Don’t rely on GDP

By Alasdair Macleod

An important error in statistical analysis is that mathematical economists have lost sight of what their beloved statistics represent —none more so than with GDP.

I explain why GDP is simply the total of accumulating currency and credit which is wrongly taken to reflect economic progress — there being no such thing as economic growth, only the growth of credit. Once that point is grasped, the significance of this basic error becomes clear, and the fiat currency paradigm is revealed for what it is: a funny-money game that will go horribly wrong.

There is only one escape from it, and that is to own the one form of money that is no one’s counterparty risk; the one form of money that always comes to humanity’s rescue when fiat fails.

And that is gold. It is neglected by nearly everyone because it is the anti-bubble. The more that people believe in fiat-denominated assets, the less they believe in gold. That is until their funny-money games implode, inevitably triggered by sharply rising interest rates.

Introduction

Let us start with a thought experiment. Last year, a person bought a car. This year, the dealer called him and said, “I can offer you a car of a different make for exactly the same price as you paid for the one I sold you last year, and it has better electronics, more acceleration, and lower fuel consumption.” He bought the new car and sold his previous model.

Clearly, the deal represented progress for the person buying the car. But what was the contribution to growth in GDP? Obviously zero, because whether a consumer purchase happens depends on what a consumer personally decides is value. Whether value be price, quality, or any other factor, for the consumer the subjective decision to buy anything is progress in his condition.

Government statisticians cannot capture an individual’s idea of progress. Nor can they capture concepts such as value for money, product improvements that consumers actually desire, or anything else that is subjective to individual consumers. Chasing statistics as a measure of the economic condition is therefore fundamentally flawed. And the justification for monetary policy as the means by which an economy is managed by the state, is a lie that should be exposed. It should be a benefit from the ultimate failure of statist economics.

Those of us with grey hairs gained in financial markets can or should recognise that after fifty years the fiat money game is ending. Particularly since covid lockdowns accelerated money printing, it has led to prices rising beyond mandated targets. It is not, as establishment economists claim, rising prices: they are simply the consequence of credit expansion which was the original and remains the correct definition of inflation. Furthermore, it is impossible to isolate from a higher price what represents an improvement in product value and what represents a decline in the value of credit. And in our fiat money regime that expansion of credit has no anchor in value.

However, rising prices in the aggregate as opposed to the specific are nothing other than currency debasement. And currency debasement leads as surely as night follows day to higher interest rates. And higher interest rates lead to falling asset values. But that doesn’t reckon with crowd psychology, leading investors to prefer to see and hear no evil rather than reason — to unquestioningly accept statist statistics as meaningful. But an understanding of the relationships between politics, economics and catallactics in current times matters more than usual. Guided by imperfect and irrelevant statistics, central banks now strive to eliminate the uncertainties of personal choice expressed in free markets and control interest rates with a Stalin-like severity. Believing in their own propaganda, central bankers themselves have lost their way in this fiat money crisis.

Despite Money being in its title, the Fed’s FOMC almost never mentions money in its regular statements on interest rate policy. And most investing institutions willingly embrace the fiction that inflation is of prices and not money. By buying fully into the central banks’ groupthink, everyone has blinded themselves to the consequences of their mismanagement. We comfort ourselves that our central banks are in control because the propaganda leads us to believe they have been in control over markets for nearly all our professional lives.

All the major group-thinking central banks are captured by similar delusions, or rather over their currencies and have no longer the simple objective of controlling their purchasing power. Instead, currency and credit have become the essential tools for funding excess government spending. And even if western leaders undergo a sudden conversion to the merits of honest money, they would face the task of stemming the tide of rapidly escalating social liabilities such as pensions and healthcare.

No, the establishment is fully bound to currency debasement as the means of funding the state’s increasing need for revenue. It requires self-delusion or concealment of the true situation, which is why central bankers are encouraged to ignore any connection between the expansion of circulating currency, bank credit and prices.

Furthermore, nearly all investment is handed over to so-called expert managers in pension funds, insurance companies, banks, portfolio managers and financial advisors (whose advice is usually taken unquestionably), so that the delegation of responsibility for our investments is always to those who extrapolate the past into the future. It amounts to an approach unable and unwilling to consider and evaluate the true factors of change.

It involves group-thinking delusion with all aspects of economic policy in favour of the survival of socialistic redistribution. But this article focuses on one aspect central to it: the fallacy of relying upon statistics and where that is likely to lead. And it demolishes one statistic which is central to the whole charade: the concept of economic growth.

Mises’s evenly rotating economy

The Austrian economist, Ludwig von Mises, pointed out that there is a fundamental difference between an economy and the statistics used to represent it. In the real world, it takes time to do things; to anticipate, to plan, to implement. The desires of tomorrow and thereafter evolve through time, as do the means to satisfy them. And in economics, time is Man’s most precious commodity. But statistics cannot capture time. They only record what has passed.

Therefore, you cannot capture human progress or the lack of it through statistics. Statistics are no more than an accounting mechanism for quantifying economic transactions after they have occurred. And if everyone tomorrow does exactly what they did yesterday like mechanical robots lacking human motivations and desires, statistics for yesterday would be a reasonable representation of what is to pass tomorrow. In other words, we would have an economy which conforming with mathematics evenly rotates.

It is of course an impossibility. As von Mises pithily put it,

“Action is change, and change is in the temporal sequence. But in the evenly rotating economy change and succession of events are eliminated. Action is to make choices and to cope with an uncertain future. But in an evenly rotating economy there is no choosing, and the future is not uncertain as it does not differ from the present known state. Such a rigid system is not peopled with living men making choices and liable to error. It is a world of soulless unthinking automatons. It is not human society; it is an anthill.”[i]

With hindsight, statisticians adjust their models from earlier expectations to what has transpired as a basis for future predictions. However, it is true that what happened yesterday will inform us for what might happen tomorrow because we are all conditioned by experience, but no more than that. The fact that we continually make changing plans for an improvement in our condition is unequivocal proof that no economy evenly rotates. But it is a useful concept because it allows governments to estimate revenues, and it allows businesses prepared to dig into the details to use estimates of current markets for their investment and production plans. But that is supplemented by non-statistical information and gut feel based on experience.

To take the concept of an evenly rotating economy as the basis of economic prediction is a mistake made today by nearly everyone. Nearly everyone now talks about economic growth represented by gross domestic product. But in GDP they unconsciously describe an evenly rotating economy, which they assume can grow numerically, confusing growth with the progress they think they are describing. So ingrained is the habit of substituting GDP for economic progress, that this unconscious deception has become fundamental to maintaining the credibility of monetary policy.

Defining GDP

So far, I have described what GDP is not, pointing out the difference between a static economic model stripped of time and the dynamic reality of a working economy. We should now consider what GDP represents, and why it changes through successive years.

GDP can be estimated by using three different approaches: income, expenditure, and production. In theory they should produce the same result. In practice, significant differences arise because they are based on dissimilar administrative and data sources that are subject to errors and omissions. And all the information is not available at the same time. The outcome is therefore subject to revisions, and usually combines these approaches to give a final estimate of total spending.

Irrespective of the approach, essentially GDP is the sum of household spending, investment in production, government spending, and net exports. Much is excluded, such as financial transactions, second-hand transactions, and the cash economy. Furthermore, the individual steps in production, or gross output are ignored.

Following on from the thought experiment at the beginning of this article, we must consider why GDP increases. Let us assume that in a closed economy, where trade and capital flows across borders do not exist, Year 1’s GDP was $100bn. Let us now assume there is no change in the quantity of currency and credit in Year 2, and that individuals’ cash liquidity balances do not alter either[ii]. Therefore, Year 2’s GDP must be the same as in Year 1. In other words, economic activity will obviously evolve as well as prices for individual goods and the number of transactions will vary. But those changes will be contained within the unchanged GDP total, which will remain at $100bn, because there is no additional currency and bank credit involved. The same must be true of successive years under the same conditions. The deployment of currency and credit between household spending, investment in production, and government spending will almost certainly differ. But they must always total $100bn.

With GDP unchanged, there is nothing to stop the economy progressing, but that is a matter decided between consumers and producers. Government spending, so long as it is fully funded by taxes, will affect the speed of economic progression but it will not alter the GDP total. The same is true of changes in the split between consumption and savings.

Another way of expressing it is in terms of Say’s law, which defines the role of money in the context of the division of labour. Over the course of a year, we make profits or losses and earn income. We allocate the proceeds into spending, savings, and taxes which are recycled by the state.

If there is no increase in the quantity of currency and credit, then those that improve their earnings and profits might appear to do so at the expense of those that don’t. But while there will always be losers, that is not true. In our example of a closed economy with no change in the quantity of credit, surpluses are always recycled either in spending or investment. Immeasurable progress leads to a greater purchasing power for credit, so that while statistically the economy doesn’t advance, it actually progresses.

Overall, an improvement in the general economic condition comes from an increase in the currency’s purchasing power, with each unit of it buying more, and goods and services improving over time. Even those who experience a slight decline in income benefit from the improvement in economic conditions, lifting more out of poverty than governments can ever achieve by increasing taxation to pay for welfare. The fear of deflation, which is the modern term for falling prices is wholly misplaced. Other things being equal, if the general level of prices declines over time they reflect economic progress and a benefit to consumers.

Cross-border trade and capital flows have been excluded from our theoretical example to simplify matters and we should comment on these separately. In a free market, an imbalance in trade sees capital flows move in the opposite direction. If importers and exporters dispose of foreign currencies acquired through trade, then the model still stands because no currency nor bank deposits are destroyed.

Without currency and credit interventions, even an overall trade deficit will not alter the quantity of currency outstanding, only its ownership changes. The adjustment will be reflected in the exchange rate and not in changes to the amount of currency and credit.

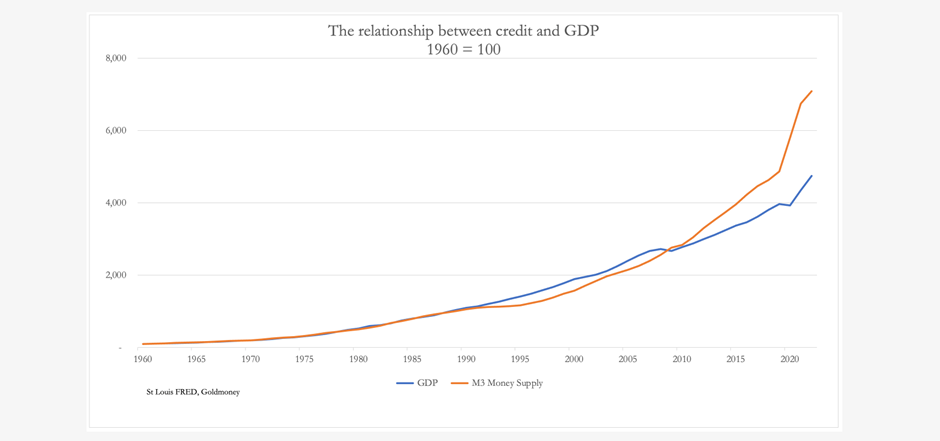

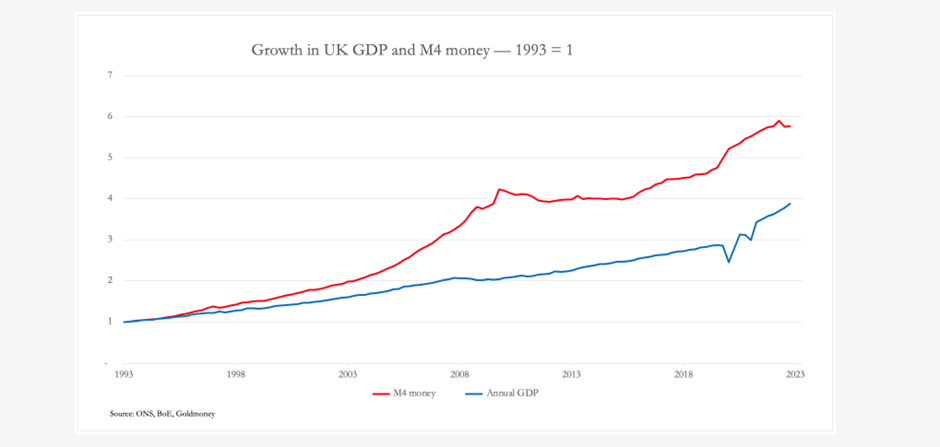

If in Year 2 GDP increases over Year 1 by, say, ten per cent to $110bn, it can only be because the quantity of currency and credit circulating in the economy has increased, not necessarily the underlying economic activity. Furthermore, in practice, bank credit fluctuates and is subject to cycles of expansion and contraction. And central banks attempt to stimulate demand for currency by managing interest rates. They intervene directly by quantitative easing and through repo and reverse repo market operations. But the fact remains that the increase in GDP can only reflect an increase in the quantity of currency and credit applied to qualifying items. The chart below shows the relationship between annual changes in broad money (M$) and GDP in the United States over time.

Between 1960 and 1990, the two increased together, confirming that GDP is no more than a measure of the quantity of currency and credit in the economy. From there, the statistics diverged, but not by much until the 2008 financial crisis when M4 rose at a far faster pace than GDP. This reflected the funnelling of credit into financial activities, as a speculative bubble developed on the back of heavily suppressed interest rates. It represents excess credit, which is now being unwound by commercial banks seeking to reduce their risk exposure and does nothing to disprove the fundamental relationship between GDP and credit.

We can therefore conclude that what is commonly described as economic growth is only an increase in the quantity of money and credit in the economy and does not reflect changes in the underlying economic condition.

The inappropriateness of a CPI deflator

Given that GDP reflects only the quantity of currency and credit for qualifying items, the practice of deflating its expansion by an index of prices serves no purpose. And by applying an adjustment for the consequences for prices from earlier monetary expansion, the use of GDP as an indicator of the state of the economy is falsely legitimised. Furthermore, the term “real GDP” for GDP modified in this way helps to fix it in the public mind as the supreme indicator of economic activity, and its increase a laudable objective for monetary policy. Behind this blunder is a chequered history.

In pursuing indexation as a means of public compensation for price inflation forty years ago, statist economists came to realise the considerable impact on state finances. Indexation of increasing quantities of bonds and of a range of welfare payments following the inflationary 1970s proved to be too expensive for expansionary governments, and consequently statisticians have continually modified their calculations of price inflation to reduce the burden on government finances.

The general level of prices is only a concept which cannot be measured. This has permitted statistics of aggregated prices and their construction to become little more than a matter of policy. It allows a statistician to use sophisticated mathematical tools and methods to claim almost anything he, or his statist employer wishes. Despite a rapidly accelerating inflation of currency and credit, government statisticians had managed to peg annual increases of consumer prices at roughly two per cent for a considerable period until only eighteen months ago.

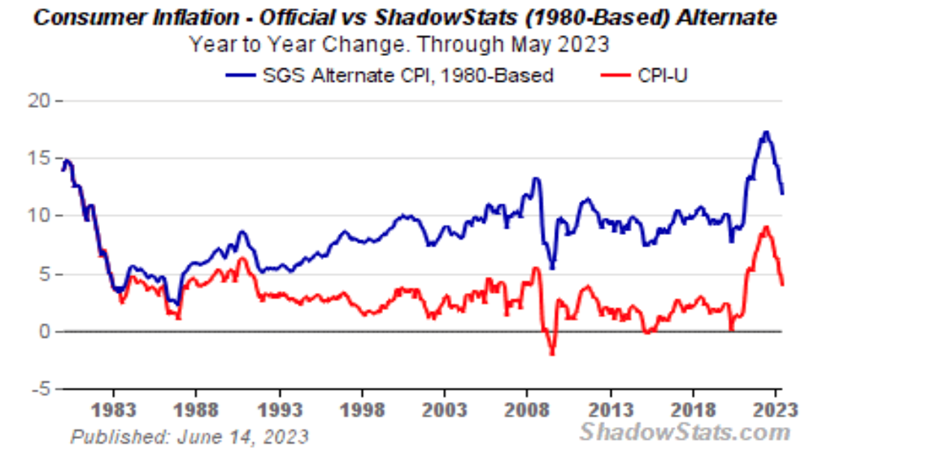

Independent statistical analysis from Shadowstats.com highlighted the statistical deception perpetrated by the CPI method by producing a rival index for the US shorn of all the statistical modifications introduced to reduce the numbers since 1980. Its figures to May, the last set which are publicly available without a subscription shows an unadjusted rate of annualised price increases at about 12% per cent, compared with the official rate of 4.9%. The divergence between the 1980 calculation basis and official recalculations of CPI is clearly illustrated in the Shadowstats chart below.

While pointing out the self-serving nature of price statistics, we must not forget they do not serve a credible economic purpose. In any event, a price index is a collection of historical prices with very little connection to the future. And to use it as a basis for monetary policy is to make the same mistake of assuming that growth in GDP is evidence of economic progress. It fails to recognise that catallactics is an evolving human science of choice which cannot be defined by the mathematics applicable to the natural sciences.

The price consequences of monetary policy

There are two basic forces in the relationship between the quantity of money and prices. The first is changes in the quantity of currency and credit, which if increased will tend to lower its purchasing power. The second is changes in the currency holders’ perception of the relation between credit and goods, reflected in changes in the liquidity to hand. Assuming for the moment that that does not change, we can see that an increase in broad money supply is bound to increase the GDP number, GDP being the sum of transactions captured within it. Irrespective of whether economic activity increases or diminishes, prices in those transactions can only rise reflecting the increase in credit in the economy.

The relationship between broad money supply and GDP illustrated in the chart above of US M3 money supply and GDP, the forces driving prices higher from the debasement of the currency are considerably greater than commonly thought.

The first force in the money relationship described above conforms with the equation of exchange, the mathematical expression of the relationship between the quantity of money and prices in the aggregate. But if there is a theme in this article it is to point out the error of applying mathematical relationships to human action. The second of the two forces mentioned above is changes in crowd psychology, which will also determine the value of a currency relative to goods.

This can be illustrated by considering changes in the average level of currency liquidity held by its users. As distinct from allocations to savings, currency to hand represents unspent production, held in reserve for unexpected changes in a person’s needs and wants.

But if in the aggregate holders of currency liquidity suspect that prices of the goods and services that they might desire but do not immediately need will begin to rise more rapidly, they will reduce their currency in hand to buy those goods. This is a fair description of current conditions: a wide range of consumer prices are now rising, encouraging anyone with excess liquidity to dispose of it, exacerbating the price trend. And we can see from the excessive quantity of currency and credit yet to be unleashed into the GDP-recorded economy that this trend is likely to have an effect additional to the mathematical relationship, possibly driving the dollar’s purchasing power down more rapidly than increases in M3 money since 2007 would suggest is likely.

The situation in the UK mirrors that of the US, but with the broadest measure of money (M4 in this case) exceeding GDP by an alarming margin. This is illustrated next, which is based on 1993, following big-bang in the mid-eighties when the financialisation of banking will have begun to impact the bank lending relationship to GDP.

The disconnection between GDP, which measures goods and services excluding financial activities, and a more rapidly increasing M4 reflects the development of financial services in London following big-bang in the mid-eighties. The excess amounts to credit deployed in non-productive activities amounting to a speculative bubble which is sure to be unwound.

The consequences for interest rates and financial markets

Examining the true relationships between currency, credit and the economy strongly suggests that a price inflation shock is still in its early stages. We have established that growth in GDP is little more than growth in broad money, and we have explained the disparities in their rates of growth. In addition to the mathematical effect of the theory of exchange, we have noted that the trend of rising prices is likely to accelerate as consumers reduce their cash liquidity by buying goods before prices rise even more. Together, these factors can be expected to lead to a generally unexpected fall in the dollar’s and sterling’s purchasing powers. And we should add that the major central banks (except possibly China’s) have pursued similar monetary policies, which will have similar consequences.

To reflect declining purchasing power for credit in nearly all currencies, interest rates must increase, and the increase in dollar and sterling rates must be substantial enough to stabilise these currencies if they are not to collapse entirely. But at this juncture we are less interested in the ultimate future for fiat currencies than the effect on financial asset values.

Fixed interest bond yields will rise substantially, which means that prices will fall. We are already seeing this happen. Higher interest rates and bond yields in turn will undermine equity values, which broadly are yet to happen. To the extent that financial asset values are in a bubble, we can expect a substantial derating of financial asset values.

The monetary response from central banks will attempt to stop markets from falling significantly for three reasons: central banks are committed to funding government deficits, and rising government bond yields hamper that objective; they believe that buoyant financial markets are essential for maintaining the public’s confidence in the economic outlook; and they are acutely aware that falling asset prices are likely to trigger an acceleration of collateral liquidation by the banks as theorised by Irving Fisher following the 1930s depression.

Gold

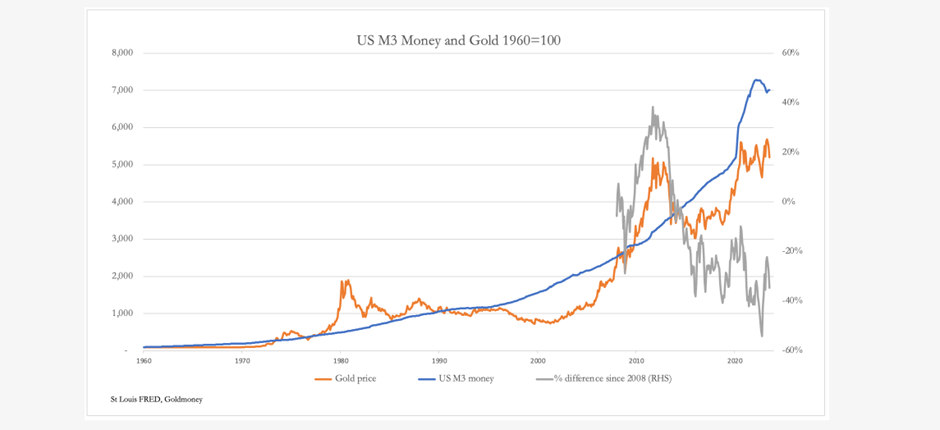

The chart below shows the relationship between the dollar gold price and US M3 money supply. The grey line shows the difference between the two, which currently shows gold at a discount of 35% relative to where it was at the time of the Lehman crisis.

It is a mistake to assume that the gold price should adhere to the growth of broad money supply, which is confirmed by periods of significant over and under relative valuations. But in general, an acceleration of the rate of monetary expansion can be expected to lead to higher gold prices.

While M3 has increased substantially before beginning to contract, gold has been left behind. In a sense, this is not surprising, because the legacy of interest rates held at the zero bound has not yet been unwound. Put another way, when there is a financial bubble, gold can be regarded as the anti-bubble, so is bound to be out of fashion — but that is now changing.

Following the Lehman crisis, the gold price rose to $1,925 against a background of mounting concern for the global banking system. Compared with M3, gold stood at a premium of 40% at that time, which we can now say discounted monetary inflation too far ahead, in the absence of an unmanageable financial crisis materialising. Today, after falling to a discount of 54% it stands at a discount of 35%, which suggests that optimism in the fiat currency system is at a similar but opposite extreme to 2011.

There is little doubt that the financial asset bubble is being burst by rising interest rates, which will be beyond the Fed’s control for the reasons outlined in this article. That being the case, there is a strong argument for leaving the funny-money game to the madness of crowds and the madness of regulated institutions. The only credible way to insulate oneself from it completely is by retreating into the one asset for which there is no counterparty risk — physical gold, and perhaps some physical silver which has the additional benefit that ownership of it is less likely to be banned by panicking governments.

[i] Von Mises: Human Action, Chapter 14: “The scope and method of catallactics”

[ii] Changes in the level of personal cash liquidity have a material impact on prices, so for our purposes we should eliminate this factor.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.