Mining M&A in 2023 – Richard Mills

2023.11.04

Much of the M&A focus in 2022 was on Canada. In Q3 alone, there were a total of $562.8 million worth, including Kinross Gold acquiring Great Bear Resources for $1.44 billion. Agnico-Eagle and Kirkland Lake Gold completed a $10B merger to become the third-largest gold producer in the world.

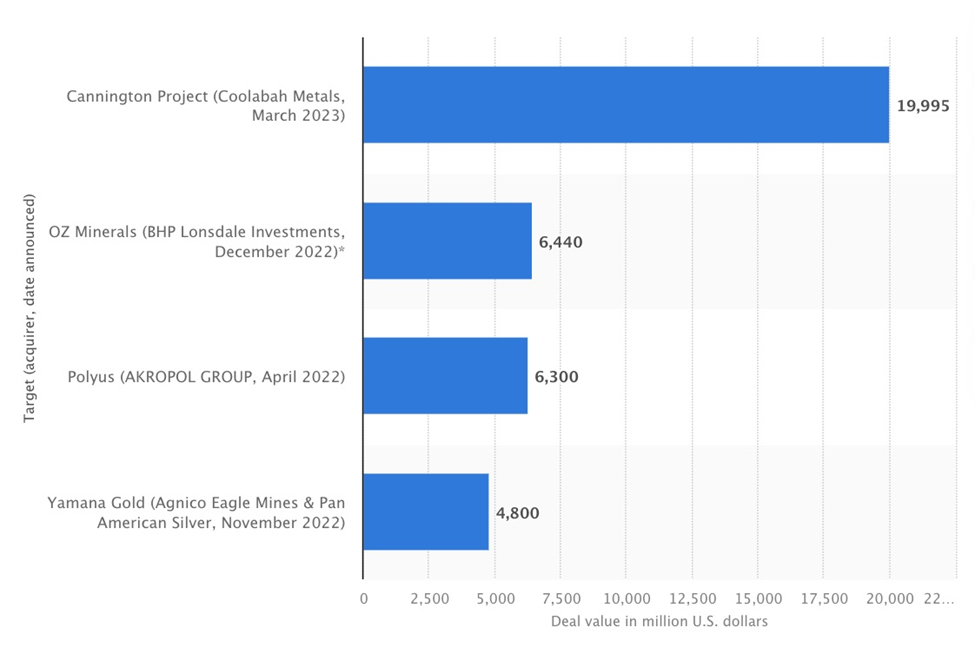

Newmont’s $19.2 billion acquisition of Newcrest was the headline of 2023, cementing its status as the world’s largest gold producer.

But it wasn’t the only multi-billion-dollar deal.

Agnico-Eagle Mines and Pan American Silver bought Canadian mid-tier Yamana Gold for $4.8 billion, BHP Group acquired Australian gold and copper producer OZ Mining for $6.61 billion, and B2Gold signed a deal to acquire Sabina Gold & Silver for $832 million.

Beyond the gold sector, BHP, Glencore and Rio Tinto all signaled renewed interest in takeovers.

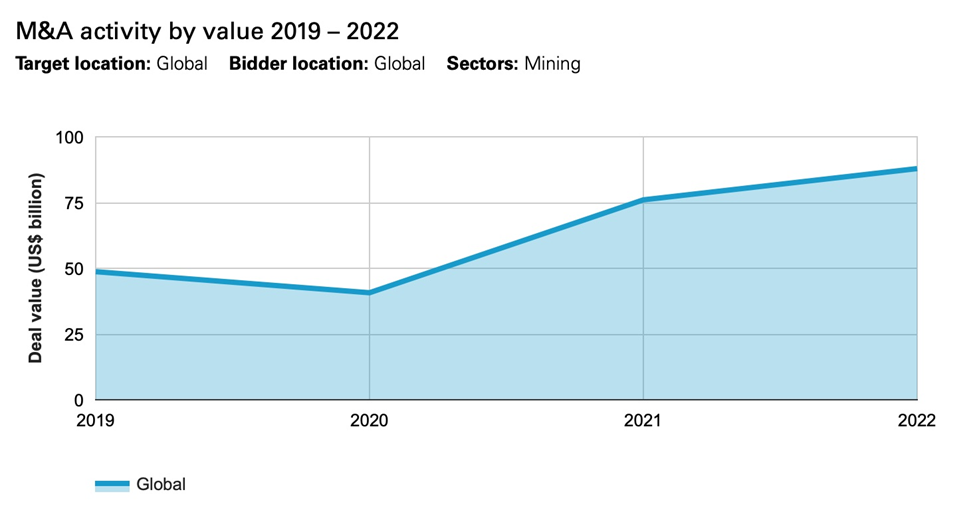

According to White & Case, Newmont’s proposal to buy Newcrest in February set the tone for M&A this year, accounting for the lion’s share of the $28B in announced mining takeovers tracked by Bloomberg in the first quarter.

The article quotes PDAC President Alex Christopher saying that a lot of small- to medium-sized companies are looking to M&A for growth, citing B2 Gold’s Sabina acquisition as an example.

Literally hundreds of agreements have been signed, with most flying under the radar of mainstream media and retail investors.

Take the third quarter of 2023, when there were 323 M&A announcements totaling $14 billion, according to GlobalData’s Deals Database. The biggest one was the $3.4B minority acquisition of Vale Base Metals by Engine No. 1 and Manara Minerals Investment.

The report, via Mining Technology, notes that M&A activity increased by 137% in the third quarter of 2023 compared to the second quarter’s $5.9B, and rose by 34% compared to Q3 2022.

In Canada alone, there were 121 M&A deals totaling $3.9B — a whopping 323% increase compared to Q2’s $842.8 million, and 597% more than the third quarter of 2022.

According to Fitch Ratings, The rise in M&A activity across the mining industry over the past year is likely to continue into 2024… The need for consolidation and reserve replenishment will support transactions in the gold industry.

One would think that in the current bear market, gold in the ground could be had on the cheap. In fact, we are seeing in-situ valuations hold up, on a transactional basis.

An example is Gold Fields’ USD$441.6 million purchase of Osisko Mining’s Windfall gold project, located in Quebec’s Abitibi gold belt. According to a feasibility study, the asset contained 3,158,173 oz of gold, valuing it at $139/oz. ($441,600,000/ 3,158,173)

When Goldcorp bought out Kaminak Gold in 2016, another bear market for the precious metal, we saw something similar. With gold junior stock values tanking, Goldcorp offered Kaminak CAD$520 million for its prized asset, the Coffee gold project located around 130 km from Dawson City. With indicated mineral resources of 3 million ounces, and another 2.2Moz inferred, that put the gold-in-the-ground calculation as follows: $540,000,000/ 5,200,000 oz = CAD$103/oz

The following, while obviously not an exhaustive list, details many of the mining M&A transactions that have occurred this year. Entries are in chronological order. Amounts are in USD unless otherwise specified.

BHP/ OZ Minerals

BHP Group concluded its takeover of OZ Minerals, an Australian copper producer, for $6.4 billion. “This acquisition strengthens BHP’s portfolio in copper and nickel and is in line with our strategy to meet the increasing demand for the critical minerals needed for electric vehicles, wind turbines and solar panels to support the energy transition,” BHP CEO Mike Henry said.

Triple Flag Precious Metals/ Maverix Metals

Canada-based Triple Flag Precious Metals agreed to acquire gold royalty and streaming company Maverix Metals for $606 million. The acquisition was expected to strengthen Triple Flag’s position as the world’s fourth-largest senior streaming and royalty company.

Hecla Mining/ ATAC Resources

After rejecting an $18.5 million offer from Victoria Gold, major US silver producer Hecla Mining entered into a letter of intent (LOI) with ATAC Resources. The $31 million combination would see Hecla acquire the Rakcla and Connaught projects located in the Yukon Territory. Rackla comprises two projects, Rau and Nadaleen, with Rau hosting the advanced-stage Tiger gold deposit containing measured and indicated resources of 4.5 million tonnes grading 3.19 g/t, for 464,000 oz.

Catalyst Metals/ Superior Gold

ASX-listed Catalyst Metals acquired TSX Venture-traded Superior Gold for CAD$55 million. The transaction will give Catalyst access to the Plutonic gold mine, in Western Australia, which hosts a 5.9-million ounce resource, 3-million-tonne-a-year processing capacity, and an annual production of 70,000 oz of gold, said Mining Weekly.

Integra Resources/ Millenial Precious Metals

Integra and Millenial agreed to a court-approved merger, whereby Integra and Millennial shareholders will own approximately 65% and 35%, respectively, of the outstanding Integra shares on the closing of the transaction. The companies also announced concurrent equity financings totaling CAD$35 million, which will be used to fund an updated resource estimate and mine plan of operations at the DeLamar project, and the preparation of a resource estimate and PEA on Millennial’s Wildcat and Mountain View projects. Wheaton Precious Metals agreed to invest an amount up to 9.9% of the issued and outstanding Integra shares.

Alamos Gold/ Manitou Gold

Alamos Gold acquired all of Manitou Gold’s shares, consolidating its existing ownership of Manitou shares and tripling its regional land package around Island Gold with the addition of the Goudreau property in Ontario.

This includes 40,000 hectares adjacent to and along strike from the Island mine, adding significant exploration potential across the relatively underexplored Michipicoten greenstone belt. This is expected to increase Alamos’ land package around the Island gold deposit to 55,277 hectares, a 267% increase, said MINING.com.

Newrange Gold/ Mithril Resources

Canada’s Newrange Gold entered into a binding scheme of arrangement to acquire ASX-listed Mithril Resources under a reverse takeover offer. The offer implies a value of AUD$11.8 million to Mithril. “The new Americas-focused exploration and development company resulting from the merger with TSXV-listed Newrange creates a highly experienced and focused board and management who are well positioned to take advantage of the considerable growth opportunities at the Copalquin mining district and the two Canadian Red Lake District properties,” said Mithril’s CEO John Skeet. The Copalquin project has a maiden resource estimate at the El Refugio target area. Newrange’s projects include the past-producing Argosy gold mine.

Steppe Gold/ Anacortes

Steppe Gold acquired all of Anacortes’ issued and outstanding shares. In addition to expanded production from Steppe Gold’s ATO mine, additional future growth would be supported by the development of the high-grade Tres Cruces oxide project in Peru, which is located approximately 10 km from the Lagunas Norte mine. The new combined company will have a potential development profile of over 200,000 ounces and a resource base of over 4.5 million gold-equivalent ounces.

Cerrado Gold/ Voyager Metals

Cerrado Gold acquired all the outstanding shares of Voyager Metals it didn’t already own. Upon completion of the transaction, Cerrado through a subsidiary will own a 100% stake in the Mon Sorcier iron and vanadium project in Chibougamau, Quebec, which is advancing towards feasibility and permitting, stated Resource World. Toronto-based Cerrado is focused on gold projects in the Americas. It owns the producing Minera Don Nicolas mine in Argentina and the Monte do Carmo development project in Brazil. At Monte do Carmo, the Serra Alta deposit is estimated to host an indicated resource of 541,000 ounces of contained gold and an inferred resource of 780,000 ounces.

Interra Copper/ Alto Verde

Interra Copper acquired all the issued and outstanding shares of Alto Verde, whose assets within the Chilean Copper Belt include three copper exploration projects: Tres Marias, Zenaida and Pitbull. The company holds a significant land package covering an area of 19,850 hectares, with the projects situated among several of the world’s largest mines owned by the largest mining companies including Glencore, Anglo American, Teck Resources and BHP.

Trillium Gold/ Pacton Gold

Trillium Gold and Pacton Gold combined to create a large land package in the Red Lake Mining District, with over 15 projects covering more than 1,260 square km. According to a press release, the new company’s property holdings will be larger than major gold producers in the district such as Evolution Mining and Kinross Gold.

Hudbay Minerals/ Copper Mountain Mining

The acquisition of Copper Mountain Mining by Hudbay Minerals created the third largest copper producer in Canada. The companies said that by combining assets in Canada, the United States and Peru, there would an opportunity to unlock $30 million per year in operating efficiencies and corporate synergies. Hudbay’s Constancia operations in Cusco, Peru, produce copper with gold, silver and molybdenum by-products. Its Snow Lake operations in Manitoba produce gold with copper, zinc and silver by-products. Hudbay’s development pipeline includes the Copper World project in Arizona and the Mason project in Nevada. Copper Mountain owns 75% of the Copper Mountain mine, located in southern British Columbia near Princeton. The mine produces approximately 100 million pounds of copper equivalent on average per year.

Fortuna Silver Mines/ Chesser Resources

Fortuna agreed to acquire all of Chesser’s shares in a transaction valued at approximately AUD$89 million. The acquisition will expand Fortuna’s presence in West Africa to include the preliminary economic assessment stage Diamba Sud gold project in Senegal. Chesser holds tenements covering about 872 km2 of prospective ground located in close proximity to and sharing similar geologic features with gold mines owned by Barrick Gold and B2Gold located in Mali. Diamba Sud comprises four open-pittable, high-grade gold deposits.

Allkem/ Livent

Allkem and Livent announced an all-stock merger valuing the combined company at $10.6 billion. According to a press release, the “cost asset portfolio in Argentina and Canada creates opportunities to both accelerate and de-risk the development of a strong pipeline of attractive growth projects expected to deliver production capacity of approximately 250 ktpa LCE [lithium carbonate equivalent] by 2027.”

“Significant expected run-rate operating synergies of approximately US$125 million per annum (pre-tax) and one-time capital savings of approximately US$200 million, driven mainly by asset proximity and co-development in Argentina and Canada.”

Silvercorp Metals/ Celsius Resources/ Orecorp

Having acquired all the shares of Celsius Resources, Silvercorp says “The addition of Celsius’ advanced-stage Maalinao-Caigutan-Biyog copper-gold project in the Philippines to Silvercorp’s profitable underground silver mining operations will move Silvercorp into being a diversified precious-base metals producer.” The total consideration is approximately AUD$56 million. Chairman and CEO Dr. Rui Feng commented, “The addition of the MCB Project to our growing project portfolio aligns with our strategic objectives of diversifying and growing our asset base and will position us to benefit from copper’s strong fundamentals.”

On Aug. 6 Silvercorp said it intended to acquire all the shares of Orecorp that the company or its associates didn’t already own. Under the deal, Silvercorp would provides OreCorp with approximately AUD$28 million in funding via an equity placement to develop its Nyanzaga gold project in Tanzania.

Benchmark Metals/ Thesis Gold

Thesis Gold was acquired by Benchmark Metals in a transaction creating one of the largest precious metals development and exploration companies in the prolific Toodoggone Mining District of British Columbia. It consolidates two significant exploration projects, as the ongoing development of Benchmark’s Lawyers project is adjacent to high-quality exploration targets on Thesis’ Ranch project. It has the potential to enhance Benchmark’s current 3.14 million ounces of gold-equivalent measured and indicated resources and 0.415 Moz AuEq inferred mineral resources at Lawyers with high-grade, near-surface mineralization at Ranch.

Lithium One Metals/ Norris Lithium

Lithium One’s acquisition of Norris Lithium creates a leading land position in James Bay, Quebec. The transaction will result in the addition of two lithium exploration projects totaling 4,500 ha in the renowned Corvette lithium belt of James Bay. As a result, Lithium One’s total land holdings in the district will total 20,750 ha. Notably, Norris Lithium’s Highway property is adjacent to Lithium One’s Ferrari property, which through the combination will grow to 9,000 ha. The combined company will have an overall lithium-prospective land position of 23,650 ha in Quebec.

Norris Lithium shareholders gain exposure to a portfolio of lithium-prospective exploration properties in Ontario, totalling 26,259 ha, for an overall total of 49,791 ha within the combined entity, creating one of the largest lithium property portfolios in Canada.

Hudbay Minerals/ Rockcliff Metals

Hudbay’s acquisition of Rockcliff has an enterprise value to Hudbay, net of Rockcliff’s cash, of about $13 million. Rockcliff is the 49% joint venture partner on Hudbay’s Talbot project and also owns six additional deposits in the Snow Lake region. Rockcliff is one of the largest landholders in the Snow Lake area with approximately 1,800 square km across all its properties. Rockcliff has measured and indicated mineral resources of 7.9 million tonnes grading 3.60% copper equivalent and inferred mineral resources of 5.1 million tonnes grading 3.19% copper equivalent.

Blackwolf Copper and Gold/ Optimum Ventures

Blackwolf entered a non-binding letter of intent for a proposed transaction whereby Blackwolf will acquire all the issued and outstanding shares of Optimum Ventures. Executive Chairman Rob McLeod commented, “We believe Blackwolf is exceptionally well positioned to “lead the pack” in the Golden Triangle [of British Columbia] with the right team and strong investor base. With two great projects in Alaska, and Optimum’s property in BC on trend from our Cantoo Project and located next to the high-grade Premier Mine that is currently in development, this is an exciting time as we kick off our inaugural drill program at the Cantoo gold-silver Project in the coming month. We are also forward planning for Optimum’s Harry Project with drilling envisioned to start later in the 2023 season.”

Glencore/ Polymet Mining

Glencore acquired 17.8% of Polymet’s issued and outstanding shares it didn’t already own, for $2.11 in cash per share. The consideration represented a 167% premium to the unaffected share price on June 30, 2023. PolyMet holds a 50% interest in NewRange Copper Nickel LLC, a joint venture with Teck Resources. NewRange Copper Nickel holds the NorthMet and Mesaba copper, nickel, cobalt and platinum group metal (PGM) deposits, located in the Duluth Complex in northeast Minnesota. The Duluth Complex is one of the world’s major, undeveloped copper, nickel and PGM metal mining regions. NorthMet is the first large-scale project to have received permits within the Duluth Complex.

Big Ridge Gold/ Gold Island

Big Ridge Gold combined with privately owned Gold Island whereby Gold Island shareholders received 0.8 of one Big Ridge share for each Gold Island share. Big Ridge’s President and CEO Michael Bandrowski said, “The acquisition will create a premier Newfoundland based gold exploration company, well positioned to continue advancing the Hope Brook Gold Project and its three new highly prospective exploration assets acquired from Gold Island, originally staked by Shawn Ryan of Ryanwood Exploration. In addition, the Transaction will add approximately CAD$4.0 million in working capital and several strategic shareholders, including Eric Sprott, The PowerOne Capital Group, Shawn Ryan, and a number of leading and highly sophisticated financial institutional shareholders, and high net worth investors.”

Metalla Royalty & Streaming/ Nova Royalty

Metalla Royalty & Streaming and Nova Royalty Corp. entered into an arrangement agreement whereby Metalla will acquire all of the issued and outstanding common shares of Nova pursuant to a plan of arrangement positioning the combined company as a leading emerging intermediate royalty company. According to a press release, “Combined company is expected to have industry-leading growth through a combined portfolio of 105 high-quality royalties and streams with upwards of two decades of sustainable growth being advanced by top tier operators in the mining sector, including First Quantum Minerals, Newmont, Hudbay Minerals, Agnico Eagle, Barrick, BHP, Glencore, Lundin Mining, Teck Resources, IAMGOLD, Equinox Gold, and others.”

“Strategic partner Beedie Capital to commit to an equity investment of C$15 million and increased Metalla’s existing convertible loan facility to C$50 million (for an aggregate of C$65 million), resulting in approximately $35 million of available liquidity, better positioning the combined company to fund value enhancing growth.”

IsOEnergy/ Consolidated Uranium

IsoEnergy and Consolidated Uranium entered into a share-for-share merger, pursuant to which IsoEnergy will acquire all of the issued and outstanding common shares of Consolidated Uranium not already held by IsoEnergy or its affiliates. “With a pro forma market cap of $903.5 million, the Company will rank among the top 10 publicly traded uranium focused companies in the world, allowing for greater access to capital and trading liquidity, strengthened position for future M&A and increased attractiveness among investors and utilities. Additionally, the Company will be backed by corporate and institutional investors including NexGen Energy Ltd., Energy Fuels Inc., Mega Uranium Ltd., and uranium ETFs,” states a press release.

Cameco/ Westinghouse

Cameco on Nov. 3 announced that its joint acquisition of Westinghouse Electric Company with Brookfield Asset Management, alongside its publicly listed affiliate Brookfield Renewable Partners and institutional partners, has received all required regulatory approvals.

Cameco plans to finance its share of the acquisition utilizing the full amount of its $600 million term loan, which will be drawn down at closing, along with available cash. The joint acquisition was previously announced on October 11, 2022.

Conclusion

In a previous article, we pointed out the dilemma being played out for copper, silver and gold, with each of these metals reaching peak supply.

The case for peak gold, silver and copper

By this we mean the mining industry lacks the capacity to ramp up production to meet rising demand; even higher prices would not make that happen, because there aren’t enough mines to tap for more supply.

The notion of peak copper provides an understandable rationale for mergers and acquisitions. We see it in BHP’s $6.4 billion takeover of Australian copper producer OZ Minerals, and Glencore’s acquisition of Polymet Mining, which has a copper-nickel joint venture with Teck, and is active in the Duluth Complex, one of the world’s major undeveloped copper, nickel and PGM metal mining regions. Hudbay’s purchase of Copper Mountain is yet another example of the need for copper.

The demand pressure about to be exerted on copper producers in the coming years all but guarantees a market imbalance, resulting in copper becoming scarcer, and dearer, with each infrastructure initiative and with each ambitious green initiative rolled out by governments.

It takes seven to 10 years, at minimum, to move a copper mine from discovery to production. In regulation-happy jurisdictions like Canada and the US, the time frame is more like 20 years.

The amount of gold M&A listings is also a reflection of limited supply; over the years there have been relatively few major gold discoveries. For gold and silver, the mining industry is currently unable to mine enough to meet annual demand, without recycling. Miners not only needs to find more gold, they need to mine it for less. Inflation is compressing margins, with everything from diesel fuel to wages and camp costs going up. In this environment, it makes sense for smaller gold companies to join forces, creating efficiencies and synergies.

While the lion’s share of the above M&A listings involve gold, there is also interest in lithium and uranium — both inputs for the clean technologies of electric vehicles and nuclear power, respectively.

Cameco’s acquisition of Westinghouse is huge for the nuclear industry. The combination of IsOEnergy and Consolidated Uranium creates a uranium company valued at close to $1 billion. The Allkem/ Livent merger and Lithium One’s acquisition of Norris Lithium are signs of consolidation in the lithium industry, despite recent low lithium prices casting a bit of a pall on the sector.

What does 2024 have in store for mining M&A? Will the flurry of mergers and acquisitions continue? In a recent report, Fitch Ratings states:

“Changing demand patterns brought about by the energy transition, increasingly lengthy greenfield project construction timelines and limited organic growth options should support deal activity beyond 2023.”

“Miners will be particularly active in future-facing metals such as lithium, nickel and copper, where the market is likely to be in structural deficit beyond 2026.”

As for exploration companies, those with great projects containing the right metals, in safe jurisdictions, led by experienced management teams, will be best placed as targets for acquisitions by mining companies hungry for more metal in the ground.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.