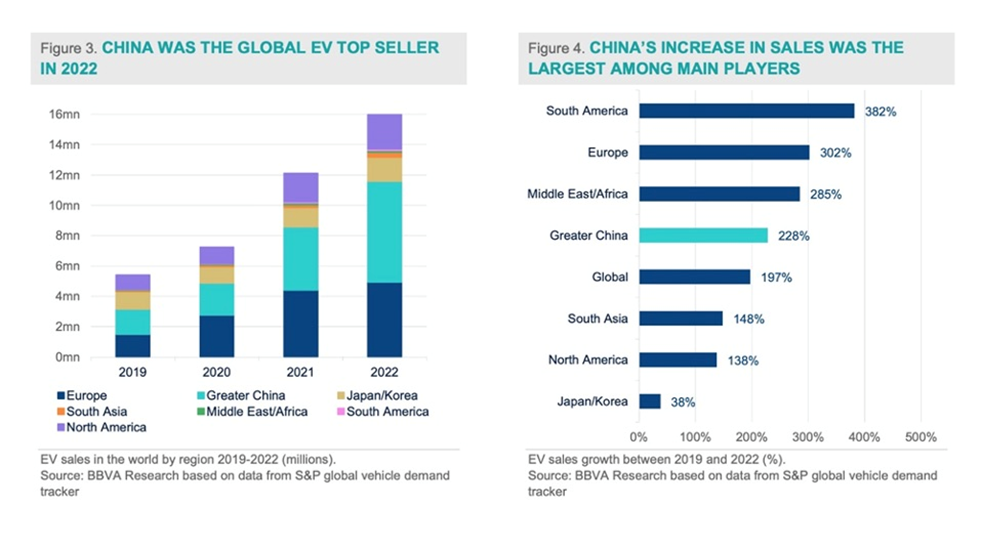

Meanwhile globally, around 1-in-5 new cars sold were electric in 2023.

Electric car sales neared 14 million in 2023, 95% of which were in China, Europe and the United States

Almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million, closely tracking the sales forecast from the 2023 edition of the Global EV Outlook (GEVO-2023).

Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. This is more than six times higher than in 2018, just 5 years earlier. In 2023, there were over 250 000 new registrations per week, which is more than the annual total in 2013, ten years earlier.

Electric cars accounted for around 18% of all cars sold in 2023, up from 14% in 2022 and only 2% 5 years earlier, in 2018. These trends indicate that growth remains robust as electric car markets mature. Battery electric cars accounted for 70% of the electric car stock in 2023. Trends in electric cars.

The following three charts are from Our World in Data

Electric cars include fully battery-electric and plug-in hybrids

.

Share of new cars sold that are battery-electric and plug-in hybrid, 2010 to 2023. Plug-in hybrids cars can run using an electric motor and rechargeable battery, or an internal combustion engine. Their battery is usually smaller than a fully battery-electric. Hybrid sales represented in blue.

China’s dominance

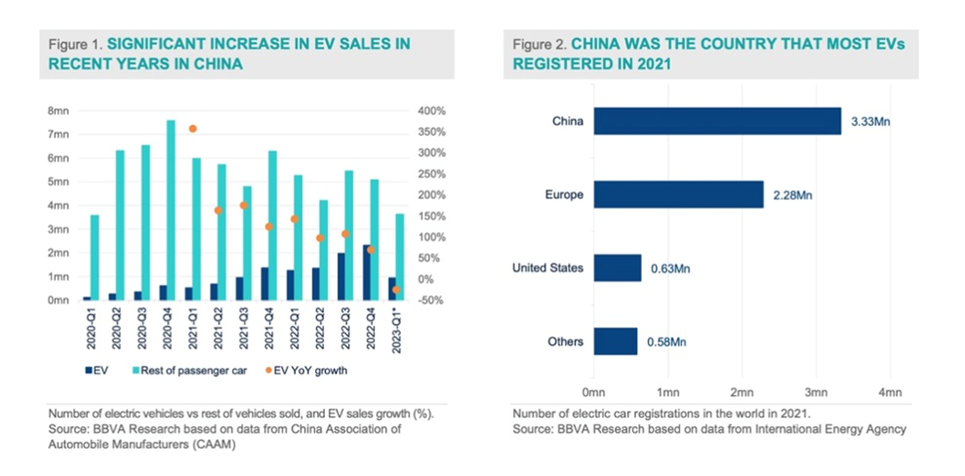

The International Energy Agency (IEA) estimates that two-thirds of global battery cell production is in China, while the United States accounts for approximately just 10%.

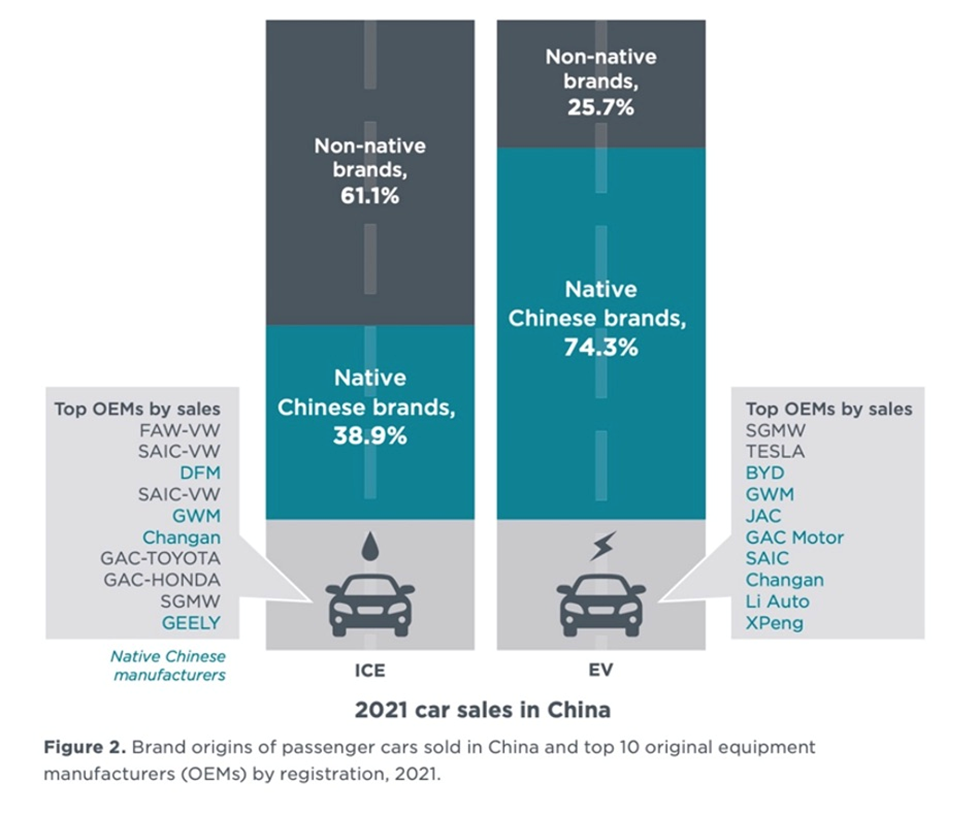

A BBVA Research report suggests China’s dominance is in part due to a national strategy that prioritizes the development and adoption of EVs. The Chinese government has implemented policy initiatives to support the production and purchase of EVs, such as tax exemptions, subsidies, and investments in charging infrastructure. Additionally, foreign automakers, such as Tesla, have been allowed to build up their factories in China. BBVA Research

In line with BBVA’s report China Briefing reports the country has more than 600,000 NEV (“new energy vehicle”)-related enterprises, with major industry players including BYD Auto, Tesla China, SAIC-GM-Wuling, Aion, and Changan Automobile.

The briefing also says China holds a dominant position in the EV supply chain, with over three-quarters of the world’s battery production capacity. The country houses more than half the world’s processing and refining capacity for graphite, lithium and cobalt. It boasts 70% of the global production capacity for cathodes and 85% for anodes.

Moreover, China’s EV manufacturing industry has a 20% cost advantage over US and European markets. This is due to government policies that support the EV industry, including subsidies and tax incentives, at the national and regional levels.

According to the International Council on Clean Transportation (ICCT), China released its first NEV development plan in 2012; 11 years later, the country has produced more NEVs (which include plug-in, battery electric, hybrid-electric and fuel cell electric vehicles) than any other country or region.

Globally, Chinese brands account for about half of all EVs sold.

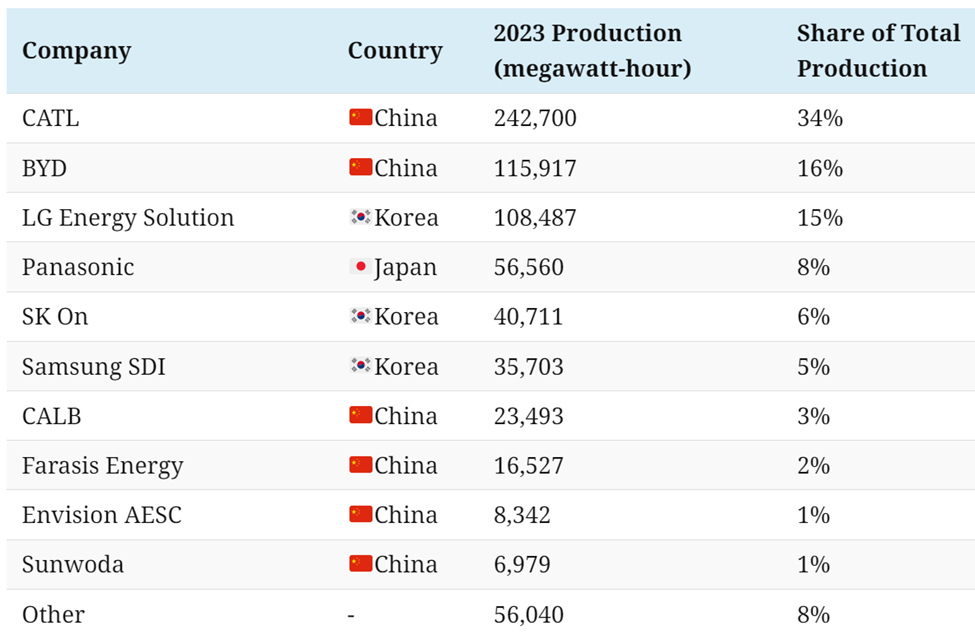

Contemporary Amperex Technology Co is the world’s largest EV automaker with 37% of market share as of the end of August, 2023. Between CATL and BYD (16%), the two Chinese companies account for more than half the battery market for electric cars.

CATL’s sales in Europe and the US almost doubled between August 2022 and August 2023, said BNN Bloomberg, noting its batteries are used in Tesla’s Model 3 and Y, BMW AG’s iX and Mercedes-Benz Group AG’s EQS, in addition to powering Chinese cars.

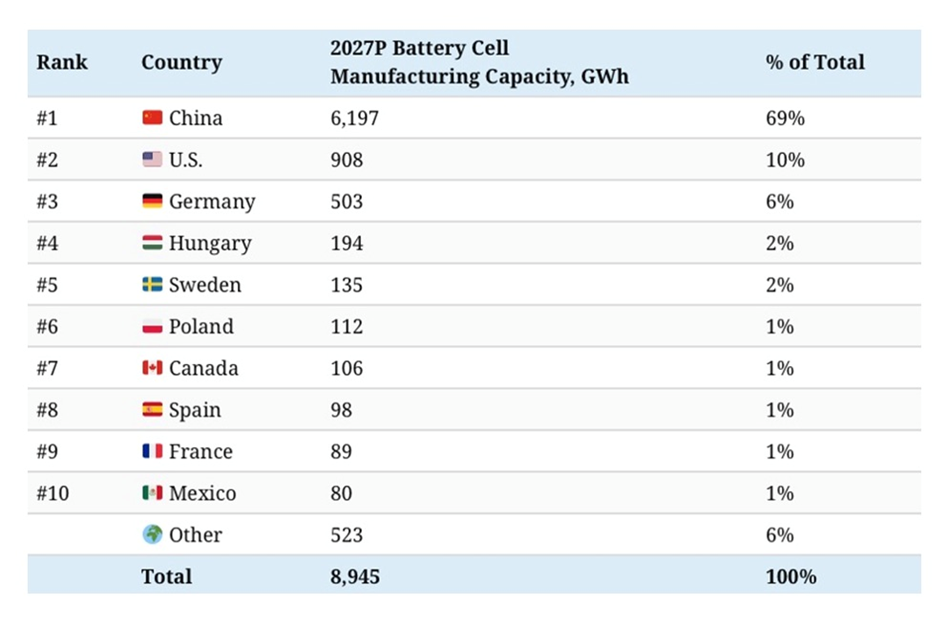

China’s dominance in both battery manufacturing, and in procuring and processing the raw materials required for the EV supply chain, is aptly demonstrated in two tables by Visual Capitalist.

The first table shows that in 2022, China had more battery production capacity than the rest of the world combined:

With nearly 900 gigawatt-hours of manufacturing capacity or 77% of the global total, China is home to six of the world’s 10 biggest battery makers. Behind China’s battery dominance is its vertical integration across the rest of the EV supply chain, from mining the metals to producing the EVs. It’s also the largest EV market, accounting for 52% of global sales in 2021.

Poland ranks second with less than one-tenth of China’s capacity…

China’s well-established advantage is set to continue through 2027, with 69% of the world’s battery manufacturing capacity.

Visual Capitalist then takes a stab at determining whether the rest of the world could end China’s monopoly by 2027. It found that “regardless of the growth in North America and Europe, China’s dominance is unmatched.” That’s because most of the parts and metals that make up a battery, like battery-grade lithium, electrolytes, separators, cathodes, and anodes — are primarily made in China.

Bloomberg said the US and Europe would have to invest a respective $87 billion and $102 billion to meet domestic battery demand with local supply chains by 2030.

The second table, using figures from Wood Mackenzie, shows the demand for lithium carbonate equivalent (LCE) is expected to be 55% higher by 2030 in an accelerated scenario (AET), whereby the world aims to limit the rise in global temperatures to 1.5 C by 2100, compared to the base case of 2.5 C, and 59% higher by 2050.

The table also shows the demand for two other essential battery metals, cobalt and nickel, is expected to be 16% and 26% higher, respectively, in 2050 in the AET scenario compared to the base case. Demand for graphite in an AET scenario is anticipated to be 46% higher than in the base case.

Business Insider notes that China has achieved EV leadership status by making its batteries cheaper. The country is one of the biggest producers of lithium-iron-phosphate (LFP) batteries which do not contain the relatively expensive minerals cobalt and nickel.

“What we’ve discovered in China is that electrification, and the democratization of the EV, prioritizes consumer affordability. By making it cheaper, China wins,” Bill Russo, Chrysler’s former China boss, told The Financial Times.

MSP

Given China’s overwhelming advantage in the global EV supply chain, the United States, along with restricting foreign content through the Inflation Reduction Act, is encouraging the mining of battery materials in countries that align with its interests.

(Remember, to qualify for a $7,500 subsidy, an EV’s parts or materials must be sourced from the United States, or from countries with which the US has a free trade agreement.)

The Minerals Security Partnership (MSP) provides “targeted financial and diplomatic support for strategic (critical minerals) projects.”

Countries in the coalition include Canada, Australia, Finland, Estonia, France, Germany, India, Italy, Japan, Norway, South Korea, Sweden, the United Kingdom and the European Union.

The goal is to reduce countries’ dependence on China by supporting mining, processing and recycling projects in other countries.

“Our vulnerabilities are obvious,” said undersecretary of economic growth Jose Fernandez, at this year’s PDAC conference in Toronto. Fernandez noted that China has placed export controls on gallium, germanium and graphite.

Graphite — military uses

Along with being an essential component of an EV battery with no substitutes, graphite is also considered critical for its military uses.

The danger of running out of minerals needed to build weapons and defend territories is a heightened risk now, during a period of intensified global conflict. With wars raging on two fronts — Eastern Europe and the Middle East — not to mention numerous smaller wars like the conflicts in Yemen and the DRC, nations are girding for war and re-arming their militaries, pushing up demand for critical and non-critical minerals including graphite, aluminum, steel, iron, rare earths, nickel and titanium.

Despite this re-arming trend, the US military and its NATO allies face dwindling stockpiles of minerals for military use. The problem is especially grave considering that China, now America’s strongest foe militarily, controls the market for most critical minerals and the United States is dependent on China (and Russia) for the materials required for building its military equipment and weaponry.

Virtually every US military system requires mineral components, from steel and titanium to graphite composites and cadmium alloys. Global defense spending shows that military demand is increasing for these platforms, munitions, and thus minerals. (Modern War Institute)

Graphite is the ideal material for defense purposes thanks to its unique properties, i.e., it is able to withstand very high temperatures with a high melting melting point; it is stable at these high temperatures; it is lightweight and easy to machine; and it is corrosion-resistant.

Four ways graphite has transformed aerospace engineering to make it more efficient, are increasing the service life of airplanes; improving fuel economy; having the ability to run hotter engines; and reducing the weight of airplanes.

Fun fact: when an industry giant replaced a single leaded bronze part with a graphite equivalent, it saw a weight decrease of 1.5 lbs. In aerospace, every pound saved equates to $5,000 a year in fuel costs.

Graphite is found in a wide range of consumer devices, including smartphones, laptops, tablets and other wireless devices, earbuds and headsets. Besides being integral to electric vehicles — graphite is used in the anode part of the lithium-ion battery — graphite is found in lubricants, nuclear reactors, graphene sheets, and in pencil lead.

Another significant characteristic is that it is chemically inert, meaning it is not affected by a majority of reagents and acids. (BYJU’s).

The European Commission last fall added synthetic graphite and aluminum to the list of strategic and critical raw materials outlined in the Critical Raw Materials Act.

In 2021, President Joe Biden signed an executive order aimed at strengthening critical US supply chains. Graphite was identified as one of four minerals considered essential to the nation’s “national security, foreign policy and economy.”

Graphite is:

- One of 14 listed minerals for which the US is 100% import-dependent.

- One of nine listed minerals meeting all six of the industrial/defense sector indicators identified by the US government report.

- One of four listed minerals for which the US is 100% import-dependent while meeting all six industrial/defense sector indicators.

- One of three listed minerals which meet all industrial/defense sector indicators — and for which China is the leading global producer and leading US supplier.

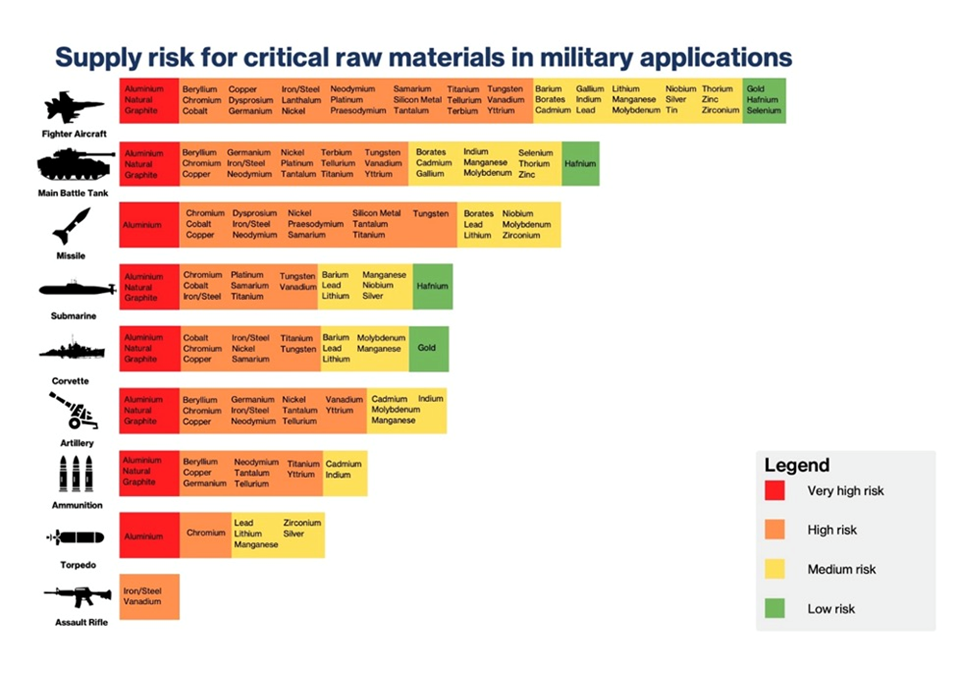

A report last year from the Hague Centre for Strategic Studies found that natural graphite and aluminium are the materials most commonly used across military applications and are also subject to considerable supply security risks that stem from the lack of suppliers’ diversification and the instability associated with supplying countries.

The report assessed the degree of criticality for each of 40 materials deemed critical or soon to be critical. Natural graphite was rated “very high-risk” for air applications, and “high-risk” for sea applications.

In the table below, natural graphite is rated red, very high risk, for its use in fighter aircraft, main battle tanks, submarines, corvettes, artillery and ammunition. Aluminum, used in fighters, tanks, missiles, submarines, corvettes, artillery, ammunition and torpedos, was also rated a very high-risk material.

The report says aluminum and natural graphite are the two most used materials in the defence industry and can be found in aircrafts (fighter, transport, maritime patrol, and unmanned), helicopters (combat and multi-role), aircraft and helicopter carriers, amphibious assault ships, corvettes, offshore patrol vessels, frigates, submarines, tanks, infantry fighter vehicles, artillery, and missiles. These materials are used in components such as airframe and propulsion systems of helicopters and aircrafts as well as onboard electronics of aircraft carriers, corvettes, submarines, tanks, and infantry fighter vehicles. The impact of supply security disruption would hence be very significant, given the multiplicity of aluminum and natural graphite’s applications.

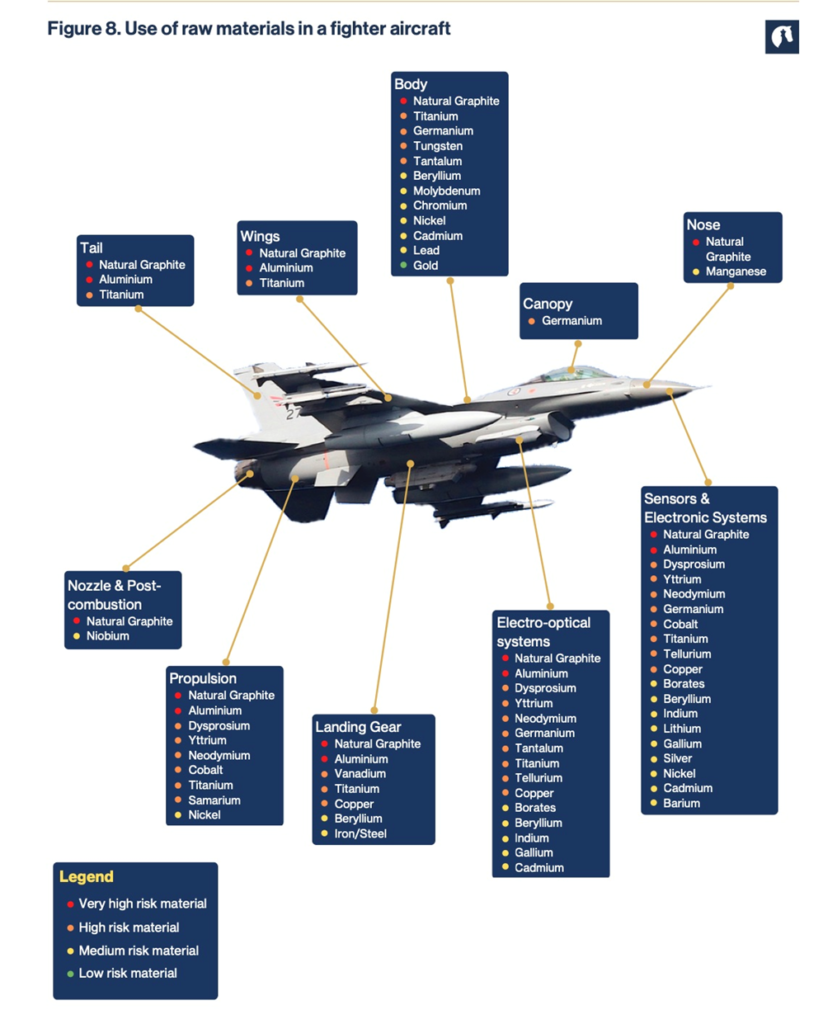

In the fighter plane graphic below, notice the use of natural graphite (red dots) in almost every part of the plane, including the body, wings, tail, nose, nozzle, propulsion system, landing gear, electro-optical systems, and sensors and electronic systems.

According to the report, the most used of the 40 materials across the air domain are aluminum, natural graphite, copper and titanium:

These materials have several applications in aeronautics. In aircrafts (fighter, transport, maritime patrol, and unmanned) and helicopters (combat and multi-role), aluminium, natural graphite, and titanium find their main application in the airframe, where they are used in the body, wings, tail, nose, and axis of the aircraft. They are also employed in the production of propulsion systems’ components such as combustors, nozzle, drive shaft, and propellers, as well as in landing gears, connectors, and electronic systems.

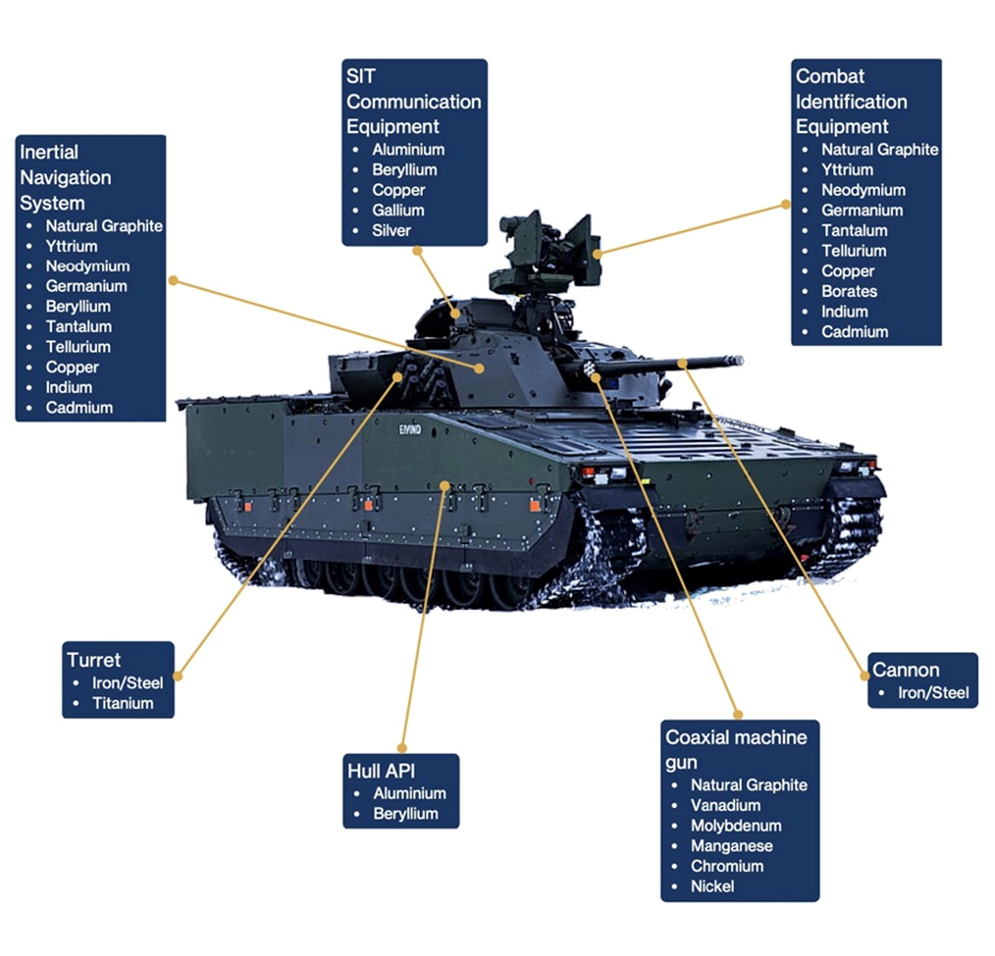

A second graphic of a tank shows natural graphite in the inertial navigation system, combat identification equipment, and coaxial machine gun.

According to the report, For the construction of tank guns, Howitzer machine guns in infantry fighter vehicles, and GPS/SAL guidance systems in ammunition, natural graphite is found in combination with other materials to construct these components.

The US military also uses graphite flakes to block electromagnetic waves that the enemy might detect and use to target troops in the field. Essentially a type of smoke, synthetic graphite flakes are released from ground-based systems that disperse bulk powders into the atmosphere. The powders, called Micro-260 and K-2, are composed of flakes of various sizes.

It should be pointed out that synthetic graphite, made from petroleum coke, is used in all the downstream industries that produce military equipment components, such as foundries (graphite electrodes) that make steel; and facilities that manufacture wheels for vehicles or body armor for soldiers (various types of graphite molds and dies).

Synthetic graphite is employed directly in graphite nozzles, used in high-powered rockets due to graphite’s ability to withstand extreme temperatures. These graphite components can be as simple as a hole drilled into a synthetic graphite block, or a more advanced, machined nozzle that has its own cooling system.

Downstream from military applications, graphite is used widely in the aerospace industry. According to Semco Carbon, heat treating synthetic graphite is used as engineered material to create precision machined plates, posts, nuts and bolts along with heating elements and fixtures used in the heat treatment of aerospace metals such as titanium, stainless steel, and other alloys…

As an extension of heat treating for aerospace, a common graphite use is as a susceptor. “A susceptor is a material used for its ability to absorb electromagnetic energy and convert it to heat (which is sometimes designed to be re-emitted as infrared thermal radiation).”

Another use for graphite is as a mold. Graphite molds are used to cast titanium, aluminum, and stainless steel to near net shapes. Graphite molds are also used for molding non-metal composites. An example of this is for a satellite dish deployed on a satellite.

Graphite itself is used for jet and rocket engine nozzles and Carbon/Graphite vanes. Impellers and rotors move aviation fuel safely without the dangers of creating sparks to ignite fuel.

Conclusion

The US government’s revised foreign-content rules are a step in the right direction for making EVs more affordable to cash-strapped North American car buyers.

Starting in 2025, plug-in cars containing critical minerals from companies controlled by US foes, including China, will be ineligible for up to $7,500 in tax credits.

But the amendment means that EV models made using materials from FEOCs will continue to qualify for the $7,500 tax credit, as long as the car manufacturer submits a plan to comply with the rules after the two-year (2025-27) transition.

The Inflation Reduction Act generally does a good job of keeping Chinese parts out of American EVs.

Pursuant to section 30D, FEOCs must be generally excluded from a vehicle battery’s supply chain in order for the vehicle to be potentially eligible for the (up to $7500) tax credit.

A FEOC includes any “foreign entity” that is owned by, controlled by, or subject to the jurisdiction or direction of a government of a covered nation (as defined in section 2533c(d) of title 10) — currently China, Russia, North Korea, and Iran.

The problem is there is a processing gap in North America.

Take graphite. When you’re out of the graphite space as the US has been since 1991, 30+ years, it’s not a case of simply not having the material. We have graphite, but we don’t have any of the knowledge base downstream from the material.

I wrote an article saying we don’t need the material from China, what we need is the processing knowledge to make the refined materials. Then we need to figure out how to manufacture what we need to be independent.

We have enough graphite here, we have enough rare earths, we have enough of whatever we need to mine. Here at AOTH we have been advocating for the creation of a “mine to magnet/ battery” electric vehicle supply chain in North America for years.

The problem is we don’t have the political will, we have NIMBYism, we don’t have refineries, we don’t have smelters. We definitely have the deposits, the biggest problem we have even if we built all this stuff is we don’t have the knowledge, we don’t know how to separate the rare earths, we don’t know how to make a rare earth magnet, we don’t know how to refine graphite, we don’t know how to make battery anodes, we don’t know any of that.

The stakes are enormous, BloombergNEF forecasts global cumulative value of all forms of EV sales will hit USD$8.8 trillion by 2030 and $57 trillion by 2050 in best case scenario.

So far we’ve let almost all of that go to China. We have to figure out how to do the knowledge transfer in the direction of us, and we have to have federal policy and federal law recognize that.

From Barron’s:

Environment ministers from the G-7 Western economies have targeted a sixfold increase in storage for renewable energy by 2030…If Chinese producers are ahead in the race for electric vehicle batteries, they outright dominate utility-scale storage batteries so far.

Renewable Energy Needs to Be Stored. China Is at the Forefront

The world’s greatest R&D country (US) in the world, and the world’s greatest potential supplier (Canada) of raw materials to the EV industry has been sidelined by China in the technology of mineral processing. It’s high time we acknowledged this fact and did something about it.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.