Energy insecurity will prevail, despite energy transition – Richard Mills

2024.03.21

Until recently economists tended to treat energy inflation and food inflation as different entities. Russia’s attack on Ukraine and other factors put a laser-like focus on the relationship between the two.

Ukraine and Russia are known as “the breadbasket of Europe” due to the region’s abundance of grains like wheat, barley, corn and soybeans. Within about a week of Russia crossing into eastern Ukraine on Feb, 24, 2022, prices for soybeans and some vegetable oils spiked up to 60%.

The United Nations’ FAO Food Price Index hit a record high the following month.

The index tracks monthly changes in the prices of five food commodities: cereals, vegetable oils, dairy products, meat and sugar.

Beyond the war in Ukraine, food inflation has been driven by climate change — droughts, floods and sudden cold snaps — labor shortages, China becoming a net importer of agricultural products, and India’s ban on rice exports.

Why food inflation isn’t going away — Richard Mills

For any product, price is determined by its inputs; food is no different. The key input in agriculture is fertilizer, which farmers use to supplement natural soil nutrients.

If the cost of fertilizer rises, food prices naturally increase. Fertilizer prices are dependent on natural gas, which Farm Progress describes as

a critical ingredient for anhydrous ammonia production and is also the primary energy source for fertilizer plants in the U.S. and abroad.

In early September, 2022, the price of NG hit a record $342 per megawatt-hour, several times as much as the previous September.

British homeowners saw an 80% increase in their energy bills.

While the prices of fuel and food have come down since the war started, they remain elevated.

US gasoline at $3.56 a gallon is the highest since August 2015. Crude oil tumbled from its one-year high of $93.68 on Sept. 27, 2023, to $69.34 on Dec. 7, but is back up to $83.66.

Canadian food inflation at 3.3% in February is the highest since February 2015.

Oxford Economics sees global food prices remaining 25% higher than during the pre-pandemic decade.

And despite food and fuel being excluded from the Federal Reserve’s core PCE inflation index, the prices of gas and groceries are very much on the minds of consumers, especially going into the US fall election.

Energy insecurity

It’s been said that oil drives the world economy, and despite the transition from fossil fuels to renewable energy and electric vehicles, oil and natural gas will be with us for decades to come. Some see decarbonization as a way to reduce dependence on Middle Eastern countries and Russia for oil and gas supplies, but many countries will simply switch dependency to China, which dominates critical mineral supply chains that control the minerals going into clean technologies.

Arguably, an energy crunch is coming and our energy supply is under threat, for various reasons to be explained. If nothing changes, the Western world should expect higher energy prices in future.

The International Energy Agency (IEA) define energy security as “the uninterrupted availability of energy sources at an affordable price”. Energy insecurity occurs when there is a deficit, where the amount of energy consumed is greater than the amount of energy produced. Energy insecurity can be created by geography, lack of wealth, over-dependence on other countries, stretched supply routes and poor management. (University of Aberdeen, ‘The Energy Trilemma’)

Energy security is considered vital for a country’s social and economic development. Before the Ukraine war upended food and energy prices, two oil crises in the 1970s caused oil prices to soar, resulting in inflation and recession in several countries. Ensuring stable oil supplies became a matter of national security.

According to a 2021 article from Science Direct, global energy demand is currently being driven by rapid population growth and economic development — mostly from Asia. Demand is expected to increase by 38% by 2040, yet it is estimated that at the current rate of energy consumption, carbon sources can cover energy needs for only 50 years.

A panel data analysis of 139 countries from 1996 to 2016 found that higher income and governance quality seem to reduce energy insecurity. In particular, economic growth leads to improvements in the ratio of energy production to consumption even though energy usage per capita appears to rise. Meanwhile, economic development fosters energy efficiency via reduced energy intensity and reduces emissions. Similarly, governance quality appears to improve energy efficiency. On the other hand, trade openness has a negative effect on energy insecurity whereas FDI does not have a significant effect.

Geopolitics

Before the war in Ukraine, conventional wisdom held that the shift to new energy sources would not only clean up the planet, but put an end to the geopolitics of the old energy order. Those hopes were dashed when the Russian army invaded Ukraine in 2022.

Foreign Affairs makes some good points on how the new geopolitics is influencing energy security. The following is from an April 10, 2023 article, lightly edited:

- By the fall of 2021, amid an energy crisis in Europe, skyrocketing natural gas prices, and rising oil prices, even the most optimistic evangelist of the new energy order had realized that the transition would be rocky at best. Any remaining romanticism evaporated when Russia invaded Ukraine in February 2022. The war revealed not only the brutal character of Russian President Valdimir Putin’s regime and the dangers of an excessive energy dependence on aggressive autocracies but also the risks posed by a jagged, largely uncoordinated scramble to develop new energy sources and to wean the world off old, entrenched ones.

- In the months that followed, Russia gradually cut its pipeline gas deliveries to Europe by more than three-quarters, triggering a crisis that led European governments to spend a staggering 800 billion euros shielding companies and households from higher energy costs. Tight energy markets allowed Russian oil and gas revenues to soar. By [2022], the mismatch between declining supplies and rising demand had already tightened the oil market. Prices leaped even further, to a 14-year-high.

- The brutality of Russia’s actions and the knowledge that those actions were funded by fossil fuel receipts reinforced the determination among many in Europe and the United States to move away from oil, gas, and coal. In Washington, one result was landmark climate legislation in the form of the Inflation Reduction Act. Europe also expedited its green plans, notwithstanding some small near-term increases in coal use.

- Many American officials worry, however, that a more accelerated energy transition will necessarily involve greater dependence on China, given its dominance of clean energy supply chains. Such fears led Congress to create incentives for the domestic production, refining, and processing of critical minerals now centralized in China.

- Driving the new energy insecurity are three main factors: the return of great-power rivalry in an increasingly multipolar and fragmented international system, the efforts of many countries to diversify their supply chains, and the realities of climate change.

- Traditional energy heavyweights are also recalibrating their positions. Saudi Arabia is now far less concerned with accommodating US requests to supply oil markets in ways consistent with US interests. In the face of a decrease in Washington’s strategic commitment to the Middle East, Riyadh has concluded it must tend to other relationships — especially its links to China, the largest customer for its oil. Regardless of the invasion of Ukraine, the Saudi government believes that Russia remains an essential economic partner and collaborator in managing oil-market volatility.

- The new energy insecurity is also shaped by forceful moves many countries have made to domesticate and diversify their supply chains since the invasion of Ukraine and the global pandemic. The U.S. Inflation Reduction Act and Europe’s Green Deal industrial plan are intended to accelerate the drive to net-zero emissions, and they reduce energy insecurity in some ways by curbing dependence on globally traded hydrocarbons exposed to geopolitical risks. Yet they also increase insecurity, since promoting domestic industries runs the risk of stoking protectionism and fragmentation, both of which can make economies less energy secure.

- Finally, climate change will be a major threat to energy security in the coming decades, posing risks to infrastructure old and new. Warmer waters and more severe droughts will make it harder to cool power plants, transport fuels, and rely on hydropower. Climate change will place much of the infrastructure for this electricity generation, transmission, and distribution at greater risk, since fragile grids and overhead wires are often more vulnerable to extreme weather, wildfires, and other climate-related risks.

- Even as oil use wanes, geopolitical risks may increase as global production becomes further concentrated in countries that can produce at low cost and with low emissions, many of which are in the Persian Gulf. In the IEA scenario in which the world reaches net-zero carbon emissions by 2050, the share of global oil supply from OPEC producers rises from around one-third today to roughly one-half.

- Faced with that outcome [US policymakers] might consider a number of options, such as extending the increasingly popular concept of “friend shoring” to oil by more actively supporting production at home and in countries such as Norway and Canada.

- The sources of the requisite technology and components, notably the critical minerals needed for batteries and solar panels, are even more heavily concentrated than oil. The world’s largest supplier of lithium (Australia) accounts for around 50 percent of global supply, and the leading suppliers of cobalt (the Democratic Republic of the Congo) and rare earths (China) each account for around 70 percent of those resources. In contrast, the world’s largest producers of crude oil—the United States, Saudi Arabia, and Russia—each account for just 10 to 15 percent of global supply. The processing and refining of these minerals are even more concentrated, with China currently performing around 60 to 90 percent of it.

- The Inflation Reduction Act encourages the production of critical minerals in the United States and elsewhere by providing tax credits and loan guarantees for domestic producers, among other measures.

- Another area that badly needs more diversification is enriched uranium, which will become more important as the use of nuclear power increases globally to meet low-carbon electricity needs. Russia’s role as a dominant supplier of nuclear fuel services to many countries, including the United States, is a source of great discomfort and vulnerability, given the current geopolitical realities.

- A secure energy system must be able to withstand and bounce back quickly from unexpected shocks and disruptions. At the most fundamental level, reliable energy infrastructure is the key to that sort of resilience. Governments and private companies have long worked to protect energy infrastructure from dangers of all kinds, from terrorist attacks to hurricanes. As the transition proceeds, they will need to step up such efforts.

- A desire for greater security has spurred the decades-long quest for “energy independence” in the United States and elsewhere. And because of the shale revolution, the United States has become energy self-sufficient in net terms. Nevertheless, the country continues to be vulnerable to geopolitical risks because in a global market, supply shocks anywhere affect prices everywhere. Proponents of the transition to a net-zero carbon system have long heralded the greater insulation from geopolitics that would likely result from the end of the fossil-fuel era. But at least for the next few decades, energy security will be advanced not through more autonomy but through more integration — just as it always has been. For the United States, energy security will require fewer trade barriers and more trade agreements with allies, as well as with other countries that meet certain environmental standards.

An article in The Economist, also from 2022, agrees with the premise of Foreign Affairs, that the new energy era will not allow an easy escape from the curse of energy crises and autocrats.

The esteemed news magazine simulated spending on a basket of 10 natural resources including oil and coal, and the metals used in electrification and decarbonization. It found over half of that will still go to autocracies, including new electrostates that provide green metals such as copper and lithium. The top ten countries will have a market share of over 75% in all our minerals, which means production will be dangerously concentrated…

Spending on green metals will surge amid a two-decade-long build-out of electric infrastructure. The windfall may be worth over $1trn a year by 2040. Some beneficiaries, such as Australia, are well-equipped to deal with this. More fragile states, including Congo, Guinea and Mongolia, are not. Mountains of cash distort economies and feed grievances…

Because self-sufficiency is rarely an option, diversification is the goal. That means new partnerships. On March 20th Germany began talks with Qatar for gas.

From geopolitica.info, author Diamarov Jamshid observes that energy security is one of the main factors underwriting a country’s national security. (The disruption of energy supply could affect security within the societies of NATO member and partner countries, and have an impact on NATO’s military operations.)

Jamshid writes: The first factor, I argue, is geography. Countries reliant on foreign countries need to be prepared to respond to the question, such as, what if the country you depend on decides to just shut off your energy supply? Poor management of energy infrastructures is another reason bringing about energy insecurity. Poor management is identified in different forms, such as using too much energy, exporting too much energy that the population of the country could suffer, and investing less in energy routes. Ensuring energy security is a critical aspect of national security and it should be accentuated that energy security and national security are closely interlinked. Energy insecurity could be a triggering point to social unrest because people become infuriated if they go through frequent blackouts, fuel shortages, increase in prices, and other energy-related problems.

Energy transition

In 2022, the amount of money invested in decarbonizing the world’s energy system surpassed a trillion dollars for the first time. 2022 was also the first year that the $1.1 trillion which poured into the energy transition matched the $1.1T global investment in fossil fuels.

The above-mentioned University of Aberdeen study found electricity’s contribution to global energy has increased from 15% to 20% over the past 20 years and will rise to around 25% by 2040.

This brings with it an increased need for resiliency and security of sources. Systems need to be capable of uninterrupted supply, by guarding against disturbances arising from equipment failure, fuel supply shortages, human error or malicious attacks.

At the same time, governments must ensure that their populations have access to affordable energy, even though energy has traditionally been a major source of tax revenue.

On the one hand, the shift from dirty to clean energy is well underway. However, the uptick in oil prices is a drag on the transition. As the University of Aberdeen notes, oil, gas and coal contribute over 80% of the world’s energy needs, so the task is huge and will not happen overnight. While low-carbon technologies exist, the challenge is to deploy them at scale and not impose fuel poverty on communities.

Among the boxes ticked in the energy transition to-do list:

- The European Union, hit squarely in the wallet by Russia’s control of natural gas supplies, passed the REPowerEU initiative, designed to end the EU’s dependence on fossil fuels especially natural gas from Russia. Under the plan, the EU will increase renewable energy supplies to 45% by 2030.

- China now leads the world in renewable energy production, and although it still operates and is expanding coal-powered fire plants, President Xi has pledged that 25% of China’s energy will come from renewables by 2030.

- The United States passed the Inflation Reduction Act, under which $370 billion is to be invested in clean energy. The IRA is expected to cut US carbon emissions 40% by 2030, and reduce the costs of climate change by $2 trillion by 2050, according to the Office of Management and Budget.

- The $1.2 trillion infrastructure plan provides substantial funding for grid modernization, cleaner ports and airports, EV infrastructure and other climate mitigation measures.

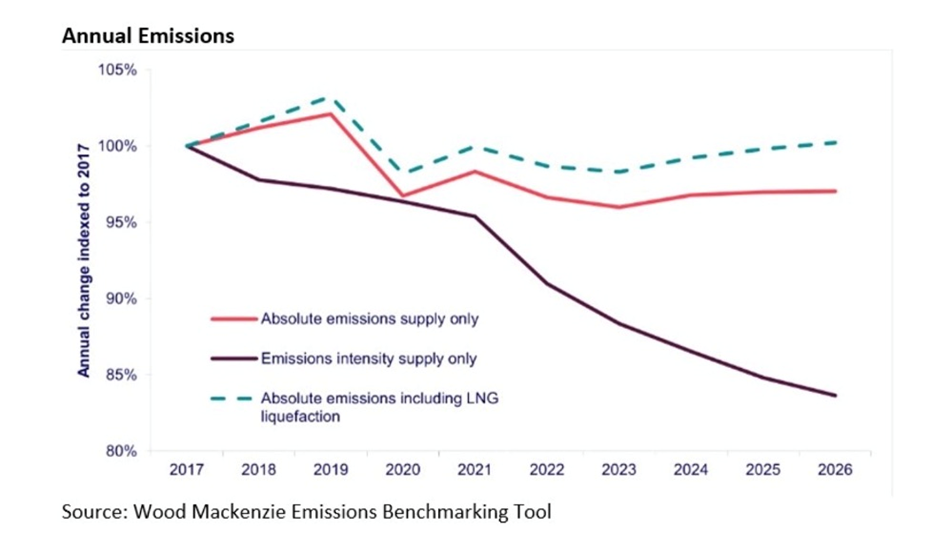

- The oil and gas industry has taken steps to decarbonize. In 2023 the Oil and Gas Climate Initiative launched a new charter that will help oil and gas companies to implement and accelerate climate actions in support of the Paris Agreement ambitions.

“The OGDC marks the first time a large number of state-owned oil and gas companies have publicly supported an ambition to reduce greenhouse gas emissions from their operations,” states a press release, noting that state oil and gas companies are important because they produce over two-thirds of the world’s oil and gas.

“The OGDC aims to achieve net zero from oil and gas operations by 2050. The largest single contribution would come from reducing the industry’s methane emissions to near zero and eliminating routine flaring by 2030. Other measures include deploying carbon capture and storage, electrification of upstream operations and use of low-carbon hydrogen.”

Arguing against the transition, consider the following:

- A sponsored post in The Economist by Schneider Electric that states Among consumers, rising energy prices have led to a sharp uptick in support for offshore drilling and fracking for oil and gas in the US.

- Earlier this week, oil prices hit a four-month high, as macro-economic data from China came in ahead of expectations, Iraq said it has reduced its oil exports for the coming months to absorb the oversupply from Jan. and Feb, while Ukrainian attacks on Russian refineries heightened geopolitical risks and reduced the amount of distilled product produced in Russia. As a result, WTI broke out to test $82 overnight, hitting a five month high, while Brent breached $86, a level that seemed inconceivable in late December when the price was in the low $70s. (Zero Hedge, March 18, 2024)

- In a ‘What to Look for in 2024’ article, consulting firm Wood Mackenzie states that, despite national oil companies (NOCs) having bigger ambitions in low carbon and emissions abatement (bullet point 5 in the first list above), “Most NOCs are still in the business of growing upstream capacity.” Growth will come mainly from Middle Eastern state oil companies and Chinese NOCs.

- Woodmac also says that some decarbonization gains will reverse in 2024: “Production will rise by 3% in 2024 and decarbonization won’t keep up. Upstream scope 1 and 2 emissions will increase by 12 million tonnes of CO2e year-on-year.”

Upstream oil and gas investment will reach just over US$500 billion in 2024, up 2% from 2023. Woodmac states:

“Investment will rise in the Middle East, but fall in the US Lower 48,” said Ian Thom, Director of Upstream Research. “The new project pipeline remains healthy, with 45 projects vying to take final investment decision (FID) — a potential investment commitment of US$170 billion to develop 25.5 billion boe. Around 30 will proceed in 2024. Many of these will be deepwater discoveries, with the 10 biggest deepwater oil projects requiring US$52 billion of investment for recoverable resources of 5 billion barrels of oil.”

A story this week on CBC.ca goes farther than all of the above in suggesting that oil and gas executives should push back against expectations of a global shift to low-carbon energy.

It quotes the head of the world’s largest energy company, Saudi Aramco’s Amin Nasser, telling a Houston oil conference that oil and gas consumption is likely to grow for at least the next decade or two:

“We should abandon the fantasy of phasing out oil and gas and instead invest in them adequately reflecting realistic demand assumptions,” Nasser said.

He noted oil consumption will reach a new record of 104 million barrels per day this year and could keep growing through 2045.

“All this strengthens the view that peak oil and gas is unlikely for some time to come, let alone 2030,” he said. “No one is betting the farm on that.”

At the CERAweek by S&P Global energy conference, ExxonMobil Chief Executive Darren Woods said, “We’re not on the path to make net-zero by 2050 currently and one of the challenges here is that while society wants to see emissions reduced, nobody wants to pay for it.”

The upshot seems to be, the end of fossil fuels has been greatly exaggerated. High oil and gas prices, including gasoline needed to fill up your car, will be with us for the foreseeable future.

Climate change

An abnormally dry winter in Western Canada is worsening drought conditions after an already bad 2023. Last year was the country’s hottest on record — a combination of global warming and the start of the El Nino climate phenomenon, which is weakening but continues.

December, January and February also hit warmth records in Canada, as spring arrives early, eliciting concerns over low snowpack and runoff, droughts and forest fires.

Last year the world was 1.45 C above pre-industrial levels.

“The year 2023 set new records for every single climate indicator,” Celeste Saulo, secretary-general of the World Meteorological Organization, told a news conference Tuesday.

It was the hottest February ever, marking the ninth straight month that heat records have fallen, CNN reported on March 6.

February also capped off the hottest 12-month period in recorded history, at 1.56 degrees above pre-industrial levels.

Global sea temperatures hit 21.06 degrees in February, the highest of any month on record. In the North Atlantic, a new daily temperature record has been set every day since March 5, 2023.

Last year was the first year in which average global sea surface temperatures went above 1 degree C compared to pre-industrial levels.

Ocean heat content — the temperatures 2,000 meters below surface — were also off the charts. Contextualizing the amount of heat our oceans took in last year, CBC News quotes a research scientist at Berkeley Earth saying we added 15 zettajoules of energy compared to 2021, which is equivalent to 25 times of all the energy used by humanity.

Antarctic sea ice extent fell to the lowest ever registered while glaciers lost an unprecedented amount of ice, Bloomberg stated.

According to the WMO, concentrations of the main greenhouse gases continued to increase in 2023 after reaching a new record-high in 2022. Levels of carbon dioxide are 50% higher than during the pre-industrial era.

Global warming has a major impact on agricultural commodities that are affected by droughts and flooding.

Droughts are impacting food production in Canada and the United States, lowering crop yields, and causing ranchers to cull their herds.

A 2017 research paper found that each degree Celsius increase would on average reduce global yields of wheat by 6%, rice by 3.2%, maize by 7.4% and soybeans by 3.1%. These foods provide two-thirds of human caloric intake.

A 2021 study showed more than a fifth of global food output growth has been lost to climate change since the 1960s, putting an estimated 34 million people on the brink of famine.

Hydroelectric dams and nuclear power plants are both highly dependent on water supplies to generate energy. It’s ironic that these “green” sources of electricity could themselves become victims to rising temperatures that dry up their water sources.

For example, during the summer of 2022, Europe and China endured historic droughts that lowered rivers and drained reservoirs. Sichuan province relies on hydro for 80% of its electricity and the extended drought cut generation in half, forcing manufacturers to close factories.

Electricity shortages in Pakistan tied to extreme heat prompted authorities to impose load-shedding blackouts, the IMF stated.

Droughts also lowered the amount of electricity generated by dams in Italy, Austria, Spain and Portugal.

In the southwestern US, dams on the Colorado River provide electricity to 5 million people, but water levels in the reservoirs have been falling for decades. The Bureau of Reclamation reported there is a nearly one in three chance that reservoir levels will fall so low that the Glen Canyon Dam will stop generating electricity, this year.

Further downstream, diminished annual generation at the Hoover Dam has started a conversation about a potential “deadpool” situation.

A 2015 drought in Zambia (a major copper producer), which depends on hydro from nearly all of its electricity, caused national power generation to decline by 40%, resulting in rolling blackouts.

Nuclear power plants are also feeling the effects of diminished river levels. A researcher at the University of Washington found that nuclear and other power plants will see a 4 to 16% drop in production between 2031 and 2060 due to climate-induced drought and heat. (InsideClimate News)

In July 2012, power generation from US nuclear plants, which normally supply 20% of the nation’s power, fell to 93% of capacity. Among the facilities affected were the Vermont Yankee plant, First Energy Corp’s Perry 1 reactor in Ohio, and the Braidwood nuclear plant near Chicago.

An Associated Press analysis quoted by NBC News states that of the United States’ 104 nuclear reactors, 24 are in areas experiencing the most severe droughts. Submerged intake pipes draw billions of gallons of water used for cooling and condensing steam after it has turned the plant’s turbines.

For nuclear power plants, it isn’t only the danger of water running low, but of water getting too hot. Water is normally used to cool the reactors before it is released into the river. But overheating can threaten fish and other wildlife.

In 2021, Wired reported that, amidst a heat wave that killed hundreds and sparked wildfires across Western Europe, Electricite de France (EDF) powered down reactors along the Rhone and Garonne rivers. The temporary shutdowns were due to river water becoming too warm. The 2021 cuts, combined with malfunctions and maintenance on other reactors, reduced France’s nuclear output by nearly 50%.

EDF also curtailed production at a nuclear plant during a heat wave last summer that triggered water restrictions.

When a critical dam in Ukraine was destroyed by some type of explosion attributed to the Russia-Ukraine war, within a matter of days the water level in the reservoir dropped by 20 feet, imperiling the Zaporizhzhia nuclear power station.

Supply chain choke points

Energy is becoming harder and more costly to move due to blockages at key transportation choke points such as the man-made canals at Panama and Suez.

In December, low water levels in the Panama Canal, fueled by drought, forced the canal authority to reduce the number of vessels transiting daily. Rain suspended further restrictions but they could be reinstated in April, when the authority re-evaluates water levels.

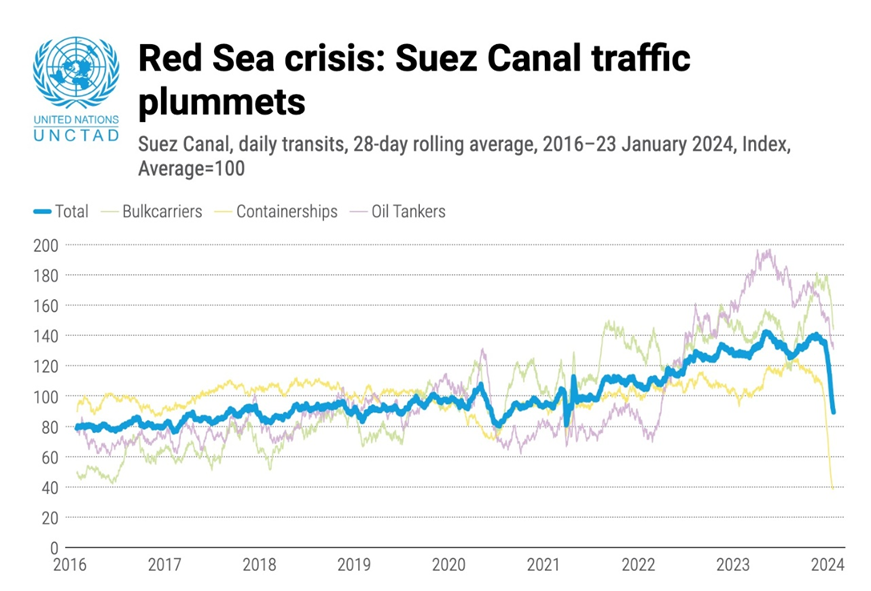

Another global choke point, the Suez Canal (and the Bab al-Mandeb Strait), is vulnerable to supply chain interruptions. Late last year, more than 100 container ships were rerouted around southern Africa to avoid the Suez Canal, where Houthi rebels were attacking vessels off the coast of Yemen. The attacks were in support of Hamas, which carried out a deadly invasion of Israel in October, prompting Israel to counter-strike the Gaza Strip.

Reuters notes: About 15% of world shipping traffic including roughly 30% of global container trade passes through the Suez Canal.

Routing ships around Africa would increase a round-trip journey by about two and a half weeks, cutting shipping capacity and pushing up costs.

According to Investopedia, at the end of January, Red Sea shipping disruptions increased shipping rates by up to 400% on some routes, with traffic through the Suez Canal falling ~64% so far this year.

A December 2023 report by KAPSARC, the King Abdullah Petroleum Studies and Research Center, cites 2020 data from the Suez Canal Authority showing that 27% of loaded ships passing through the canal in 2020 were LNG and oil tankers.

Globally, about 7% of tankers transit the Suez Canal, making it a critical constraint on the global hydrocarbon value chain and a critical energy security choke point…

Any disruption in the canal causes far-reaching ripple effects on trade with a severe impact on prices and the timely availability of essential goods such as food and energy.

The United Nations Conference on Trade and Development (UNCTAD) underscored the economic implications of these disruptions:

Prolonged interruptions, particularly in container shipping, pose a direct threat to global supply chains, raising the risk of delayed deliveries and higher costs.

While current container rates are approximately half of the peak seen during the COVID-19 crisis, it will take time for the higher prices to hit consumers, with the full impact expected within a year.

Energy prices are witnessing a surge as gas transits are discontinued, directly impacting energy supplies, especially in Europe.

The crisis is also impacting global food prices, with longer distances and higher freight rates potentially cascading into increased costs.

Disruptions in grain shipments from Europe, the Russian Federation and Ukraine pose risks to global food security, affecting consumers and lowering the prices paid to producers.

Infrastructure breakdown

Energy security is also hampered by aging transmission infrastructure.

In the United States, over 70% of the electricity grid is over 25 years old, and is not set up to meet anticipated demand for clean energy sources i.e., wind and solar. When the Biden administration passed the infrastructure law in November 2021, the Department of Energy said that creates “vulnerability”; the act is designed to catalyze investment in the grid, with over $20 billion available.

In 2021, the most recent year for which data is available, CNBC reported US electricity customers were without power for slightly longer than seven hours on average. More than five of those seven hours were major weather events including snowstorms, hurricanes and wildfires.

“Extreme weather events like the Dixie Wildfire, Hurricane Ida, and the 2021 Texas Freeze have made it clear that America’s existing energy infrastructure will not endure the continuing impacts of extreme weather events spurred by climate change,” the U.S. Department of Energy said.

According to the National Council of State Legislatures, the US will need to spend up to $2 trillion on grid modernization by 2030 only to keep the reliability of the electricity grid. (Medium.com, Jan. 24, 2023)

In a column on the subject, electrical design engineer Usman Jabbar quotes a recent report highlighting the significant impact of power outages and blackouts on the economy and society. The report estimates that power outages cost the US economy between $18 billion and $33 billion per year, with businesses and households both being impacted. Additionally, the report notes that power outages can have significant health and safety impacts, such as the loss of life-supporting medical equipment, increased risks from extreme temperatures, and impacts on public safety and transportation systems.

Some of the county’s biggest companies aren’t waiting to become victims to the latest weather-related power failure.

Amazon’s clean-energy portfolio, for example, is now big enough to power 7.2 million American homes per year. The portfolio comprises solar and wind projects in more than 20 states and 27 countries.

Power gluttons

An already strained US electrical grid is facing more pressure due to electrification — and that’s without power-hungry industries like cryptocurrencies and artificial intelligence (AI).

According to an energy project out of Princeton University called REPEAT, via CNBC, domestic electricity demand is expected to increase by up to 18% by 2030 and 38% by 2050, from 2022 levels. This compares to a 5% increase from 2012 to 2022.

Upgrading distribution grids to account for this new demand will be expensive. California alone will have to spend $50 billion by 2035 to meet its ambitious EV targets.

One source said if grid infrastructure doesn’t keep up with the EV boom, drivers can expect charging difficulties such as long queues or only being able to charge at certain times and places. An overly strained grid will also be more vulnerable to extreme weather events and prone to blackouts, which California experienced in 2020.

Canada, meanwhile, would need to double or triple its grid capacity by 2050 to reach its net-zero goal. The Canadian Climate Institute estimates that, to meet growing demand from electrification, Canada must, on average, grow system capacity at a rate three to six times faster than it did in the past decade, until 2050. (CBC News, Aug. 15, 2023)

The popularity of cryptocurrencies like bitcoin would likely be dented if supporters knew the size of the industry’s environmental footprint.

According to a recent estimate by the Energy Information Administration, cryptocurrency creation uses between 0.6% and 2.3% of US electricity consumption, annually.

As of January 2022, almost 38% of all bitcoin mining occurred in the United States, with electricity usage ranging from 25 terawatt-hours to 91 TWh — roughly the electricity consumption of Utah or West Virginia.

So far, the EIA has found 137 cryptocurrency mining facilities, with several of the largest ones located in Texas, states Heatmap.

New bitcoins are generated through a “proof of work” system requiring computers to solve complex mathematical problems. The “miner” who completes the equation the fastest certifies the transaction and is rewarded with a bitcoin payment.

It is bitcoin’s decentralized nature that makes it such an electricity hog. As Forbes explains it, Multiple miners are using electricity in competition for rewards. Even though there may be hundreds of thousands of computers racing to solve the same problem, only one can ultimately receive the Bitcoin honorarium.

“Of course, this is wasteful in the sense that 99.99% of all the machines that did work just throw away the result since they didn’t win the race,” says Paul Brody, global blockchain leader at EY. While this process produces a fair and secure result, it also creates a ton of carbon emissions. “I very much doubt [whoever founded] Bitcoin anticipated such enormous success in the future and, consequently, the enormous amounts of power we’re talking about,” Brody says.

And if you thought bitcoin was power-hungry, wait until you see what artificial intelligence (AI) has in store for our electrical grids.

The New York Times reported recently that AI servers by 2027 could use between 85 and 134 terawatt-hours annually, similar to what some countries (Argentina, the Netherlands, Sweden) use in a year. The technology relies on thousands of specialized computer chips.

Amazon’s cloud and Google’s search engine already use between 1 and 1.3% of the world’s electricity. That excludes crypto mining, which uses an additional 0.4%.

A data scientist at Vrije Universiteit Amsterdam figured out a way to estimate electricity consumption using projected sales of Nvidia A100 servers, the hardware used by 95% of the AI market.

By 2027, Alex de Vries projected Nvidia could ship 1.5 million servers. He then multiplied that number by its servers’ electricity use: 6.5 kilowatts for Nvidia’s DGX A100 servers, for example, and 10.2 kilowatts for its DGX H100 servers.

“Each of these Nvidia servers, they are power-hungry beasts,” de Vries said.

ESG

By now it should be obvious to readers that to fix broken electrical grids and make them more resilient to ever-more powerful storms (made worse by rapidly worsening climate change), plus to be able to handle electrification and power-hungry technologies like cryptocurrencies and artificial intelligence, is going to require a massive increase in electricity. It is going to require hundreds more miles/ kilometers of transmission lines, and many more times the current energy-generation capacity — whether that capacity comes from fossil fuels, nuclear or renewable energy sources like hydro, wind and solar.

Yet one of the biggest challenges to creating more energy is the requirement for companies to adhere to ESG principles. ESG stands for environmental, social and governance.

Among the key takeaways from a 2022 S&P Global report, ‘ESG Materiality Map Oil And Gas’, are the following:

- Climate transition risks are highly material for the oil and gas industry and its value chain, from both the stakeholder and credit perspectives. Efforts to decarbonize transportation and industrial activity, primarily through regulation, may affect the industry’s long-term profitability and reduce oil and gas demand.

- Operational risks are high in the sector, especially related to pollution and physical climate risks, which can disrupt production and expose companies to potential public opposition, large penalties, and reputational damage that can affect their credit profiles.

Although it should be noted that so far, the oil and gas industry has weathered the ESG storm, despite pressures to sell oil and gas equities by institutional investors like banks, and the growing popularity of ESG funds.

While there has been a lack of access to financing because of climate concerns, investor demands to decarbonize, and a shortage of sufficient investments in new supply for many years, Forbes contributor Jude Clemente wrote in 2022, a banner year for oil and gas stocks,

We’re dangerously setting up an era of structurally higher energy prices and that begins with oil because it’s the input for just about everything that we consume.

I’ve already said it but the anti-oil business today could be installing the next recession tomorrow.

We’ll be trapped in a guessing game of how high gasoline prices could go as our refineries continue to be closed.

With the oil companies this year far outperforming “clean energy: stocks, top experts at the University of Chicago have shown divestment to be a “costly and ineffective” climate strategy.

Indeed the profits continuing to be made by Big Oil are proving too tempting for even the most politically correct investors.

In December 2023 Bloomberg reported that The world’s biggest ESG fund class, which sits on roughly $5 trillion of client assets, has raised its exposure to the oil and gas sector by about two-thirds since stricter regulations were enforced 2 1/2 years ago.

As for low-carbon energy sources, the ESG crowd has been pressuring the mining industry, which plays a crucial role in the energy transition, to face up to and overcome its checkered past regarding these issues.

For many years the industry managed to sidestep ESG, but the period of evading responsibility has come to an end and mining firms are increasingly being called upon to explain how they plan to incorporate ESG into their planning.

ESG seen as biggest risk to mining industry

The problem is the energy transition requires a huge boost in critical minerals like lithium, cobalt and graphite, yet their sources and the technologies used to produce them are often anything but green.

With cobalt, for example, 70% comes from the DRC, where nearly three-quarters of the population lives in extreme poverty and one-fifth of cobalt mined there comes from artisanal miners many of which use child labor.

According to Wood Mackenzie’s Accelerated Energy Transition scenario, 170% more cobalt will be demanded by 2025, and +270% by 2040.

Nickel processing is extremely dirty.

Indonesia and China killed the nickel market

The demand for rare earths in an accelerated energy transition is forecasted to increase by 233% between 2020 and 2050.

Visual Capitalist sums up the ESG connundrum for miners nicely:

There is a clear dilemma for energy transition metals in an era of unprecedented demand. Can vital energy transition metals markets ramp up production fast enough to satisfy demand, while also revolutionising supply chains to meet ever-more stringent ESG requirements?

Like most things in corporate life though, it all comes down to money. Mining companies haven’t suddenly gained an environmental or social conscience; they recognize that to continue receiving funding from deep-pocketed investors, they will need to change their ways.

Conclusion

The Western world has been blessed with cheap and plentiful energy and food, but this is beginning to change, and imo, will only get worse.

While food inflation has come down from its peak — 11.4% in the US in August 2022 — the cost of groceries and to dine out remain above pre-pandemic levels. We face yet another year of drought, as an abnormally warm winter has depleted snowpacks, depriving reservoirs of needed runoff and, likely, negatively affecting harvests and herds.

Food will continue to get more expensive due to ongoing climate change including dangerously warm surface and ocean temps. Supply chain interruptions at choke points like the Panama Canal and the Suez Canal are re-routing containerized shipments, including food exports.

Energy is becoming harder and more costly to move due to blockages at key transportation choke points. In 2020, 27% of ships passing through the Suez Canal were LNG and oil tankers.

Gasoline prices have been high in both Canada and south of the border, and will likely keep climbing due to higher demand during the summer driving season.

On a longer-term basis, energy security will continue to be challenged due to the factors we have pointed out here.

Driving the new energy insecurity are three main factors: the return of great-power rivalry in an increasingly multipolar and fragmented international system, the efforts of many countries to diversify their supply chains, and the realities of climate change.

Even as oil use wanes, geopolitical risks may increase as global production becomes further concentrated in countries that can produce at low cost and with low emissions, many of which are in the Persian Gulf. In the IEA scenario in which the world reaches net-zero carbon emissions by 2050, the share of global oil supply from OPEC producers rises from around one-third today to roughly one-half.

The critical minerals needed for batteries and solar panels are even more heavily concentrated than oil. A more accelerated energy transition will necessarily involve greater dependence on China, given its dominance of clean energy supply chains.

On the one hand, the shift from dirty to clean energy is well underway. However, the uptick in oil prices is a drag on the transition. As the University of Aberdeen notes, oil, gas and coal contribute over 80% of the world’s energy needs, so the task is huge and will not happen overnight. While low-carbon technologies exist, the challenge is to deploy them at scale and not impose fuel poverty on communities.

The CEO Saudi Aramco, Amin Nasser, recently told a Houston oil conference that oil and gas consumption is likely to grow for at least the next decade or two:

“We should abandon the fantasy of phasing out oil and gas and instead invest in them adequately reflecting realistic demand assumptions,” Nasser said.

Energy security is also hampered by aging transmission infrastructure. An already strained US electrical grid is facing more pressure due to electrification — and that’s without power-hungry industries like cryptocurrencies and artificial intelligence (AI).

Fixing broken electrical grids and making them more resilient to ever-more powerful storms (made worse by rapidly worsening climate change), plus to be able to handle electrification and power-hungry cryptocurrencies and artificial intelligence, is going to require a massive increase in electricity.

Yet one of the biggest challenges to creating more energy is the requirement for companies to adhere to ESG principles. An S&P Global report states, Climate transition risks are highly material for the oil and gas industry and its value chain, from both the stakeholder and credit perspectives. Efforts to decarbonize transportation and industrial activity, primarily through regulation, may affect the industry’s long-term profitability and reduce oil and gas demand.

The same goes for the mining industry, which is facing increasing ESG pressure to extract minerals in a way that is environmentally friendly and incorporates local communities — despite higher costs.

In my opinion it all points to higher energy and mining costs in future, and unless the energy transition also involves a move to more domestic mining and mineral processing, China, the DRC, Russia and other countries unfriendly to Western interests will replace the Middle Eastern oil titans and result in more energy insecurity, not less.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.