Renforth pivots to new geological model at Parbec gold project -Richard Mills

- Home

- Articles

- Metals Battery Metals

- Renforth pivots to new geological model at Parbec gold project -Richard Mills

2024.04.12

Gold hit a record-high $2,365.09 on Monday, April 9, fueled by buying momentum and geopolitical risks, but fell back on Wednesday following higher-than-expected US inflation data.

The U.S. Bureau of Labor Statistics said the Consumer Price Index in March rose to 3.5%, a point higher than the 3.4% expected and February’s reading of 3.2%. Persistently high prices forced traders to shift bets on the Federal Reserve lowering interest rates from June to September, resulting in the US 10-year Treasury rising to 4.5% and the US dollar index surging to 105. (FX Street, April 10, 2024)

Still, spot gold is up 14% this year, following a 13% gain in 2023. As of writing on Thursday, April 11, gold was trading at US$2,354.60/oz, a strong performance given the headwinds facing the precious metal.

These include a strong US dollar, positive real yields (Treasury yields minus inflation above zero), investors selling their gold ETFs, and inflation coming down from 40-year highs. (gold buyers often purchase bullion as an inflation hedge)

Dollar Collapse published three charts showing how gold is defying conventional behavior, explaining the phenomena thus (edited):

Normally when the Federal Reserve raises interest rates, it pushes the value of the US dollar up. The effect drives the price of gold down. In the past two months, gold has broken out past $2200 to almost $2300. Yet, there’s no change in Federal Fund interest rates.

When yields go up, gold goes down.

And that’s because there’s an opportunity cost to holding gold when a person can make more money from bonds. So people drop gold and go for yields…

Except not this year, ever since October of last year, 10-year treasury bond yields and gold have generally been rising together.

When the dollar rises in value, it can make gold more expensive in other currencies, which reduces demand for gold lowering its price. Then a stronger dollar can also mean increased prices for US Bonds, lowering yields.

That being said, a strong dollar historically lowers the price of gold. Not since the beginning of March…

Since the start of March, the strength of the dollar slowly rose. Yet, the price of gold continues to make leaps and bounds.

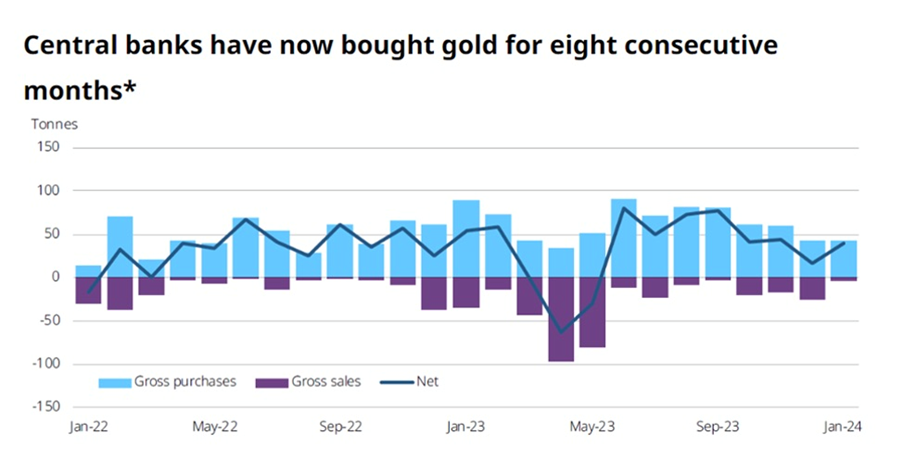

Demand is being driven by “momentum buying” by institutional investors, strong central bank buying, with developing nations in particular stocking up on bullion as insurance against having their foreign currency reserves frozen like happened to Russia after it invaded Ukraine; and geopolitical instability, with wars in Ukraine and Gaza still raging, and there’s China’s positioning on Taiwan causing stress. Commercial shipping in the Red Sea continues to come under attack from Houthi rebels.

The gold price started to kick higher in October when market sentiment began pricing in three quarter-point rate cuts in 2024. This was confirmed at the Fed’s December meeting, and made even more explicit at the March 19-20 meeting.

Normally when gold rises, gold stocks follow, but since 2021, this has not been the case.

Historically, though, gold mining stocks have performed well following periods when they have significantly trailed bullion.

MarketWatch columnist Mark Hulbert analyzed what happened in the wake of large divergence between gold and gold-mining shares using data going back to the mid-1980s.

Hulbert observes that, following periods in which shares have lagged gold, like they have over the past two years, the gold shares tend to perform well rather than gold performing poorly.

The divergence may have already begun. Hulbert points out that in the month prior to March 20, the XAU index gain was double that of gold, 12.5% versus 6.3%, respectively, leading to his bottom-line conclusion: If you want to bet on gold in coming weeks and months, you may want to favor gold-mining shares over gold bullion.

Gold analyst Adam Hamilton says gold stocks’ spring rally has proven their strongest seasonal one during gold’s modern bull-market years.

Underperforming precious metals and copper stocks poised to correct

Historically, junior resource companies offer the best leverage to rising commodity prices.

One of the more interesting plays right now, particularly in a buoyant gold price environment, is Renforth Resources (CSE:RFR, OTCQB:RFHRF, FSE:9RR) and its Parbec gold project.

Parbec

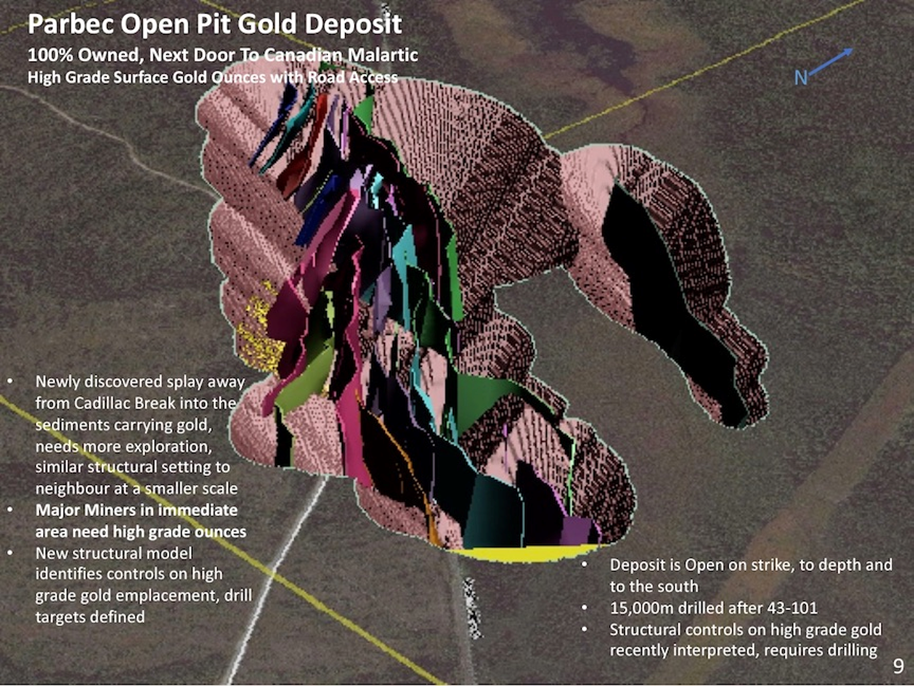

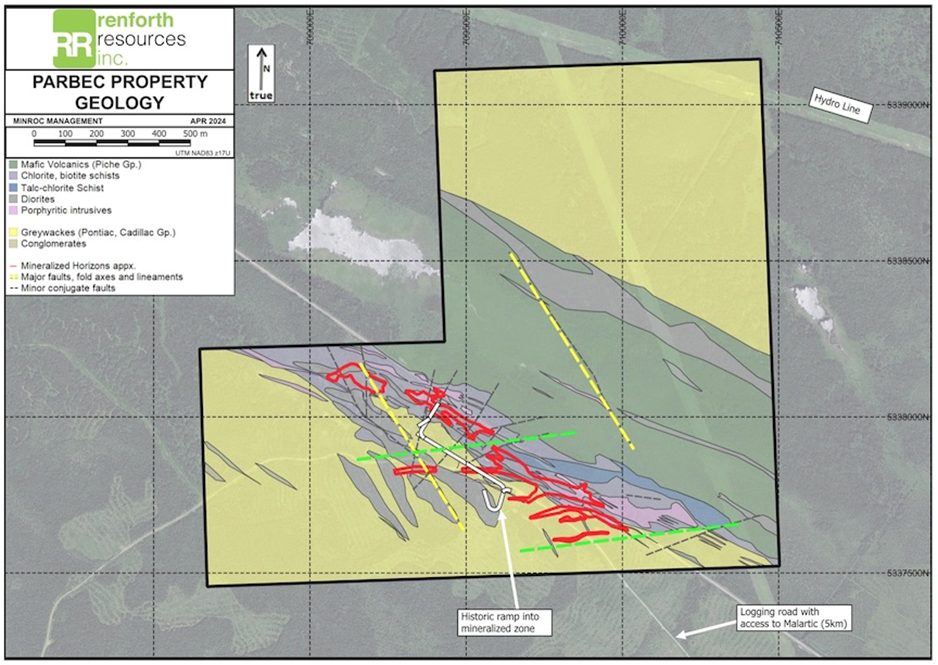

The Parbec project being developed by Renforth is an open-pit-constrained gold deposit located in the town of Malartic, Quebec.

It sits on 1.8 kilometers of the Cadillac Break, a prolific regional gold structure, and is adjacent to Canadian Malartic, Canada’s largest open-pit gold mine.

2019 drilling by Renforth proved that mineralization at Parbec is continuous for 1.8 km along the Cadillac Break.

Among the highlights are three areas of mineralization on the property: the discovery zone within the Cadillac Break, where the gold resource is largely above 200m, with the zone open to depth; the “Island Trench Zone”, sampled on surface and pierced to 738m, where 0.96 g/t gold was drilled over 0.5m; and the “Diorite Splay Zone” where gold is present on surface within cross-cutting faults, and at contacts between sediments and diorite intrusives, in the Pontiac sediments — a unique setting similar to Canadian Malartic.

Parbec currently hosts an open-pit-constrained gold resource estimate of 104,500 indicated ounces grading 1.78 grams per tonne gold, and an inferred 177,300 ounces gold at 1.77 grams per tonne.

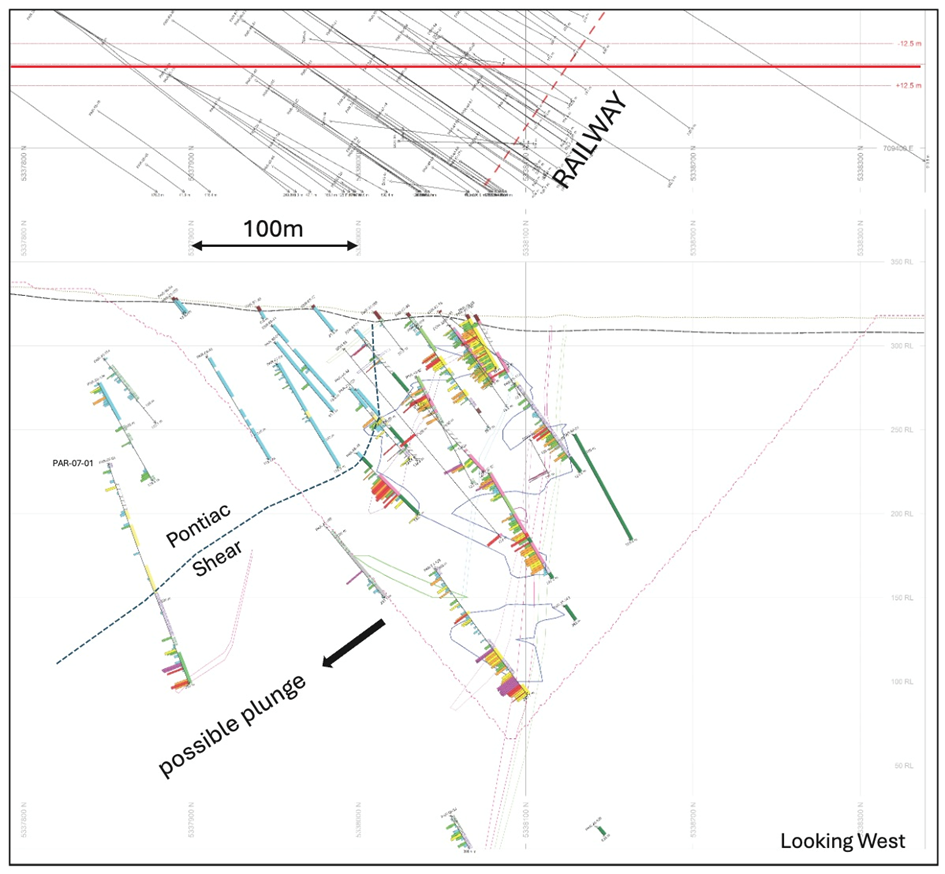

This week, Renforth Resources announced a new geological of the Parbec deposit that will guide exploration going forward.

The updated interpretation proves the presence of gold mineralization in structures oriented obliquely (on a slant) to the Cadillac Break, and extending into the Pontiac sediments.

According to Renforth, Interpreted conclusions include instances where surface mineralization within the Cadillac Break forms a continuous zone with gold mineralization within the Pontiac sediments to the south, crossing the lithologies. This is a new exploration target concept at Parbec with bulk tonnage potential. These interpreted oblique structures carry gold mineralization to the south of the Break, within the Pontiac sediments and have been intersected in several locations at Parbec.

How does this new geological model differ from the old one? Renforth explains:

The prior Parbec modelling approach used vertical sections oriented perpendicular to the Cadillac Break. Mineralization was difficult to model and resulted in an interrupted continuity of mineralization and abrupt shifts in grades and widths as the zones were thought to be constrained by lithological units. The new model illustrates cross-cutting mineralized structures to the Cadillac break and lithologies which were not clearly identified in previous interpretations. Simply stated, a slight change in how the drill data is studied has identified new areas with previously unrecognized exploration potential.

The remodeling of the Pontiac sediments has important implications.

For one, the model results in a stacking of individual gold zones at or near surface and continuing at depth into the Pontiac sediments with a clear southward dip underneath the Pontiac sedimentary/Cadillac Break contact.

South dipping extensions of known mineralized zones have been identified along the Pontiac contact, including tying in much deeper mineralized intercepts from 2007-08 drilling.

Remodeling of the Pontiac sedimentary contact has identified significant structural complexity, particularly in the north-western half of the Parbec deposit. An area previously referred to as the “diorite splay” is in fact an opening of the Pontiac contact, trapping a large mass of diorite, known to be gold-bearing, with only limited surface prospecting, trenching and drilling.

Current modeling efforts are defining exploration target areas for mineralized zone expansion to the south under the Pontiac contact within embedded felsic intrusions. Previously, mineralization in several deeper holes was difficult to correlate; the new geological model reconciles these deeper holes and offers infill drilling targets.

Surface expression of the mineralization indicates that the horizontal thickness varies from a few meters to approximately 20 meters. Many new targets are becoming apparent along different mineralized trends covered by a maximum 5 meters of overburden. The company is working to define a surface mineralized footprint amenable to a small-scale open pit. To date, two areas have been identified in the northwestern part of the property that are amenable to stripping and sampling followed by bulk sampling if warranted.

Renforth notes there has been almost no exploration in the Pontiac sediments, and that the entire area has significant exploration potential, validated by the new geological model.

Of the greater than 40,000 meters drilled at Parbec, none has been in the Pontiac sediments. Renforth says there are many more areas to be drilled. Also of note: the contiguous Canadian Malartic gold mine has operated successfully in the Pontiac sediments.

The new model gives rise to promising exploration potential.

According to Renforth, The new interpretation does not yet cover the entirety of the Cadillac Break’s ~1.8km of strike on the property, or the deepest pierce points on the property (>700m depth). Additional drilling, guided by this new interpretation, is justified, in the Cadillac Break, the Pontiac sediments and the Piché volcanics to the north, each of which host gold mineralization and untested strike.

To date, the new modelling interpretation has identified four target areas along a strike length of about 800 meters for follow-up exploration work. This early-stage work shows that each target area demonstrates continuity of mineralization from surface down to a depth of about 150 meters along a horizontal distance of approximately 200 meters. Mineralization thickness varies from a few meters to 20 meters or more at the center of lenses. The model is limited by drilling density at depth, as such the targets are open along strike and below a depth of 150 meters.

Follow up exploration will be planned with drill holes oriented at differing azimuths to test the continuity for the newly interpreted mineralized zones trending in northerly, East-West and North-East – South-West directions.

Malartic Metals Package

The new interpretation at Parbec should not discount the significant progress Renforth has made at its other Quebec project, the Malartic Metals Package (MMP), formerly named Surimeau.

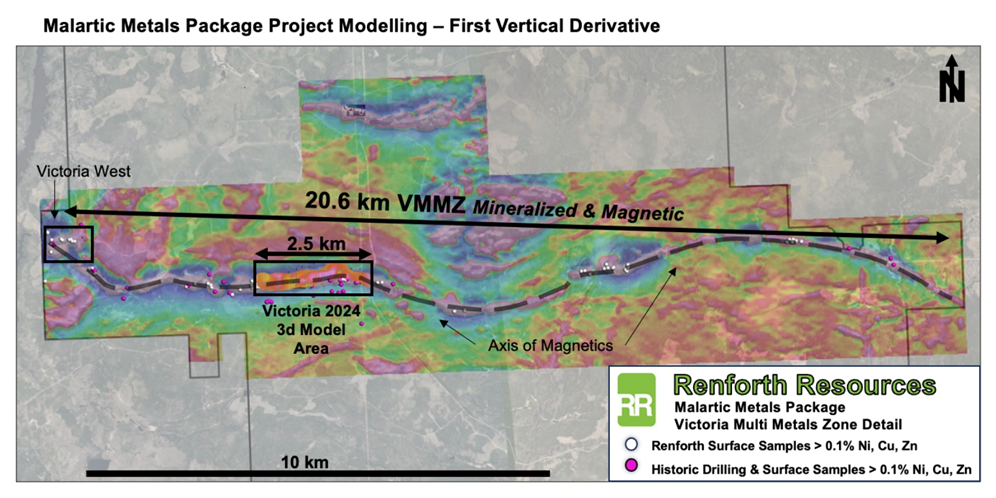

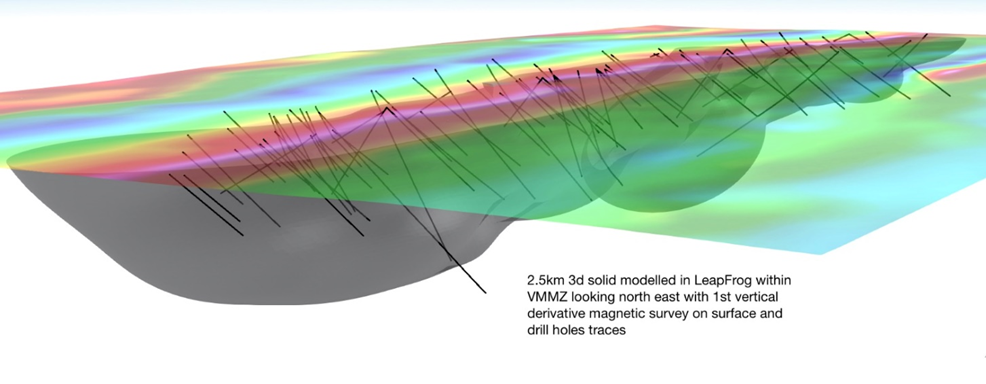

Renforth completed an infill drill program at MMP in early December, specifically at the Victoria target, a ~20-km-long magnetic structure bearing nickel, copper, zinc and cobalt mineralization at surface.

The program comprised 11 holes and 3,500 meters. In total, Renforth has drilled 10,316 meters in 44 drill holes within a 2.5-km section of the 20-km structure.

In February, Renforth confirmed continuity of mineralization within the 2.5-km section, with the deepest mineralized pierce point at 225m.

Nickel is reportedly present in pyrrhotite, pentlandite and sometimes millerite sulfides. The alteration zone contains minimal to no olivine or magnesium, with the majority of the nickel hosted in sulfides.

Earlier this year, Renforth also conducted a review of the 20-km Victoria Multi Metals Zone (VMMZ), to better understand the vectors of mineralization; and to test for gold and platinum group elements (PGEs), the latter previously found in surface samples.

Core samples were taken from the mineralized zones of several drill holes and sent in for assaying.

In early April, Renforth reported a notable increase in gold, platinum and palladium values. The highlights were 0.001 parts per million gold, 0.0047 ppm platinum, and 0.006 ppm palladium over 0.4 meters; 0.002 ppm Au, 0.0021 ppm Pt and 0.0138 ppm Pd over 0.8m; and 0.026 ppm Au, 0.0372 ppm Pt and 0.0388 ppm Pd over 1.5m.

MMP’s geology is best described as a sulfide nickel magmatic sulfide deposit, juxtaposed with a copper-zinc massive sulfide deposit. The nickel-containing ultramafic orebody has been fused with the VMS deposit alongside it, giving it a unique geological flavor.

This style of mineralization is rare; however, it is known to occur in the Outokumpu District of Finland, which contains sulfide deposits with economic grades of copper, zinc, cobalt, nickel, silver and gold.

These deposits are formed by structural juxtaposition of two types of mineralization — magmatic nickel-copper-platinum group metals, and stratabound syngenetic zinc-copper VMS types. Additionally, in the Outokumpu mines, black graphitic schist hosts the deposits.

Renforth interprets the VMMZ, which stretches ~20 km west to east across the central portion of the ~330 square km MMP property, to be an “Outokumpu-style” mineralized occurrence, commencing on surface to the deepest pierce point drilled to date, 225m vertical depth.

The Outokumpu-type assemblage found at MMP generally consists of carbonate rock, calc-silicates and serpentinite in close contact with bands of graphitic mudstones that are generally less than 5 meters thick. Structural repetition is evident in drill core where in certain cases there are multiple repeated sequences.

The Talvivaara mine just north of Outokumpu shares similar geology to MMP and is notable for its “green” bioleaching process.

Mapping and prospecting work in August-September focused on four areas: Lac Beaupre, Victoria West, Lalonde Northeast and Fouillac.

The program identified two new locations of surface nickel-cobalt-zinc-copper mineralization north of the Lalonde system and south of the Victoria system. The polymetallic mineralization is similar to that seen at Victoria.

Lithium was found in lithium/cesium/tantalum fractionated pegmatites and in the Pontiac sediments, where elevated lithium/rubidium/cesium appears to indicate proximity to blind pegmatites and may represent the mobility of lithium, offering an exploration vector.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.02; 2024.04.11

Shares Outstanding 325m

Market cap Cdn$6.5m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Renforth Resource (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of RFR.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.