Max Resource discovers target area 14, 28 targets for potential drill testing identified – Richard Mills

2024.02.09

Faced with the grim prospect of falling short of our climate targets, the race to find more minerals needed to accomplish both electrification and decarbonization becomes ever more important.

The world needs more mines to come online over the coming years to avoid significant supply deficits that derail our decarbonization goals. This starts with identifying the right projects in favorable mining jurisdictions that can be developed in a timely manner.

For copper and silver, we own Max Resource Corp (TSX.V:MXR, FSE:M1D2, OTC:MXROF) and its flagship CESAR copper-silver project in Colombia.

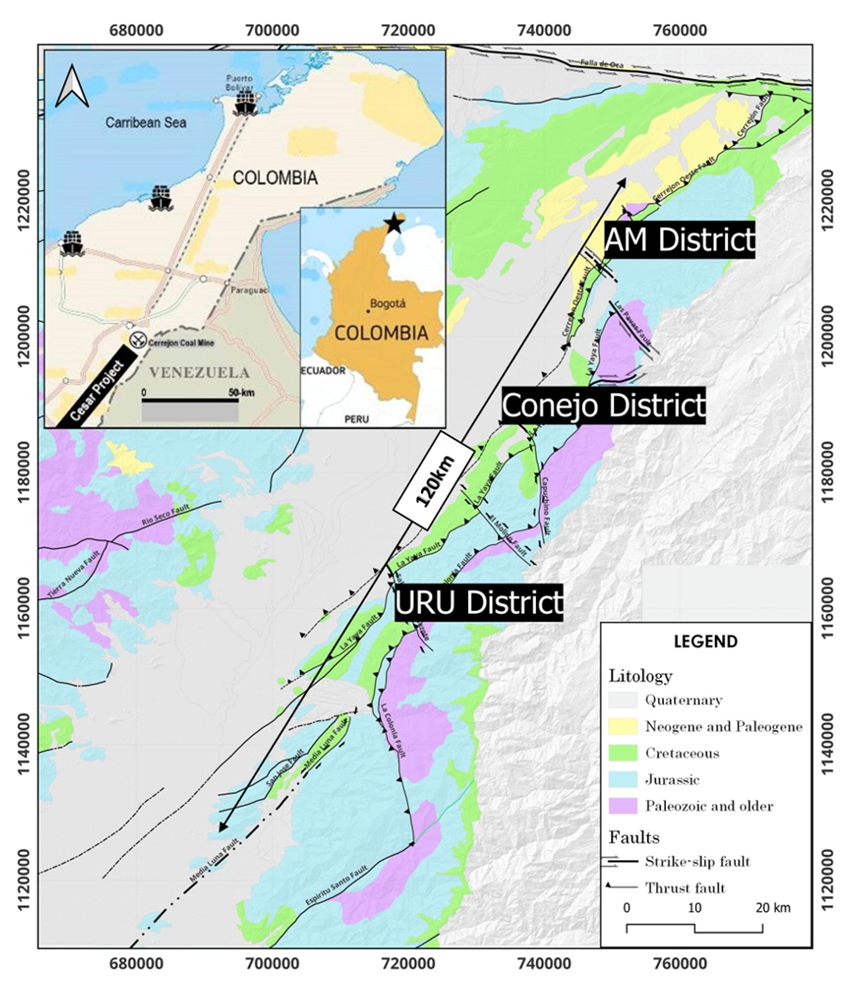

Max’s CESAR project is situated along the copper-silver-rich Cesar Basin of northeastern Colombia. This region provides access to major infrastructure resulting from oil & gas and mining operations.

Max was the first to recognize the potential for the Cesar Basin and the company’s land package now spans more than 1,150 km of geology prospective for sedimentary-hosted copper and silver deposits.

Max’s field teams have so far identified 28 targets across three districts of the 120-km Cesar copper-silver belt: AM, Conejo and URU.

The company announced on Nov. 8 that it has secured 12 more applications for mining concessions covering over 132 square kilometers. It means CESAR now spans 120 km along strike, from the previous 90 km, in a north-northeast/ south-southwest direction.

While Max has demonstrated that the Cesar Basin is fertile for copper-silver mineralization over a large area, only a fraction of the basin has been explored. Therefore, Max says its geological teams are dedicated to regional exploration, with the goal of discovering additional copper-silver prospects over 1,000 square kilometers.

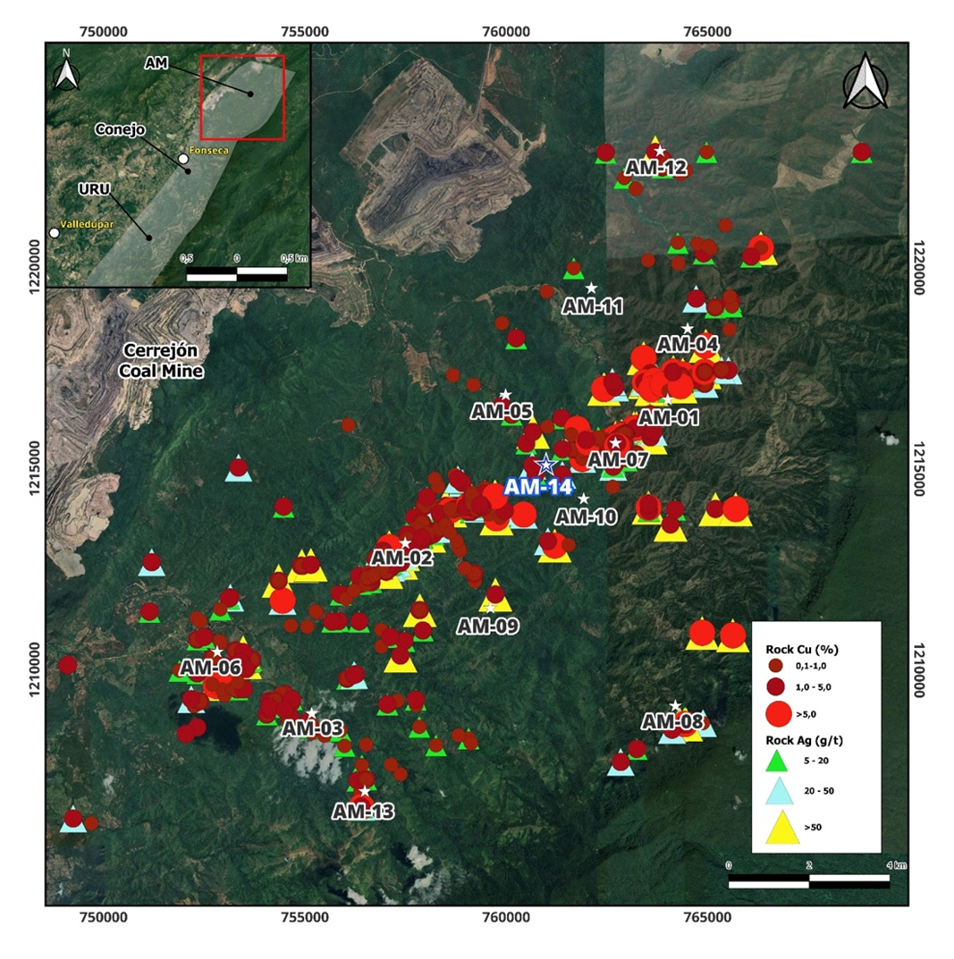

In late October, interpretation of preliminary airborne magnetic-radiometric survey data identified four new targets within the AM district. The targets are AM-9 to AM-12.

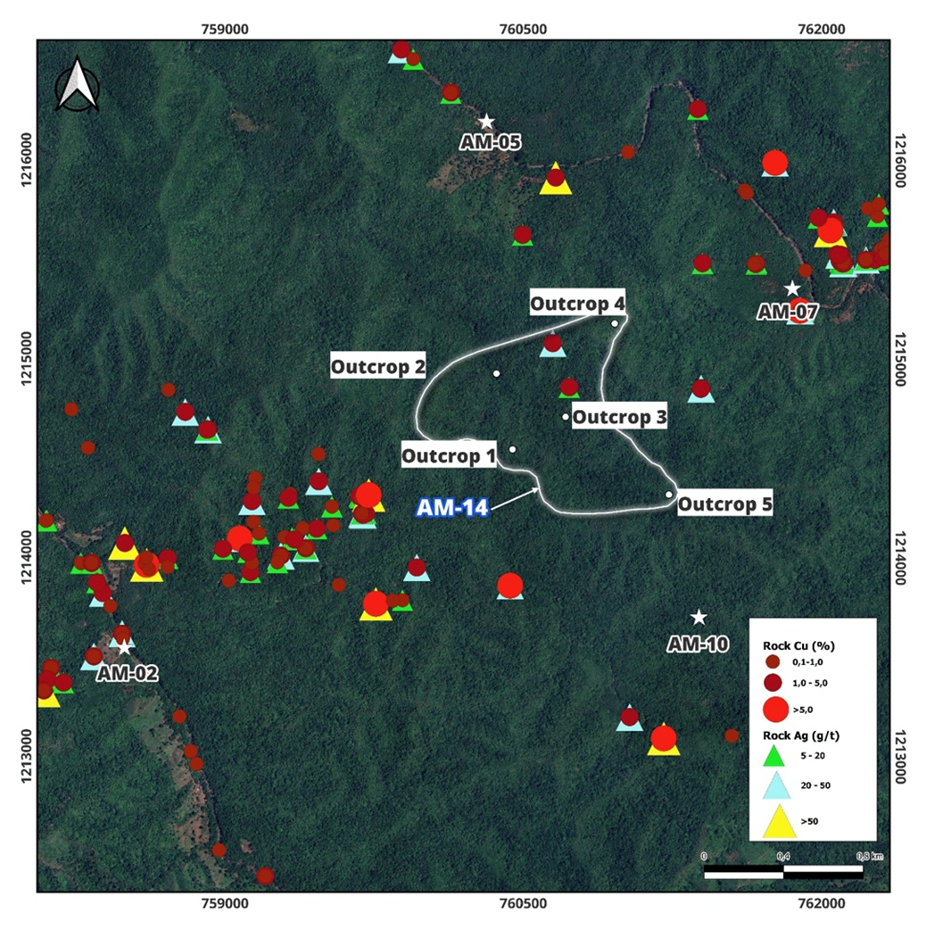

The company announced this week that it has found an additional series of five mineralized outcrops within the AM District. Collectively thy are known as target area AM-14, seen on the map below.

The five outcrops of stratiform copper-silver mineralization cover 1,000 square meters. The mineralized layers are exposed up to 285m along strike and range in thickness from 0.8m to 4.0m.

According to Max, it confirms there are multiple copper-silver bearing layers within a 700-meter-thick sequence of interbedded sandstones in the AM District. Additionally, there is strong evidence to suggest that one of the newly discovered outcrops (outcrop #2) is a continuation of the mineralized horizon at target AM-07, located approximately 1.5 km to the northeast. This supports the company’s interpretation that the copper-silver bearing layers in the AM District are continuous over large distances, similar to the Kupferschiefer and Kamoa-Kakula deposits, that are the two depositional models at the CESAR project.

Nearly 50% of the copper known to exist in sediment-hosted deposits is contained in the Central African Copper Belt, headlined by Ivanhoe’s 95-billion-pound Kamoa-Kakula discovery in the Democratic Republic of Congo.

Kupferschiefer, considered to be the world’s largest silver producer and Europe’s largest copper source, is an orebody ranging from 0.5 to 5.5m thick at depths of 500m, grading 1.49% copper and 48.6 g/t silver. The silver yield is almost twice the production of the world’s second-largest silver mine.

“As we continue to obtain high-grade results and locate significant structural and stratiform copper-silver mineralization, the Company’s staunch belief in Cesar as a potential for significant deposits comes ever closer to fruition,” said Max’s CEO Brett Matich, in the Feb. 7 news release.

“The AM-14 mapping and sampling outlines an area some 600 to 1000 metres by 1000 to 1200 metres, strongly supporting our belief in Cesar as a regional or district copper-silver target, as opposed to a cluster of smaller unrelated zones. We look forward to assay results in the coming weeks,” he concluded.

Despite being at the bottom of the mining food chain, junior resource companies perform an essential function: they find, own, and develop, to a certain point the world’s future mineral deposits.

Juniors help the majors to replace the ore that they are constantly depleting in their operating mines, thereby helping to overcome the supply shortfall that is coming for several metals.

One of our top junior explorer picks is Max Resource Corp. Max’s CESAR property hosts abundant copper-silver mineralization. With both metals facing deficits, that makes CESAR potentially, imo, relevant to the new electrified economy, and helpful to end users wanting security of supply at reasonable prices.

Furthermore, CESAR might have the size and scalability that majors need in new deposits that will add to their reserves.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.09 2024.02.08

Shares Outstanding 161.9m

Market cap Cdn$16.7m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does own shares of Max Resource Corp. (TSXV:MAX). MAX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.